The focus shall be on global equities, fixed income, forex, precious metals, real estate trusts, and alternative assets.

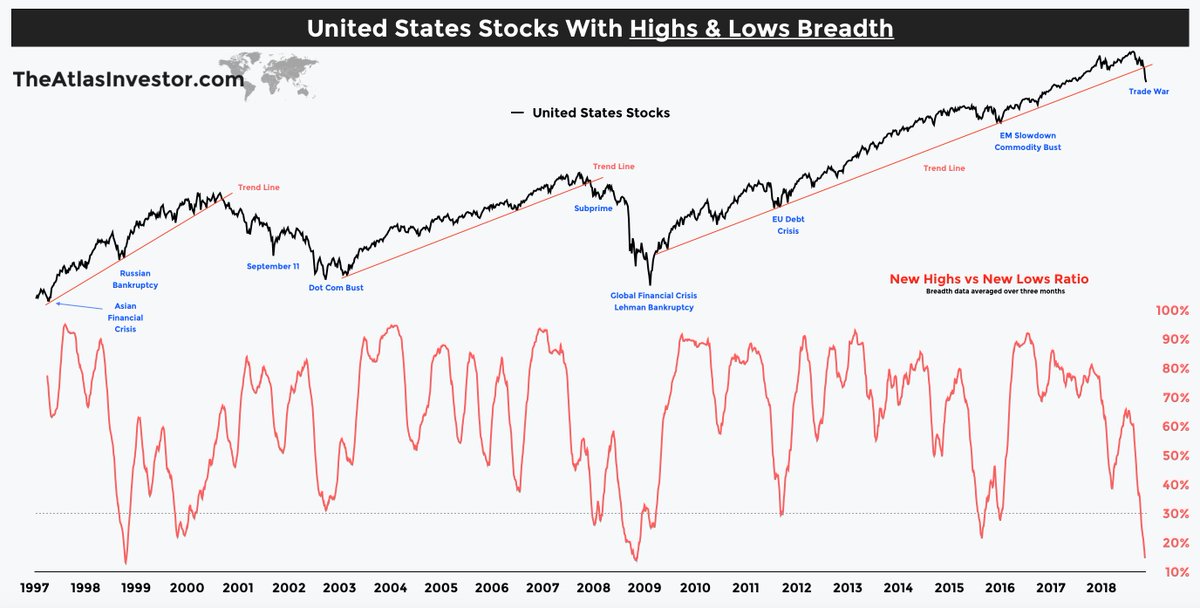

US equities: not interested (returns could be too low, risks might be too high)

EU equities: not interested (could do better but potential value trap)

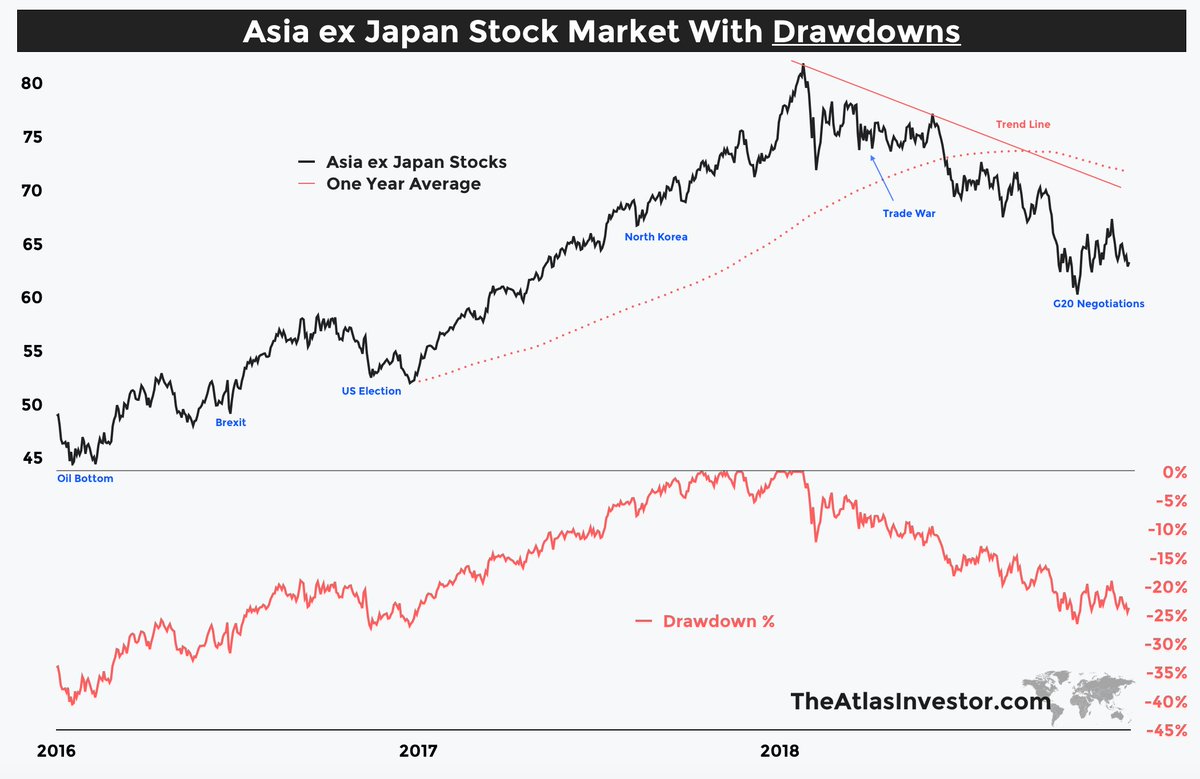

EM equities: interested (right timing/country selection could see 10%+ p.a.)

Fixed Income: not interested (returns will be dreadful)

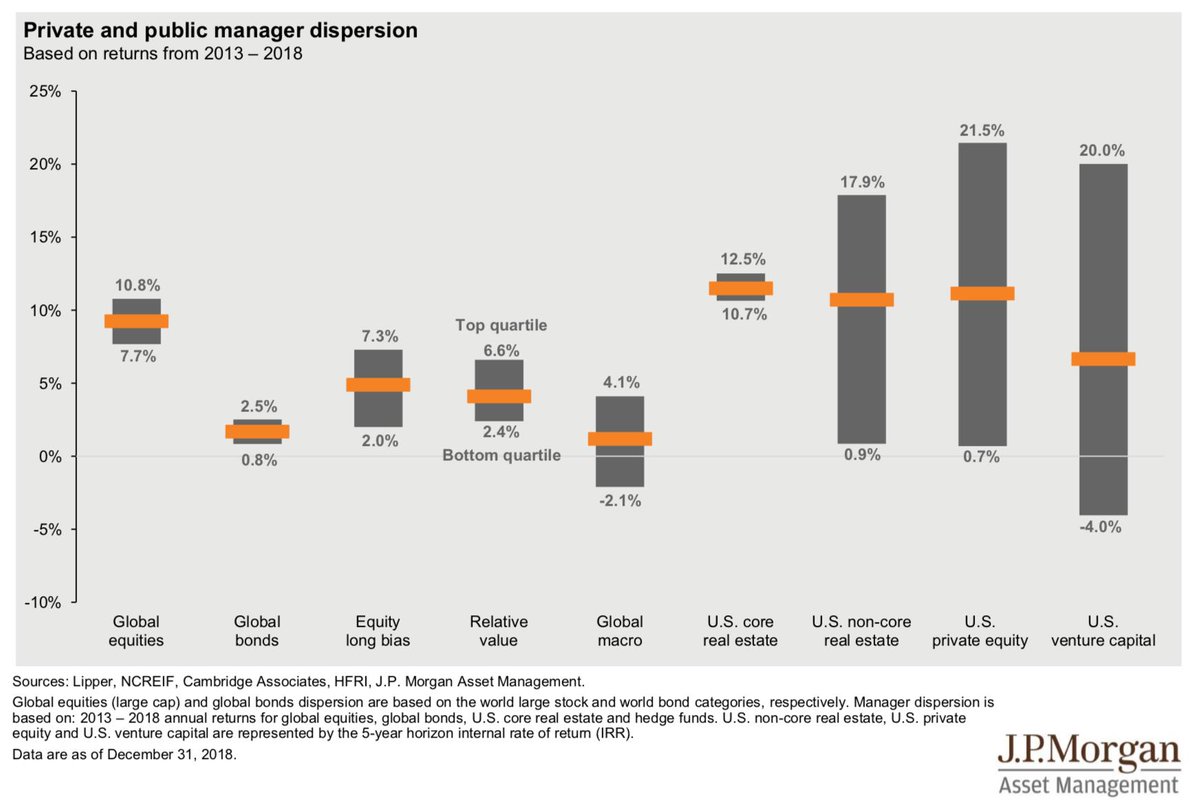

Private Credit: very interested (right selection could see 10-25% p.a. in real estate debt)

Real Estate: very interested (equity potential for 20%-100%+ p.a. in value-add / development)