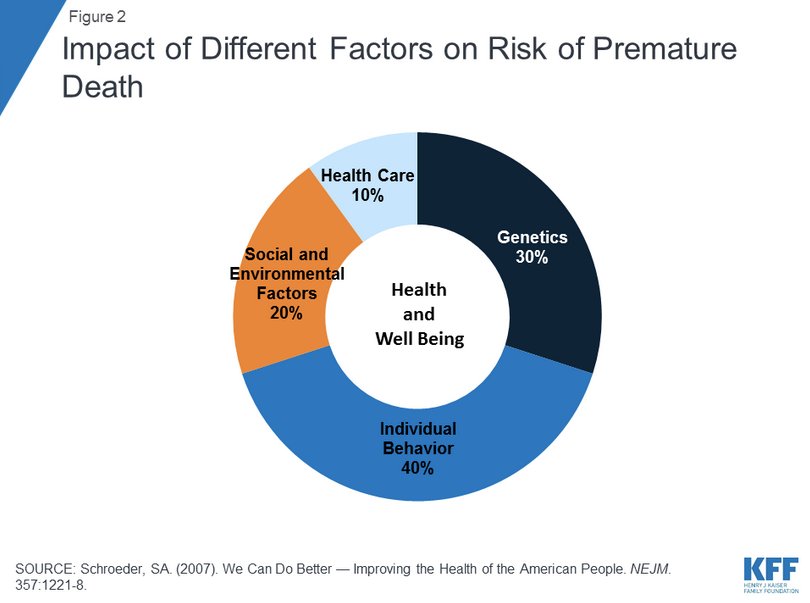

Today, @BorisJohnson has said that taxes on unhealthy foods should be reviewed citing a lack of evidence. The only such UK tax is the soft drinks industry levy, or #sugartax, so please let me take you through that 'lack of evidence'.

bbc.co.uk/news/uk-politi…

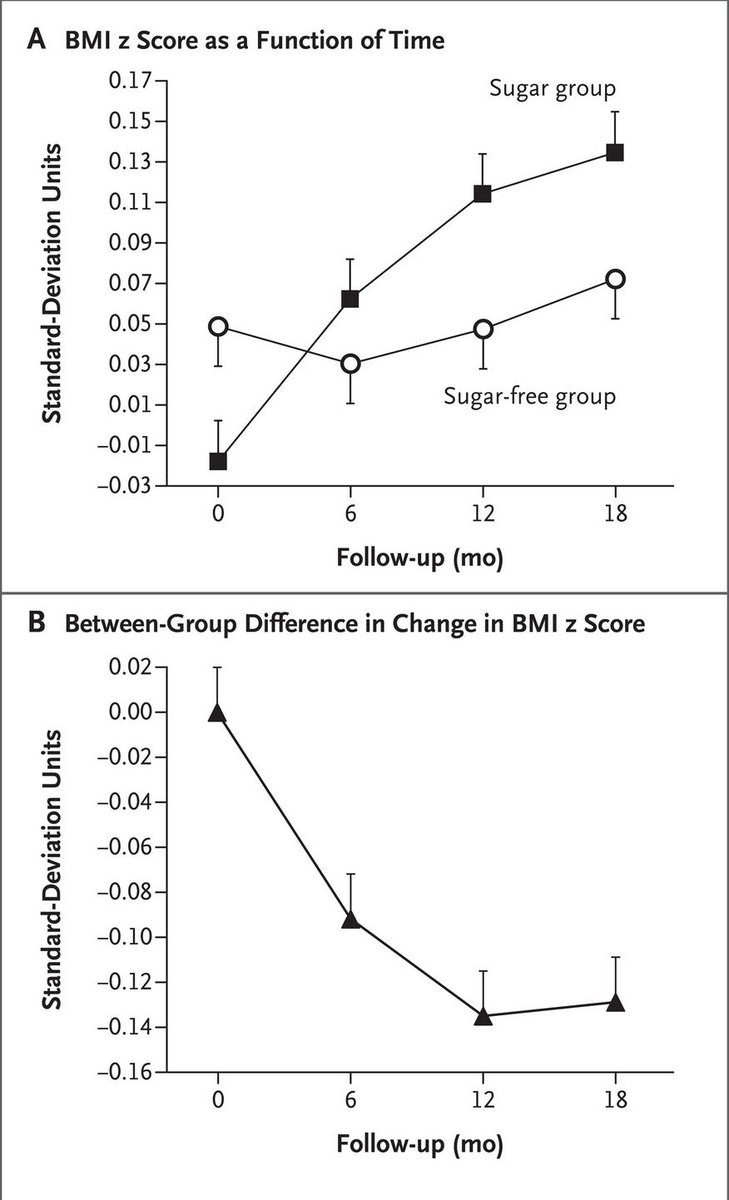

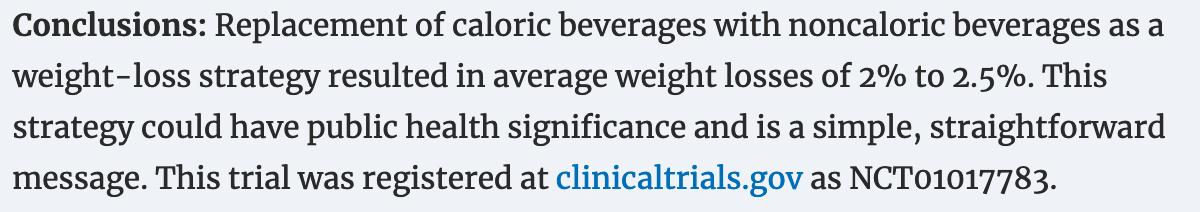

Randomised-controlled trials show sugary drinks cause weight gain in children and adults. E.g.

nejm.org/doi/full/10.10…

nejm.org/doi/full/10.10…

academic.oup.com/ajcn/article/9…

bmj.com/content/346/bm…

Sugary drinks are also associated with increased risk of diabetes, over and above any effect through weight gain. Over 10 years, they are estimated to directly cause 79,000 cases of diabetes in the UK, and 124,000 cases when including weight gain.

bmj.com/content/351/bm…

And they're also associated with tooth decay, heart disease, and high blood pressure.

ncbi.nlm.nih.gov/pubmed/25735740

ahajournals.org/doi/10.1161/CI…

ahajournals.org/doi/full/10.11…

assets.publishing.service.gov.uk/government/upl…

ncbi.nlm.nih.gov/pubmed/24323509

Beyond their health impact, sugary drinks are thought to be reasonable to tax because:

1. they have no nutritional benefit beyond their calories

2. people switch to drinks that are generally healthier

3. people don't eat more to compensate

4. they can be legally defined

relevant references in this first of several shamelessly self-promoting references:

bmj.com/content/347/bm…

A sugary drink tax was supported by evidence-based reports from @PHE_uk and @CommonsHealth, and supported by the breadth of the medical profession (@TheBMA @FPH @AoMRC @rcgp and others).

assets.publishing.service.gov.uk/government/upl…

publications.parliament.uk/pa/cm201516/cm…

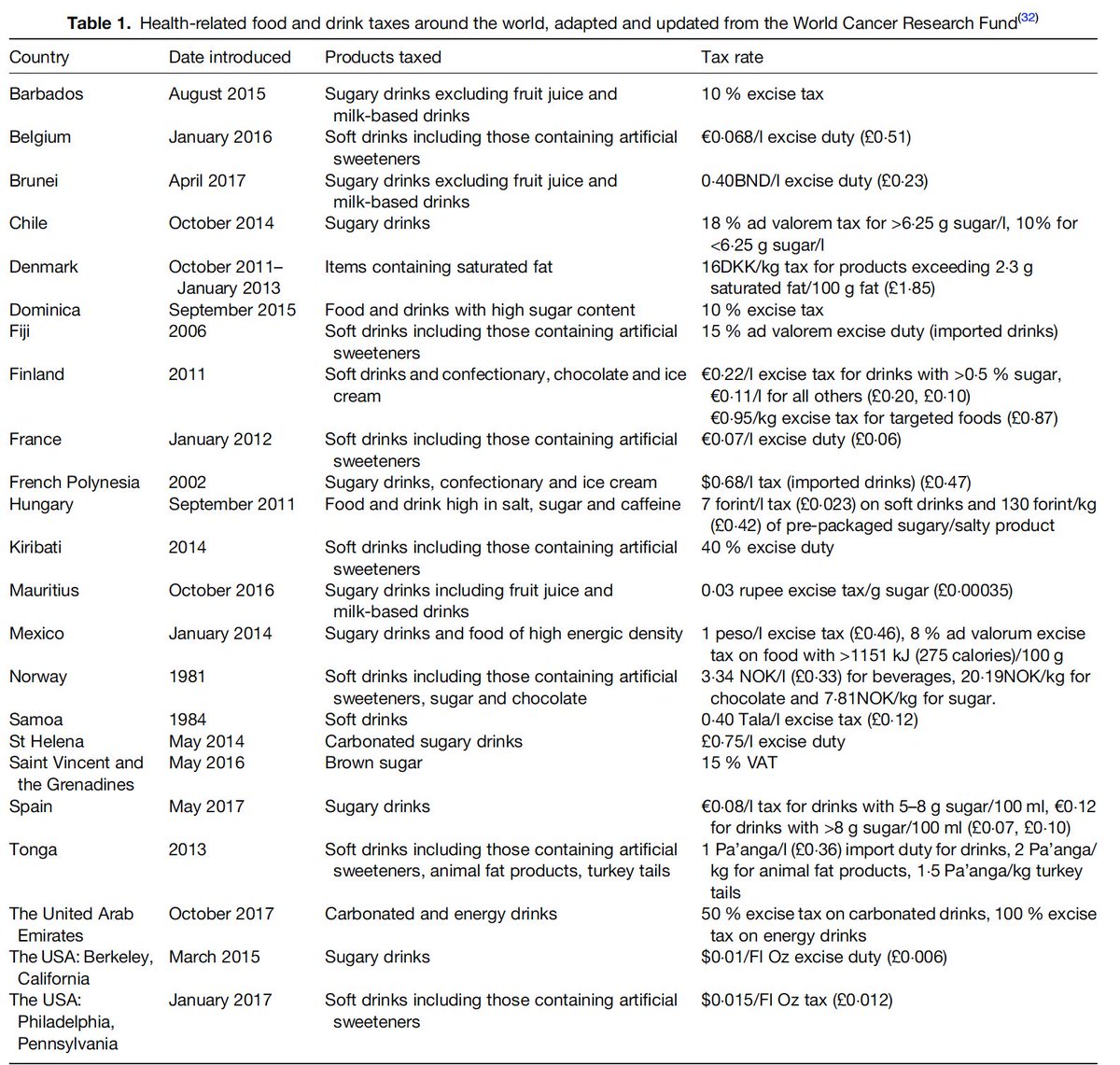

Initially data about their potential impact on purchasing/consumption/health was based on modelling, but now there are loads of countries who've adopted some kind of sugary drink tax & 'real-world' data are flooding in (see wcrf.org/int/policy/nou… for an up to date list)

And just in case it's useful, the modelling suggests some fairly useful impacts (!warning! more self promotion)

thelancet.com/journals/lanpu…

bmj.com/content/347/bm…

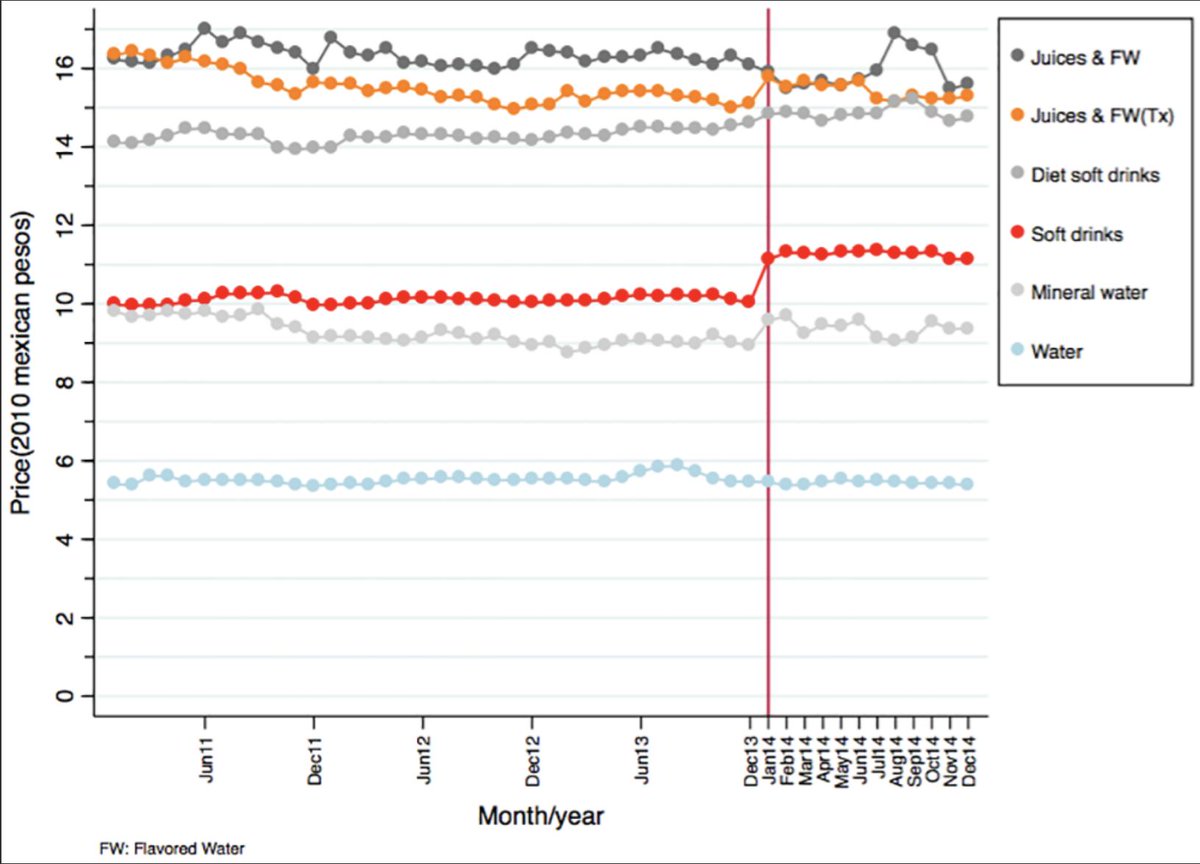

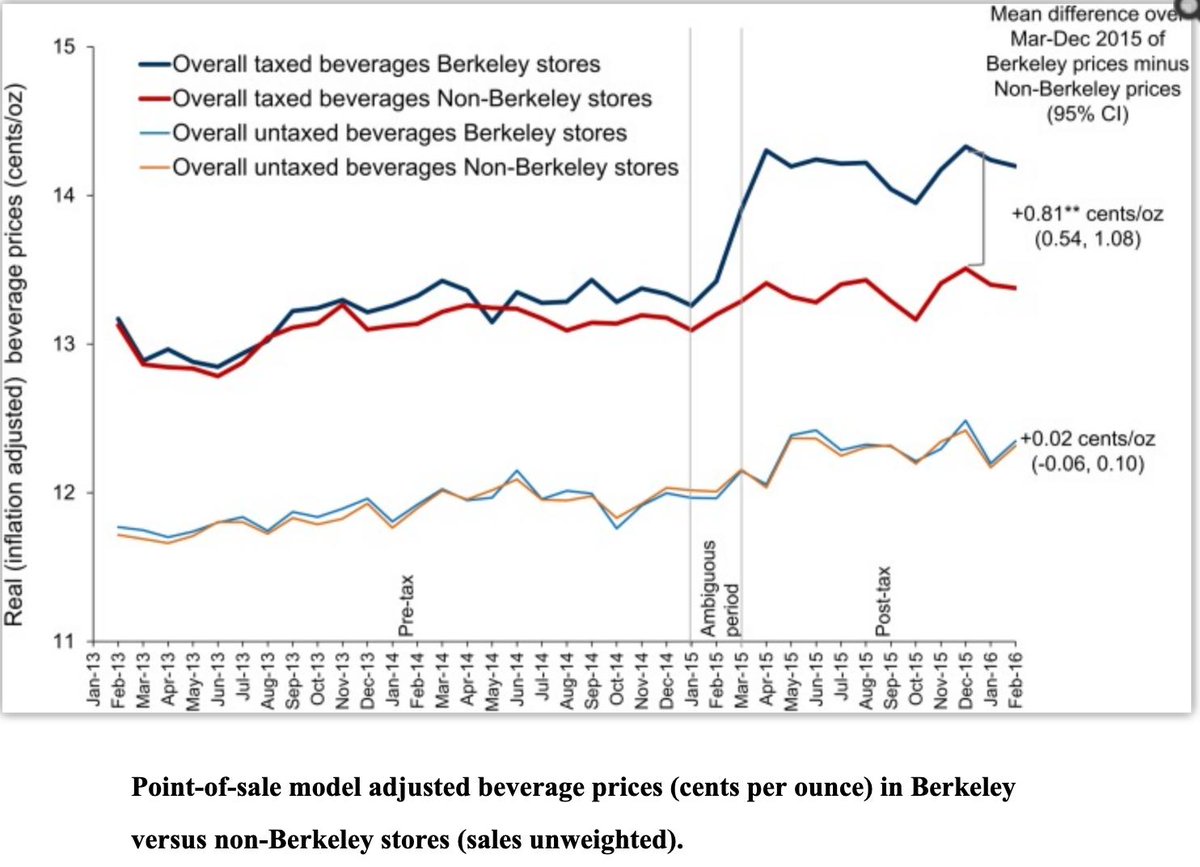

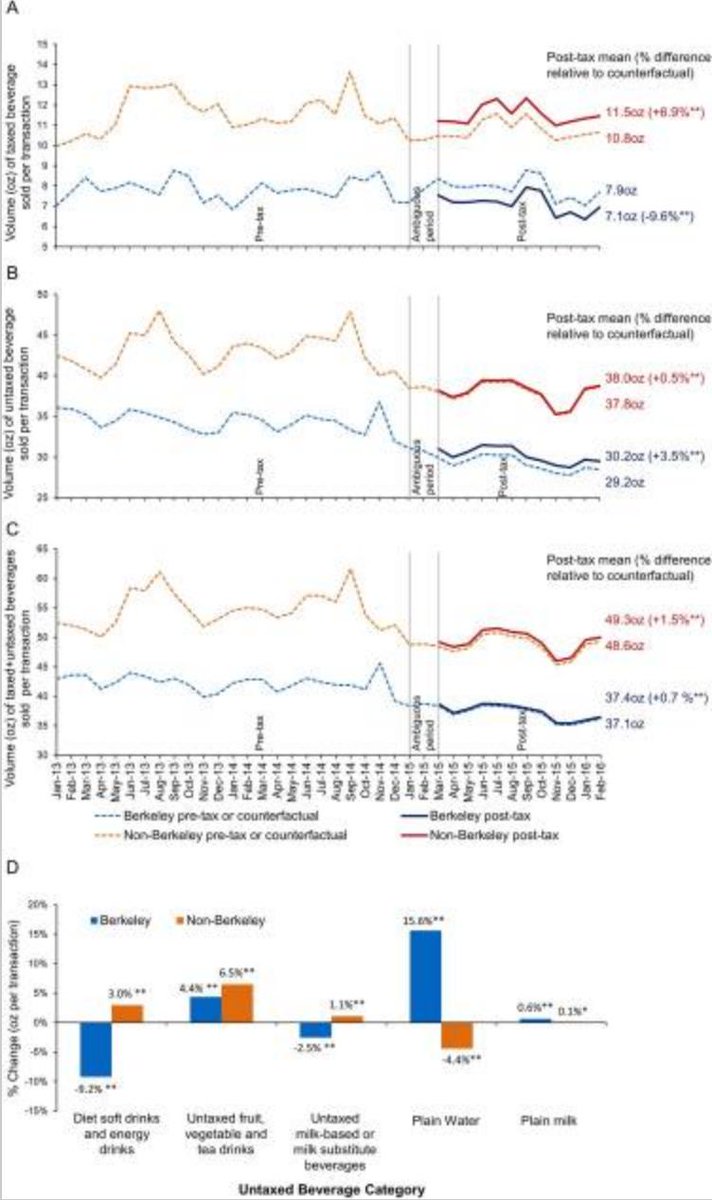

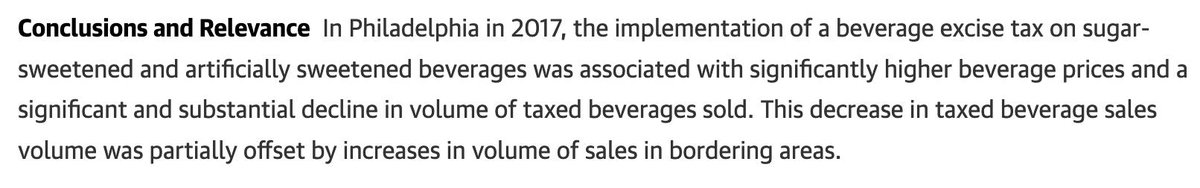

So, 'real world' evaluations of these taxes are filtering through. They're showing big effects on price and purchases.

jamanetwork.com/journals/jama/…

journals.plos.org/plosone/articl…

ncbi.nlm.nih.gov/pubmed/28419108

journals.plos.org/plosmedicine/a…

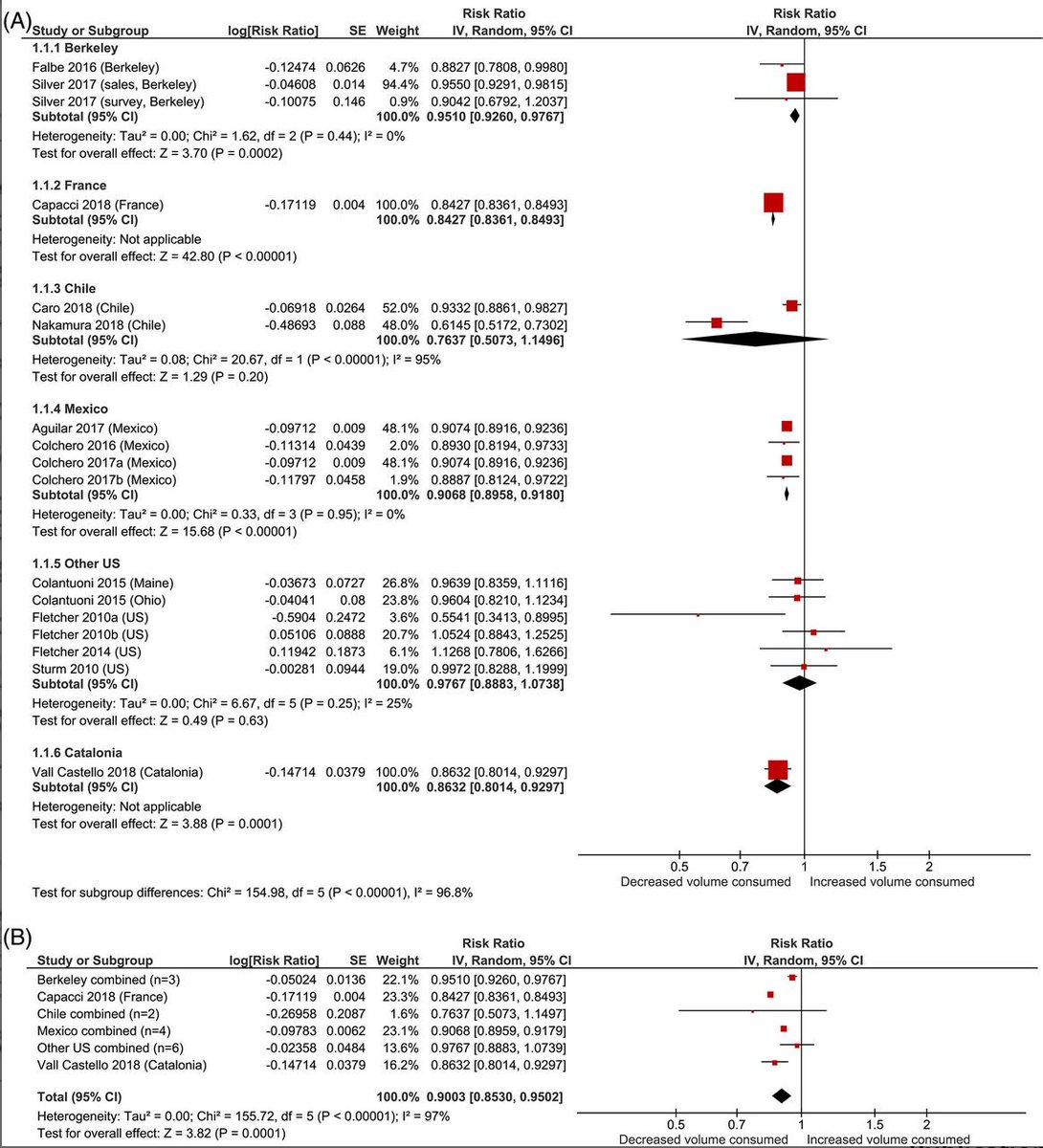

And the systematic reviews of these papers are now also being published

academic.oup.com/ajcn/article-a…

onlinelibrary.wiley.com/doi/10.1111/ob…

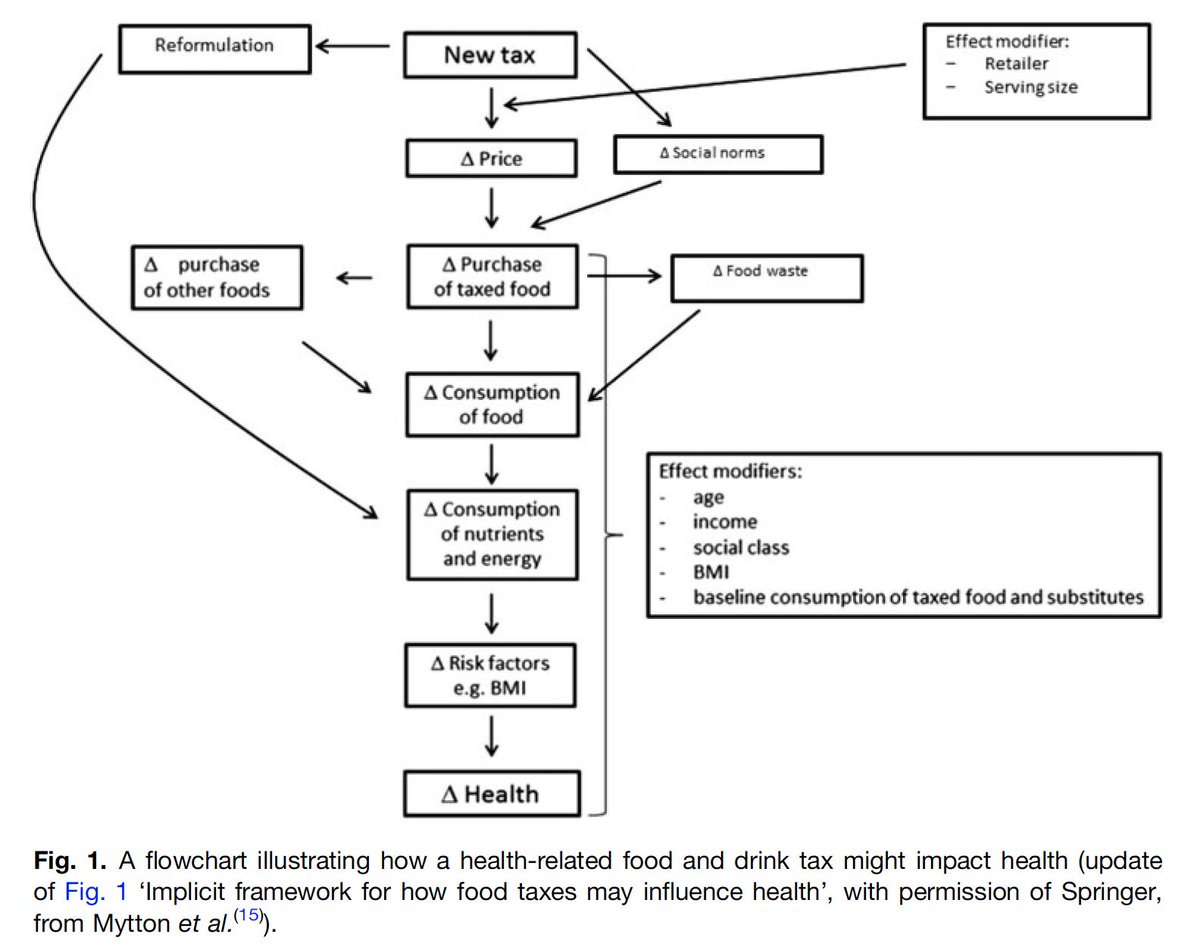

However, it's highly likely that sugary drink taxes will have wider impacts on consumer behaviour beyond their direct price effects (self-promotion claxon).

cambridge.org/core/journals/…

So what about the assertion that these taxes "clobber those who can least afford it"?

These types of taxes - like VAT, like excise taxes, like cigarette taxes - are regressive. Those with less money pay a higher proportion of their income. But, the data show that they are more like to change their behaviour and more likely to have health benefits.

Here are the references:

ncbi.nlm.nih.gov/pubmed/27182835

journals.plos.org/plosmedicine/a…

healthaffairs.org/doi/abs/10.137…

(note our initial 2013 UK modelling didn't suggest progressive health benefits, but data since then - above - do)

But perhaps this could be addressed by either use the revenue generated to subsidise healthier food, or even better, @BorisJohnson, just ensure the rest of the tax system is proportionately made more progressive...

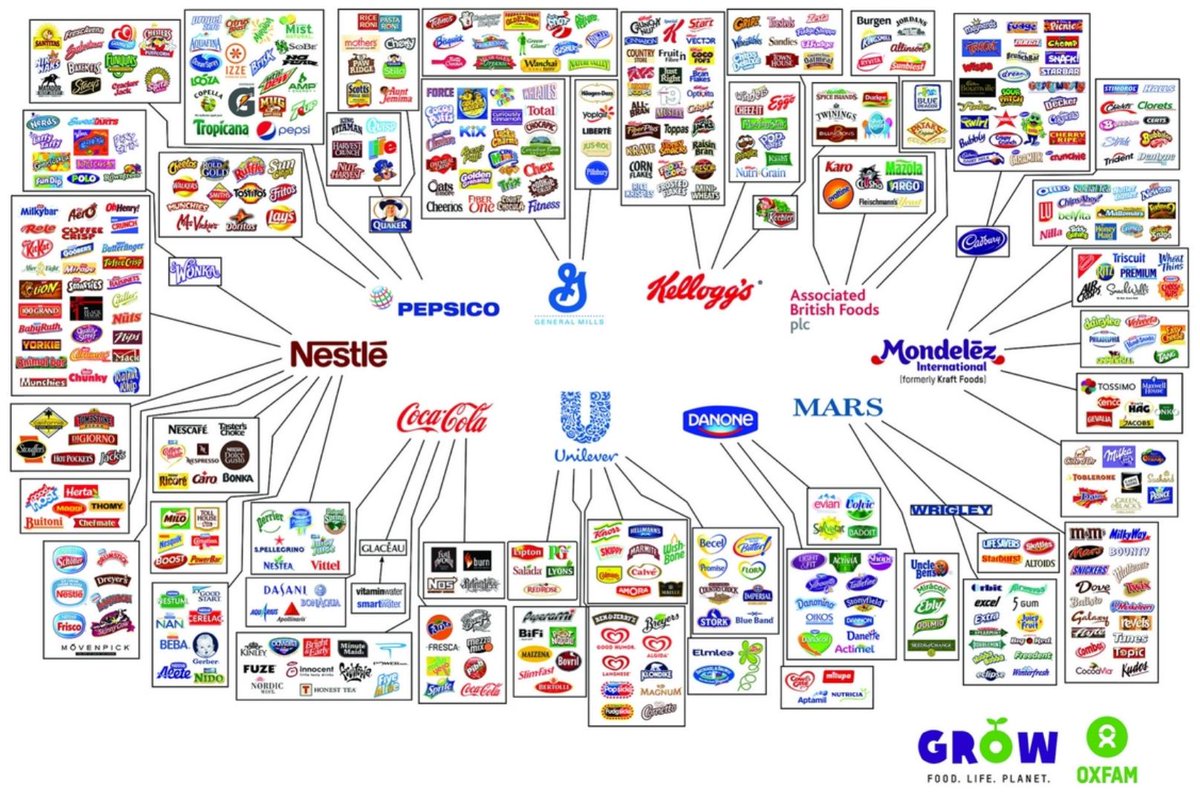

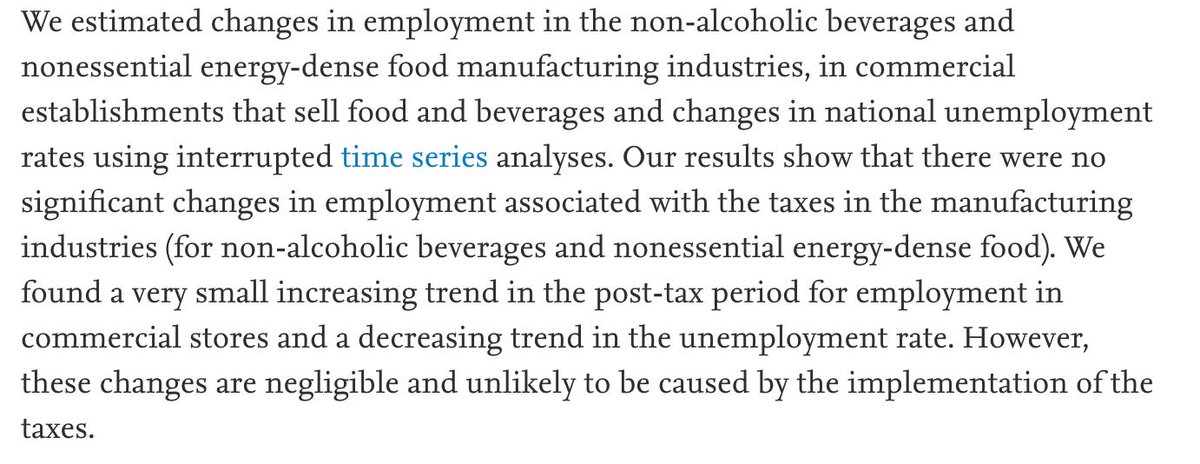

The impact on jobs of these taxes has also been raised but this has largely been quashed. And in any case, sugary drink companies make all the other drinks you'd switch to...

ncbi.nlm.nih.gov/pubmed/24524492

sciencedirect.com/science/articl…

Taxes on unhealthy foods are more tricky - what people switch to is harder to predict. However, carefully designed and evaluated policies shouldn't be shelved pending 'real world evidence'. If models suggest benefits, then trial the policy & be prepared to say you were wrong.

And reviewing the current sugary drink tax is in progress, with (excitingly) the first tranch of data on industry and consumer behaviour to be published soon.

nihr.ac.uk/news/nihr-fund…

So, my view (for what it’s worth), is that obesity is a massively complex problem and no single solution is going to be enough to solve the current crisis - hence having a broad reaching obesity strategy. But, as single interventions go, sugary drink taxes are right up there.

They are likely to 'shift the curve', i.e. affect the whole population to be more healthy. And unlike most interventions to increase exercise, they don't require individual agency and are more likely to be both effective and equitable.

journals.plos.org/plosmedicine/a…

Plus, while i'm here, calling an intervention aimed at supporting people to reduce their mordidity and mortality against a sea of obesogenic environmental triggers in an non-judgemental and equitable way a 'sin tax', is just lazy.

So suggesting that we should throw out one of the few pieces of genuine evidence-based public health policy on a day when we hear that obesity is now causing more cancers than smoking for four subtypes, seems particularly short sighted (he said, politely).

@MattHancock @sarahwollaston @denis_campbell @martinwhite33 @Pete_Scarbs @felly500 @davidjbuck @BrineMinister @JonAshworth @stevencjcummins @MikeRayner @CRUK_Policy @OHA_updates @Jeremy_Hunt