On November 2nd, 2018, the world of #crypto changed forever

@haydenzadams launched @uniswap, revolutionizing decentralized finance

I've spent 100+ hours researching $UNI, and learned it's much more than just a #DEX

Here’s everything you need to know about 🦄

👇

🧵

@haydenzadams launched @uniswap, revolutionizing decentralized finance

I've spent 100+ hours researching $UNI, and learned it's much more than just a #DEX

Here’s everything you need to know about 🦄

👇

🧵

2/

#Uniswap is the largest decentralized crypto exchange (we’ll explain what this means below)

It has a marketcap of $4.5B and FDV of $5.9B, and is backed by the $UNI token, which trade at $5.88

During the bull market of 2021, the price exceeded $40

#Uniswap is the largest decentralized crypto exchange (we’ll explain what this means below)

It has a marketcap of $4.5B and FDV of $5.9B, and is backed by the $UNI token, which trade at $5.88

During the bull market of 2021, the price exceeded $40

3/

This thread we will cover:

• The problem with centralized exchanges

• How DEXes solve this problem

• How Uniswap works

• The $UNI ecosystem

• #DEX competitive landscape and UNI’s moat

• $UNI tokenomics

• The “fee switch” debate

• The protocol’s long-term potential

This thread we will cover:

• The problem with centralized exchanges

• How DEXes solve this problem

• How Uniswap works

• The $UNI ecosystem

• #DEX competitive landscape and UNI’s moat

• $UNI tokenomics

• The “fee switch” debate

• The protocol’s long-term potential

4/

🟢 The Problem with Centralized Exchanges

Traditional asset exchanges, such as the NYSE, Nasdaq or #Coinbase, provide a platform to match buyers and sellers of securities.

While they have offered a reliable way to trade for centuries, they’re not the most efficient model

🟢 The Problem with Centralized Exchanges

Traditional asset exchanges, such as the NYSE, Nasdaq or #Coinbase, provide a platform to match buyers and sellers of securities.

While they have offered a reliable way to trade for centuries, they’re not the most efficient model

https://twitter.com/NYSE/status/1129361789660073987

5/

In particular, they are vulnerable to:

❌ Censorship and manipulation

❌ Liquidity issues

❌ High fees

❌ Security Risks

❌ Lack of transparency

Fortunately, #blockchains provide a solution to this problem

In particular, they are vulnerable to:

❌ Censorship and manipulation

❌ Liquidity issues

❌ High fees

❌ Security Risks

❌ Lack of transparency

Fortunately, #blockchains provide a solution to this problem

6/

🟢 Solution: Decentralized Exchanges

Decentralized exchanges, also known as #DEXs are digital marketplaces that operate on a #blockchain network, enabling peer-to-peer trading of #cryptocurrencies and other digital assets

🟢 Solution: Decentralized Exchanges

Decentralized exchanges, also known as #DEXs are digital marketplaces that operate on a #blockchain network, enabling peer-to-peer trading of #cryptocurrencies and other digital assets

7/

Unlike centralized exchanges, DEXs do not rely on a central authority or intermediary to facilitate trades

Instead, they operate through smart contracts, which execute trades automatically when certain conditions are met

Unlike centralized exchanges, DEXs do not rely on a central authority or intermediary to facilitate trades

Instead, they operate through smart contracts, which execute trades automatically when certain conditions are met

8/

Decentralized exchanges have several key advantages over centralized ones, including:

✅ Peer-to-Peer Trading

✅ Control

✅ Privacy

✅ Transparency

✅ Security

✅ Lower Fees

✅ Global access

Decentralized exchanges have several key advantages over centralized ones, including:

✅ Peer-to-Peer Trading

✅ Control

✅ Privacy

✅ Transparency

✅ Security

✅ Lower Fees

✅ Global access

9/

🟢 Protocol Overview

#Uniswap is the largest decentralized exchange

It’s built on the #Ethereum blockchain, allowing users to swap any token on the Ethereum network or its scaling solutions (#Optimism, #Arbitrum and #Polygon)

🟢 Protocol Overview

#Uniswap is the largest decentralized exchange

It’s built on the #Ethereum blockchain, allowing users to swap any token on the Ethereum network or its scaling solutions (#Optimism, #Arbitrum and #Polygon)

10/

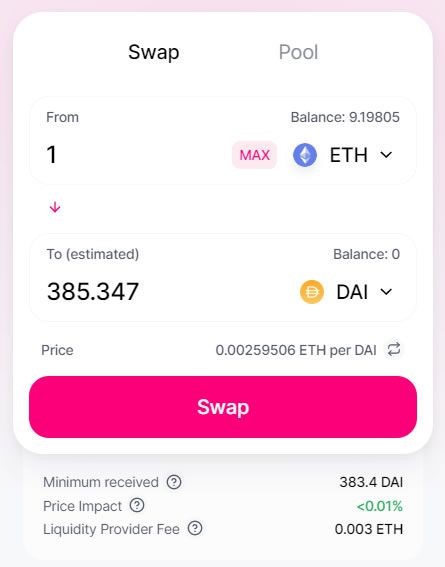

It offers a simple interface that lets users swap tokens directly with other users

Swaps are arranged in pairs

For example, you could trade Ethereum ($ETH) tokens for USD Coin ($USDC), Chainlink ($LINK) for Wrapped Ether ($WETH), Shiba Inu ($SHIB) for Apecoin ($APE), etc…

It offers a simple interface that lets users swap tokens directly with other users

Swaps are arranged in pairs

For example, you could trade Ethereum ($ETH) tokens for USD Coin ($USDC), Chainlink ($LINK) for Wrapped Ether ($WETH), Shiba Inu ($SHIB) for Apecoin ($APE), etc…

11/

$UNI offers over 943 tokens and 1,734 trading pairs on its platform

At the the time of writing, the ones with the most volume are:

• $WETH / $USDC

• $USDC / $USDT

• $WETH / $USDT

• $WBTC / $WETH

• $DAI / $USDC

$UNI offers over 943 tokens and 1,734 trading pairs on its platform

At the the time of writing, the ones with the most volume are:

• $WETH / $USDC

• $USDC / $USDT

• $WETH / $USDT

• $WBTC / $WETH

• $DAI / $USDC

12/

🟢 How AMMs works

Unlike traditional exchanges, which use centralized order books and market makers, Uniswap pioneered a new model known as an Automated Market Maker (“#AMM”)

Let’s dive into how they work…

🟢 How AMMs works

Unlike traditional exchanges, which use centralized order books and market makers, Uniswap pioneered a new model known as an Automated Market Maker (“#AMM”)

Let’s dive into how they work…

13/

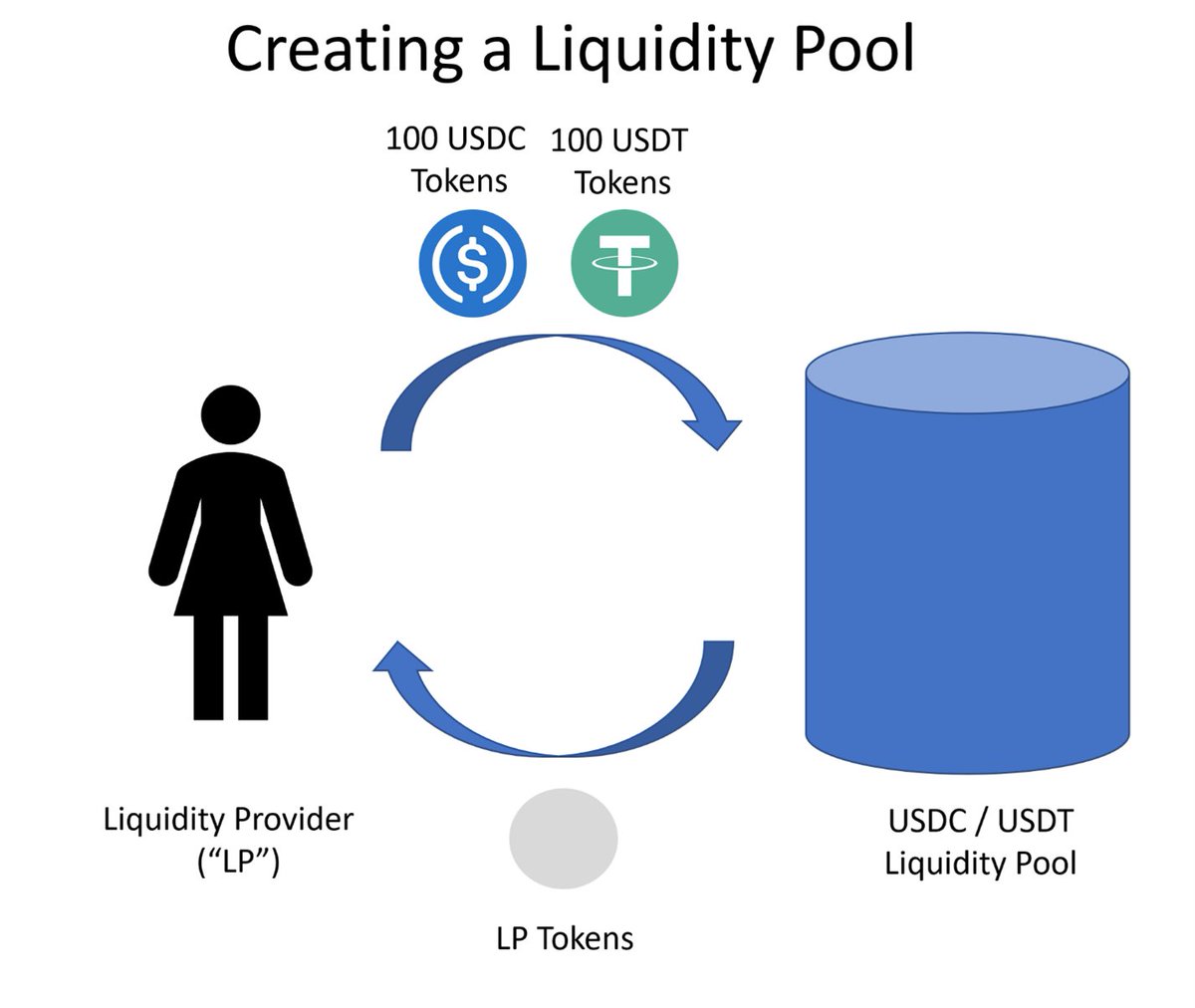

The #AMM works by creating a “liquidity pool” for each token pair

Users – known as “liquidity providers” or “LPs” - deposit an equal value of each token into the pool

For instance, an #LP could create a pool by adding 100 USDC tokens and 100 USDT tokens

The #AMM works by creating a “liquidity pool” for each token pair

Users – known as “liquidity providers” or “LPs” - deposit an equal value of each token into the pool

For instance, an #LP could create a pool by adding 100 USDC tokens and 100 USDT tokens

14/

Once the pool is created, users can freely exchange tokens

For example, let’s say you wanted to trade $USDC for $ETH on Uniswap. You would simply go to the site, access the $ETH-$USDC pool, send in your $USDC and receive $ETH in return.

Once the pool is created, users can freely exchange tokens

For example, let’s say you wanted to trade $USDC for $ETH on Uniswap. You would simply go to the site, access the $ETH-$USDC pool, send in your $USDC and receive $ETH in return.

15/

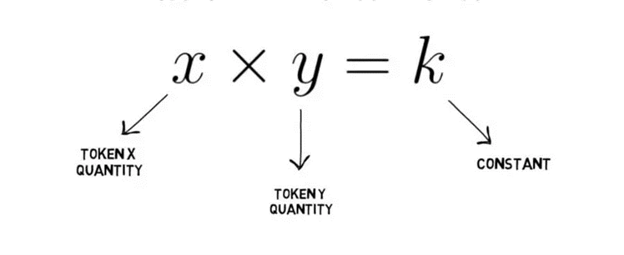

The price of these tokens is calculated by a simple algorithm known as a “constant product formula”

We won’t get into the math here, but the gist is the formula raises the price of a token when demand increases, and lowers it when demand falls.

The price of these tokens is calculated by a simple algorithm known as a “constant product formula”

We won’t get into the math here, but the gist is the formula raises the price of a token when demand increases, and lowers it when demand falls.

16/

Users pay a fee for each swap (there are currently three tiers: 0.05%, 0.3% and 1%)

This fee goes directly to the LPs for providing liquidity

Users pay a fee for each swap (there are currently three tiers: 0.05%, 0.3% and 1%)

This fee goes directly to the LPs for providing liquidity

17/

This is all done automatically through smart contracts, so no centralized authority or intermediary is needed

This makes AMMs

✅ Cheaper

✅ More secure

✅ More liquid

✅ Permissionless

✅ Always open

This is all done automatically through smart contracts, so no centralized authority or intermediary is needed

This makes AMMs

✅ Cheaper

✅ More secure

✅ More liquid

✅ Permissionless

✅ Always open

18/

🟢 Uniswap Ecosystem

Ultimately, #Uni is much more than a simple DEX. It’s a powerhouse in #DeFi and #Web3 with several major initiatives:

• Uniswap #DAO

• Uniswap Labs

• Uniswap Foundation

• Uniswap Ventures

• DeFi Education Fund

Let’s check out each…

🟢 Uniswap Ecosystem

Ultimately, #Uni is much more than a simple DEX. It’s a powerhouse in #DeFi and #Web3 with several major initiatives:

• Uniswap #DAO

• Uniswap Labs

• Uniswap Foundation

• Uniswap Ventures

• DeFi Education Fund

Let’s check out each…

19/

◾ Uniswap DAO

The Uniswap DAO is the community-led organization that governs #Uni

$UNI token holders can propose, vote, and make decisions about the future of the protocol, such as protocol upgrades, fee structures, and community initiatives.

It's the largest #DAO by AUM

◾ Uniswap DAO

The Uniswap DAO is the community-led organization that governs #Uni

$UNI token holders can propose, vote, and make decisions about the future of the protocol, such as protocol upgrades, fee structures, and community initiatives.

It's the largest #DAO by AUM

20/

◾ Uniswap Labs

Uniswap Labs is the for-profit software development company that created Uniswap

Its responsible for the “day-to-day” operations of the protocol including development, upgrades and enhancements and technical support

◾ Uniswap Labs

Uniswap Labs is the for-profit software development company that created Uniswap

Its responsible for the “day-to-day” operations of the protocol including development, upgrades and enhancements and technical support

21/

◾ Uniswap Foundation

The @UniswapFND was formed in 2022 to allocate $60M in the form of grants to academics developers and entrepreneurs building tools and resources that make it easier for key stakeholders to participate in the Uniswap Ecosystem

◾ Uniswap Foundation

The @UniswapFND was formed in 2022 to allocate $60M in the form of grants to academics developers and entrepreneurs building tools and resources that make it easier for key stakeholders to participate in the Uniswap Ecosystem

https://twitter.com/UniswapFND/status/1572630688838610944

22/

◾ Uniswap Ventures

@UniswapLabsVC is the venture capital arm of #Uniswap Labs

It invests in companies helping to build the #Web3 stack, from infrastructure to developer tools to #dapps

The fund was launched in April of 2022

◾ Uniswap Ventures

@UniswapLabsVC is the venture capital arm of #Uniswap Labs

It invests in companies helping to build the #Web3 stack, from infrastructure to developer tools to #dapps

The fund was launched in April of 2022

https://twitter.com/Cointelegraph/status/1513834355256348674

23/

◾ DeFi Education Fund

Uniswap also backs the DeFi Education Fund (@fund_defi), which explains decentralized finance (#DeFi) to policymakers around the world and advocates for policies welcoming of decentralized financial infrastructure

◾ DeFi Education Fund

Uniswap also backs the DeFi Education Fund (@fund_defi), which explains decentralized finance (#DeFi) to policymakers around the world and advocates for policies welcoming of decentralized financial infrastructure

24/

🟢 Market Overview

#DEXes have exploded in popularity over the past 3 years

Although significantly down from the 2021/22 bull market, they’re still doing > $100B in volume per month

This represents roughly 10%-16% of the volume of centralized crypto exchanges (CEXs)

🟢 Market Overview

#DEXes have exploded in popularity over the past 3 years

Although significantly down from the 2021/22 bull market, they’re still doing > $100B in volume per month

This represents roughly 10%-16% of the volume of centralized crypto exchanges (CEXs)

25/

🟢 Competitive Landscape

#UNI is the largest #DEX with >50% of overall volume

This is impressive because the protocol has successfully defended its moat against a growing base of competitors that includes Curve, Sushiswap, Pancakeswap and DODO

🟢 Competitive Landscape

#UNI is the largest #DEX with >50% of overall volume

This is impressive because the protocol has successfully defended its moat against a growing base of competitors that includes Curve, Sushiswap, Pancakeswap and DODO

26/

🟢 Competitive Advantage

This is likely due to several competitive advantages, including:

✅ Wide range of tokens

✅ Large amounts of liquidty

✅ High security

✅ User-friendly interface

✅ Strong community

✅ Good tokenomics

✅ Community Governance

🟢 Competitive Advantage

This is likely due to several competitive advantages, including:

✅ Wide range of tokens

✅ Large amounts of liquidty

✅ High security

✅ User-friendly interface

✅ Strong community

✅ Good tokenomics

✅ Community Governance

27/

🟢 Traction

Indeed, @Uniswap has achieved significant traction including:

• 4.5M+ total users

• $1.3T+ total volume

• 136M+ all time trades

• 362K #DAO members

• $2.5 DAO AUM

🟢 Traction

Indeed, @Uniswap has achieved significant traction including:

• 4.5M+ total users

• $1.3T+ total volume

• 136M+ all time trades

• 362K #DAO members

• $2.5 DAO AUM

28/

◾ Roadmap

It is also constantly evolving, and has recently launched:

• A self-custodied mobile wallet (a al Metamask)

• Support for #NFT purchases

• Fiat purchases with credit cards

It’s even gone “cross-chain” and deployed on #BNB via the #Wormhole bridge

◾ Roadmap

It is also constantly evolving, and has recently launched:

• A self-custodied mobile wallet (a al Metamask)

• Support for #NFT purchases

• Fiat purchases with credit cards

It’s even gone “cross-chain” and deployed on #BNB via the #Wormhole bridge

https://twitter.com/DefiantNews/status/1636527781264891906

29/

🟢 Team

#Uniswap is a #DAO, so technically it's governed by the community

But Uniswap Labs - the company that controls the day-to-day operation - is a for profit entity that lists 132 employees on LinkedIn

🟢 Team

#Uniswap is a #DAO, so technically it's governed by the community

But Uniswap Labs - the company that controls the day-to-day operation - is a for profit entity that lists 132 employees on LinkedIn

30/

Notable team members include

• CEO @haydenzadams

• COO @Mclader

• VP Prod @willruben

• VP Eng @chaddepue

• Ventures Lead @teo_leibowitz

• Head of #NFTs @Scott_eth

Notable team members include

• CEO @haydenzadams

• COO @Mclader

• VP Prod @willruben

• VP Eng @chaddepue

• Ventures Lead @teo_leibowitz

• Head of #NFTs @Scott_eth

31/

🟢 Investors

$UNI was recently valued at $1.6B after a $165M Series B led by @polychain.

Other investors in the protocol include: @coinbase, @usv, @a16zcrypto, @svangel, @paradigm

🟢 Investors

$UNI was recently valued at $1.6B after a $165M Series B led by @polychain.

Other investors in the protocol include: @coinbase, @usv, @a16zcrypto, @svangel, @paradigm

32/

🟢 Tokenomics

$UNI is the native token of Uniswap

It has a circulating supply of 762MB and total supply of 1B

Below we will cover $UNI ’s:

• Usage

• Initial distribution

• Emissions schedule

🟢 Tokenomics

$UNI is the native token of Uniswap

It has a circulating supply of 762MB and total supply of 1B

Below we will cover $UNI ’s:

• Usage

• Initial distribution

• Emissions schedule

33/

◾ Token Usage

$UNI’s primary use is as a governance token, as it allows holders to vote on proposals related to the development and operation of Uniswap

The token can also be used to provide LP staking rewards and other incentives to the ecosystem

◾ Token Usage

$UNI’s primary use is as a governance token, as it allows holders to vote on proposals related to the development and operation of Uniswap

The token can also be used to provide LP staking rewards and other incentives to the ecosystem

34/

◾ Initial Distribution

#Uni minted 1B tokens in its launch in September 2020

These tokens have a 4-year unlock schedule, and were distributed as follows:

• 60% to the community

• 21.3% to the team

• 18% to investors

• 0.7% to advisors

◾ Initial Distribution

#Uni minted 1B tokens in its launch in September 2020

These tokens have a 4-year unlock schedule, and were distributed as follows:

• 60% to the community

• 21.3% to the team

• 18% to investors

• 0.7% to advisors

35/

◾Emissions Schedule

$UNI is an inflationary token with a fixed rate of growth

The current supply of 1B tokens will be fully vested by September 2024

At this point, the protocol will initiate a perpetual inflation rate of 2% per year

◾Emissions Schedule

$UNI is an inflationary token with a fixed rate of growth

The current supply of 1B tokens will be fully vested by September 2024

At this point, the protocol will initiate a perpetual inflation rate of 2% per year

36/

🟢 Long-Term Vision

@Uniswap dominates the DEX market with >50% share

But to continue its growth trajectory in the face of rising competition, the protocol will have to continue to innovate

🟢 Long-Term Vision

@Uniswap dominates the DEX market with >50% share

But to continue its growth trajectory in the face of rising competition, the protocol will have to continue to innovate

37/

Three areas that are we are likely to see development in are:

• Multichain functionality

• Ecosystem development

• Protocol augmentations

Let’s take a look at each

Three areas that are we are likely to see development in are:

• Multichain functionality

• Ecosystem development

• Protocol augmentations

Let’s take a look at each

38/

◾ Multichain Functionality

#Uniswap is already deployed on #Optimism, #Arbitrum and #Polygon and it recently deployed on #BNB

As we enter a multichain world, Uniswap will likely start to pursue functionality on other #L1 networks

◾ Multichain Functionality

#Uniswap is already deployed on #Optimism, #Arbitrum and #Polygon and it recently deployed on #BNB

As we enter a multichain world, Uniswap will likely start to pursue functionality on other #L1 networks

https://twitter.com/MTorygreen/status/1603797185585242113

39/

◾ Ecosystem Development

As an open source protocol, $UNI will likely continue to court developers to integrate with the protocol

Historical examples of this include:

• Aggregators (@1inch)

• Wallets (@TrustWallet, @rainbowdotme)

• DeFi protocols (@MakerDAOO, @opyn_)

◾ Ecosystem Development

As an open source protocol, $UNI will likely continue to court developers to integrate with the protocol

Historical examples of this include:

• Aggregators (@1inch)

• Wallets (@TrustWallet, @rainbowdotme)

• DeFi protocols (@MakerDAOO, @opyn_)

40/

◾Protocol Augmentations

#Uni is constantly working on upgrades to the system

Some of these include initiaitives to:

• Improve liquidity management (@ArrakisFinance)

• Support trading bots (@hummingbot_org)

◾Protocol Augmentations

#Uni is constantly working on upgrades to the system

Some of these include initiaitives to:

• Improve liquidity management (@ArrakisFinance)

• Support trading bots (@hummingbot_org)

41/

🟢 Value Capture

Perhaps the biggest criticism of the $UNI token is that it doesn’t share in the revenue of the protocol

Today, all fees generated by Uniswap are paid directly to LPs

That’s why some call $UNI a “worthless #governance token”

🟢 Value Capture

Perhaps the biggest criticism of the $UNI token is that it doesn’t share in the revenue of the protocol

Today, all fees generated by Uniswap are paid directly to LPs

That’s why some call $UNI a “worthless #governance token”

https://twitter.com/shomakishi/status/1364576621622145024

42/

But that may be a bit myopic

The protocol has a built in “fee switch” that allows tokenholders to vote to redirect 10% to 25% of the fees back to #Uniswap

Once the protocol has these revenues, it would be simple to distribute them to the tokenholders

But that may be a bit myopic

The protocol has a built in “fee switch” that allows tokenholders to vote to redirect 10% to 25% of the fees back to #Uniswap

Once the protocol has these revenues, it would be simple to distribute them to the tokenholders

43/

This could be significant value proposition for $UNI

@BanklessHQ estimates that it could generate the protocol > $120M in revenue per year

But is it really that simple?

This could be significant value proposition for $UNI

@BanklessHQ estimates that it could generate the protocol > $120M in revenue per year

But is it really that simple?

44/

Right now, one of Uniswap’s advantages is that all of the fees go to LPs

That's a huge incentive to provide liquidity

Critics say stopping that could create a vicious cycle

Once the switch is turned on, LPs will flee, reducing liquidity and ultimately scaring away users

Right now, one of Uniswap’s advantages is that all of the fees go to LPs

That's a huge incentive to provide liquidity

Critics say stopping that could create a vicious cycle

Once the switch is turned on, LPs will flee, reducing liquidity and ultimately scaring away users

https://twitter.com/BanklessHQ/status/1562911346999820288

45/

Supporters don’t agree

They believe that #Uniswap has built a deep enough moat to retain users despite an increase in fees

They argue that if done correctly – starting with a moderate fee on select pools – turning on the “fee switch” will be a huge win

Supporters don’t agree

They believe that #Uniswap has built a deep enough moat to retain users despite an increase in fees

They argue that if done correctly – starting with a moderate fee on select pools – turning on the “fee switch” will be a huge win

46/

Ultimately, no one really knows

But if you’re interested in learning more, #UNI commissioned @Alastor_ooo to create a detailed overview of the potential qualitative and quantitative consequences of shifting to a fee-based model

drive.google.com/file/d/1Dr_gGY…

Ultimately, no one really knows

But if you’re interested in learning more, #UNI commissioned @Alastor_ooo to create a detailed overview of the potential qualitative and quantitative consequences of shifting to a fee-based model

drive.google.com/file/d/1Dr_gGY…

I used a lot of great resources to write this thread

If you want to learn more about @uniswap, I suggest you follow them!

@BanklessHQ

@haydenzadams

@MR_UNISWAP

@NoahZinsmeister

@sassal0x

@Scott_eth

@teo_leibowitz

@Uniswap

@uniswap_gem

@UniswapD

@UniswapFND

@UniswapLabsVC

If you want to learn more about @uniswap, I suggest you follow them!

@BanklessHQ

@haydenzadams

@MR_UNISWAP

@NoahZinsmeister

@sassal0x

@Scott_eth

@teo_leibowitz

@Uniswap

@uniswap_gem

@UniswapD

@UniswapFND

@UniswapLabsVC

https://twitter.com/MTorygreen/status/1638586393000820736

• • •

Missing some Tweet in this thread? You can try to

force a refresh