The moment is here!

Our shopping list of 2023:

⚛️ Generational: $ATOM

⚛️ Real yield: $KUJI, $SWTH

⚛️ Modularity: $TIA, $DYM

⚛️ Money printers: $EVMOS, $TORI

⚛️ App & consumer chains: $GNOT, $SEI, $ARCH, $NTRN

1/62

Our shopping list of 2023:

⚛️ Generational: $ATOM

⚛️ Real yield: $KUJI, $SWTH

⚛️ Modularity: $TIA, $DYM

⚛️ Money printers: $EVMOS, $TORI

⚛️ App & consumer chains: $GNOT, $SEI, $ARCH, $NTRN

1/62

Before we dive into the shopping list, let's get two things right from the get go.

First, recap what a shopping list is.

Second, review narratives.

2/62

First, recap what a shopping list is.

Second, review narratives.

2/62

Our shopping list strategy is based on the idea that every year there are big spikes up and down in the markets, where you don't have time to research individual assets “on the fly”.

If you try, you will most likely miss a buying opportunity.

Instead, have a plan in hand.

3/62

If you try, you will most likely miss a buying opportunity.

Instead, have a plan in hand.

3/62

Every shopping list starts with establishing (A) a thesis and (B) a buying plan.

(A) Your thesis is what catalysts will drive markets in the next 3-5 yrs.

(B) Your buying plan is how much scale to buy of each asset, and what conditions to buy under (price, spikes etc).

4/62

(A) Your thesis is what catalysts will drive markets in the next 3-5 yrs.

(B) Your buying plan is how much scale to buy of each asset, and what conditions to buy under (price, spikes etc).

4/62

A thesis is revisited yearly to review the catalysts that you think could drive assets on your shopping list.

A buying plan is personal and based on an individual's circumstances, risk tolerance and timeline.

5/62

A buying plan is personal and based on an individual's circumstances, risk tolerance and timeline.

5/62

As long term investors holding 3-5 yrs, we know the risk of large drawdowns and having to hold for multiple years.

We also expect some assets going to zero. That's ok, crypto is risky, we will just have to make sure we size the bets accordingly (high risk high reward).

6/62

We also expect some assets going to zero. That's ok, crypto is risky, we will just have to make sure we size the bets accordingly (high risk high reward).

6/62

What is useful about a shopping list is avoiding to “over invest” into a few assets and/or buy all at once.

But don’t copy-pasta our shopping list.

Your shopping list should consist of assets *YOU* believe in.

We only share ours based on what we think will perform.

7/62

But don’t copy-pasta our shopping list.

Your shopping list should consist of assets *YOU* believe in.

We only share ours based on what we think will perform.

7/62

Overall, remember, this isn't investment advice.

A purchase that is right for us, may not be right for you.

Any asset purchased could be a good purchase one day, and a bad purchase the next.

In other words, always DYOR.

8/62

A purchase that is right for us, may not be right for you.

Any asset purchased could be a good purchase one day, and a bad purchase the next.

In other words, always DYOR.

8/62

A shopping list also isn't static.

Reevaluate on a monthly basis - sometimes weekly - to adjust how much/if you should invest.

Think of it in the context of macroeconomics, shifting industry events and new developments.

In investing, being static is a deathwish.

9/62

Reevaluate on a monthly basis - sometimes weekly - to adjust how much/if you should invest.

Think of it in the context of macroeconomics, shifting industry events and new developments.

In investing, being static is a deathwish.

9/62

We always aim for "Strong Opinions; Loosely Held".

Meaning we have conviction & reason behind our choices, but we’re not afraid to adjust when new information comes in.

Running this account and hosting spaces with founders is a very useful way to get new information.

10/62

Meaning we have conviction & reason behind our choices, but we’re not afraid to adjust when new information comes in.

Running this account and hosting spaces with founders is a very useful way to get new information.

10/62

Now lets dive into this year's shopping list.

Just a disclaimer:

We own our own assets.

We wouldn’t buy if we didn't believe in the asset.

There are no “paid ads”, a coin mentioned in the shopping list is what we are buying ourselves.

Still, always DOYR.

11/62

Just a disclaimer:

We own our own assets.

We wouldn’t buy if we didn't believe in the asset.

There are no “paid ads”, a coin mentioned in the shopping list is what we are buying ourselves.

Still, always DOYR.

11/62

So with that out of the way.

This year’s thesis summary:

1⃣ Generational

2⃣ Real yield

3⃣ Modularity

4⃣ Money printers

5⃣ App & consumer chains

12/62

This year’s thesis summary:

1⃣ Generational

2⃣ Real yield

3⃣ Modularity

4⃣ Money printers

5⃣ App & consumer chains

12/62

1⃣ GENERATIONAL

This is a category that you wanna hold until your (grand)kids inherent your portfolio.

Generational assets need solid tech, wide-spread adoption, a plethora of dapps/protocols using it, and max probability that this token will be around decades from now.

13/62

This is a category that you wanna hold until your (grand)kids inherent your portfolio.

Generational assets need solid tech, wide-spread adoption, a plethora of dapps/protocols using it, and max probability that this token will be around decades from now.

13/62

$ATOM from @cosmoshub

The native token for #Cosmos, securing Cosmos Hub, bringing tons of airdrops to stakers, not to mention 20%+ APR in rewards.

$ATOM is hard to ignore when it comes to building generation #crypto wealth.

14/62

The native token for #Cosmos, securing Cosmos Hub, bringing tons of airdrops to stakers, not to mention 20%+ APR in rewards.

$ATOM is hard to ignore when it comes to building generation #crypto wealth.

14/62

$ATOM is about to roll out so many things that it’s hard to mention all of it in this thread. Some highlights:

⚛️ Interchain Security (ICS)

⚛️ Interchain Accounts (ICA)

15/62

⚛️ Interchain Security (ICS)

⚛️ Interchain Accounts (ICA)

15/62

Interchain Security (ICS)

By allowing new chains to deploy on the Cosmos Hub and rent security from the $ATOM validators, stakers of $ATOM will earn rewards in MULTIPLE tokens, besides 20%+ APR in $ATOM!

16/62

By allowing new chains to deploy on the Cosmos Hub and rent security from the $ATOM validators, stakers of $ATOM will earn rewards in MULTIPLE tokens, besides 20%+ APR in $ATOM!

16/62

https://twitter.com/CosmosClub_/status/1558039103173705729

Interchain Accounts (ICA)

Interchain Accounts allow one blockchain to securely control an account on another blockchain, using #IBC.

With ICAs, you will never have to leave #cosmos again!

17/62

Interchain Accounts allow one blockchain to securely control an account on another blockchain, using #IBC.

With ICAs, you will never have to leave #cosmos again!

17/62

https://twitter.com/CosmosClub_/status/1565694841924771840

2⃣ REAL YIELD

This is a category with actual revenue generated by the protocol.

Even better, real yield in multiple coins lets you diversify your portfolio without touching a finger.

Basically, focus on real revenue catalysts with novel infrastructure.

18/62

This is a category with actual revenue generated by the protocol.

Even better, real yield in multiple coins lets you diversify your portfolio without touching a finger.

Basically, focus on real revenue catalysts with novel infrastructure.

18/62

$KUJI from @TeamKujira

Kujira is an L1 chain with built-in dapps such as:

👉 FIN: Orderbook DEX similar to GMX $GLP

👉 BOW: Liquidity hub similar to Curve $CRV

👉 ORCA: Liquidation hub similar to #Terra's Anchor

👉 $USK: Stable similar to $DAI

19/62

Kujira is an L1 chain with built-in dapps such as:

👉 FIN: Orderbook DEX similar to GMX $GLP

👉 BOW: Liquidity hub similar to Curve $CRV

👉 ORCA: Liquidation hub similar to #Terra's Anchor

👉 $USK: Stable similar to $DAI

19/62

https://twitter.com/CosmosClub_/status/1557667870158585857

While a strong foundation has been built by the Kujira team, other dapps are built by teams who are not core Kujira developers. These include:

👉 @CALC_Finance

👉 @BlackWhaleDeFi

👉 @TeamLocalMoney

👉 @Fuzion_App

and more..

20/62

👉 @CALC_Finance

👉 @BlackWhaleDeFi

👉 @TeamLocalMoney

👉 @Fuzion_App

and more..

20/62

As a result, Kujira’s TVL has been exploding, obtaining the highest growth chain by TVL in January.

And people are piling in, using various Kujira-powered dapps.

21/62

defillama.com/chain/Kujira

And people are piling in, using various Kujira-powered dapps.

21/62

defillama.com/chain/Kujira

$SWTH from @0xcarbon

Carbon is unique in that they are not just talking about cross-chain interoperability. They are doing it.

Carbon is a degen paradise, allowing users to borrow, lend, trade and everything a degen would do on MULTIPLE chains!

22/62

Carbon is unique in that they are not just talking about cross-chain interoperability. They are doing it.

Carbon is a degen paradise, allowing users to borrow, lend, trade and everything a degen would do on MULTIPLE chains!

22/62

https://twitter.com/CosmosClub_/status/1617889450578829314

These degen strategies are probably just the beginning on Carbon, as (1) derivatives/perps and (2) interoperability expands:

1⃣ Perpetuals launched recently: blog.switcheo.com/introduction-t…

2⃣ Interoperability is being built across both PolyNetwork, #IBC and #EVM networks

23/62

1⃣ Perpetuals launched recently: blog.switcheo.com/introduction-t…

2⃣ Interoperability is being built across both PolyNetwork, #IBC and #EVM networks

23/62

$SWTH stakers get rewarded from trading and borrowing fees on @demexchange.

Similar to how $KUJI stakers earn fees across #Kujira.

Both see staking yield increase, but for $SWTH yield is exploding currently at 18%.

APR can be estimated using stakeo.com

24/62

Similar to how $KUJI stakers earn fees across #Kujira.

Both see staking yield increase, but for $SWTH yield is exploding currently at 18%.

APR can be estimated using stakeo.com

24/62

3⃣ MODULARITY

This category is about a new breed of blockchains that are entering the market.

Modular blockchains are here to disrupt the monolithic types of chains, who are never going to bring mass adoption of blockchain and web3.

25/62

This category is about a new breed of blockchains that are entering the market.

Modular blockchains are here to disrupt the monolithic types of chains, who are never going to bring mass adoption of blockchain and web3.

25/62

$TIA from @CelestiaOrg

Celestia is the first modular blockchain network allowing anyone to easily deploy their own blockchain, without having to create their own consensus network.

Celestia does not execute transactions, they only order and publish them.

26/62

Celestia is the first modular blockchain network allowing anyone to easily deploy their own blockchain, without having to create their own consensus network.

Celestia does not execute transactions, they only order and publish them.

26/62

So what are modular blockchains?

Unlike a monolithic blockchain ($ETH, $SOL, $BTC etc), the four main blockchain functions are spread across various layers:

1) Execution

2) Settlement

3) Consensus

4) Data Availability

Each layer has its own isolated responsibility.

27/62

Unlike a monolithic blockchain ($ETH, $SOL, $BTC etc), the four main blockchain functions are spread across various layers:

1) Execution

2) Settlement

3) Consensus

4) Data Availability

Each layer has its own isolated responsibility.

27/62

What are the benefits of this modular setup?

To mention a few key reasons that makes modular blockchains a paradigm shift:

1) Scalability

2) No congestion

3) Shared security

4) Sovereignty & customizability

28/62

To mention a few key reasons that makes modular blockchains a paradigm shift:

1) Scalability

2) No congestion

3) Shared security

4) Sovereignty & customizability

28/62

This setup is opposite to most if not all other chains, where users have to download all data to check if it is available.

This prices out most average users.

Lower barriers -> more users -> more collective power -> more scalability -> higher security

29/62

This prices out most average users.

Lower barriers -> more users -> more collective power -> more scalability -> higher security

29/62

As for the Celestia $TIA token, the main characteristics are:

✅ Central hub to pay for gas fees

✅ Consensus will be PoS so users stake the token to help validate the network

✅ Celestia will have a fee-burn mechanism similar to EIP-1559 on #Ethereum

30/62

✅ Central hub to pay for gas fees

✅ Consensus will be PoS so users stake the token to help validate the network

✅ Celestia will have a fee-burn mechanism similar to EIP-1559 on #Ethereum

30/62

We think Celestia will see a lot of adoption, and hence the competition for blockspace on Celestia-powered chains will be large.

This will accrue a lot of value back to the $TIA holders and stakers, which is why we are loading up the truck.

31/62

This will accrue a lot of value back to the $TIA holders and stakers, which is why we are loading up the truck.

31/62

$DYM from @dymensionXYZ

Dymension is a rollapp protocol using Celestia tech, including:

A) RollApp Development Kit (RDK)

B) dYmension Settlement Layer

C) Inter-Rollup Communication (IRC)

D) RollApp Virtual Machine (RVM)

E) Embedded Hub AMM

32/62

Dymension is a rollapp protocol using Celestia tech, including:

A) RollApp Development Kit (RDK)

B) dYmension Settlement Layer

C) Inter-Rollup Communication (IRC)

D) RollApp Virtual Machine (RVM)

E) Embedded Hub AMM

32/62

https://twitter.com/CosmosClub_/status/1584272375222505472

While we are big believers in building on top of Celestia, the underlying economics of $DYM is a real kicker, where income is generated from

🤑 User fees

🤑 Operator revenue

🤑 Operator cost

🤑 Operator profits

33/62

🤑 User fees

🤑 Operator revenue

🤑 Operator cost

🤑 Operator profits

33/62

As more RollApps get deployed, a flywheel effect starts to kick in:

☸️ User fee = RollApp gas or other collectable fee mechanics

☸️ Operator revenue = User fees + MEV

☸️ Operator cost = settlement layer fee + DA fee + Off-chain operator costs

34/62

☸️ User fee = RollApp gas or other collectable fee mechanics

☸️ Operator revenue = User fees + MEV

☸️ Operator cost = settlement layer fee + DA fee + Off-chain operator costs

34/62

Investors are starting to pay attention also to Dymension.

They recently raised $6.7M, giving them a healthy runway to build out killer tech that users will love and adopt to scale the network manyfold.

35/62

They recently raised $6.7M, giving them a healthy runway to build out killer tech that users will love and adopt to scale the network manyfold.

35/62

https://twitter.com/dymensionXYZ/status/1623706686362902531

4⃣ MONEY PRINTERS

This category consists of coins that earn high staking rewards, yet are still likely to appreciate in price due to a solid team, great partnerships and an approach combining various elements of #crypto in a new way that is here to stay.

36/62

This category consists of coins that earn high staking rewards, yet are still likely to appreciate in price due to a solid team, great partnerships and an approach combining various elements of #crypto in a new way that is here to stay.

36/62

$EVMOS from @EvmosOrg

Do you like #Ethereum?

Do you like #Cosmos?

Then you love $EVMOS.

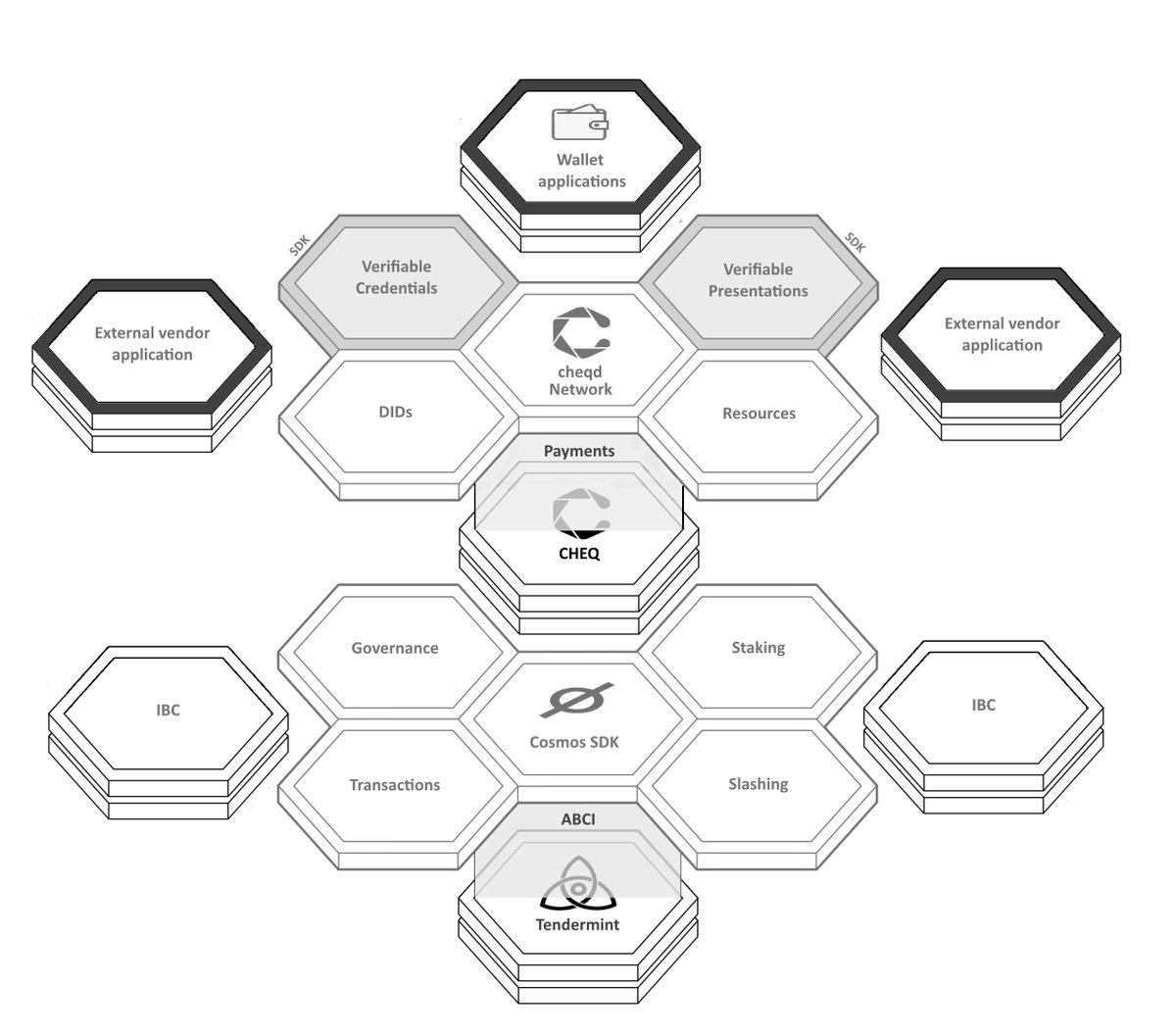

Evmos is essentially an "Ethereum copy" that is EVM compatible, but built on Tendermint and the Cosmos SDK that integrates with IBC

37/62

Do you like #Ethereum?

Do you like #Cosmos?

Then you love $EVMOS.

Evmos is essentially an "Ethereum copy" that is EVM compatible, but built on Tendermint and the Cosmos SDK that integrates with IBC

37/62

https://twitter.com/CosmosClub_/status/1548248671401041925

In many ways, Evmos scales horizontally (across chains with #IBC) and vertically (with #Ethereum & L2s like #Polygon).

Others have seen the same and forked EVMOS, including but not limited to $CANTO and $REBUS.

However, you cannot fork team and first mover advantage.

38/62

Others have seen the same and forked EVMOS, including but not limited to $CANTO and $REBUS.

However, you cannot fork team and first mover advantage.

38/62

Something else that you cannot fork is partners launching with $EVMOS

@AaveAave Money market

@coslend Money market

@fraxfinance Stablecoin

@KinesisLabs Stablecoin ecosystem

@diffusion_fi AMM

@Exswapdotxyz AMM

@CronusFinance AMM

@spacefi_io DEX

@AngelDAOorg Liquid staking

39/62

@AaveAave Money market

@coslend Money market

@fraxfinance Stablecoin

@KinesisLabs Stablecoin ecosystem

@diffusion_fi AMM

@Exswapdotxyz AMM

@CronusFinance AMM

@spacefi_io DEX

@AngelDAOorg Liquid staking

39/62

Recently, it even became possible to liquid stake $EVMOS with @stride.

Imagine that, earning juicy staking rewards while keeping your sweet EVMOS liquid!

This also brings more #DeFi usecases to $EVMOS, instead of locking up tokens for staking.

40/62

Imagine that, earning juicy staking rewards while keeping your sweet EVMOS liquid!

This also brings more #DeFi usecases to $EVMOS, instead of locking up tokens for staking.

40/62

https://twitter.com/stride_zone/status/1625494016493252613

Low $EVMOS prices present a great opportunity to accumulate $EVMOS.

Many have criticised EVMOS’ high staking rewards, using it as the explanation to negative price action.

However, from an investment perspective it is a great hedge to be able to sell staking rewards.

41/62

Many have criticised EVMOS’ high staking rewards, using it as the explanation to negative price action.

However, from an investment perspective it is a great hedge to be able to sell staking rewards.

41/62

If you converted 100 $ATOM to $EVMOS, you could sell your staking rewards from $EVMOS back to $ATOM until you have your original investment back.

This is exactly why we love projects like EVMOS that also has:

1. great team

2. powerful narrative

3. many partnerships

42/62

This is exactly why we love projects like EVMOS that also has:

1. great team

2. powerful narrative

3. many partnerships

42/62

If price goes down, you can at least hedge your investment by selling $EVMOS staking rewards on a rolling basis.

If price goes up, you win twice.

43/62

If price goes up, you win twice.

43/62

$TORI from @TeritoriNetwork

We also love $TORI and the high staking rewards, hedging our risk by selling staking rewards.

However, $TORI is not just vaporware with high APR.

@Teritori is doing something interesting in #cosmos with NFTs.

44/62

We also love $TORI and the high staking rewards, hedging our risk by selling staking rewards.

However, $TORI is not just vaporware with high APR.

@Teritori is doing something interesting in #cosmos with NFTs.

44/62

https://twitter.com/CosmosClub_/status/1576999520717901826

@TeritoriNetwork is creating all kinds of social features where users can interact with DAOs and users through their public profile and feed.

Giving users a much easier user experience in #web3, Teritori aims at becoming an all-in-one hub of dApps.

45/62

Giving users a much easier user experience in #web3, Teritori aims at becoming an all-in-one hub of dApps.

45/62

If they succeed, there will be a large demand for $TORI - much larger than the inflation rate - to support the 900%+ APY staking rewards!

If they don’t, then at least we have a chance to sell staking rewards on a rolling basis to get back our original investment back…

46/62

If they don’t, then at least we have a chance to sell staking rewards on a rolling basis to get back our original investment back…

46/62

5⃣ APP & CONSUMER CHAINS

This category is made up of #cosmos chains we are bullish on.

Having covered almost all chains running Cosmos tech on this account, this category was by far the hardest to nail down to just a handful of projects.

47/62

This category is made up of #cosmos chains we are bullish on.

Having covered almost all chains running Cosmos tech on this account, this category was by far the hardest to nail down to just a handful of projects.

47/62

$GNOT from @_gnoland

Gno.land (pronounced no-land) is a layer 1 smart contract platform that gained initial interest as @jaekwon (cofounder of @Cosmos) is behind, trying to lower the barriers to entry for developers to become blockchain developers.

48/62

Gno.land (pronounced no-land) is a layer 1 smart contract platform that gained initial interest as @jaekwon (cofounder of @Cosmos) is behind, trying to lower the barriers to entry for developers to become blockchain developers.

48/62

Gno.land does so by creating:

👉 It's own Gnolang (Gno) programming language, an interpreted version of Golang (Go)

👉 A state-of-the-art VM written in Go

49/62

👉 It's own Gnolang (Gno) programming language, an interpreted version of Golang (Go)

👉 A state-of-the-art VM written in Go

49/62

https://twitter.com/CosmosClub_/status/1551134614344929283

Gno is "the next generation of interoperable concurrent smart contract for wide-scale developer adoption" that wants to solve three key problems in #web3:

✅ Lack of transparency

✅ Lack of fairness & justice for coders

✅ A simpler way to build scalable smartcontracts

50/62

✅ Lack of transparency

✅ Lack of fairness & justice for coders

✅ A simpler way to build scalable smartcontracts

50/62

In a nutshell, Gno is:

☑️ First blockchain to use Gnolang

☑️ Native token is $GNOT

☑️ A fork of #Tendermint, which will eventually become the official Tendermint2

☑️ Will host import packages from other Gnolang projects

☑️ Governed by contributors

51/62

☑️ First blockchain to use Gnolang

☑️ Native token is $GNOT

☑️ A fork of #Tendermint, which will eventually become the official Tendermint2

☑️ Will host import packages from other Gnolang projects

☑️ Governed by contributors

51/62

It is quite clear that Gno.land focuses on rewarding contributors to the protocol rather than deep pockets.

They call this “Proof of Contribution” where developers can earn rewards by completing pre-defined tasks or bounties.

52/62

They call this “Proof of Contribution” where developers can earn rewards by completing pre-defined tasks or bounties.

52/62

https://twitter.com/CosmosClub_/status/1595168827372933143

This combination of aggressive focus on:

🥇 Onboarding "web2" developers to become "web3" developers

🥈 Reward developers to build Gno.land

🥉 Team who have “done it” before

is what really excites us about $GNOT and why it is on our shopping list.

53/62

🥇 Onboarding "web2" developers to become "web3" developers

🥈 Reward developers to build Gno.land

🥉 Team who have “done it” before

is what really excites us about $GNOT and why it is on our shopping list.

53/62

$SEI from @SeiNetwork

AMMs like @Uniswap and @Balancer have become the norm in #DeFi.

But, AMMs are inherently less efficient than limited order books who offer lower slippage, tighter spreads, and more.

This is where Sei Network comes in.

54/62

AMMs like @Uniswap and @Balancer have become the norm in #DeFi.

But, AMMs are inherently less efficient than limited order books who offer lower slippage, tighter spreads, and more.

This is where Sei Network comes in.

54/62

https://twitter.com/CosmosClub_/status/1564998899500204032

Sei will be an orderbook-specific L1 blockchain.

It’s built using the Cosmos SDK, Tendermint core, and also features a custom built CLOB module.

In addition, Sei integrates the wasmd module to support CosmWasm (CW) smart contracts.

And, ofc, it's #IBC-enabled

55/62

It’s built using the Cosmos SDK, Tendermint core, and also features a custom built CLOB module.

In addition, Sei integrates the wasmd module to support CosmWasm (CW) smart contracts.

And, ofc, it's #IBC-enabled

55/62

In a way, Sei can be seen as a more decentralised version of @dYdX.

Sei has already seen protocols built on it AND getting acquired by massive DEXs like @SushiSwap, proving that the tech is solid and working.

56/62

decrypt.co/121027/sushisw…

Sei has already seen protocols built on it AND getting acquired by massive DEXs like @SushiSwap, proving that the tech is solid and working.

56/62

decrypt.co/121027/sushisw…

There is an airdrop coming for the $SEI token, but we intend to load up the truck with more $SEI regardless if we receive the airdrop or not.

57/62

57/62

https://twitter.com/CosmosClub_/status/1564998931607654401

$ARCH from @archwayHQ

Most layer 1 protocols reward either validators for running their chain. Archway flips that and rewards dapps.

Similar to @_gnoland, Archway is designed to reward builders for the value they contribute to the protocol.

58/62

Most layer 1 protocols reward either validators for running their chain. Archway flips that and rewards dapps.

Similar to @_gnoland, Archway is designed to reward builders for the value they contribute to the protocol.

58/62

https://twitter.com/CosmosClub_/status/1605135841852014592

In general, bets on building a strong developer community in #Cosmos is something that we are extremely #bullish on.

We need #DeFi to extend beyond stables, oney markets and trading.

Archway could be the protocol that pulls that off, and hence on our shopping list

59/62

We need #DeFi to extend beyond stables, oney markets and trading.

Archway could be the protocol that pulls that off, and hence on our shopping list

59/62

$NTRN from @Neutron_org

Neutron is the first consumer chain on our shopping list secured by interchain security.

Instead of being secured by their own validator set, Neutron will be secured by the Cosmos Hub validator set and all their $ATOM.

60/62

Neutron is the first consumer chain on our shopping list secured by interchain security.

Instead of being secured by their own validator set, Neutron will be secured by the Cosmos Hub validator set and all their $ATOM.

60/62

https://twitter.com/CosmosClub_/status/1551867219222708225

Being the first consumer chain secured by the @cosmoshub is by itself exciting, and devs are taking notice.

Lido - the largest LSP in #Ethereum is working with Neutron to bring Lido’s liquid staking offerings to #Cosmos!

This and more makes us #bullish on Neutron!

61/62

Lido - the largest LSP in #Ethereum is working with Neutron to bring Lido’s liquid staking offerings to #Cosmos!

This and more makes us #bullish on Neutron!

61/62

So much exciting stuff is happening in #cosmos and #crypto that it almost hurts.

Just writing up this shopping list, we had to go and revisit multiple parts, adding the latest changes and announcements.

62/62

Just writing up this shopping list, we had to go and revisit multiple parts, adding the latest changes and announcements.

62/62

We look forward to see how 2023 will unfold, how the narratives play out and which of the picks in our shopping list will not go down the way we think, which ones will, and most important, why.

Thank you for reading all the way to the end! 🙏

Give us a follow if you liked this.

Thank you for reading all the way to the end! 🙏

Give us a follow if you liked this.

• • •

Missing some Tweet in this thread? You can try to

force a refresh