Apakah pilihan bagus untuk kita invest disitu?

Misal usaha : PECEL PUNI

Asset : 150 juta

Liability (Hutang) : 50 juta

Equity (Modal bersih) =

Asset - Liability = 100 juta

.

#belajarfinance #AMMS

.

Tahun 1, penjualan bersih PECEL PUNI mengahsilkan Net Profit (Laba Bersih) sbsar 30 Juta.

ROE = (Net Profit/ Equity)

= (30jt/ 100jt)= 0,3 = 30%

PECEL PUNI bisa menghasilkan untung 30% dari Modal.

.

DER = (Total Liability / Equity)

= 50jt/ 100jt = 0,5

PECEL PUNI memiliki hutang sebesar 0,5x dari Modal Bersih

Warung Pecel Favorit di dekat rumah, yg jual namanya Mbah Puni.

Menu wajib sarapan dari jaman kecil.

Buka after subuh, dan g pernah sepi.

Productnya hanya itu itu saja, tapi punya pelanggan setia yg sudah lintas generasi..

Jadi lapar 🤣

- Listed share (jumlah saham yg diterbitkan) : 100.000 lembar

- Kode Emiten : PPUN

- Price/ harga saham : Rp. 2.000

.

BV scra 'simplenya' adalah Harga Wajar saham.

Wlpn sbnernya harga wajar lbih dari BVnya.

BV = Equity/ Listed Share

= 100jt / 100.000 = 1.000

Setiap 1 lembar saham PPUN seharga 2.000, kita sbg investor mmliki hak equity PPUN sebesar 1.000

.

Untuk menentukan apakah suatu saham itu overvalued atau under valued, murah atau mahal.

PBV = Price / BV

= 2.000/ 1.000 = 2

Artinya PUPN menjual harga sahamnya 2x dari harga equitynya.

.

EPS = Net Profit / Listed Share

= 30jt / 100.000 lembar = 300

PECEL PUNI (PPUN) mampu menghasilkan keuntungan Rp 300 untuk setiap lembar sahamnya.

.

PER = Price / EPS

= 2.000 / 300 = 6,67

Harga saham PPUN 6,67 x lipat dibanding keuntungan per lembar sahamnya

Bukannya kita lbih suka "Dg harga saham murah, perusahaan bisa mnghasilkan untung lbh besar" right?

PER kecil, Performa Perusahaan 👍🏻

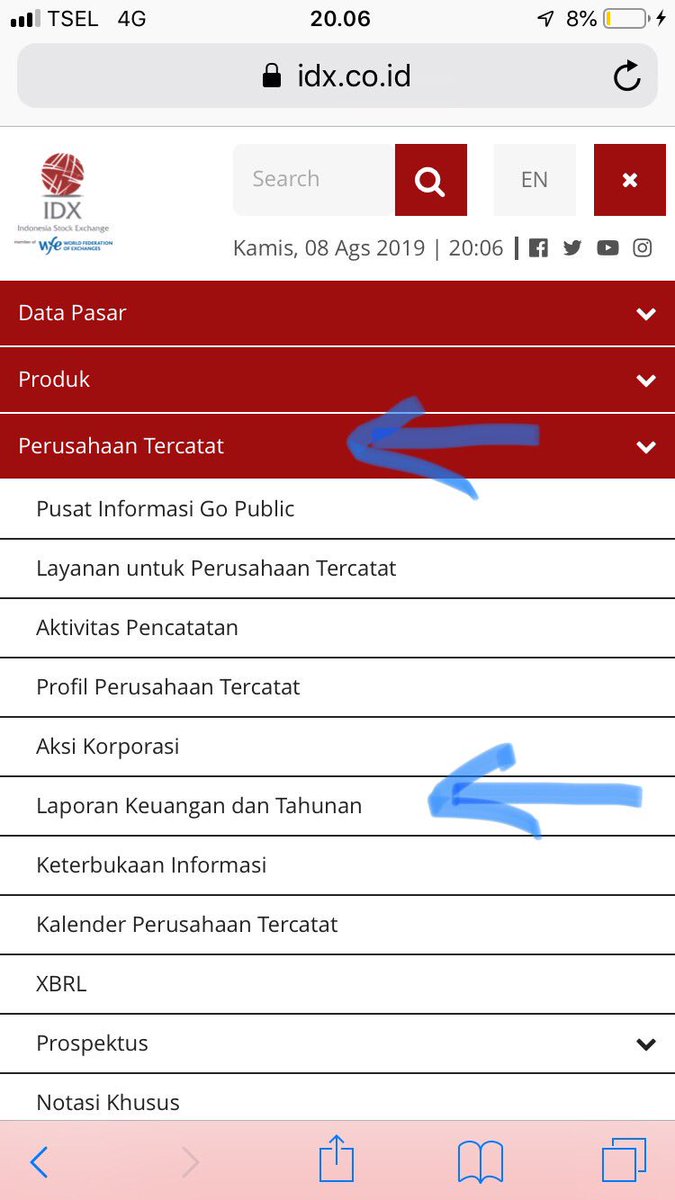

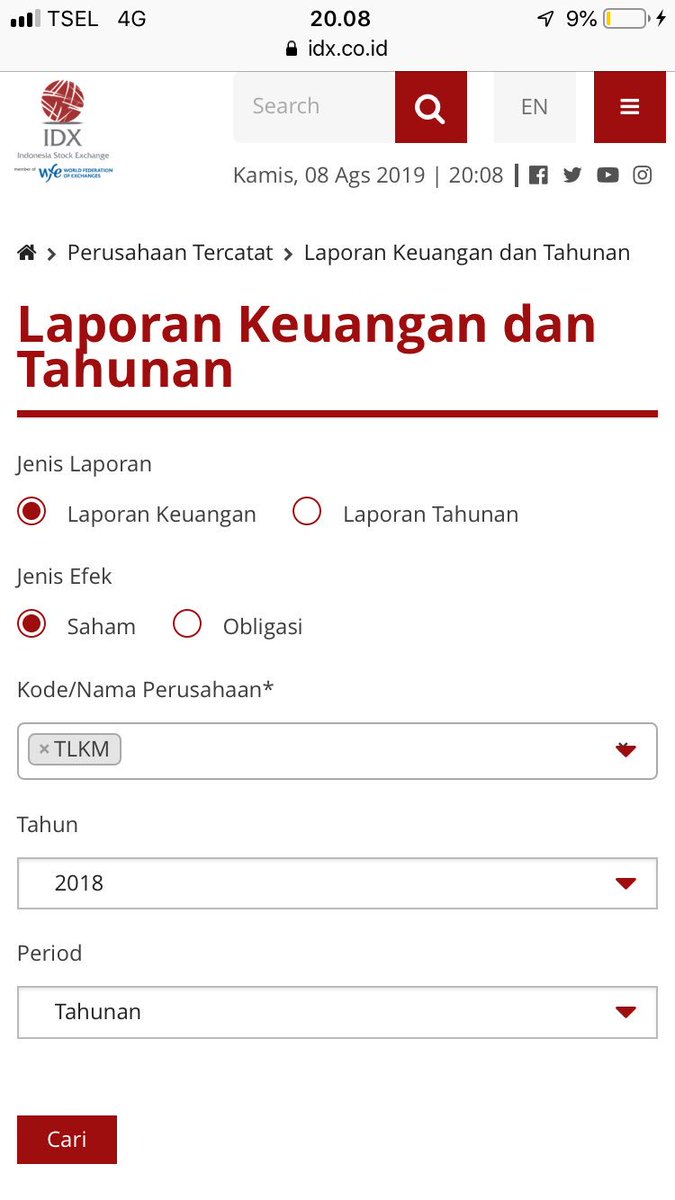

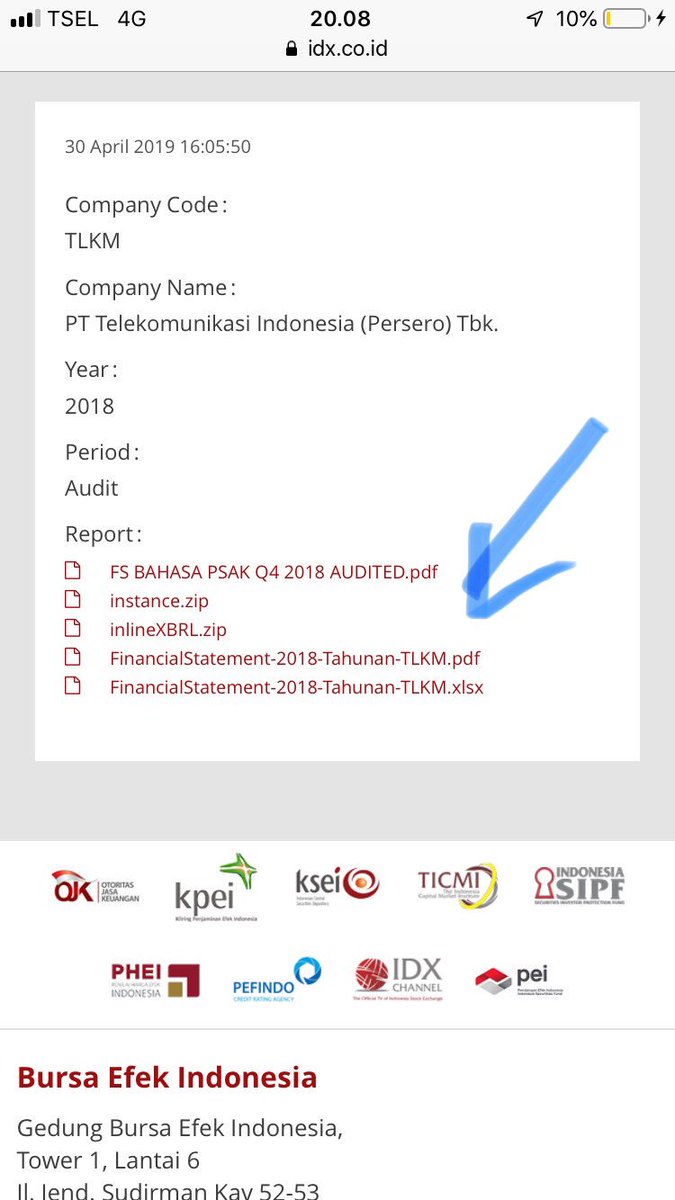

Oh ya, untuk perhitungan2 di atas, bisa menggunakan data laporan keuangan Perusahaan yg kita incar, dapetnya di Web @IDX_BEI yow..

Selamat menganalisa 💪🏻