Rex Tillerson takes the stand this morning in the NYAG’s fraud case against Exxon.

I will cover it live for @CourthouseNews.

ICYMI, my coverage of opening arguments more than a week ago: courthousenews.com/ex-exxon-ceo-r…

The NYAG's Oct. 5, 2019 brief fell under the radar.

From March 2017: courthousenews.com/fraud-probe-un…

Proceedings are about to begin.

Tillerson: Yes.

"Yes," he replies.

Tillerson's not on the email, but it refers to him as "RWT."

"RWT reviewed the document and found it acceptable."

The email attaches the 2014 report "Energy and the Climate."

Tillerson said he couldn't "recall" that, but has no reason to doubt it.

Referring to greenhouse gases, “We are an international group of institutional investors, collectively representing nearly USD 3 trillion in assets, writing to inquire about ExxonMobil’s exposure to these risks and plans for managing them.”

“There’s nothing wrong with that," he said earlier. "That’s fine.”

Asked whether activist shareholders have the right to truthful disclosures, Tillerson replied: "Absolutely."

From Exxon's report: "Based on this analysis, we are confident that none of our hydrocarbon reserves are now or will become 'stranded.'"

“This is an email exchange," Berger says. "You are not on it, but it references conversations with you.”

Balles replies: "One potential change I would like to discuss is whether to harmonize [planning & budgeting] assumptions and [energy outlook] assumptions."

"Rex seemed happy with the difference previously – appeared to feel it provides a 'conservative' basis." Eizember added a caveat to that.

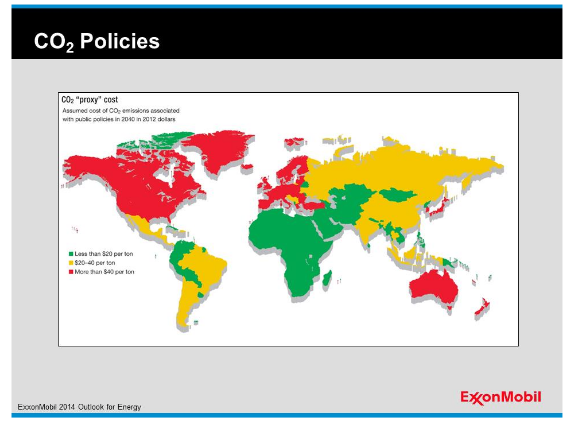

“In recent reports released by EM (….) we have implied that we use the EO basis for proxy cost of carbon when evaluating investments.”

Tillerson agrees, saying: “It was a lot of money.”

Tillerson: That’s right

“We really are trying to undertake the most attractive opportunities that we see, thinking about them in terms of 30 years. Are we going to be happy with this over the next three decades?"

Berger asks him about a question from Robert Fore, a rep from the Presbyterian Church U.S.A. Foundation, on this issue.

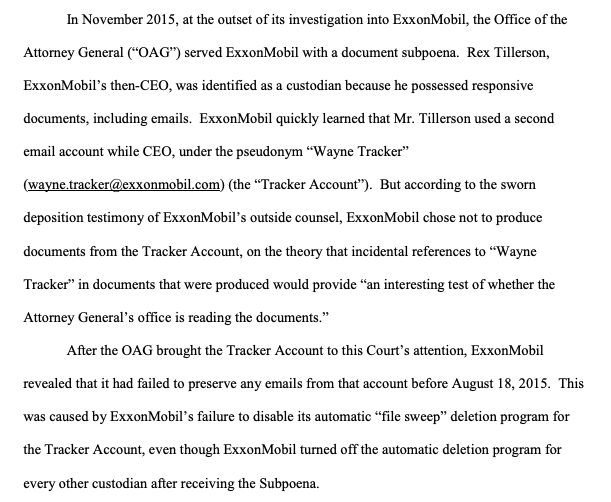

Despite the pretrial motions, nothing on Wayne Tracker.

Rex: Yes.

Wells shows the first sentence of the complaint: "This case seeks redress for a longstanding fraudulent scheme by Exxon, one of the world’s largest oil and gas companies, to deceive investors and the investment community."

Rex claims false.

Series of similar questions with Rex denying claims follows.

Complaint: "Exxon’s fraud was sanctioned at the highest levels of the company."

Rex claims false.

Rex: "It was a real system."

Asked whether anyone on Exxon's management committee had been approached for an interview, he responded: "Not to my knowledge."

Rex said Exxon supported a carbon tax, as the "best regulatory mechanism."

Rex expresses preference for that over emissions trading.

Tillerson: "t would have been one way of dealing with it at a macro level."

"I did," he replied.

"This was the first time we had any success dealing with this as a global problem" requiring a "global solution."

Providing an example, he says it would factor in electric cars on gas purchases.

“It’s just one of the many expense items,” he adds, referring to GHG costs.

Rex: “That’s correct.”

Tillerson agrees.

Brief redirect by NYAG.

“I’ve met with some of these people,” Tillerson says of the signers.

“I don’t recall” pops up again with some frequency, here in response to questions about an alternative methodology to calculating greenhouse gas costs.

Court officers order press and public to remain seated as they escort him out.