bloomberg.com/opinion/articl…

For now.

blogs.uoregon.edu/timduyfedwatch…

A financial bubble and crash, a big rise in oil prices, a recession elsewhere in the world, a big policy mistake by our leaders, etc.

What will cause it this time?

And that's certainly possible.

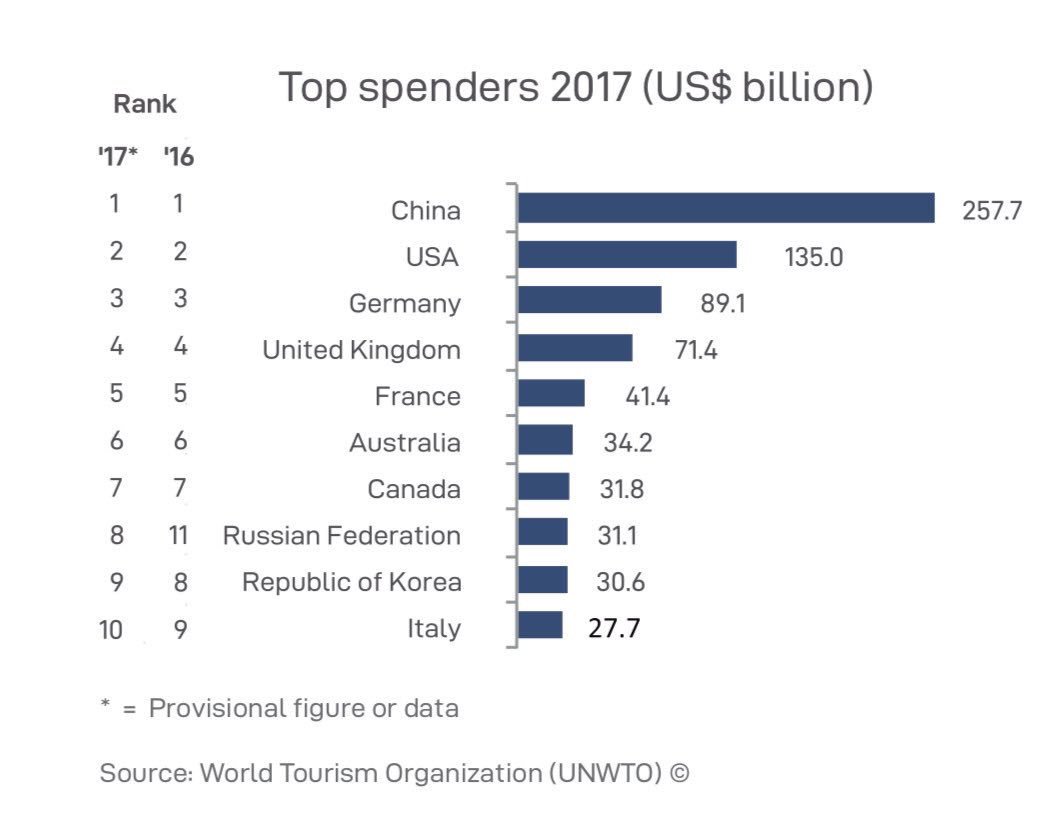

The recent 30-year cycle of Chinese-led globalization may be coming to an end.

GLOBAL growth is already looking weak. And China seems to be at the epicenter.

bloomberg.com/news/articles/…

Most obviously, Trump's trade war.

The trade war is hurting the U.S., but it's probably hurting China more.

bloomberg.com/opinion/articl…

Its whole growth model has been shifting since the Great Recession, from export-oriented manufacturing to domestic-focused real estate and infrastructure investment.

bloomberg.com/opinion/articl…

For example, its working-age population is now shrinking...at an accelerating rate.

reuters.com/article/us-chi…

sciencedirect.com/science/articl…

cnbc.com/2019/05/31/us-…

Already, manufacturers are trying to shift production elsewhere...

bloomberg.com/news/articles/…

Those supply chains may now bifurcate. One inside of China. And one outside of China.

bloomberg.com/news/articles/…

1. Natural China slowdown

2. U.S. trade war hurts the U.S.

3. U.S. trade war hurts China, which then hurts the U.S. collaterally

4. Disentanglement of Chinese and non-Chinese economies hurts the whole world

--> Recession!

If a recession comes, I think this is the likeliest story for why.

(end)

bloomberg.com/opinion/articl…