So turns out, not many people are selling paintings or bags full of USD for crypto. There's only one major business that sells real-world things for crypto: exchanges.

Almost every realistic 51% attack will go as follows: deposit crypto on exchange -> withdraw to other chain / USD -> revert original crypto deposit. The attacker has now 2Xed their money.

The answer: they don't.

In practice, if there's a long chain reversion, almost all of the bystander transactions will remain intact (those transactions pay fees, so why not include them in your fork?).

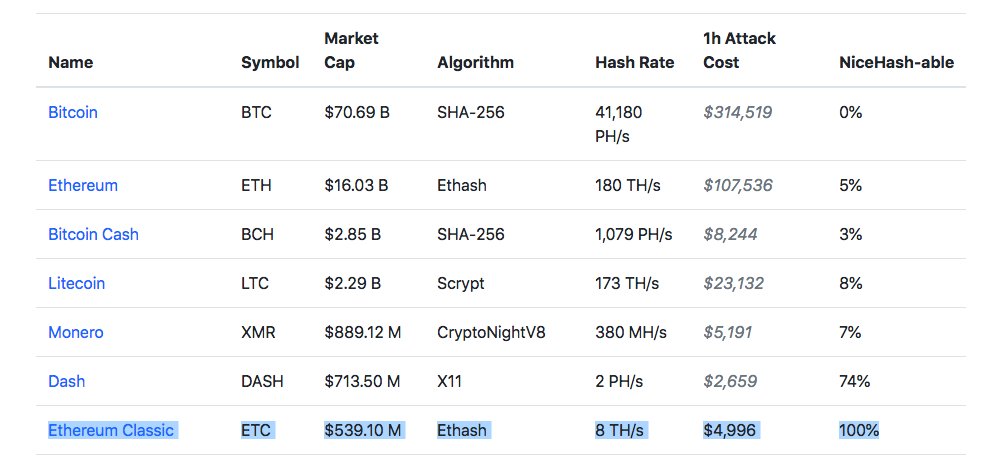

But how was ETC, a top 20 currency, able to be 51% attacked?

The attacker made ~$250K from the attack, which is a pretty good return.

But the target for these double spends was a lesser-known Chinese exchange called gate.io. They were probably targeted because of their weaker AML/KYC.

The first is something we've known for a while: PoW is only secure for currencies with high hash rates. We could ignore that in 2018, not so much going forward.

BTC or ETH aren't at risk, but other smaller currencies definitely are. So exchanges should start delisting ETC and other PoW currencies with low hash rates.

Second, exchanges can consider start mounting active defenses against 51% attackers. This is more farfetched, but bear with me. @balajis @phildaian

Simple: if exchanges commit to doing this, the incentive to attack goes down tremendously.

An ounce of prevention and so on.

It's a wacky idea, but hey, it's crypto, right? FIN