(1) Financial assistance includes a gift, guarantee, security or indemnity, loan, any form of credit & financial assistance given by a coy, net assets of which are thereby reduced to a material extent or which has no net assets #Skyebank

2015

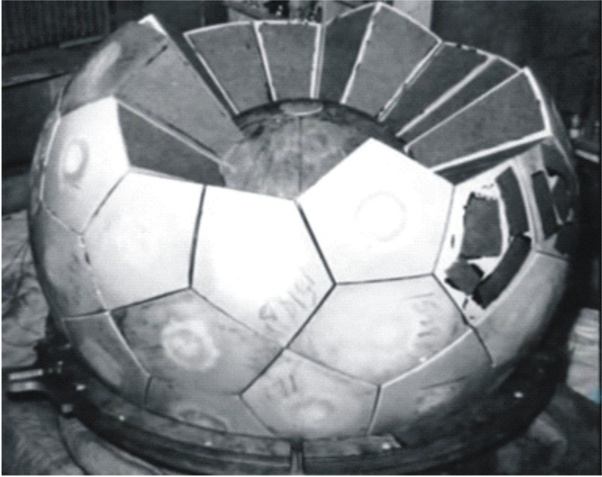

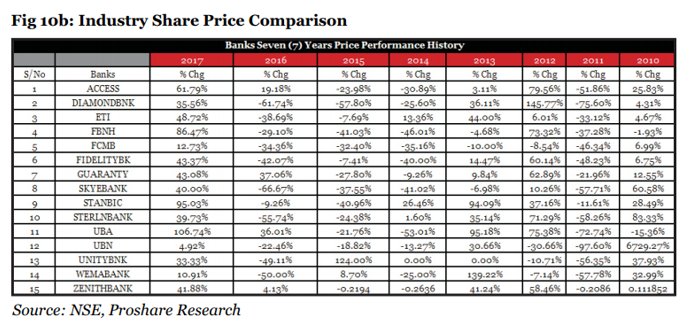

Following the acquisition, the indicators coming out from #SkyeBank showed clearly that something wasn’t right. Apart from falling below regulatory standard in terms of Capital Adequacy (7.7%) and Loan to Deposit (92%) in 2015...

1. In October of 2015, the House of Reps ordered the investigation of the sale of some banks by AMCON. One of those banks was MainStreet Bank. The Adhoc committee raised several issues among which were... #SkyeBank

3. The bank delayed in making available its Q4 2015 and Q1 2016 Annual Financial reports. That sent alarm bells ringing in the market.

By 2016, things took a turn for the worse. TSA didn't help since the #Skyebank was heavily dependent on public sector funds. It lost N125 Billion to TSA alone. Add the fact of the N127B of its own money used to acquire the bank and several other payments tied to the same...

- liquidity ratio at 8% as opposed to the regulatory min of 30%;

- CAR 10.48% vs. 16% (for SIBs);

- Loan to Deposit Ratio of 98% vs recommendation ratio of 80%

#Skyebank

By May 2016, it remained unable to release its Q4'15 & Q1'16 earnings reports, long after the expiration of the extension of the grace period, without any rational reasons for the delay.

By July 2016, the CBN sacked the board and took control of the mgt. In reality the CBN had little option. It had sanctioned the deal that ultimately was the death kernel for this bank. #Skyebank

-Stabilize the Bank

-Achieve the mandatory key regulatory ratio requirements.

-Turn around and return the Bank to profitability.

-Improve the quality of its risk assets

#Skyebank

- A negative capital position of N690 billion as at Dec 2016. #Skyebank