Please do RT thank you 🙏

What Scholars actually ask for Shariah Compliance vs What they should be asking

#islamicbanking #Islamicfinance #Shariah

I will try to explain how and why such

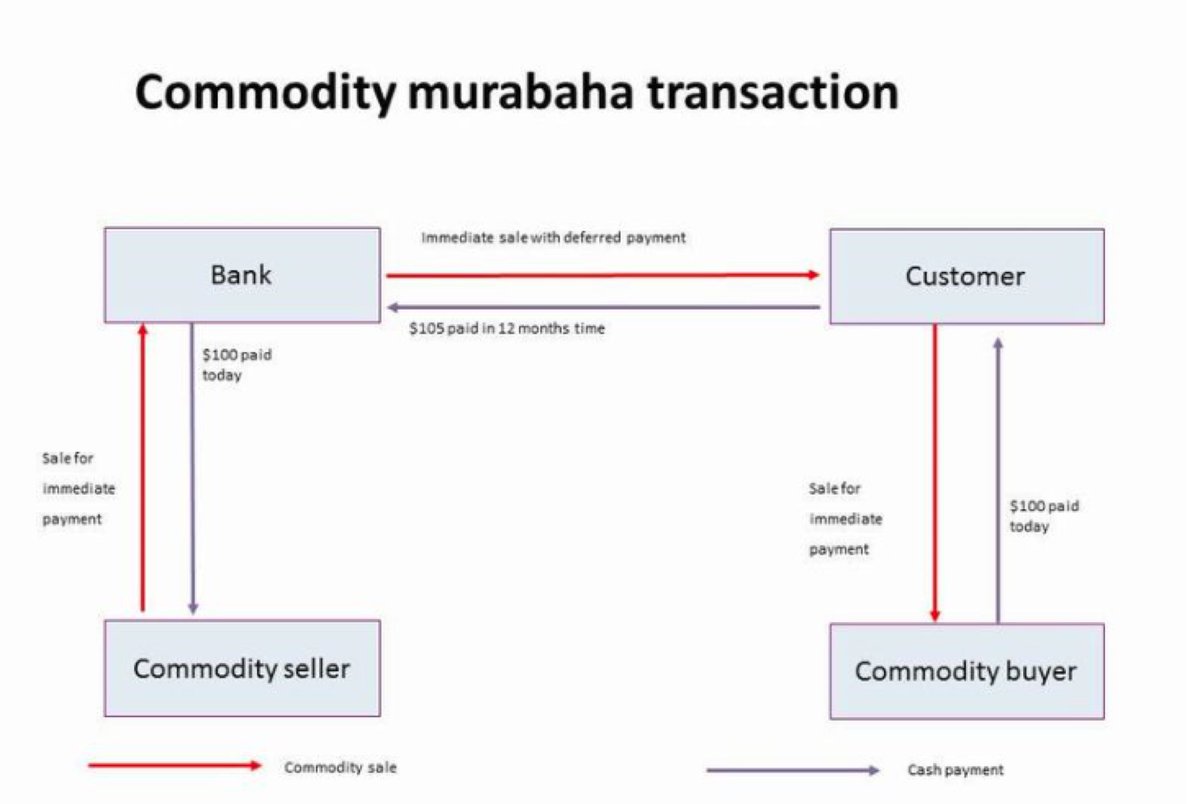

In this case let us assume this CM is for a bank to deliver financing to a customer.

First of all, let’s establish what a simple CM looks like: I found a

OK, so let’s find a better diagram:

This is from mohammedamin.com who is an experienced professional in Islamic banking.

@Mohammed_Amin

Ok, so, in order - the transaction on the left occurs first, then the top one,

OK, so the bank here wants to get Shariah approval for this structure, this is what the conversation looks like:

What Scholars do – they ask questions like the following:

Bank: it is based on the Murabaha contract.

S: Ok, so the bank purchases commodity first?

B: Yes

S: And then sells it to the customer, on a deferred payment basis?

B: Yes

S: and the bank discloses the cost price, thus making this a

B: Sheikh, Sheikh – of course not. They are two different parties.

S: Ok, and tell me about this commodity, where does it come from?

B: It is metal that is quoted on the London Metal Exchange?

S: I see, and this is an international market with established norms and

B: Yes

S: Tell me, how does the bank calculate the mark up, or profit, on the second transaction, when you sell the commodity to the customer

B: It is simply a % of cost, Sheikh. And the parties negotiate and agree and then execute this transaction.

B: (coughing slightly) ANSWER 1 – well Sheikh, once the customer is the owner of the commodity

ANSWER 2 – Sheikh, these are transactions on international markets, and it is a requirement

S: Stop. Does the commodity seller have ownership of this commodity when he sells it to the bank?

B: But of course, Sheikh, how can he sell what he does not own?

S: And how does the seller get hold of

S: Like what, like 5% profit for example?

B: Yes, something like that

S: and when does the customer repay you back

B: In the future

S: When?

S: And you obtain a promise from the customer to purchase the commodity from you - you receive this promise BEFORE you purchase this commodity?

B: Yes, of course, so that-

S: and this promise includes reference to the sale price and thus the profit you will make?

S: Don’t be stupid.

B: But, Sheikh –

S: Why are you entering into all these transactions? Did the customer approach you for a loan and then you create these transactions in order to deliver the financing?

S: So, if the customer did not approach you for the loan, then it is fair to say the customer had no intention of buying or owning such commodity?

B: Well-

S: Shut up. So, now you are seriously telling me that he might want to choose to KEEP this commodity

S: Tell me the price – let’s say he wants a loan of £50k for one year and your profit rate is 5% per annum.

B: Well, if he pays it all back after one year, we can sell it to him for £52.5k and he can pay us back after one year.

S: So he will pay you £52.5k.

B: Well, we would have paid £50k for it.

S: So why is the customer paying you above market price here? Why can he not just buy the same metal as you did and just pay 50k, like you did?

B: Well, Sheikh, we are trading on

S: Let’s move on. So the customer can choose to keep it (!) or he can sell it, yes?

B: Yes, Sheikh

S: How on earth will a retail customer know how to sell such commodity?

B: Well, we aim to serve, so we can help him here…

S: You will act as his agent in order for him

B: Yes

S: This is impermissible

B: Normally yes, of course, but AAOIFI make allowances for international markets where the customer is thus required to request us to act as his agent

S: So this is a transaction on the international markets?

B: Well, this is commodity that is quoted, and the price can move, so-

S: Shut up. If the loan he applies for is £50k, then will you arrange for him to sell the commodity for £50k

B: Well, yes

B: Sheikh, this is a complex process, but we have knowledge of the markets and can arrange an expert buyer here

S: And this buyer is not the same party as the commodity seller, as this would be impermissible?

B: Certainly not Sheikh!

B: erm, well he is a broker

S: He an authorised broker on the LME?

B: (quickly wondering if these lists are made public, and realising that they are) – erm…

B: Well, yes, but-

S: Shut up. Is it true that this commodity buyer will return the commodity to the commodity seller?

B: erm…

B: Yes, don’t you think it’s a little warm in here?

S: And then he sells it for £50k?

B: Yes

S: So the customer is making a loss of £2.5k?

B: Yes

S: Really? You would sell the metal back to the market at the prevailing market price?

B: erm…

S: But you just told me you did not

B: erm..

B: erm…

S: As such, is it fair to say that you have no meaningful risk at all in terms of ownership and loss in

B: Sheikh! We own the metal. While we are the owners, we take risk-

S: Shut up. Once you have purchased the metal, how long do you own it for, prior to selling it? One day?

B: Sheikh, we take a view based on market risk, market conditions-

S: Uskut, how long? 6 hours?

B: Sheikh, look at the time, I have a conference call now, I have to run. My secretary will be in touch to resume our conversation.

Now, THIS is how scholars should conduct their due diligence when approving contracts and structures.

Put a Shariah scholar who is not an expert in finance, markets and trading, in front of a banker who knows basic Shariah, you will likely get what the banker wants.

How do I know this?

Well, take a guess…

/THREAD