Research finds that surprise billing has nothing to do w/ narrow networks, and any legislation to curb out-of-network payments will also cut insurer profits. 1/n

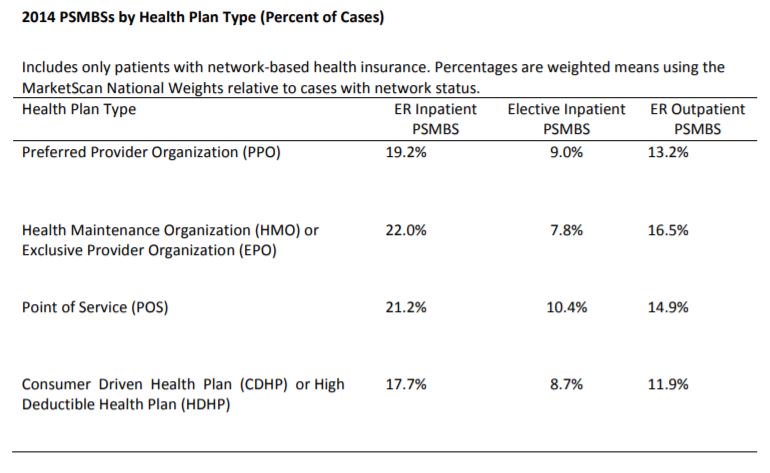

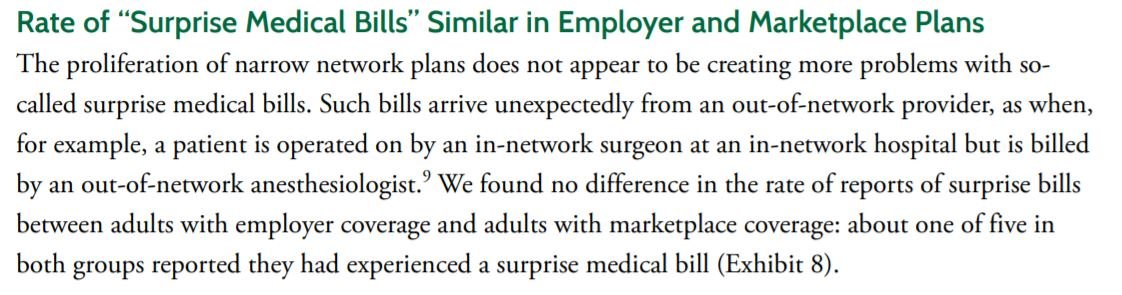

For example, @cjrhgarmon & Ben Chartrock found that a 10th of hospital stays & 1 in 5 ER visits results in an OON bill, with no major differences by plan type (PPO etc).

commonwealthfund.org/sites/default/…

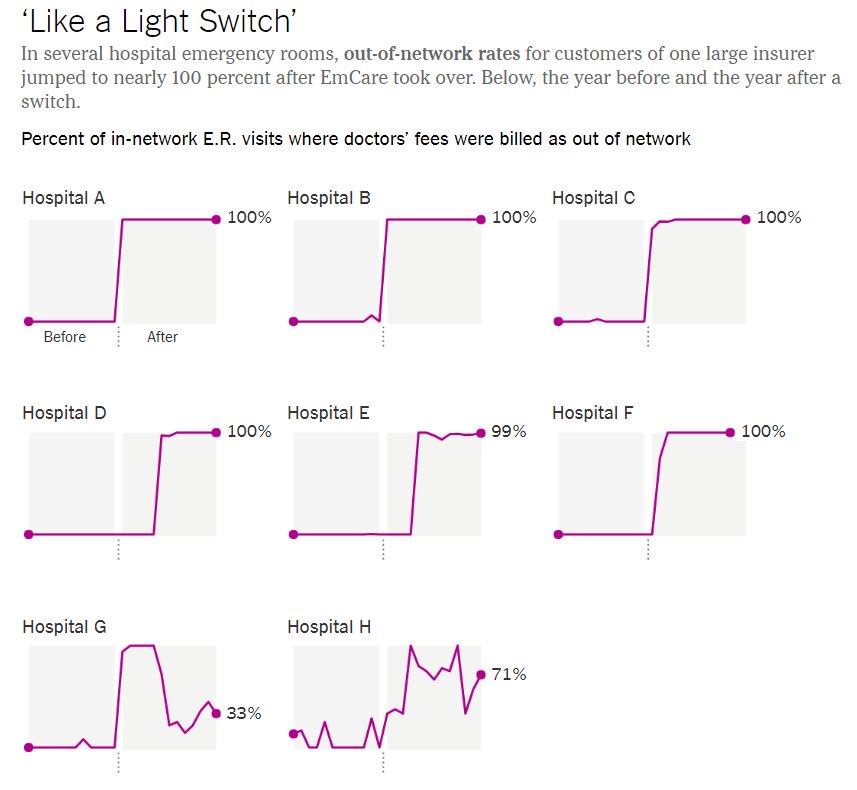

By definition, surprise bills occur when a patient has no choice, and hence network size is irrelevant

The patient & plan pay more for non-network anesthesiologists, so what purpose would this serve?

Which means that any decrease in out-of-network reimbursement will also cut insurer profits. Any savings accrue to employers & patients. /n