#FairTaxWeek @FairTaxMark

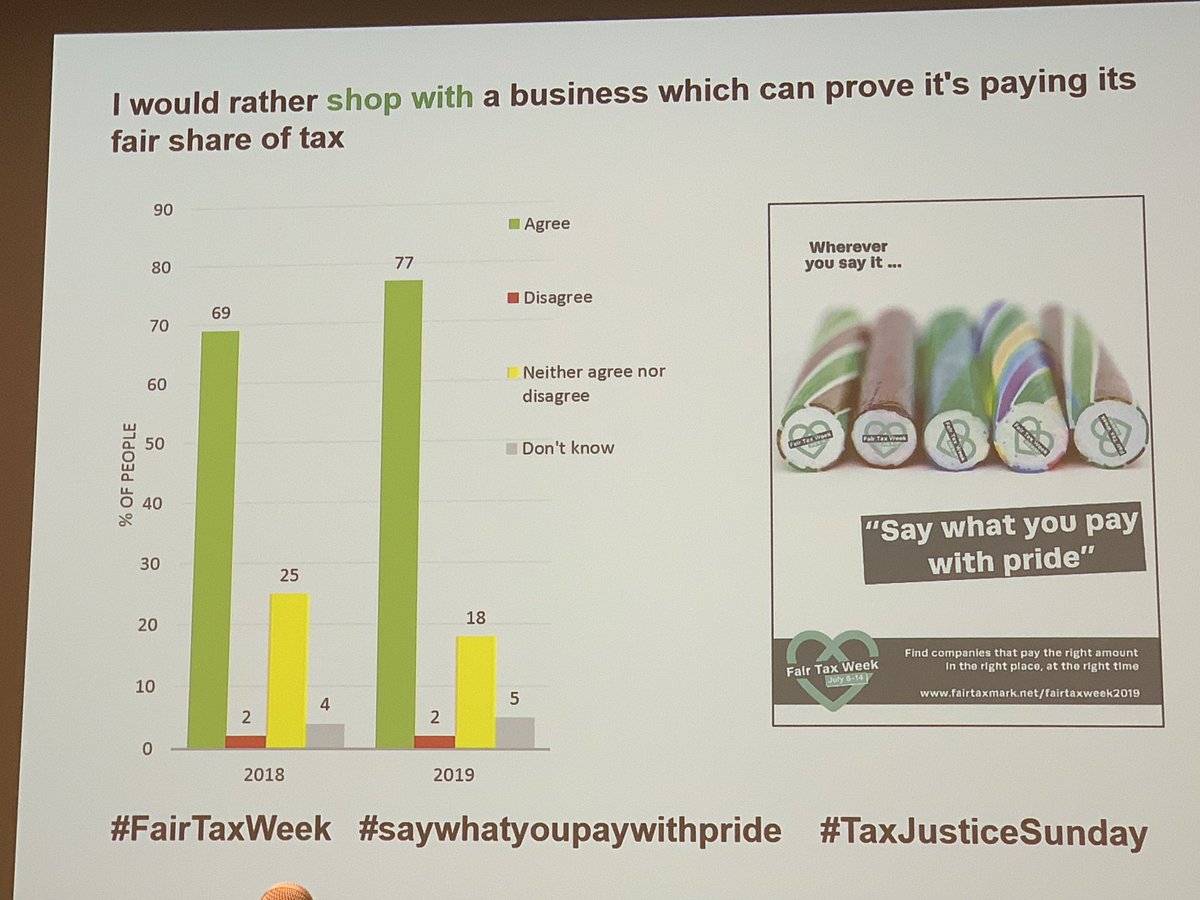

This question shows substantially more consumers want to buy from shops that can prove they pay fair tax #FairTaxWeek

In context the entire prison system costs £3bn.

Being a ‘responsible capitalist’ is the right thing to do, Julian says, and he sleeps better at night.

He says trying to do the right thing has made Richer Sounds a better business...

To help with this he funds @taxwatch to investigate and expose aggressive tax avoidance.

He says “If you knew that for every £1 invested you got £10 back you’d invest more wouldn’t you? But the government has cut money to HMRC!”

- Stop inheritance trusts so we all pay death duty fairly

- Stop anonymous trusts purchasing property and land.

- Punish accountancy firms recommending dodgy schemes

- Have a tax register, those paying tax should have nothing to hide

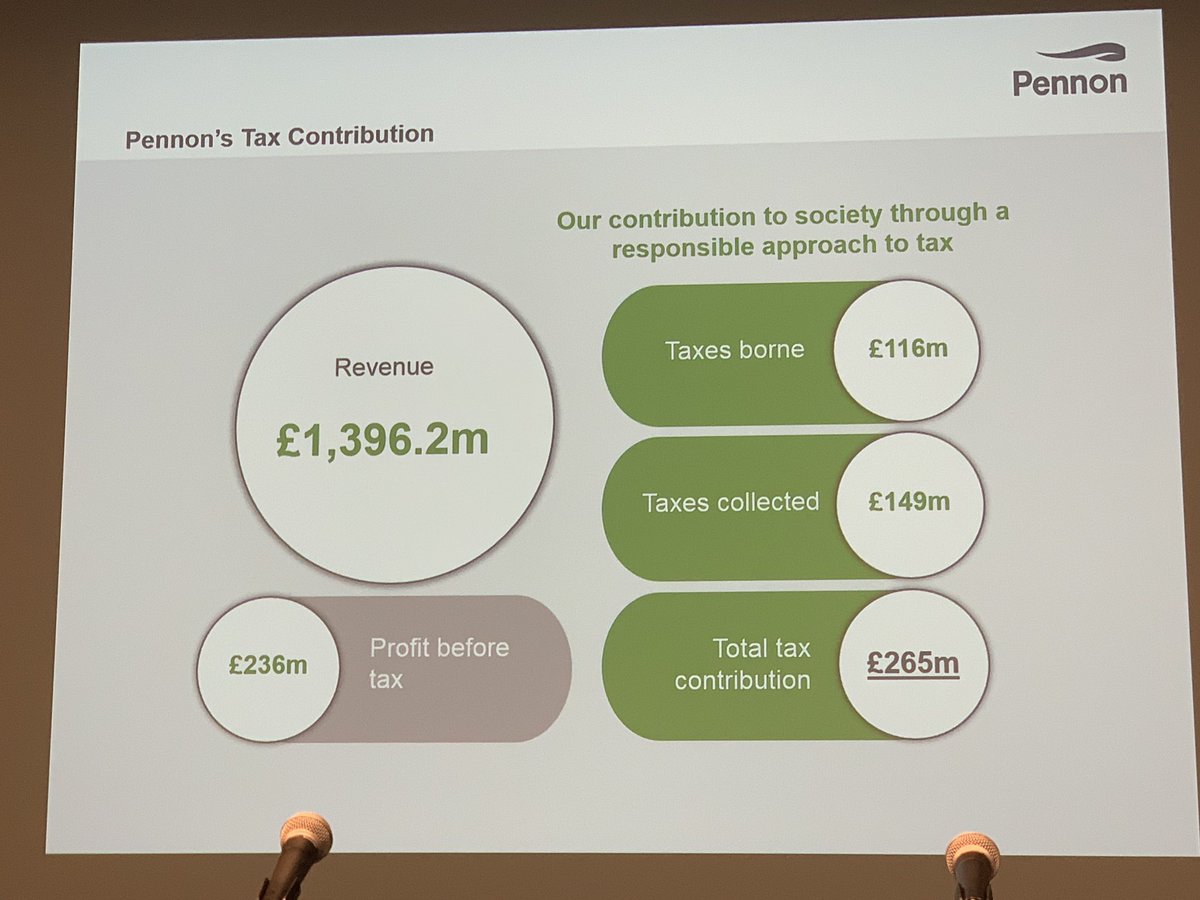

At SSE we’ve always been very transparent, yes we pay a lot of tax, but we’re pleased to say it’s the right amount of tax

But beyond the morality there’s actually a very good business case for paying the right amount of tax...

For customers they just want to provide good bath products. Everything else about fair trade/fair tax/etc is for themselves

But to run a healthy business you need to have the real picture.

So avoiding taxes is actually damaging, while taking a fair tax approach is healthy