#AskQuestions

#AskQuestions

LINKS

June 2015: dmo.gov.ng/debt-profile/s…

#AskQuestions

#AskQuestions

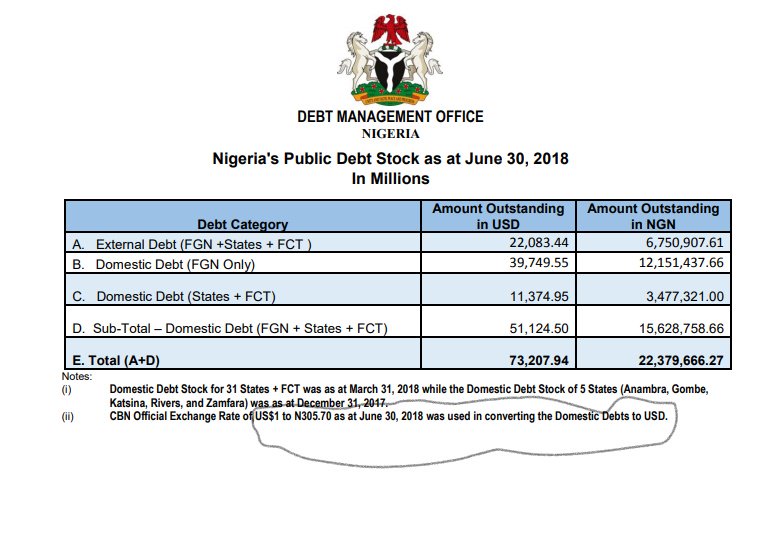

Public Debt Stock 2018: dmo.gov.ng/debt-profile/t…

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#AskQuestions

#GetInvolved