Pyramiding (scaling into the winner) - most important concept in trading

@PAVLeader @piyushchaudhry @bluechips4u @candleseye @sanstocktrader @Neha_trade @RajarshitaS @Abhishekkar_ @harrie007 @purohitjay @scorpiomanojFRM @rajenvyas @

Pyramid trading means scaling into a winning position. ie; additional entry in order to add to an existing position after the market makes trending move in the favourable direction

Principle is;

When u r right – make the winner into huge winner

When u r wrong – make to loser as thin as possible

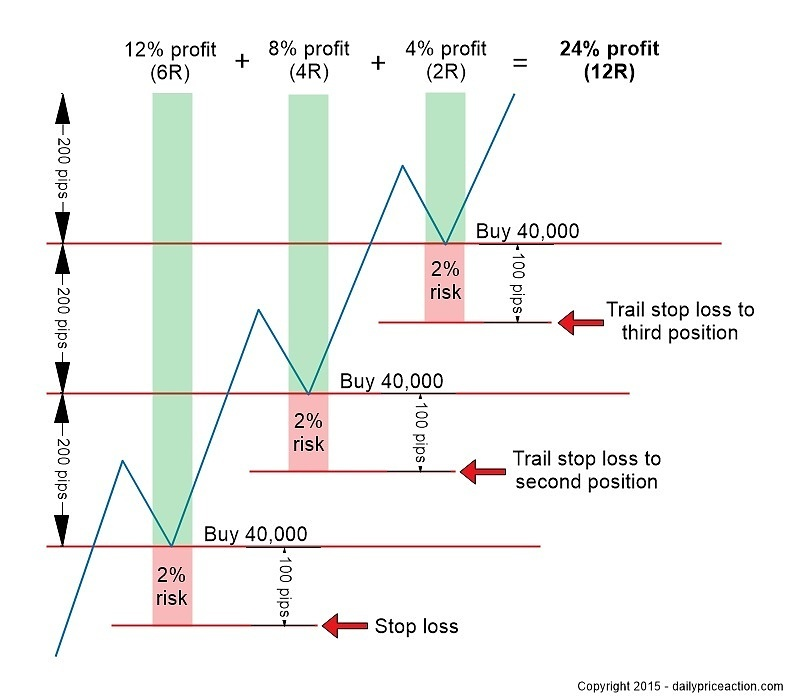

Consider a stock which is in continous uptrend making higher highs and higher lows where it is continually breaking resistance and then retesting that resistance as new support. Market conditions such as this are ideal for scaling into a winning trade.

The initial buy order in the illustration above is triggered when the market retests former resistance as new support. The second and third buy orders are similar to the first, which are both triggered when the market retests a former resistance level as new support

Important thing here is the stock has to keep on breaking each level uupside and should hold enough strength to hold it abv.

Now from the image abv, for example, we r buying into a winner thrice, 40,000 each time

First entry

Worst case – 2%

Max profit – 12%

Second entry

Worst case – break even (2% gain from first entry and 2% loss from second entry)

Max profit – 20%

third entry

Worst case – 6% profit (6% gain from first entry,2% gain from second entry and 2% loss from third entry)

Max profit – 24% !!!!!!!!!!!!!!!

Here the key result is that with pyramiding we have doubled our profit. And in no point of trade, we had a risk of more than 2%. Simply we were mitigating it throughout our position.

As u would have noted, we need to have proper risk reward set up prior to the entry. Here, we had a 1:6 RR set up to start with. With each further entry, the RR dicreses; yet no additional risk.

the image in the tweet has taken from dailypriceaction.com website and the credit goes to them for the pic

the written texts are original and not posted anywhere before

a write of position sizing was prepared by @PAVLeader sir. pls go thru that as well