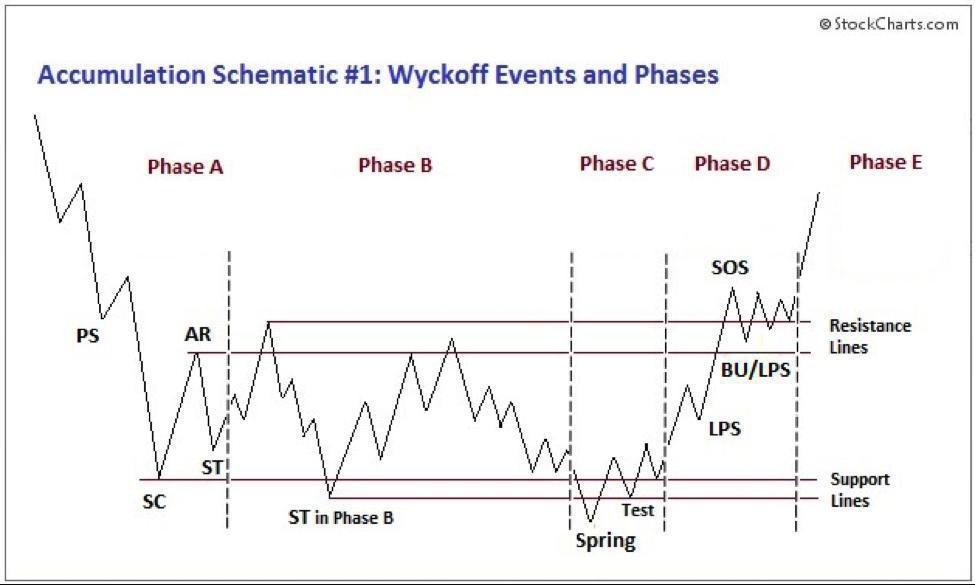

Wyckoff update

Full detailed description of first and third laws of Wyckoff (supply & demand and effort vs. result)

p.s. this model was designed almost a century ago, people didn't have calculators and were drawing charts by hand using pencil and ruler.

Wyckoff (1937)

Wyckoff (1937)

Wyckoff (1937)

Wyckoff (1937)

Wyckoff (1937)

Wyckoff (1937)

Wyckoff (1937)

Source: Wyckoff (1937)

All that you call manipulation or nonsense is just the game of big players. Learn how to play along them, and not to blame it all on manipulation.]

Edward Morra 2018