scholar.harvard.edu/files/ganong/f…

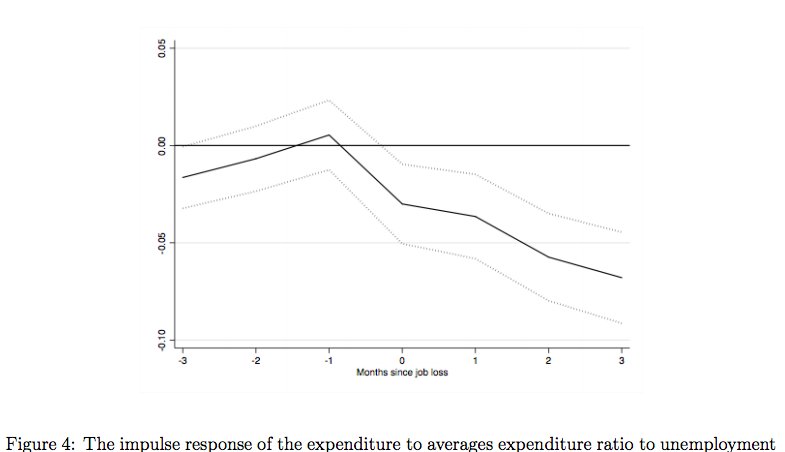

dropbox.com/s/1ya10trur7s4…

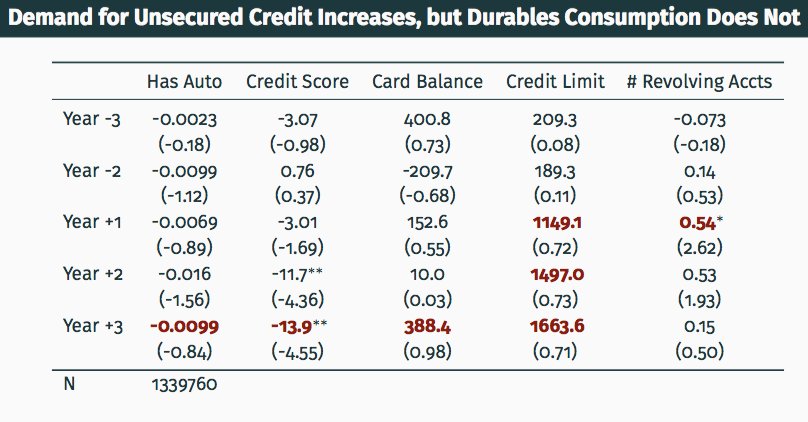

-> people using high-cost borrowing, but not to smooth transitory shocks

papers.ssrn.com/sol3/papers.cf…

Harder to say, and large literature, but at least consistent with behavioral biases inducing myopic borrowing behavior

- more formal employment

- higher wages (2.5%)

- longer commutes

- persistent: motorcycle lottery winners has 10-year persistent impact

- Guiso, Sapienza, Zingales suggest social capital kellogg.northwestern.edu/faculty/sapien…

- People have pointed to institutional differences (competitive city-states in north; more autocratic "extractive" institutions in south due to foreign invasions

- mafia, corruption

- many others

From this standpoint; the puzzle is more that the south didn't ever come close to parity with the north, despite wage differential

Impact of Saving on Wealth Inequality

by Laurent Bach, Laurent E. Calvet, and Paolo Sodini

cepr.org/sites/default/…

- decreasing with net worth up to 90th percentile of net worth (decreases wealth inequality)

- within wealth groups, a lot of dispersion in saving (widens wealth inequality)

- variation in returns drives wealth inequality

One hypothesis: greater role for aristocratic landowners in Europe, and more persistence in real estate wealth (as opposed to owning one idiosyncratic factory)

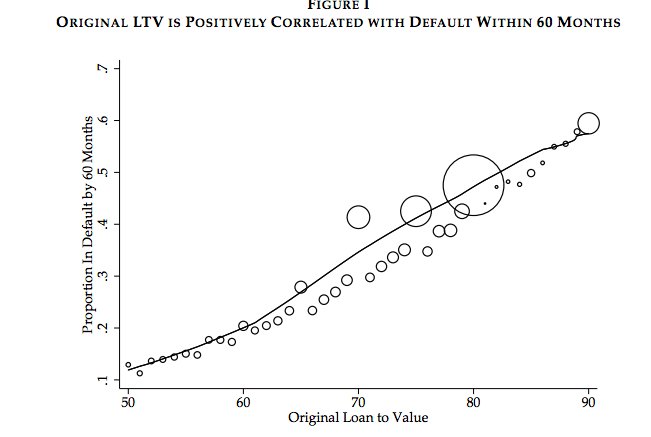

Selection, Leverage, and Default in the Mortgage Market

cepr.org/sites/default/…

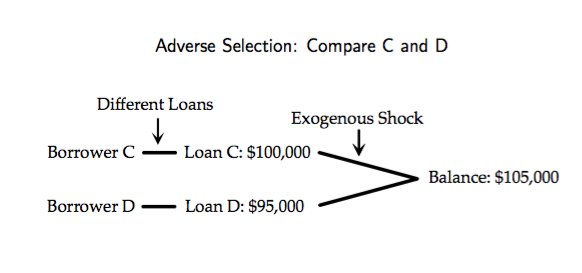

- moral hazard: higher loan balances induce strategic default

- adverse selection: riskier borrowers select higher leverage contract

-> which is dominant in explaining leverage has large impact on ideal regulation

But *with* selection, borrowers use down payments to screen themselves. So cap pushes riskier borrowers down in the distribution.

-> default externality needed to make LTV cap welfare-neutral are calibrated to be 50% higher

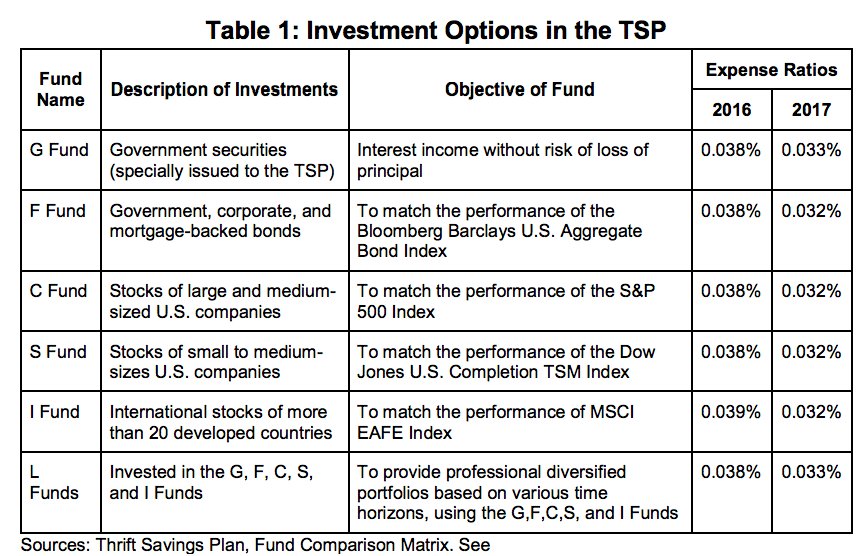

by John Beshears, James Choi, David Laibson, @BrigitteMadrian, William L. Skimmyhorn, Stephen Zeldes,

Financial decisions are not always salient, sometimes opaque, hard to calculate

-> suggests greater cognitive ability should limit mistakes

Part of generic annuity puzzle nber.org/papers/w18575

- education could predict financial decisions causally (in which cases returns to education are even higher)

- education can be selected for by people who make good decisions

My takeaway in general is that financial decisions are hard, so generally people should make fewer decisions and we should focus on incentivizing/regulating intermediaries well

Increase in perceived signal precision -> "do" something

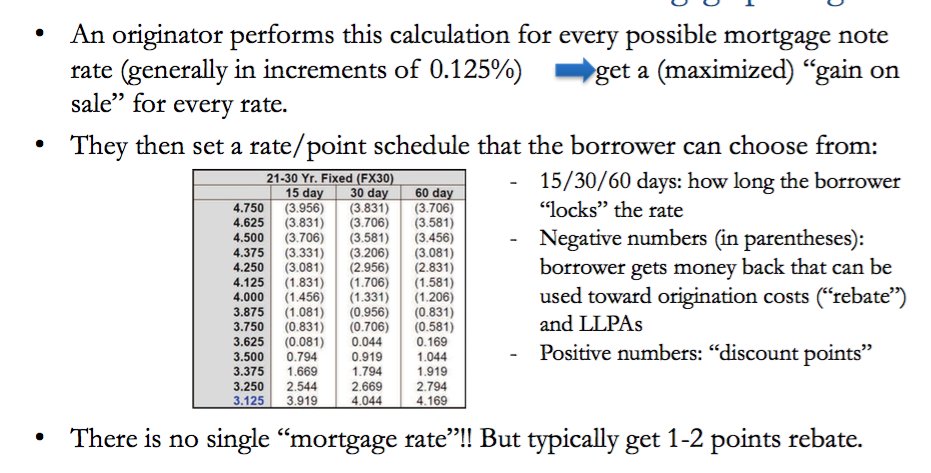

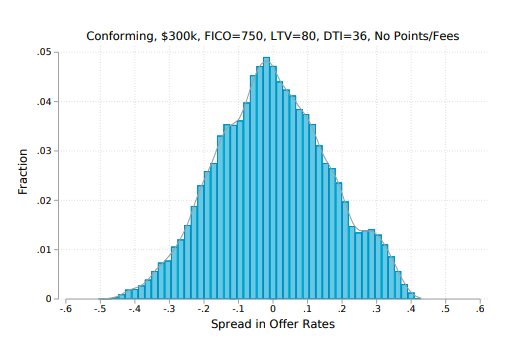

by Neil Bhutta Andreas Fuster, and Aurel Hizmo

cepr.org/sites/default/…

However, has been hard to measure historically.

- small loans (search morewith larger loan)

- low fico score borrowers already pay more for credit risk. But also pay more due to these search frictions

- borrowers in low rate periods (behavioral in some way - borrowers feel less need to keep shopping around)