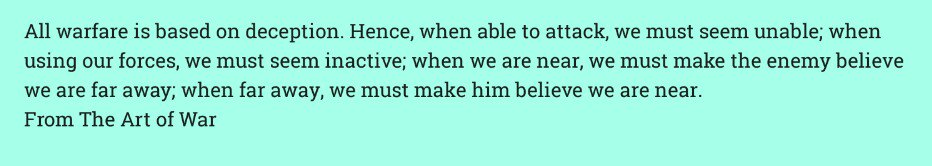

1. Calendar spreads (contango or backwardation)

2. Location basis spreads (wti-brent)

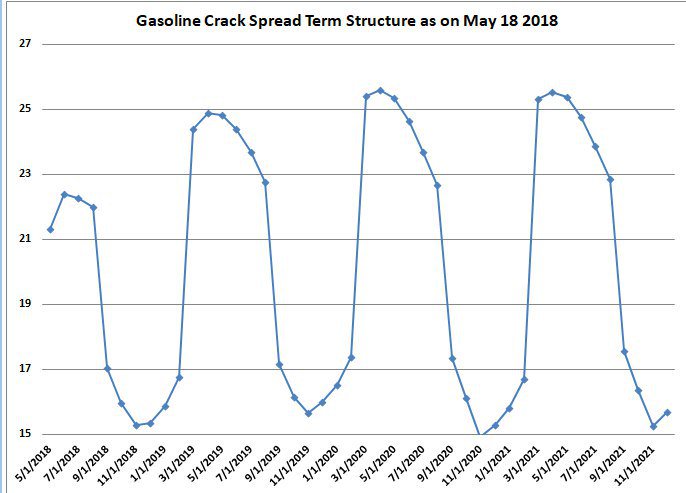

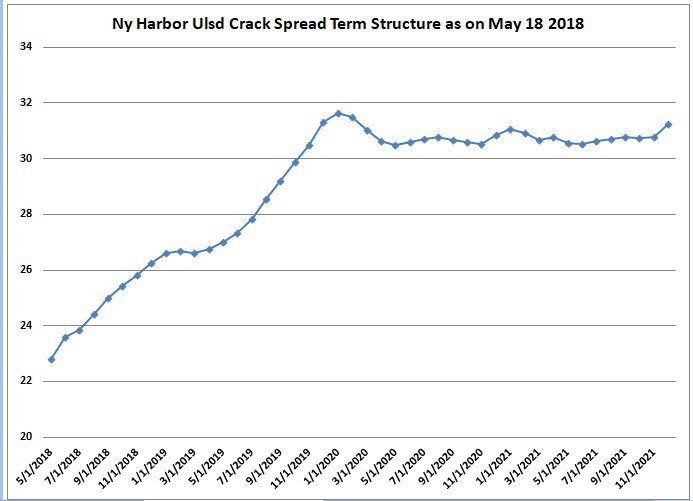

3. Refining spreads ( gas/heat cracks

Most of these spreads are a function of relative fundamental supply and demand. Will explain each and what the fundamental drivers of each are soon if people are interested

1. Transportation (gasoline, diesel, jetfuel, residual oil)

2. Weather (propane, diesel)

3. Economic growth. Plastics or petrochemicals (naphtha, ethane, propane)

4. Power (diesel, residual oil)

Now crude demand is gone since refinery stops

eia.gov/petroleum/supp…

1. Electricity

2. Natgas

3. Crudeoil

Electricity supply demand has to be balanced in realtime since there is no storage for the most part electricity s&d

1. Heating demand (weather)

2. Industrial demand (chemicals and fertilizers) as a raw material

3. Transportation through CNG (compressed natural gas)

4. Power stack (as a competing feedstock vs coal diesel residual fuel oil)

Supply - demand = change in inventory

Now we have to account for import of lng which is regassified or export of lng which is liquiefied

Supply-Demand+ import of lng - export of lng = change in inventory and this is the same balance for crude oil as well only difference is crudeoil needs to be further analysed for where it comes from since each part of the world has different

1. Quality difference of the crude. Even though both are light sweet each one when refined produces a different blend of products and depending on product price

2. Transportation costs. The cost to bring brent from northsea to the gulf of mexico or the east coast of the us

So if for eg asia is short light crude they will aggresively pull on brent and west african crudes increasing the value of brent relative to wti.

cmegroup.com/market-data/se…