- RPI = fixed 2.4%

- CPI = fixed at 1.9%

- Salaries and salary-based thresholds increase with CPI

- Loan interest charged at RPI below £25725, RPI+3% above £46305, linearly scaled between the two

2/

- Repayments charged at 9% of earnings above £25750

- Interest pre-graduation = RPI + 3%

- Repayments for 30 years

- Fee = £9250/yr (for 3 years)

- Subsistence = e.g. £5000/yr (for 3 years)

3/

- Repayments charged at 9% above £23000

- Interest pre-graduation = RPI

- Repayments for 40 years

- Max loan = 1.2 * original loan (+ inflation)

- Fee = £7250/yr (for 3 years)

- Subsistence = e.g. £3000/yr (for 3 years) [due to grants]

4/n

Low salary profile: Start £20k, +£750/yr , cap at £30k

Average: £25k, +£1k/yr, cap at £45k

High: £25k, +£2k/yr, cap at £60k

V High: £30k, +£2k/yr, no cap

Ex high: £30k, double each decade

Super-rich: £50k, doubles each decade

5/n

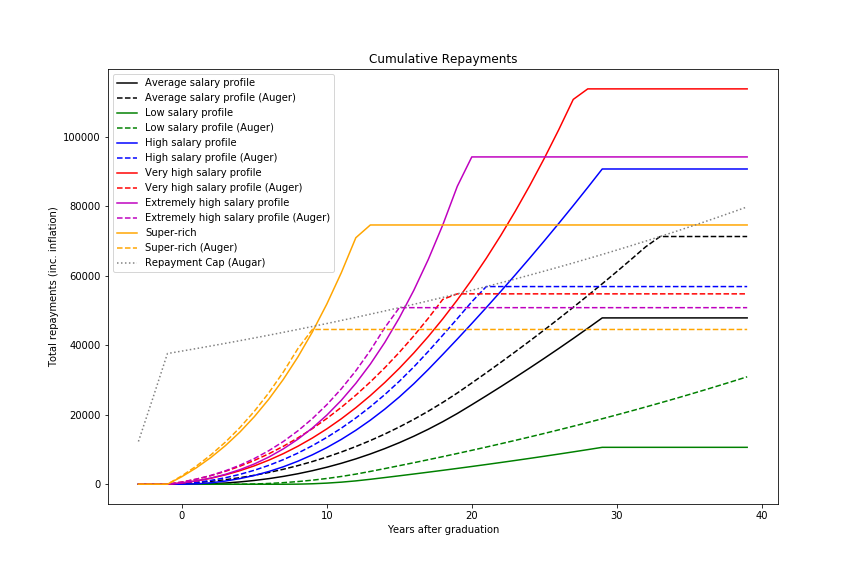

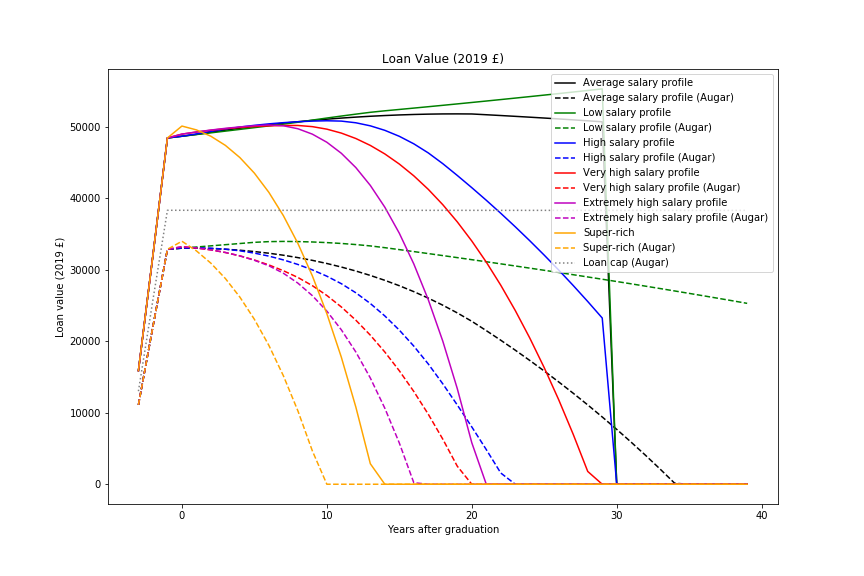

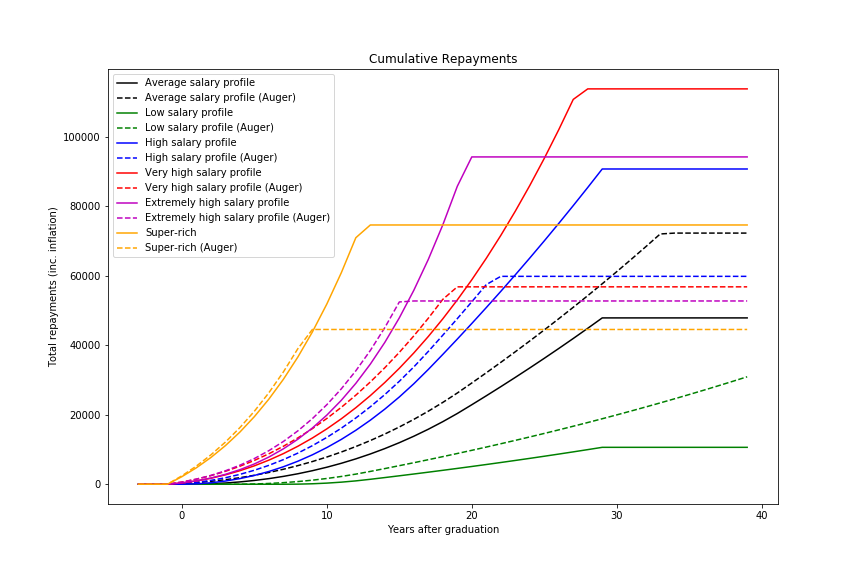

Post-Augar (dashed lines), the total loan value is lower due to lower fee and lower subsistence loan

The loan cap has very little impact

raw.githubusercontent.com/chrisnorth/loa…

7/n

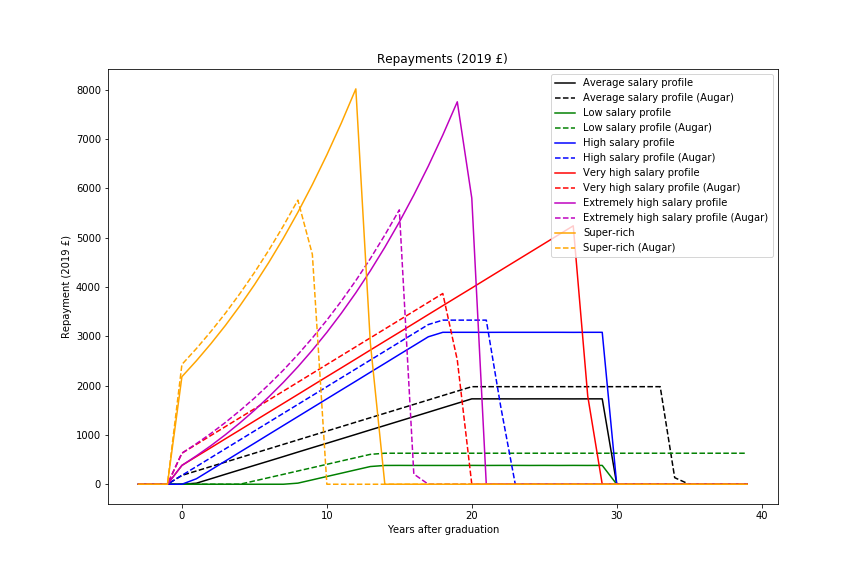

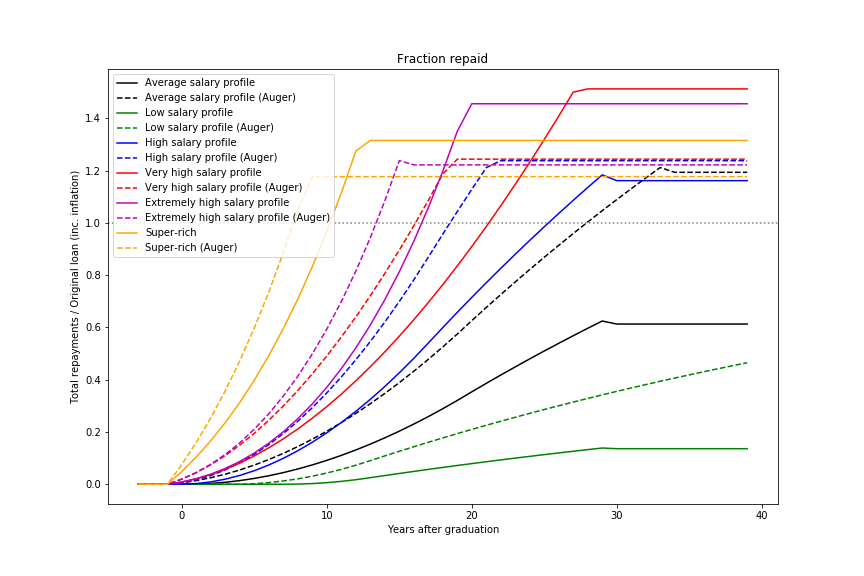

Under Augar (dashed lines), repayments are higher for all, and continue for longer for lower earners

raw.githubusercontent.com/chrisnorth/loa…

8/n

Those who pay the most in total post-Augar are the Average earners. Above that

raw.githubusercontent.com/chrisnorth/loa…

9/n

raw.githubusercontent.com/chrisnorth/loa…

10/n

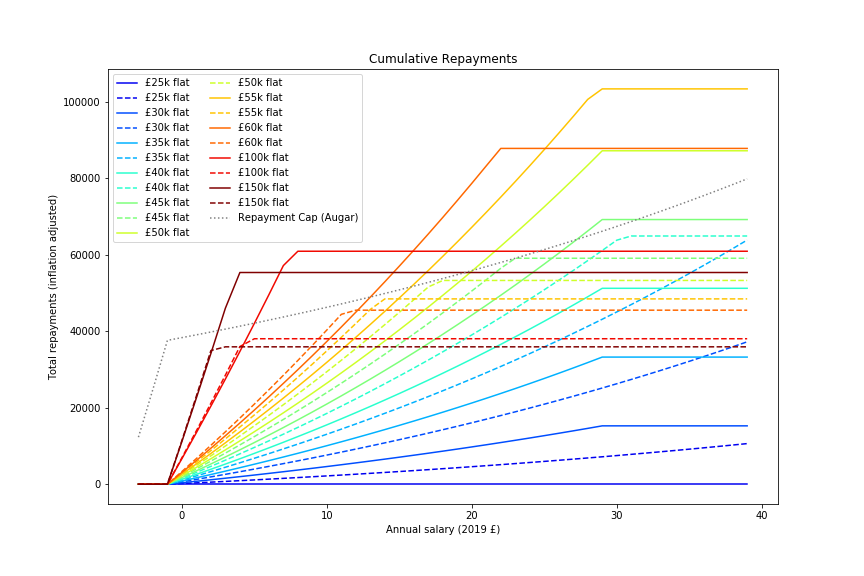

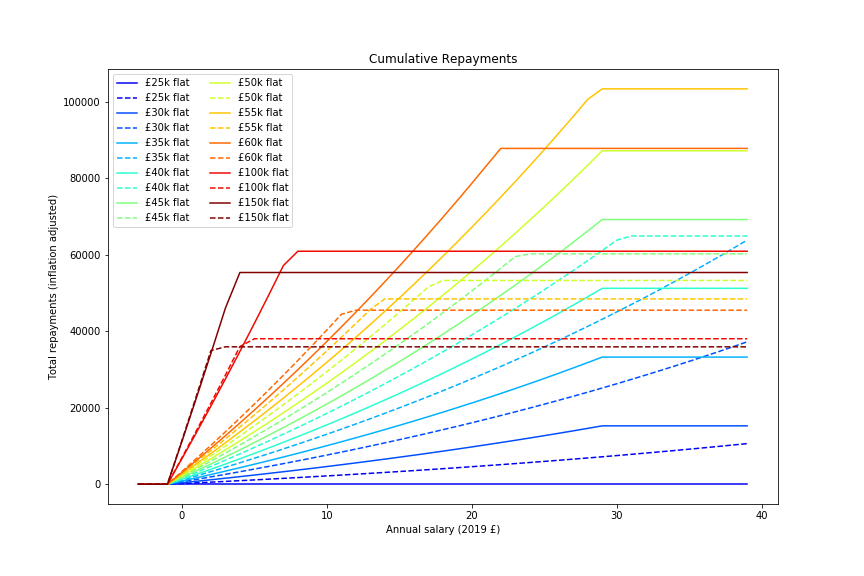

Peak payments are for £55k at present. Augar increases total payment for low salaries, and decreases for higher salaries (peak now £40k)

raw.githubusercontent.com/chrisnorth/loa…

11/n

raw.githubusercontent.com/chrisnorth/loa…

12/n

Pre-Auger, above about £60k the more you earn the less you pay off, whether in terms of total amount or relative to total earnings

Post-Auger, the turning point is £40k

Earners above £45k benefit, below £45k pay

raw.githubusercontent.com/chrisnorth/loa…

13/13

/fin

raw.githubusercontent.com/chrisnorth/loa…

raw.githubusercontent.com/chrisnorth/loa…

Mostly helps the mid-high earners, but effect is small.

/fin+1