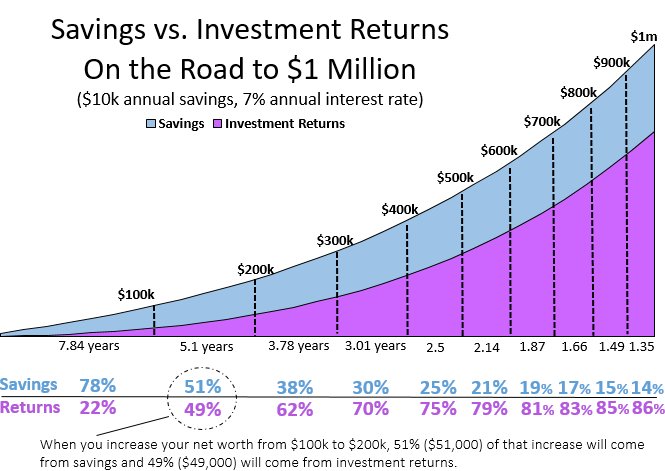

Short answer: savings in the short-term (<10 yrs) and investment returns in the long-term (>20 yrs)

Long answer: keep reading

A 7% return on $1,000 is only $70.

A 7% return on $10,000 is only $700.

Early net worth growth is purely dependent on how much of your income you can save.

Over time, two factors begin to work in your favor: increasing investment returns and increasing income.

As you invest more, the amount you receive in returns will increase. As you get older, your income should increase as well.

fourpillarfreedom.com/lifestyle-choi…

-educational degrees

-your skill set

-side hustles

-your own small business

fourpillarfreedom.com/how-to-create-…