wsj.com/articles/how-t… 1/n

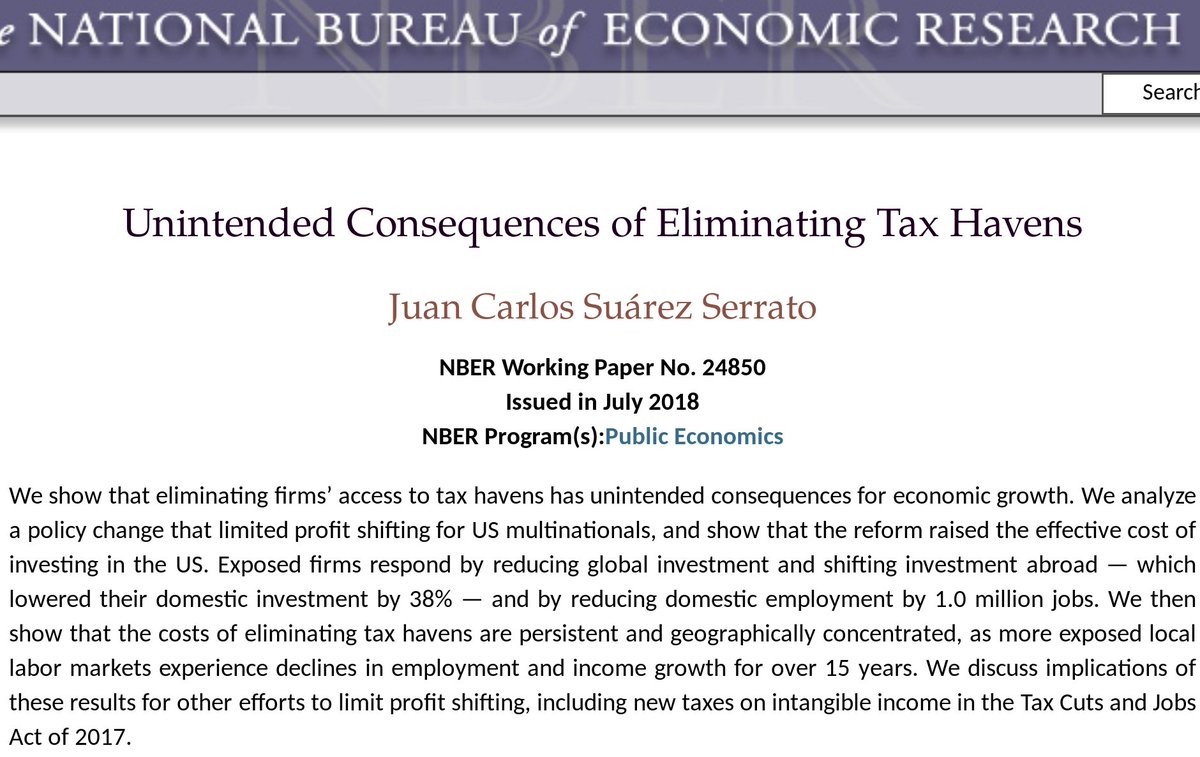

Navarro-style ignorance of international economics at its worst. 14/n

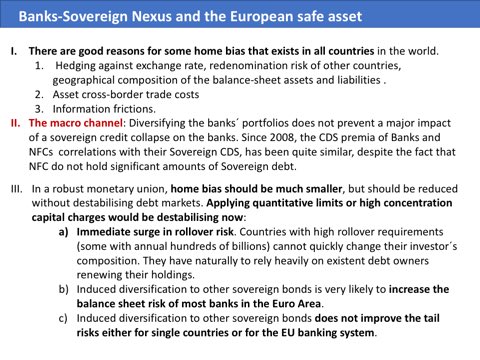

- @nberpubs Working Paper: nber.org/papers/w24353

- @cepr_org Discussion Paper: cepr.org/active/publica…

- Ungated: faculty.washington.edu/ghiro/BCGMainT… (main text) and faculty.washington.edu/ghiro/BCGAppen… (appendix) n/n