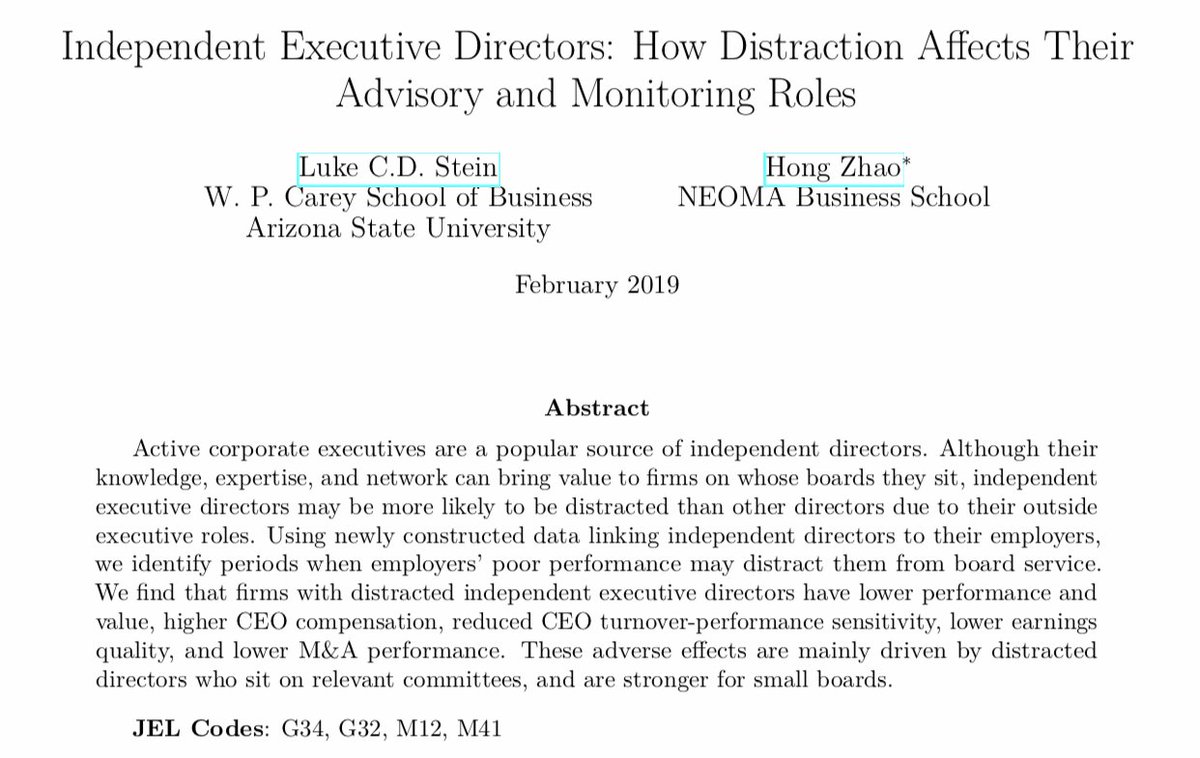

- The Impact of the Opioid Crisis on Firm Value and Investment

- Organized Crime and Firms: Evidence from Italy

blogs.wpcarey.asu.edu/financeconfere…

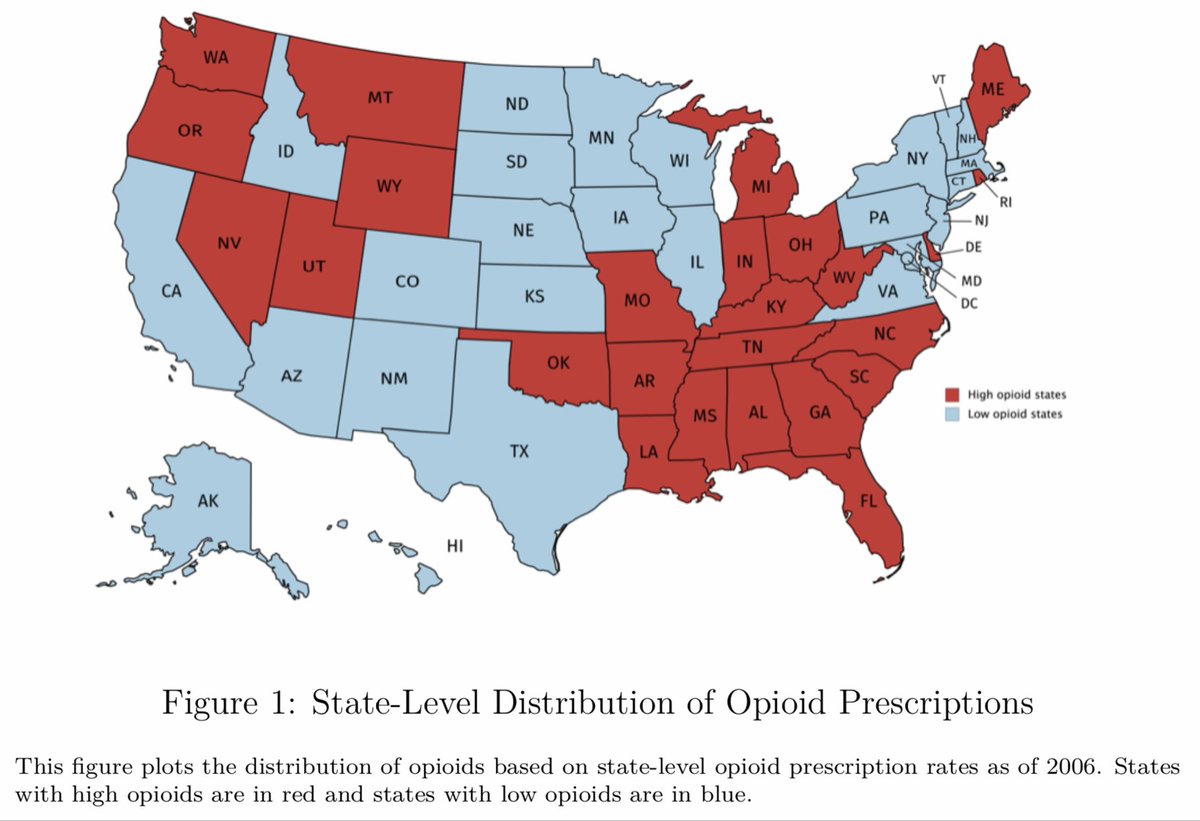

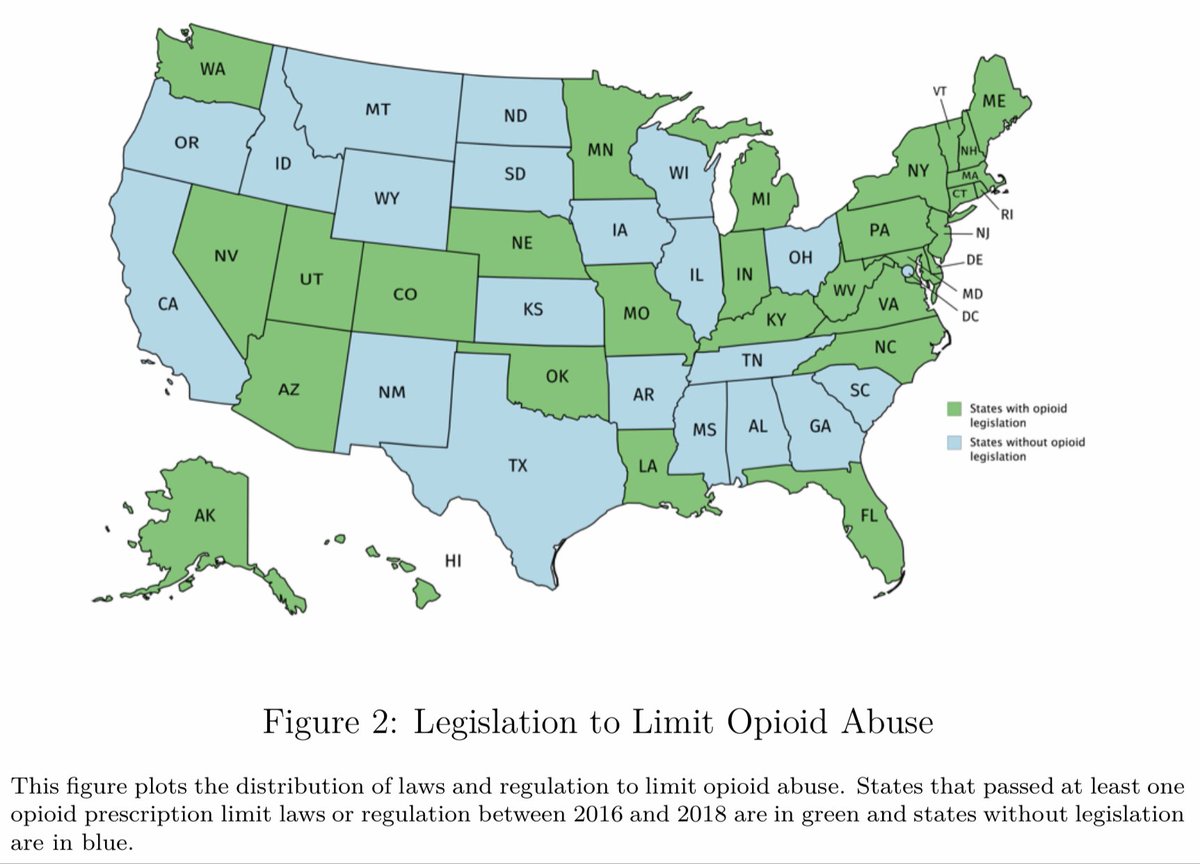

Uses geographic variation in opioid use/legislation to understand their effect on firms.

blogs.wpcarey.asu.edu/financeconfere…

→ Local firms have lower performance and value.

→ Local firms invest in physical capital and automation to substitute away from labor!

This great paper connects evidence from firm behavior and financial markets.

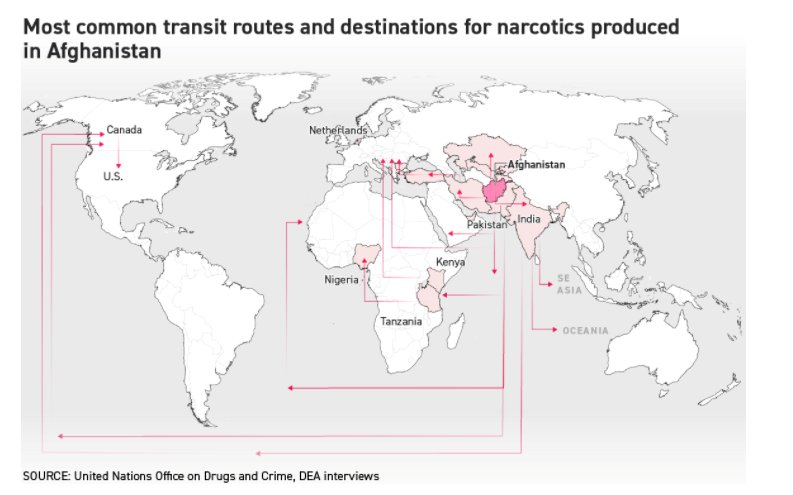

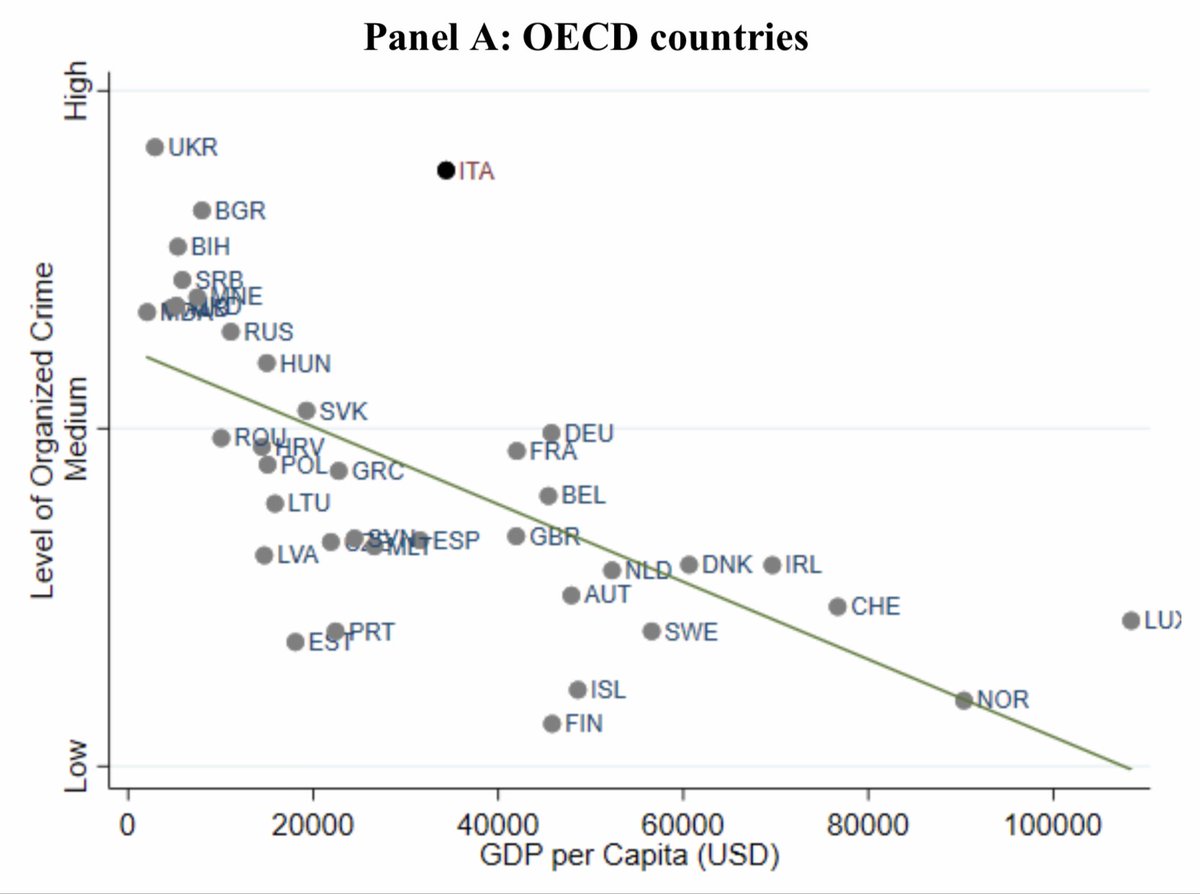

OC has revenue ≈1.5% of world GDP [!], and OC associated with poor economic growth.

Why? In particular, how does OC affect firms?

blogs.wpcarey.asu.edu/financeconfere…

→ Much higher firm turnover (more entry and more exit)

→ More innovation

→ More competition in public procurement auctions

Mafia seems to protect firms in non-tradable sectors from competition

Firms founded when local mafia powerful more affected

So…

But we work on all kinds of other stuff too!

— fin —