- Bitcoin's price will double every year

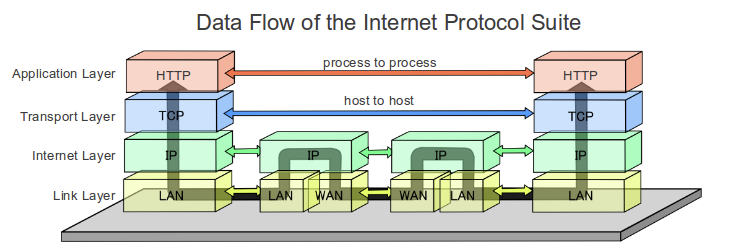

- Transaction fees will make up for lost revenue

bitinfocharts.com/comparison/tra…

While Bitcoin's hashpower steadily increases, transaction fees are extremely volatile

- Bitcoin will transition to the much cheaper POS, in order to try and maintain its 21M supply cap.

- Bitcoin will stick with POW but raise its cap in order to sustain the heavy cost of POW.