With promising new projects promising cross-chain capabilities, many people overlook the OGs in the space and what they're doing: Enter @chainlink, building #CCIP.

And they've already got a major player using it: @swiftcommunity

Here's how it'll be a game changer 👇

1/🧵

And they've already got a major player using it: @swiftcommunity

Here's how it'll be a game changer 👇

1/🧵

#CCIP stands for Cross-Chain Interoperability Protocol, and it allows developers to build Omnichain-capable dApps.

This means that the days of having to integrate every single chain individually are over.

2/🧵

This means that the days of having to integrate every single chain individually are over.

2/🧵

It opens up a myriad of possibilities for users too! All the hassle of having to use unsafe bridges/shady CEXes just to get into a new chain? Gone.

Here are some examples of how it'll completely change user experience in #DeFi:

3/🧵

Here are some examples of how it'll completely change user experience in #DeFi:

3/🧵

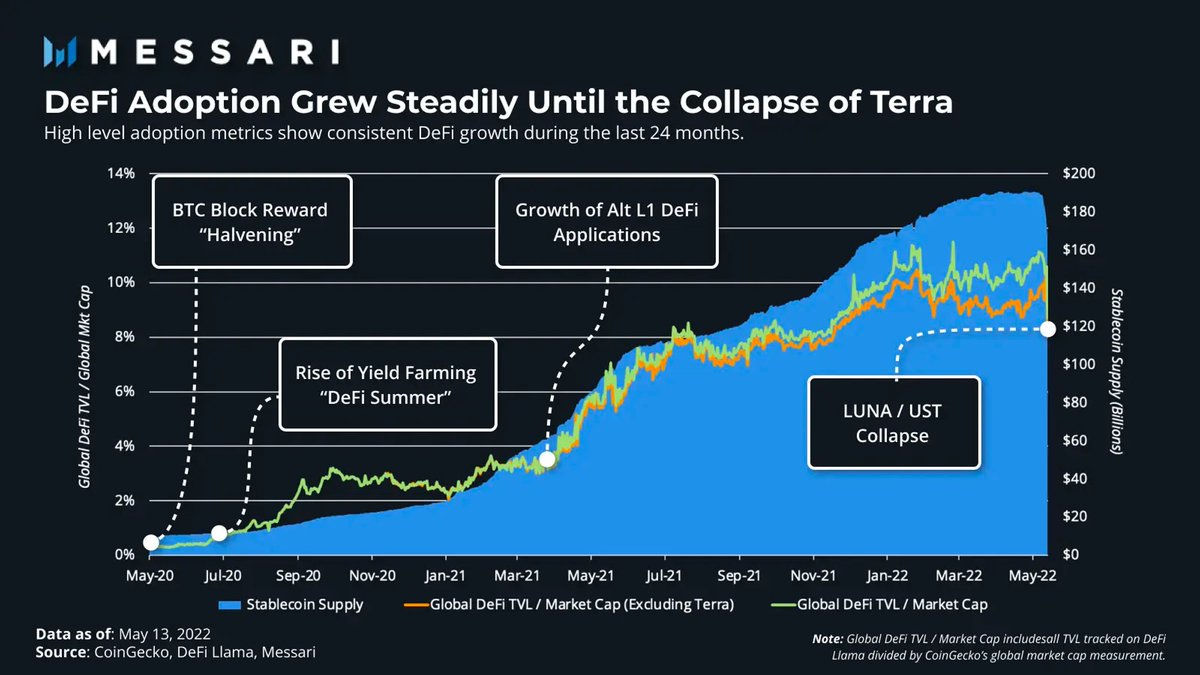

Yield farming

Farmers will no longer have to scour chains for the best yield. Thanks to facilitated aggregation, you'll be able to get optimized yield faster and easier!

4/🧵

Farmers will no longer have to scour chains for the best yield. Thanks to facilitated aggregation, you'll be able to get optimized yield faster and easier!

4/🧵

Optimized lending/loaning market

Example: Let's say @AaveAave has the best lend yields for a certain token on #Ethereum, and the lowest borrow rates on #Avalanche. You'll be able to deposit collateral on #Eth, and borrow on #Avax!

5/🧵

Example: Let's say @AaveAave has the best lend yields for a certain token on #Ethereum, and the lowest borrow rates on #Avalanche. You'll be able to deposit collateral on #Eth, and borrow on #Avax!

5/🧵

Lower transaction costs

Kind of how L2s work: Transaction data is processed on a high-TX, low-cost chain, with the results of said transaction bridged over to the original chain to finish up the transaction.

Imagine the convenience of #Optimism or #Arbitrum on any chain!

6/🧵

Kind of how L2s work: Transaction data is processed on a high-TX, low-cost chain, with the results of said transaction bridged over to the original chain to finish up the transaction.

Imagine the convenience of #Optimism or #Arbitrum on any chain!

6/🧵

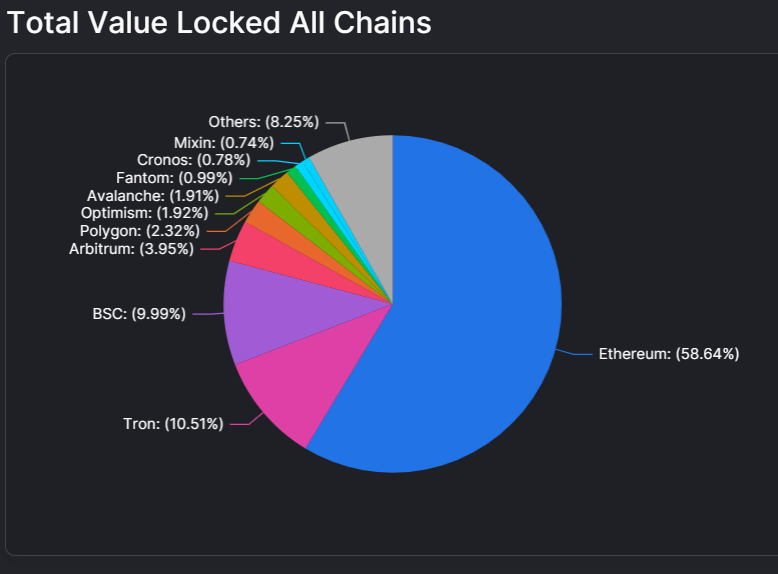

And it's not just good for users: it makes developing across chains easier.

Protocols that rely on thick liquidity will be able to unify liquidity pools to achieve maximum efficiency.

This means users always have the best rates on each and every chain a protocol is in.

7/🧵

Protocols that rely on thick liquidity will be able to unify liquidity pools to achieve maximum efficiency.

This means users always have the best rates on each and every chain a protocol is in.

7/🧵

It also accelerates the mass adoption of crypto.

While institutions are trying to enter #crypto in droves, most have no idea how to do it. This is where #CCIP and @swiftcommunity come in!

8/🧵

While institutions are trying to enter #crypto in droves, most have no idea how to do it. This is where #CCIP and @swiftcommunity come in!

8/🧵

Facilitating over 40m+ transactions with over 11,000 member institutions, #swift allocates a “Bank Identifier Code” (BIC) to each member, giving enough information to other members to allow a transaction to happen safely and fast.

9/🧵

9/🧵

Well, as fast as you can get with #TradFi, that is. With #CCIP, they can interact with any chain through those existing BICs. As Sergey Nazarov said, "Just like we don't want to build KPIs for 11,000 banks, SWIFT doesn't want to build integrations for every chain."

10/🧵

10/🧵

As of now, #Link has 2045 integrations. With just #Swift alone, they'll get 11,000 more connections, with every bank connected to it.

Talk about mass adoption! Curious to see how they'll implement all of it!

11/🧵

Talk about mass adoption! Curious to see how they'll implement all of it!

11/🧵

This was a small little thread on #Chainlink's take on interoperability. Like and follow if you want to see more!

By the way, we're not just an educational page - we build cool stuff too! Stay tuned for our announcement (coming SOON)!

See you later!

12/END🧵

By the way, we're not just an educational page - we build cool stuff too! Stay tuned for our announcement (coming SOON)!

See you later!

12/END🧵

• • •

Missing some Tweet in this thread? You can try to

force a refresh