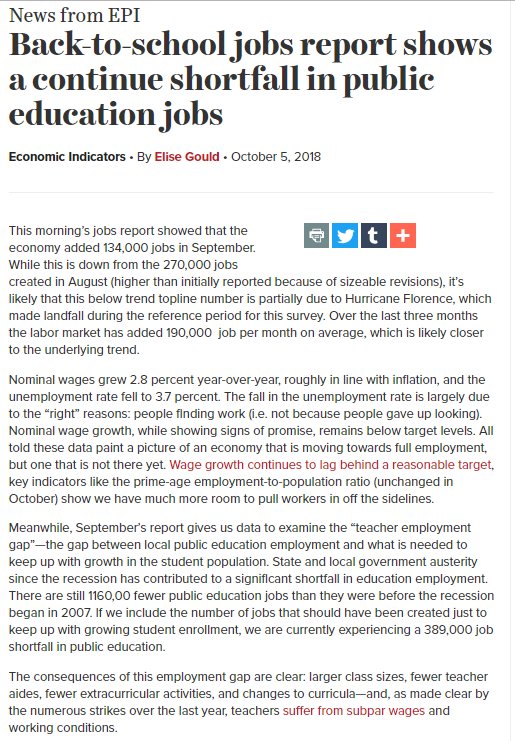

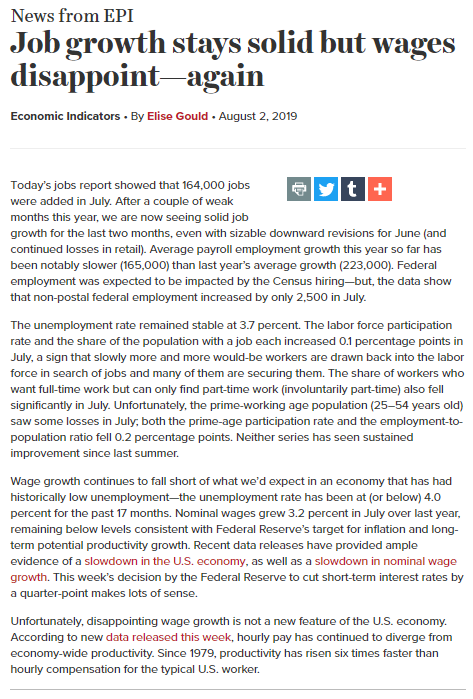

epi.org/press/job-grow…

#JobsReport @EconomicPolicy 1/n

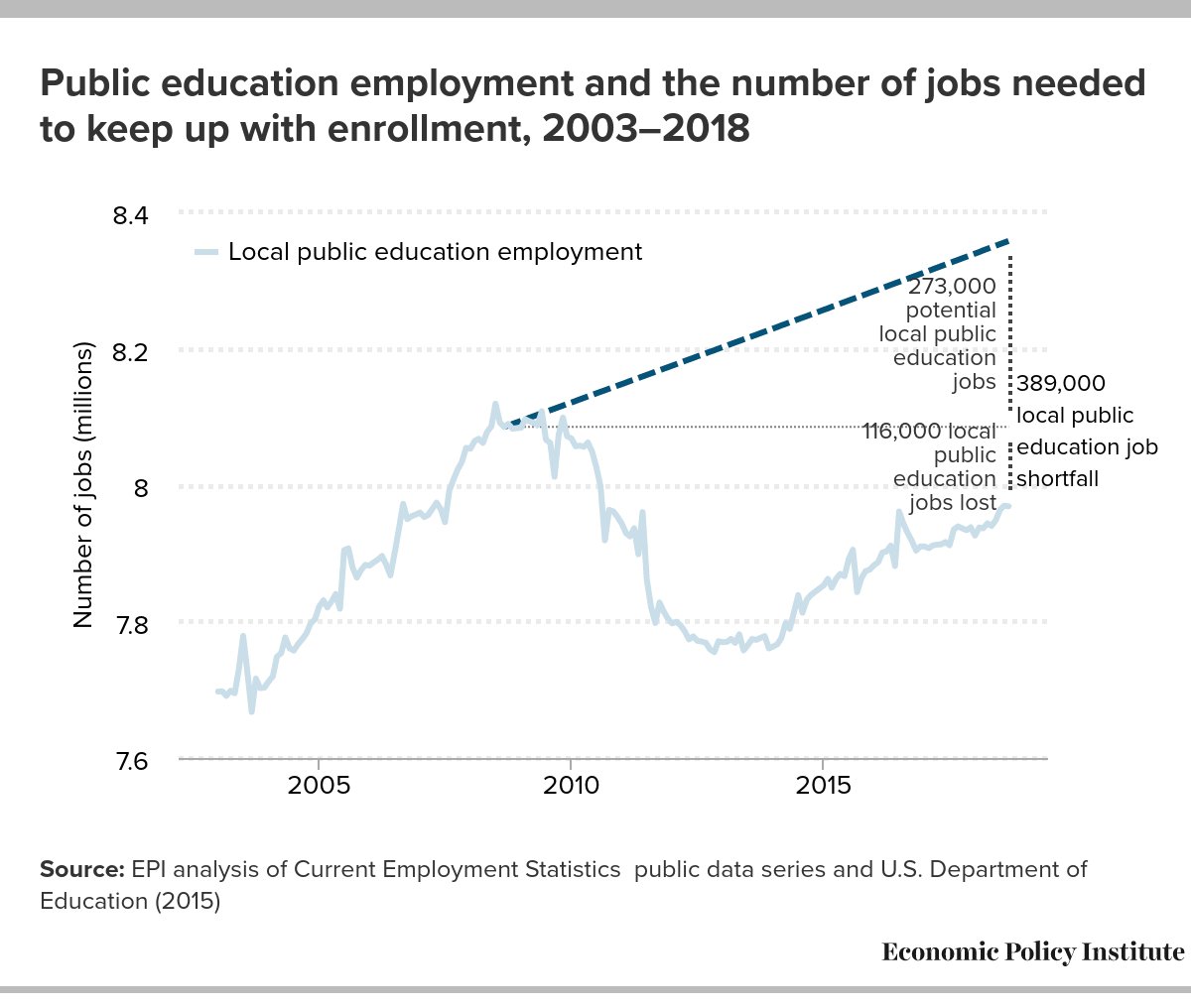

3/n

4/n

5/n

6/n

7/n

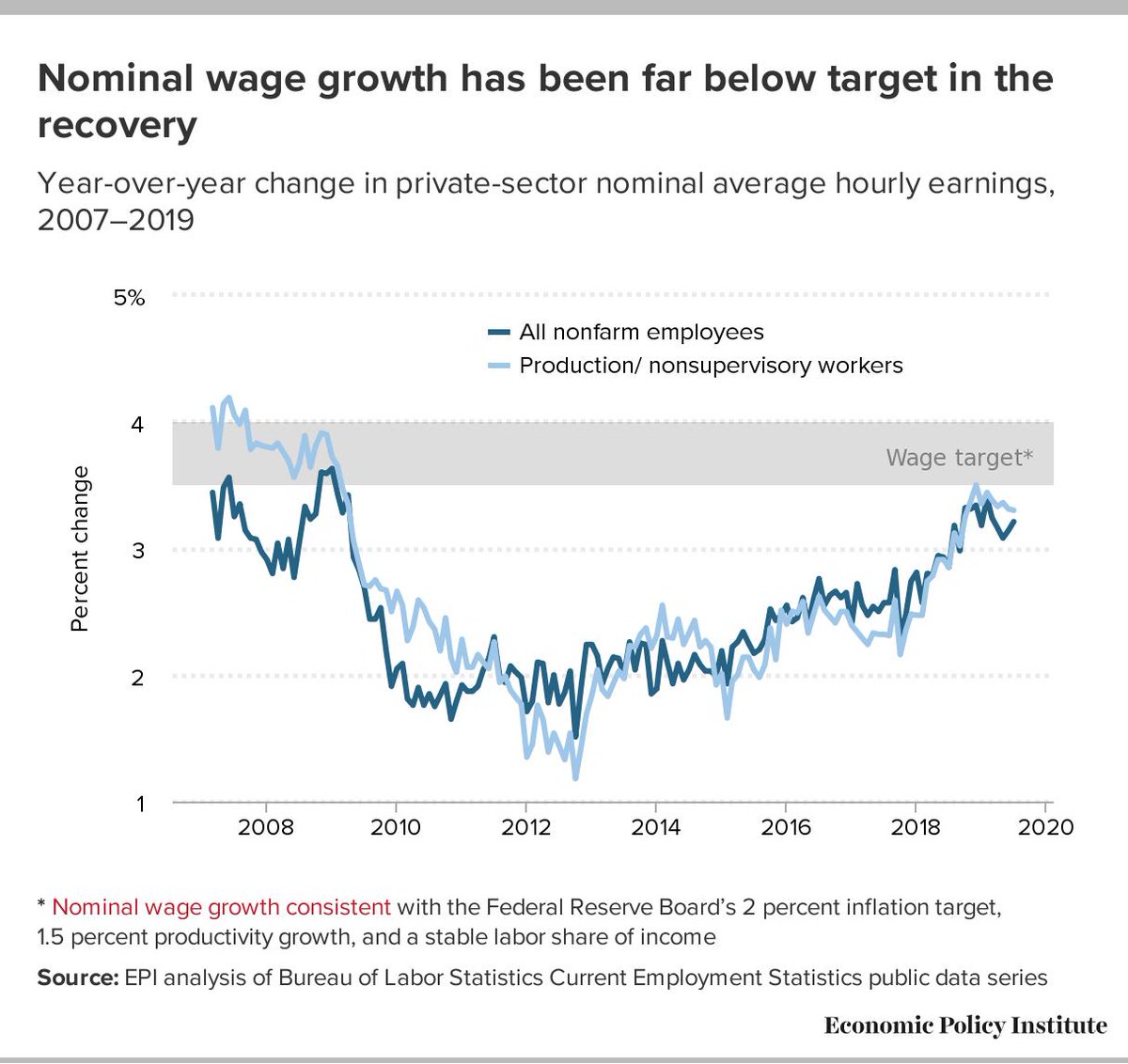

epi.org/nominal-wage-t…

8/n

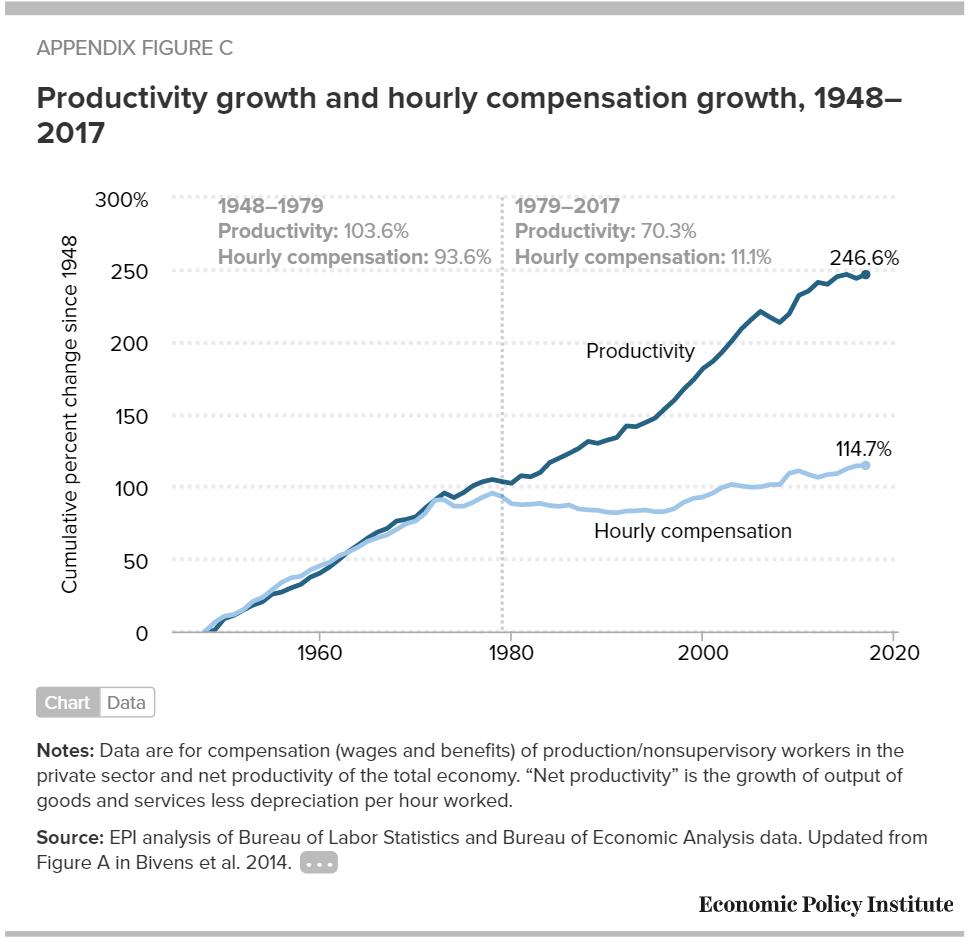

via @joshbivens_DC @EconomicPolicy

9/n

federalreserve.gov/monetarypolicy…

10/n

11/n

12/n

14/n

15/n

16/n

17/n

18/n

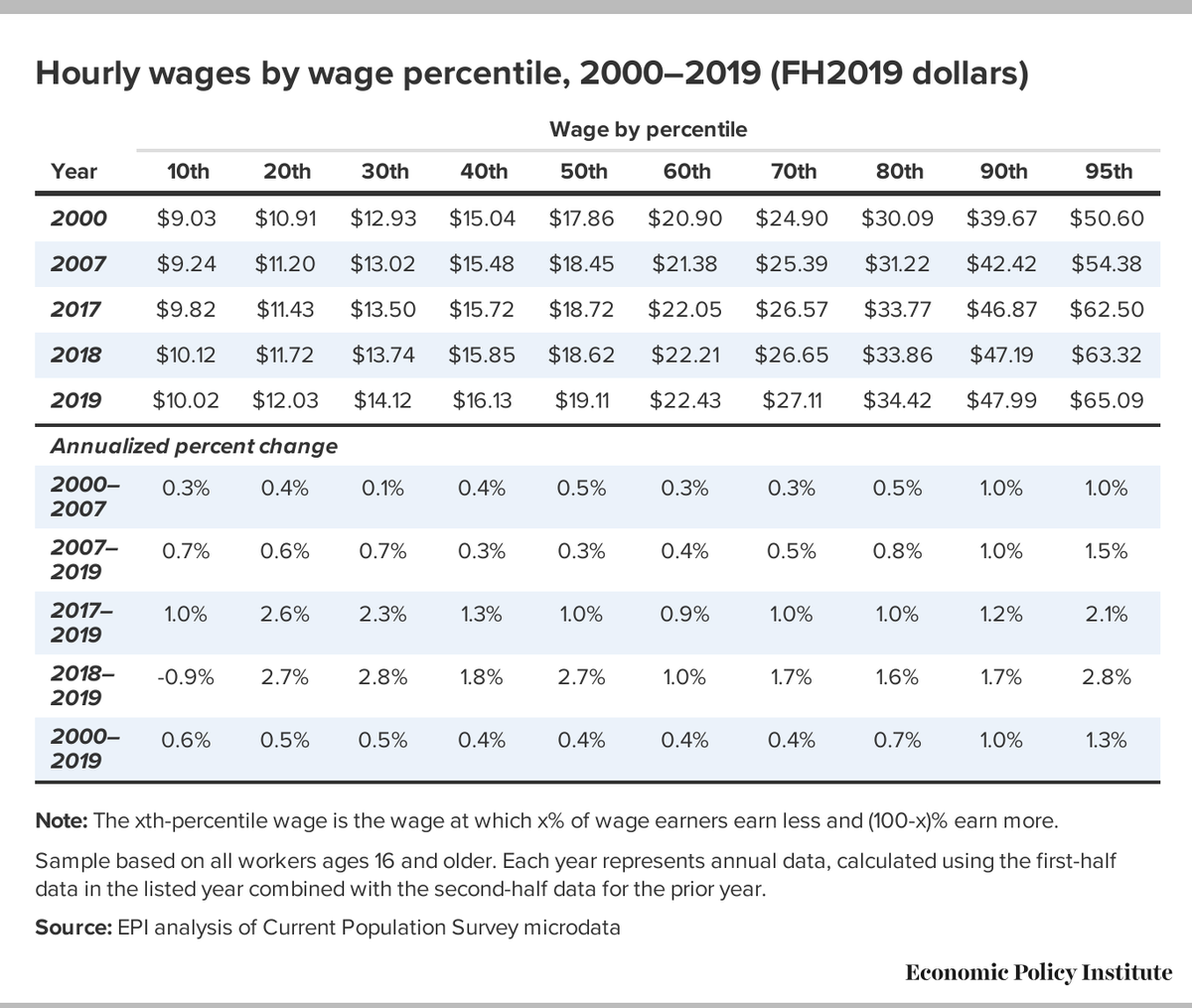

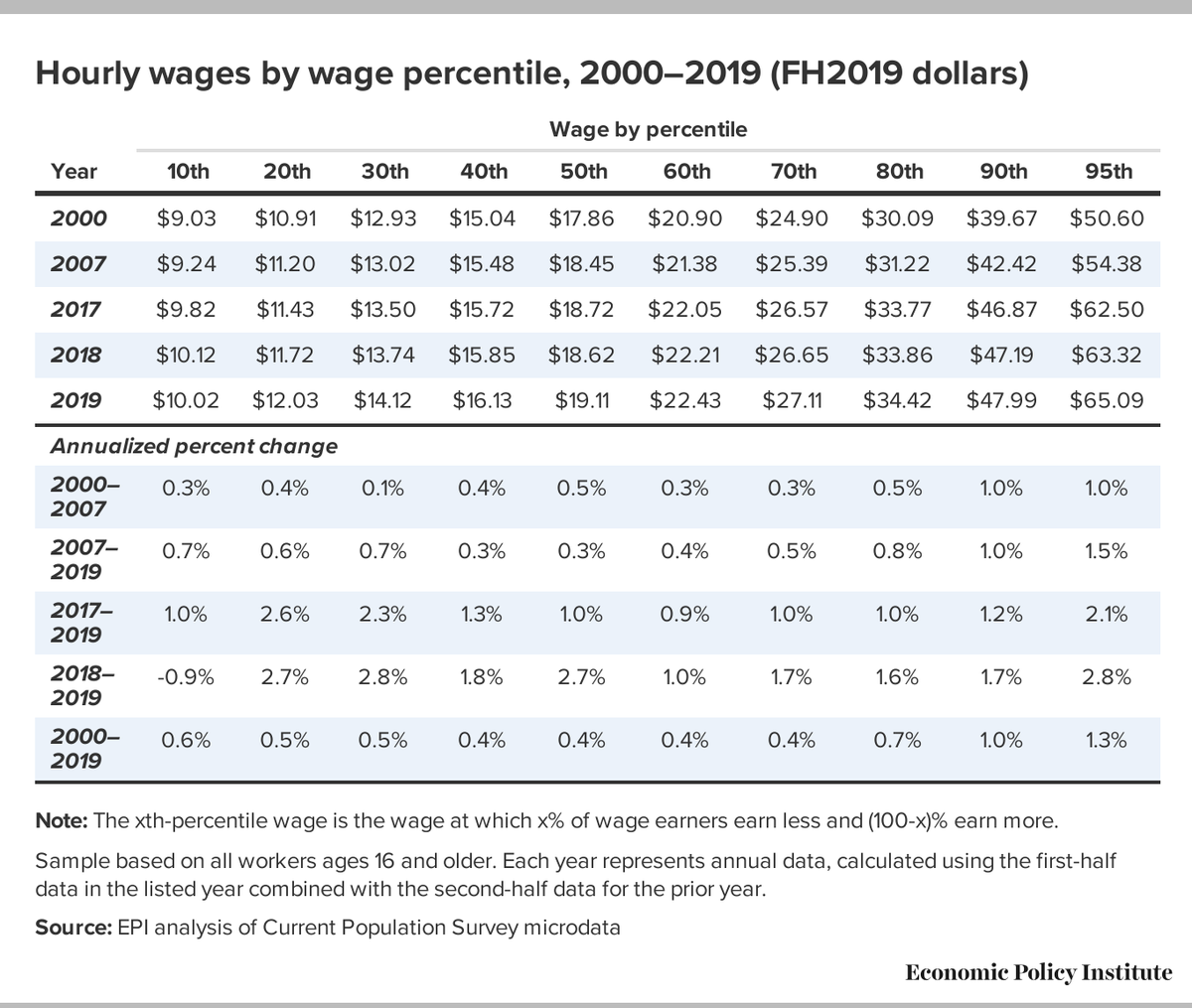

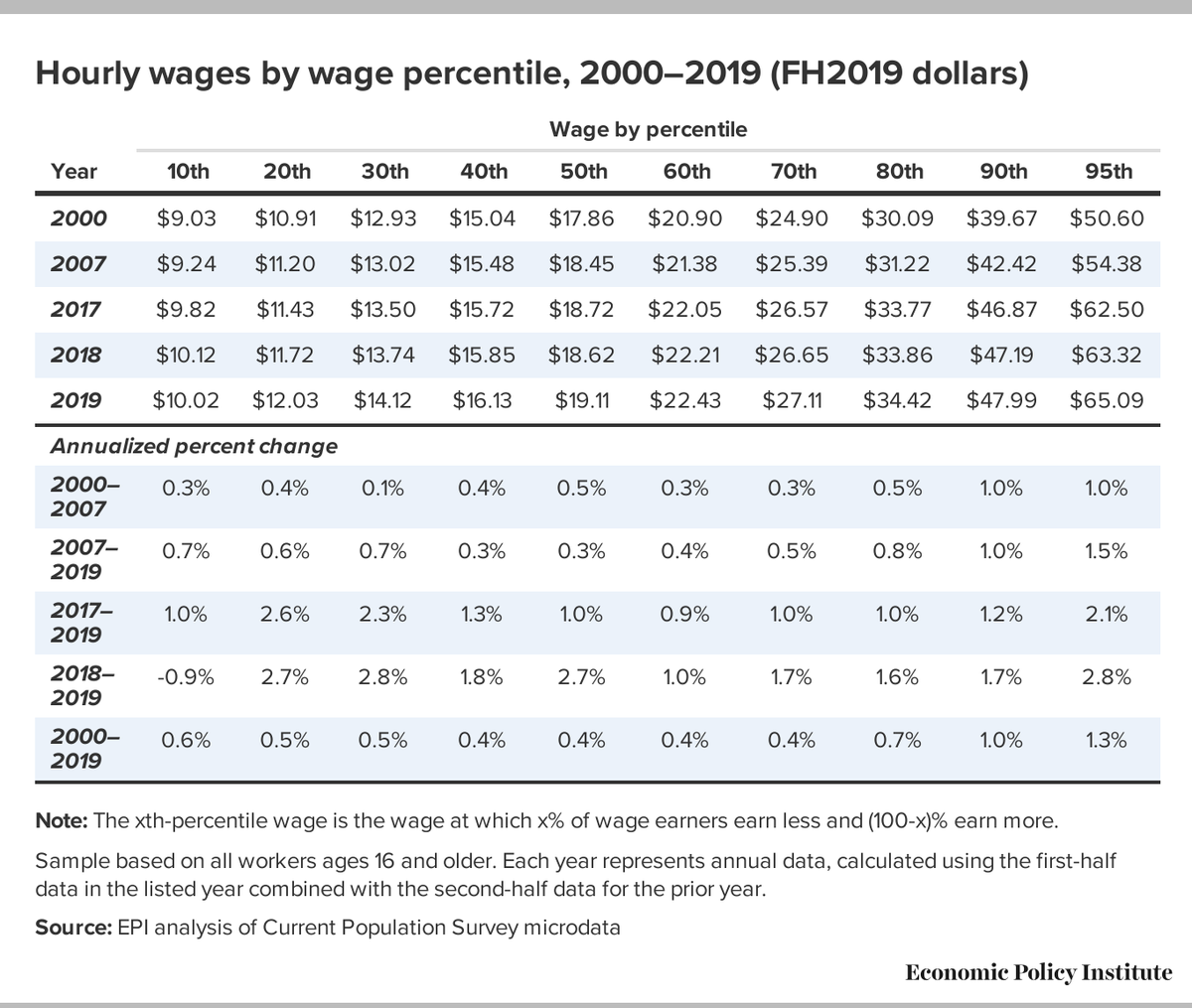

Even $11 an hour is higher than the 10th percentile of the national wage distribution (at $10.02).

19/n

20/n

21/n

22/n

23/n

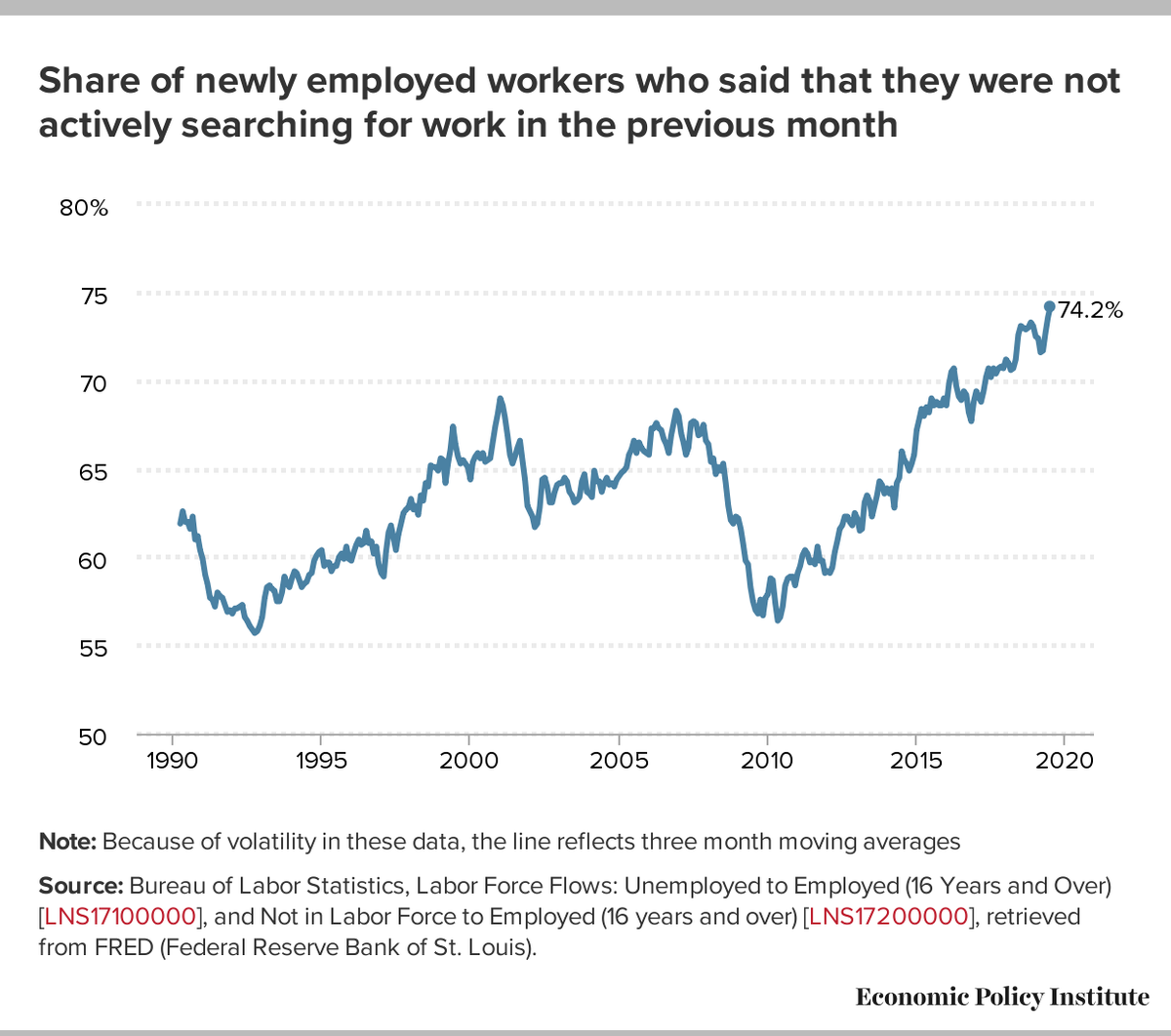

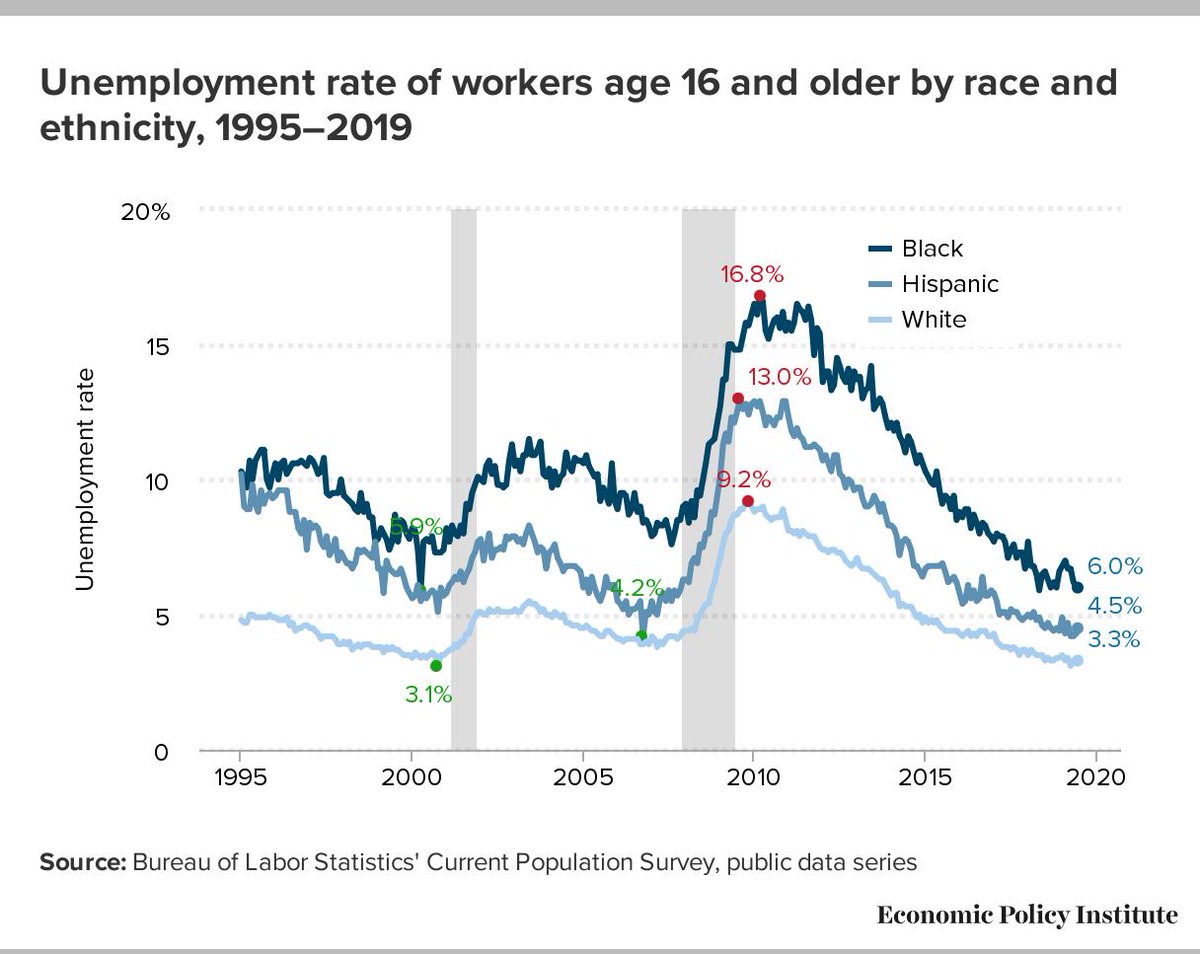

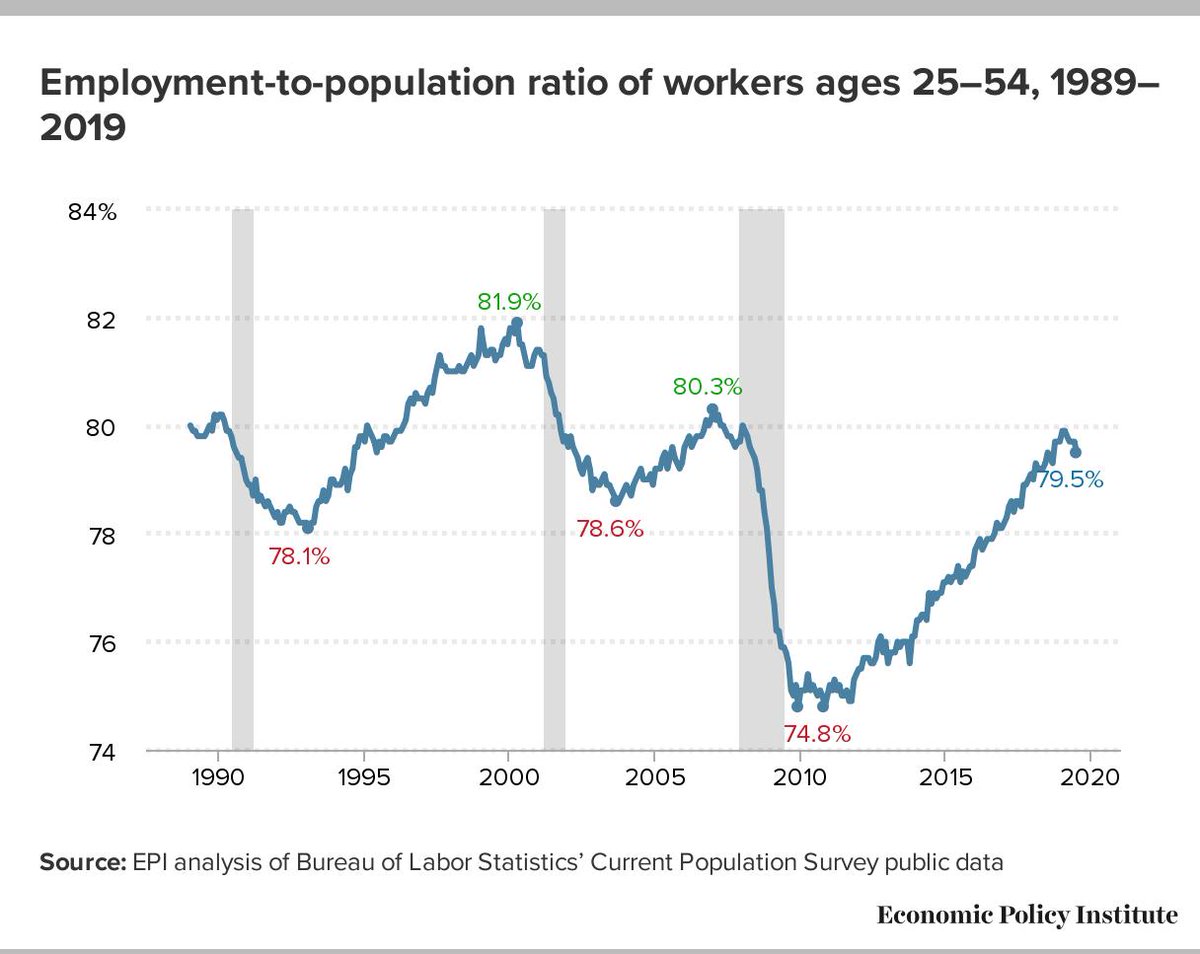

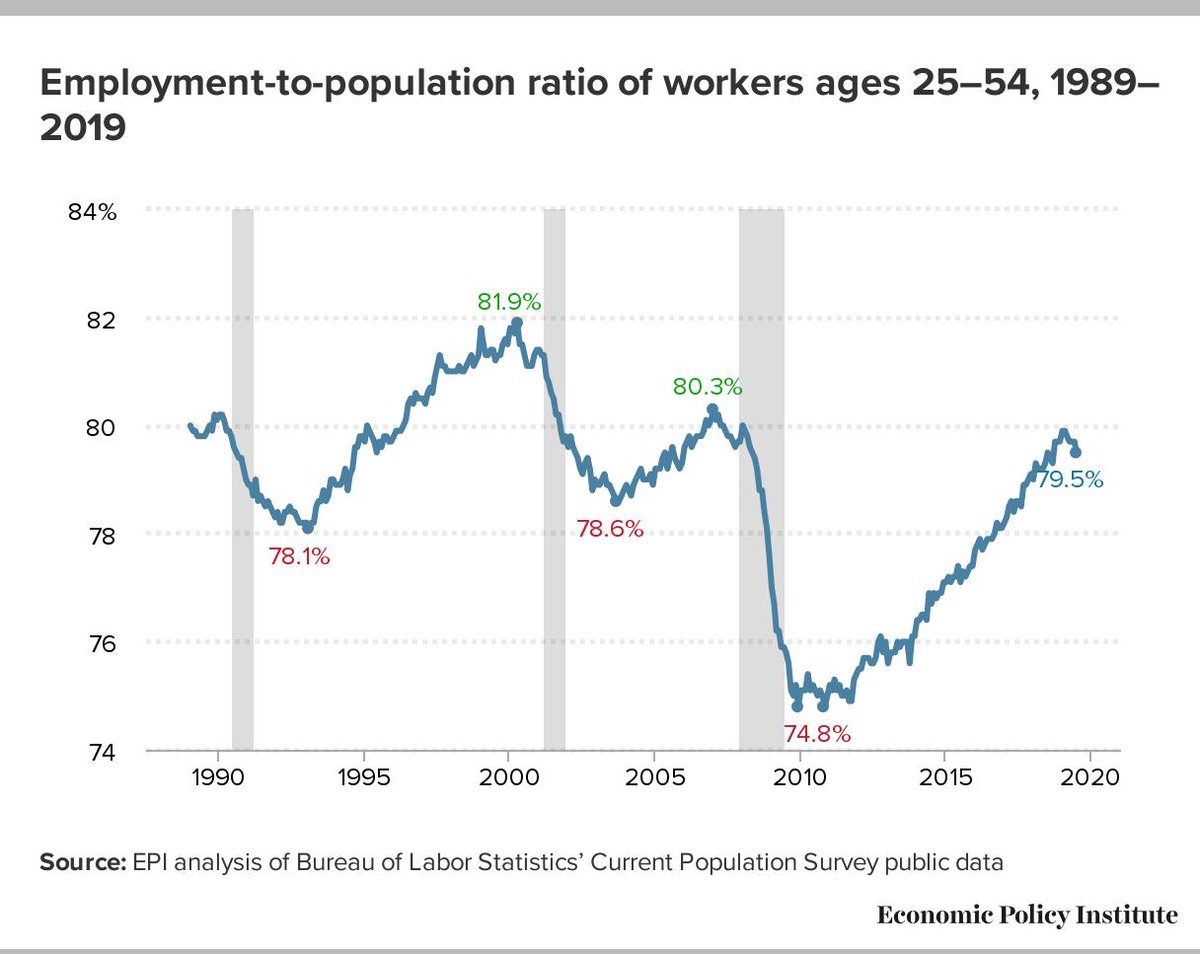

1. The share of the prime-age population with a job is still below where it was in the peaks of the last two business cycles and hasn't showed sustained improvements since last summer.

24/n

25/25