1/ NEW REPORT: Our first ever Canadian Pension Climate Report Card reveals Canada’s major pension funds are not on track to protect pensions from the worsening #climatecrisis or to align their portfolios with a safe climate future. #cdnpoli

A 🧵. Read on! shiftaction.ca/reportcard2022

A 🧵. Read on! shiftaction.ca/reportcard2022

2/ Canada's pensions must do much more to develop and implement credible Paris-aligned climate action plans, fulfill their fiduciary duty to invest in members’ best long-term interests, and protect retirement security in a world that limits global heating to 1.5°C. #cdnpoli

3/ The report finds a high level of inconsistency among pension funds with a collective >$2 trillion in AUM, with the degree of urgency, detail, transparency, and ambition varying widely for managing climate-related risks and opportunities across the sector. #climaterisk #cdnpoli

4/ It offers an independent benchmark for evaluating the quality, depth and credibility of 11 Canadian pension managers’ climate policies based on the latest science and international best practice. It also includes examples of 4 international pensions for comparative purposes.

5/ A significant gap has emerged between Cdn funds & leading global investors in their approach to #fossilfuels, w/ Canada's pension sector mostly failing to recognize the imperative of a rapid phase-out of fossil fuel investments to protect beneficiaries' retirement security.

6/ The report is designed to educate pension managers, directors and trustees, plan members, sponsors and other stakeholders of progress to date, document challenges and shortcomings faced by individual funds, and highlight best practices and emerging leadership.

7/ Pensions toward the bottom of the ranking lack meaningful plans to achieve climate objectives. Beneficiaries of these funds should be concerned about the vulnerability of their pension savings to #climaterisk, & about the use of their savings to make the #climatecrisis worse.

8/ Emerging leaders, particularly @LaCDPQ, @OTPPinfo & @UPP_Ontario, have set strong short- & medium-term targets for emissions ⬇️.

CDPQ, OTPP & other pensions like @IMCOinvest, @InvestPSP & @cppinvestments are also setting targets for increasing investment in climate solutions.

CDPQ, OTPP & other pensions like @IMCOinvest, @InvestPSP & @cppinvestments are also setting targets for increasing investment in climate solutions.

9/ Leaders have also made clear that a stable climate is critical to protecting their members' retirement security, set clear expectations for portfolio companies to align their business with 1.5°C pathways, & begun excluding high-risk investments in #fossilfuels.

10/ In Canada, only one pension manager has followed expert advice to phase out investments in high-risk #fossilfuels to date - @LaCDPQ, which committed to selling all of its $4 billion in holdings in oil producers by the end of 2022. #polqc #cdnpoli bloomberg.com/news/articles/…

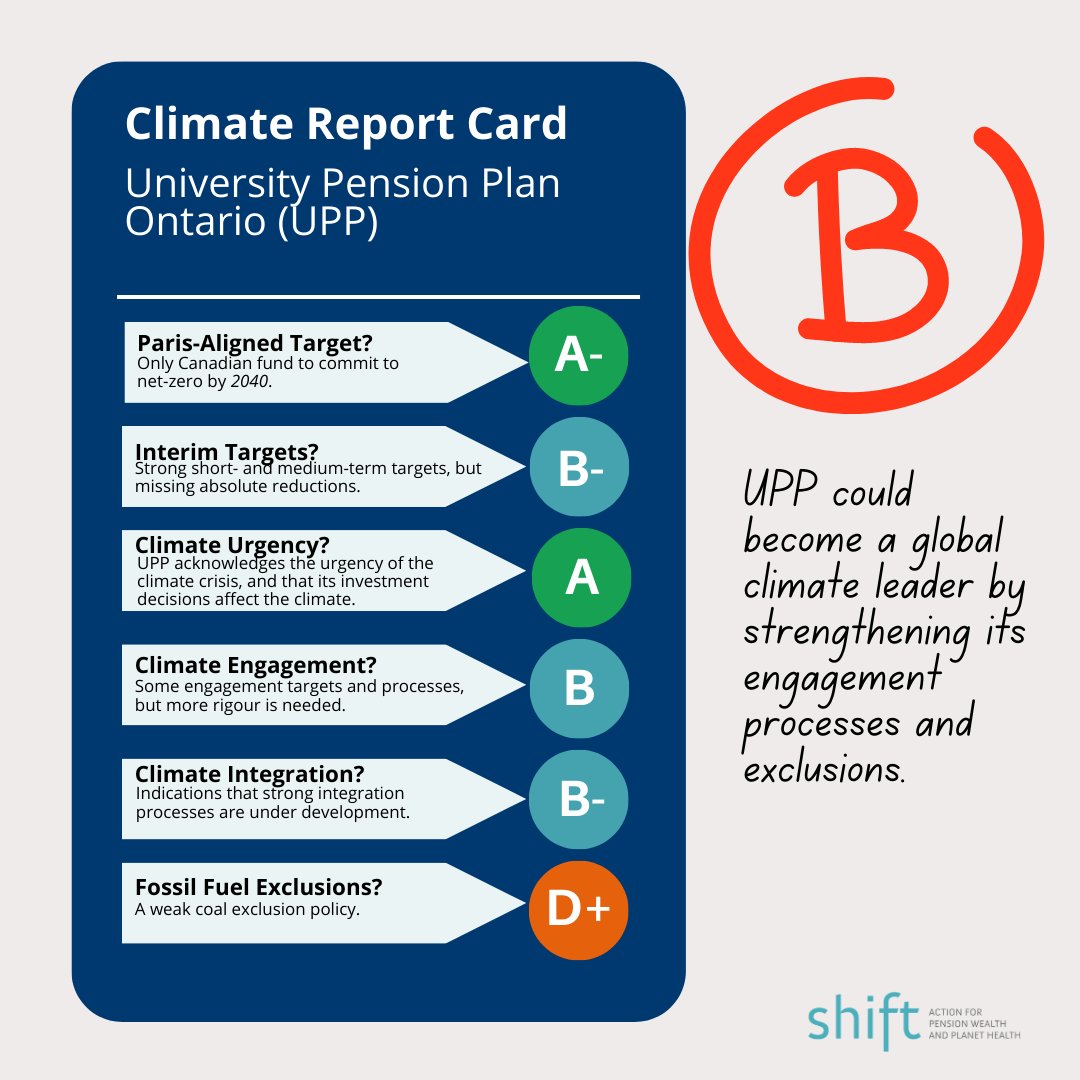

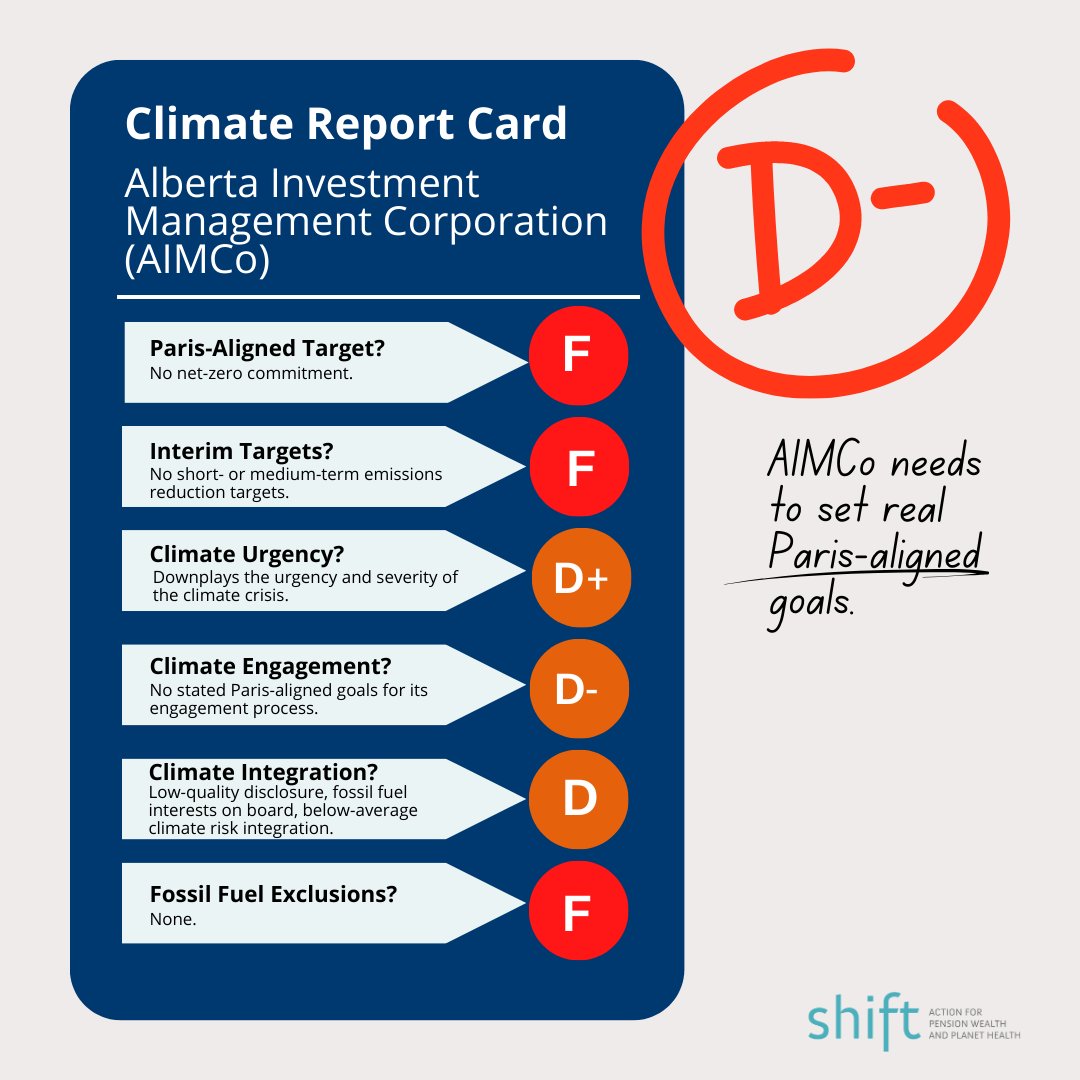

11/ Our report assigns letter grades to pension funds based on 6 indicators, including pensions’ Paris-aligned targets, interim targets, climate urgency, climate engagement, climate integration & use of #fossilfuel exclusion.

See our methodology & scoring: shiftaction.ca/reportcard2022…

See our methodology & scoring: shiftaction.ca/reportcard2022…

12/ The analysis also assesses the extent to which pensions managers disclose how they consider Indigenous rights in their investments and stewardship, particularly the right to Free, Prior and Informed Consent. #UNDRIP #cdnpoli #FPIC shiftaction.ca/reportcard2022…

13/ As #greenwashing is rampant among Canadian finance institutions, we also assigned a bronze, silver & gold “Greenwashing Award” to 3 Canadian pension managers.

@InvestPSP wins bronze, @OTPPinfo silver, and @cppinvestments takes the gold star. #cdnpoli shiftaction.ca/reportcard2022…

@InvestPSP wins bronze, @OTPPinfo silver, and @cppinvestments takes the gold star. #cdnpoli shiftaction.ca/reportcard2022…

14/ The report card is rich in detail, and can be used to evaluate climate plans for all Canadian pension managers.

See this comparison of pension funds' emissions reduction and other climate-related targets as an example (p.20). #cdnpoli static1.squarespace.com/static/5b9a975…

See this comparison of pension funds' emissions reduction and other climate-related targets as an example (p.20). #cdnpoli static1.squarespace.com/static/5b9a975…

15/ Do your pension fund’s shiny responsible investing & #netzero claims stand up to rigorous scrutiny on climate?

We did the research so you don’t have to.

Check out our detailed analysis of the climate policies of 11 Canadian pension plans. #cdnpoli shiftaction.ca/reportcard2022

We did the research so you don’t have to.

Check out our detailed analysis of the climate policies of 11 Canadian pension plans. #cdnpoli shiftaction.ca/reportcard2022

16/ With $392 billion AUM, @laCDPQ is the investment manager for more than 45 public pension and insurance plans on behalf of 6 million Quebecers, including the Quebec Pension Plan.

CDPQ scored the highest among Canadian pension managers. #cdnpoli #polqc shiftaction.ca/reportcard2022…

CDPQ scored the highest among Canadian pension managers. #cdnpoli #polqc shiftaction.ca/reportcard2022…

17/ With $242.5 billion AUM, @OTPPinfo took 2nd place. It's Canada's largest single-profession pension plan, investing on behalf of 333,000 active and retired Ontario teachers. #cdnpoli #onpoli #onted

@osstf @ETFOeducators @OECTAProv @AEFO_ON_CA @otffeo

shiftaction.ca/reportcard2022…

@osstf @ETFOeducators @OECTAProv @AEFO_ON_CA @otffeo

shiftaction.ca/reportcard2022…

18/ @UPP_Ontario, with $11.8 billion AUM, launched in 2021 and combined the pension funds for faculty and staff at Ontario universities (@queensu, @UofT, and @uofg, with @TrentUniversity added later) into a multi-university jointly sponsored pension plan. shiftaction.ca/reportcard2022…

19/ @IMCOinvest is the investment manager for the Ontario Pension Board, the administrator of Ontario’s $33.7 billion Public Service Pension Plan, which is the pension fund for over 93,000 active and retired Ontario public servants. #cdnpoli #onpoli shiftaction.ca/reportcard2022…

20/ @InvestPSP, with $230.5 billion AUM, is a Crown corporation and the pension manager for over 900,000 active and retired employees of Canada’s federal government, including federal public servants, the RCMP, and Canadian Armed Forces. #cdnpoli shiftaction.ca/reportcard2022…

21/ @cppinvestments, or CPPIB, manages the Canada Pension Plan, the national retirement fund for over 21 millions Canadians outside of Quebec and one of the largest investment funds in the world, with $529 billion AUM. #cdnpoli shiftaction.ca/reportcard2022…

22/ BCI, with $211.1 billion AUM, is the investment manager for over 715,000 members of British Columbia’s public pension plans, as well as the insurance and benefit funds for over 2.5 million workers and retirees in BC. #cdnpoli #bcpoli shiftaction.ca/reportcard2022…

23/ OMERS, with $119.5 billion AUM, is the investment manager for the pension fund of Ontario’s municipal employees, with 541,000 members and 1,000 participating employers (ranging from large cities to local agencies). #onpoli #cdnpoli shiftaction.ca/reportcard2022…

24/ @OPTrust ($25.9 billion AUM) is the @OPSEU pension plan for over 100,000 active & retired provincial public servants, most of whom work for the Ontario Public Service, municipal govts & service providers, & Ontario’s public colleges. #cdnpoli #onpoli shiftaction.ca/reportcard2022…

25/ Toward the bottom of the pack is @HOOPPnow ($114.4 billion AUM), a pension plan for >400,000 Ontario health sector workers.

HOOPP's beneficiaries include members of @SEIUHealthCan, @OCHU_Healthcare, @ontarionurses & @OPSEU. #onpoli #ONhealth #cdnpoli shiftaction.ca/reportcard2022…

HOOPP's beneficiaries include members of @SEIUHealthCan, @OCHU_Healthcare, @ontarionurses & @OPSEU. #onpoli #ONhealth #cdnpoli shiftaction.ca/reportcard2022…

26/ Finally, the lowest score on our report card went to @aimcoinvests, the investment manager for Alberta's public pension plans, as well as the province's government, endowment, and specialty funds, with $168.3 billion AUM. #cdnpoli #ableg shiftaction.ca/reportcard2022…

END/ Adopting credible climate plans is not easy. The #climatecrisis presents an unprecedented challenge for pension managers.

We look forward to working with beneficiaries to improve their pensions' scores. #cdnpoli

Read our Pension Climate Report Card! shiftaction.ca/reportcard2022

We look forward to working with beneficiaries to improve their pensions' scores. #cdnpoli

Read our Pension Climate Report Card! shiftaction.ca/reportcard2022

• • •

Missing some Tweet in this thread? You can try to

force a refresh