YTD EPS vaulted to 66. Q3 EPS is double of last FY EPS. It's even better if we consider the numbers are after adjustment of exceptional loss of 5.6 crs for the qtr.

Normalised for exceptional items Q2 EPS is at 16.54 vs Q3 EPS of 37.21, more than doubled.

#mangalamorganics

That untapped market is where the future growth is going to come in. Huge potential..

#MangalamOrganics

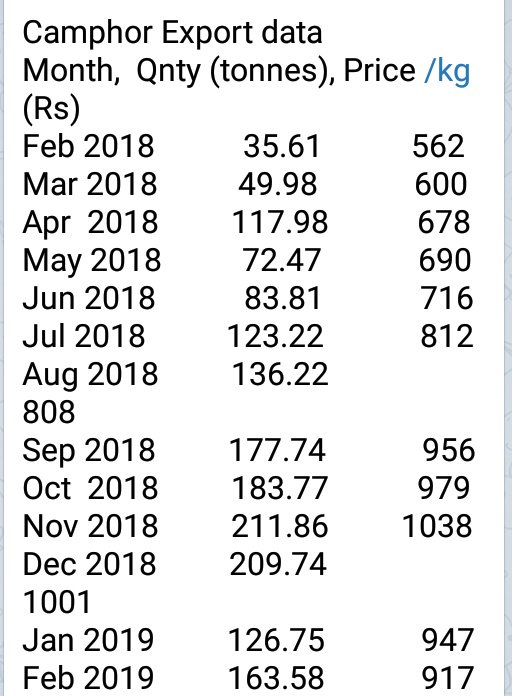

India turned, net exporter of camphor on recent years & China has become net importer.

99% world's capacity in these two countries.

Camphor prices still holding & may go up by 50%

Has started producing specific products for DRT. Exports & DRT can take up Q4 slump in domestic demand

With no seasonality & improved earnings, PE rerating possible?

Available in retail stores & also online in 'India's Apni Dukan' - Amazon.

Do check it out...

tinyurl.com/yxgrjmdg

-Puja Tablets

-Room Freshener Cone

-Insect Repellent Sticks

-Room Freshener Spray

-Cold or headaches Roll-on

-Cold Nasal Inhaler

-Pain relief Spray

-Bathing Soap Bar

1. Direct Retail - Brand building, High Margins & variety

2. Bulk Sales - Firming up of wholesale rates helping margins

3. DRT Channel Sales - Exclusivity

#MangalamOrganics

Definitely a good sign of times to come.

#MangalamOrganics

- Hand Wash

- Hand Sanitizer

- Pain Relief Balm

- Camphor Oil

All these are under B2C segment & available at Amazon.

Camphor prices sustained elevated levels in March too. Expecting a good Q4.

Latest SHP reveals an interesting fact. Count & volume under <2 lac is lower vs last Qtr. Accumulation by strong hands ??

#TimeToFly

Game on #MangalamOrganics

With DRT as their partner & sole distributor of their products in Europe, the volume game will kick in .

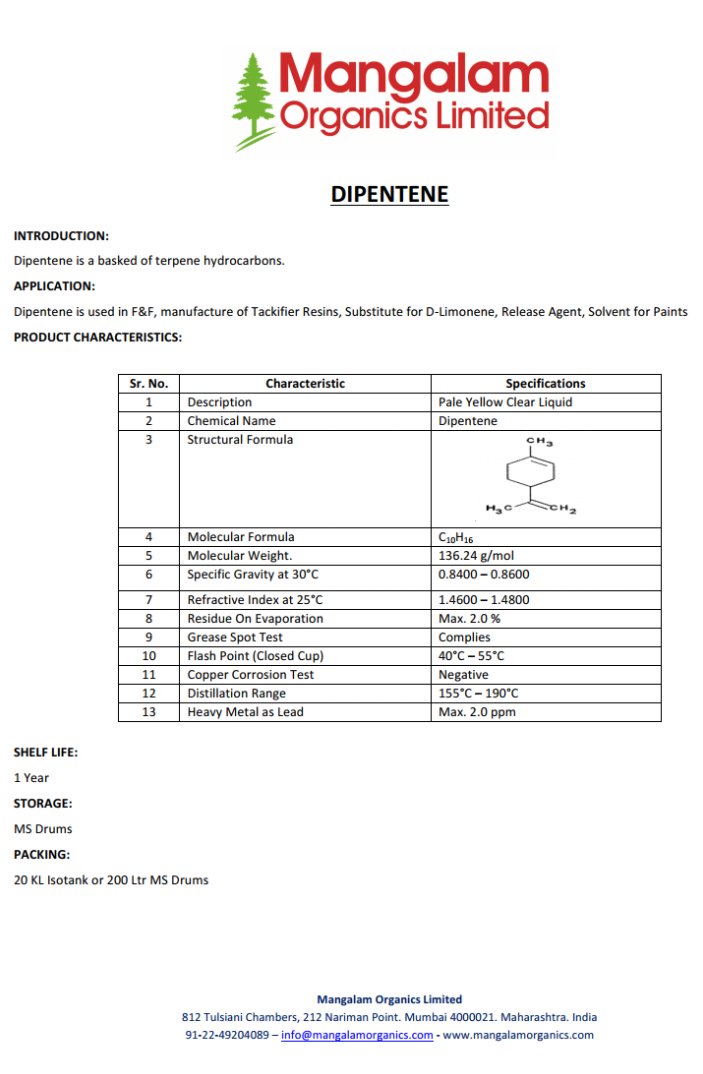

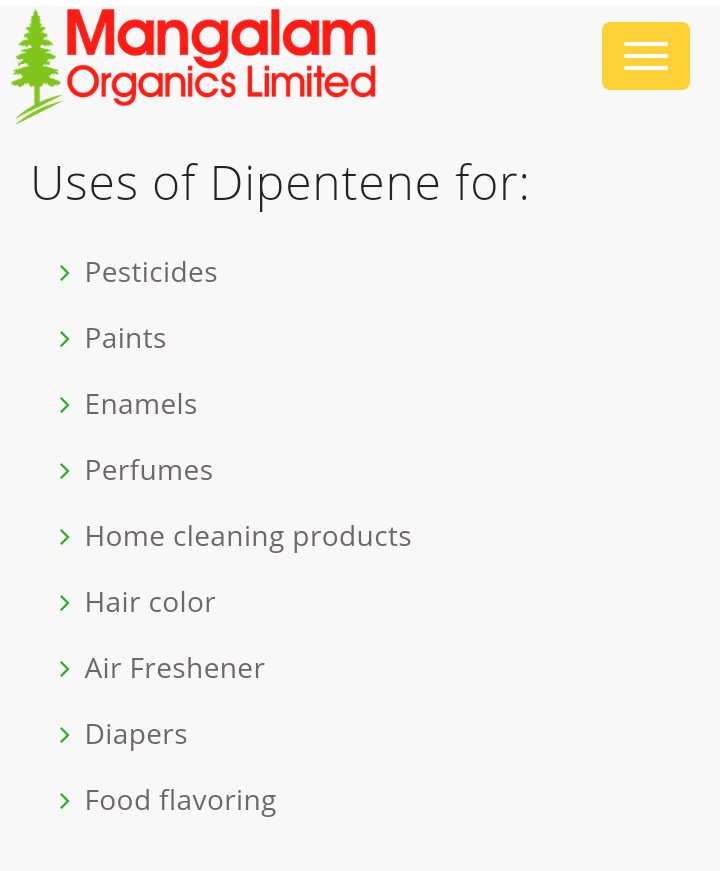

Dipentene is used in verity of applications..

YoY comparison makes sense for seasonal businesses rather than QoQ.

Revenue ⬆️ >100%

PAT ⬆️ >500%

Note:

1. Q4 has balance tax prov for the year - low tax provision made in earlier quarters

Contd..

3. On full year basis EPS of Rs.84 vs Rs.14 for previous yr

4. YoY Increase in P&M to 51 cr from 33cr with 4 cr still in CWIP - Capacity expansion almost finished

Contd

6. New capacity & full DRT sales to kick in from Q1 - To drive volume

Excited for management commentary & Q1.. #MangalamOrganics

Tailwinds :

- Capacity expansion

- DRT incremental volume

- Strong international camphor prices

- Value added products

- Retail expansion