Let's run Augmented Dickey Fuller tests

So which one is a random walk?

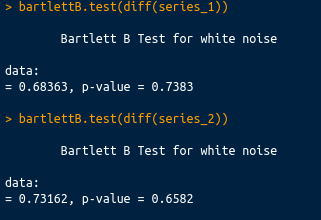

-ACF show no auto-correlation on the differenced series

-Periodograms(differenced series) look (somehow) like white noise

-Regressions have slopes too close to 1

-Both unit root tests imply compatibility with the random walk hypothesis

Reminder X_t~RW if ΔX_t~N(0,σ)

White noise hypothesis not rejected in any of the two