OK, so a bond is simply a type of debt. The issuer of a bond receives money, and agrees to repay this same amount back to the investor in the future.

This coupon can be fixed rate or floating. The bond will have a fixed duration, for example 5 years.

Question – why do we not see 1 year or 2 year bonds?

Bonds are seen as more risky than cash deposits, but less risky (volatile) than stock markets and real estate. They have an important part to play

This is because, if you just get a bank loan, sooner or later you will use up your credit lines. Bonds enable an issuer to tap into a much wider investor base, such as funds, insurance companies, pension funds,

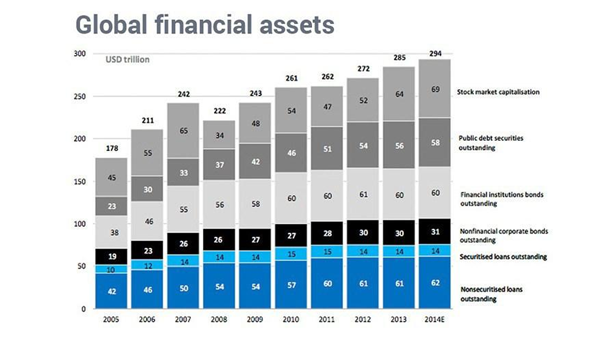

Next, bonds are liquid instruments, that means that the owner of a bond can sell them on the open market. As we have seen, this market is huge.

Investors do have this option – they can quite easily trade in and out of bonds, either to release capital or to rebalance their portfolio.

Bonds are more

Ok, so a bond can have a fixed or floating rate coupon.

A fixed rate bond delivers the same amount of interest on a regular basis. The coupon can be 4% per annum, or 20% per annum. This will be paid regardless

The coupon can be paid monthly, quarterly, semi annually, or annually.

NOTE – the coupon is expressed as a % of the face or par value of the bond, which is normally 100.

A floating rate means

Also, a spread is applied to reflect the credit risk of the issuer. A less risky issuer may only pay LIBOR +25 basis points, and a

Well, we need to apply a discounting rate, and that depends on many things, such as the cost of funds and the interest rate environment. For example, if the annual interest rate is 5%, then we can place a deposit of 95

So we can say the PV of 100 is 95 (technically the PV of 105 is 100 but you get my point).

So, we have to look at all the future cash flows we are due to receive on a bond, and take the PV of EACH cash flow.

Then we add

PHEW, ok, let’s move on.

OK, so if the discount rate (market interest rate) is 5%, and the coupon is also 5%, then we can say that the bond should be priced at 100. That is because, this is really the same as

Now, if the market rate was 4%, then the bond is paying more than market, so it is worth more than a deposit of 100 now, so the market value of the bond will be > 100.

Similarly, if coupon < market rate, then the value will

Interest rates and bond prices

Now, let us consider how the price of a bond changes when interest rates change.

First of all, we have to see if the bond is paying fixed or floating rate. If it is a floating rate, there is no change in price. This is because the

However, if the coupon is fixed rate, then the price of the bond WILL change when interest rates change.

OK, so let us assume a bond is paying 4% per annum, and the interest rates are also 4%

Now, if the interest rates rise to 5%, the bond is still paying 4% coupon, which is $4. But if you place a deposit of $100 at a bank for 12 months, you would expect to get (in theory) 5% return. So the bond is now delivering a

We can illustrate this simply, by saying we have to work out a price of the bond, when a $4 annual coupon would mean the investor is receiving a 5% return. We can see if the price of the bond moves

1)Investor pays 100 to buy new bonds that are issued, par value 100.

2)Investor receives a pre agreed coupon, for the duration of the bond

3)Investor receives 100 when the bond matures and is “redeemed” by the issuer

No, as they pay interest.

Instead Muslims are allowed to invest in Sukuk, Islamic bonds.

However, if you think any aspect of a Sukuk is different to the key aspects of a bond, think again – they are designed, very carefully

Thank you for taking the time to read.

/THREAD