A developer team ICOs CollateCoin (COCO) a utility token for listicles.

✅ whitepaper +

✅ memes +

✅ hype =

$30 million worth of ETH raised.

Now, what to do with the money...

2.1/x

Yes, developer incentives, marketing, exchange listing fees and travel and office space all cost.

But it nets to, what, ~$1 million a year?

30 years of runway!

Plenty!

But they worry about the next war.

2.2/

The COCO developer team (our heroes), still 2 years from product, might get buried by the competitor's PR before they can even get to launch.

😱

2.3/

Rationally, to hedge this risk, they keep as much of their treasury as possible inside the cryptoasset stack.

2.4/

So what?

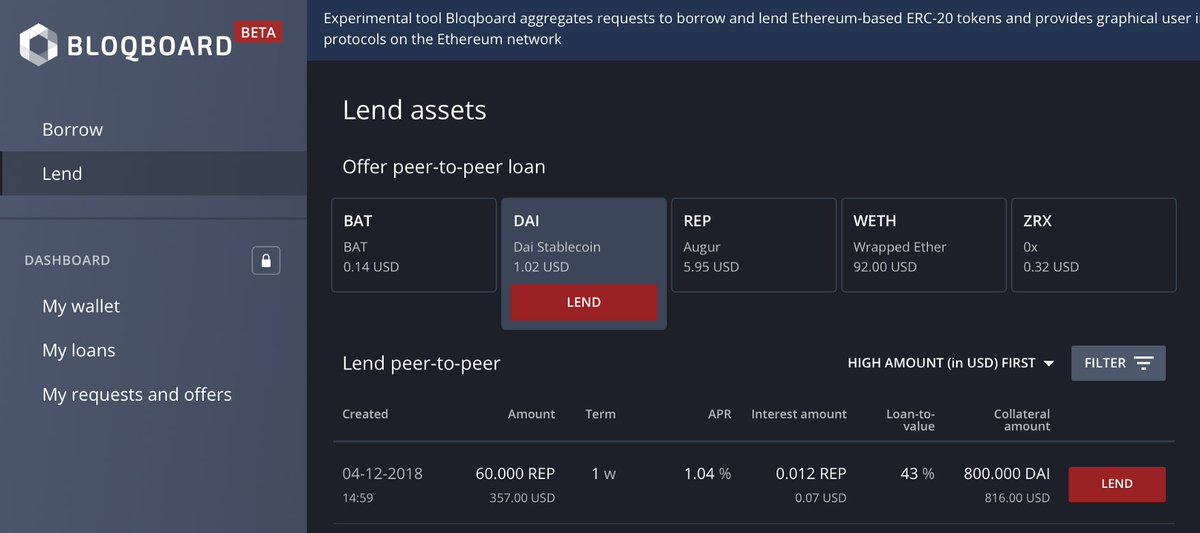

By doing so they are no longer just developer teams; they are also lenders.

(This is how the leverage hides; in plain sight)

/2.5

😶

/2.6

But there's more to it than that.

The money that the COCO team leaves in cryptoassets can then be re-deployed to fund additional ICOs.

2.7/

That team raises $29mm, also extracts $1mm, and puts the rest into the ICO that follows.

That team raises $28mm...

A single $30mm ICO can ramify into $465mm of ICO funding.

🌎

🐢

🐢

🐢

2.8/

😳

Now *that's* leverage.

30x leverage to be precise

2.9/

So obvious once you recognize it that you can't look away.

And it doesn't even require market participants to experience some sort of profound epiphany with regards to fundamental value;

even incrementally weaker ICOs can keep layering value onto the stack.

2.10/

😐

2.11/

They are also (unwitting) lenders.

They may even be financing their marginal competitors.

And like all good lenders they only really attune to their exposure when they realize it might not come money-good.

2.12/

To be conservative teams might extract 2 years of fiat rather than 1.

Rational, but the system-wide effect = credit tightening.

2.13/

2.14/

(Or perhaps the true weakness is still to come 🙊)

2.15/

There is massive internally embedded leverage in cryptoassets, and it's obvious once you look at it, but what does that imply?

2.16/ to be continued