- What is it?

- Does it matter?

- How do we solve for it?

One might argue it is the result of unintended market timing.

This is also called "tranching" or "staggered portfolios."

Investors acknowledge market cycle risk and therefore tend to invest in multiple PE or VC funds over time to diversify the risk.

We wrote about it with respect to tactical portfolios, but over time appreciated that it affected almost *all* portfolios with a fixed rebalance schedule.

jii.pm-research.com/content/early/…

- Demonstrate that timing luck impacted something as simple as a 60/40 portfolio

- Prove that overlapping portfolios were the optimal solution

- Derivate an equation to estimate timing luck ex-ante

I won't go into the proof here, but suffice it to say that I think the result is pretty intuitive. It's just diversification!

The equation we derived is:

L = 0.5 x (T / F) x S

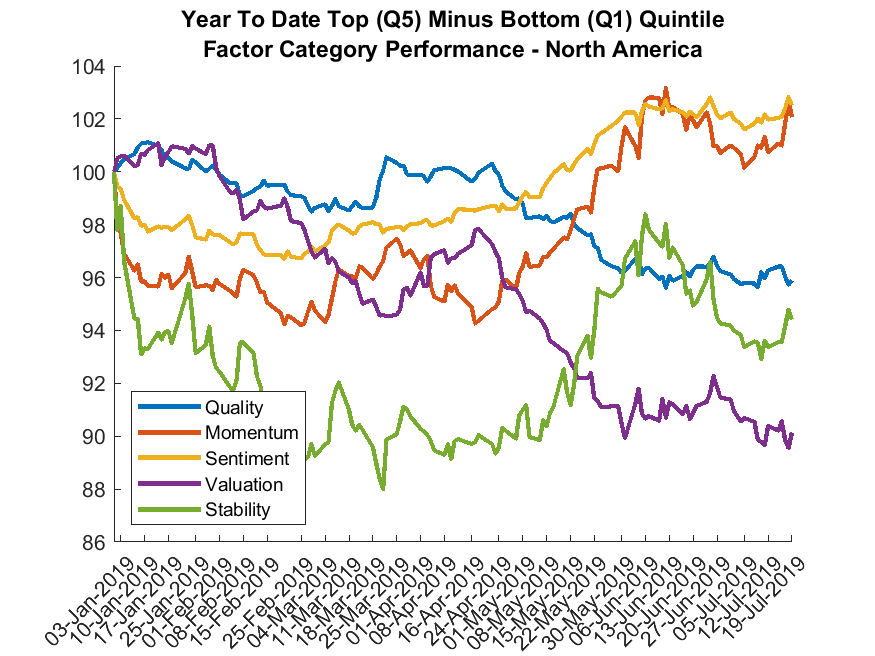

If totally unconstrained, S will be very high. If highly constrained (e.g. implemented intra-sector), S will be much lower.

e.g. a momentum portfolio likely has to rebalance more frequently than a value portfolio.

(Still with me? Here's a sneak peek: digioh.com/em/10484/17010…)

Our expectation is those strategies with higher turnover, less frequent rebalancing, and fewer constraints will exhibit more rebalance luck.

For a 100 stock value portfolio rebalanced semi-annually (hmm... sounds like most smart-beta products...), we're talking about 2.5% *per year.*

Or, put another way, "when" is a meaningful axis of diversification that we ignore at our own peril.

Far too much noise comes from the impact of "when."

Q: Are the results mean-reverting?

A: Augmented Dickey-Fuller tests suggest no. Random, but not mean reverting. This appears to be a totally uncompensated risk.

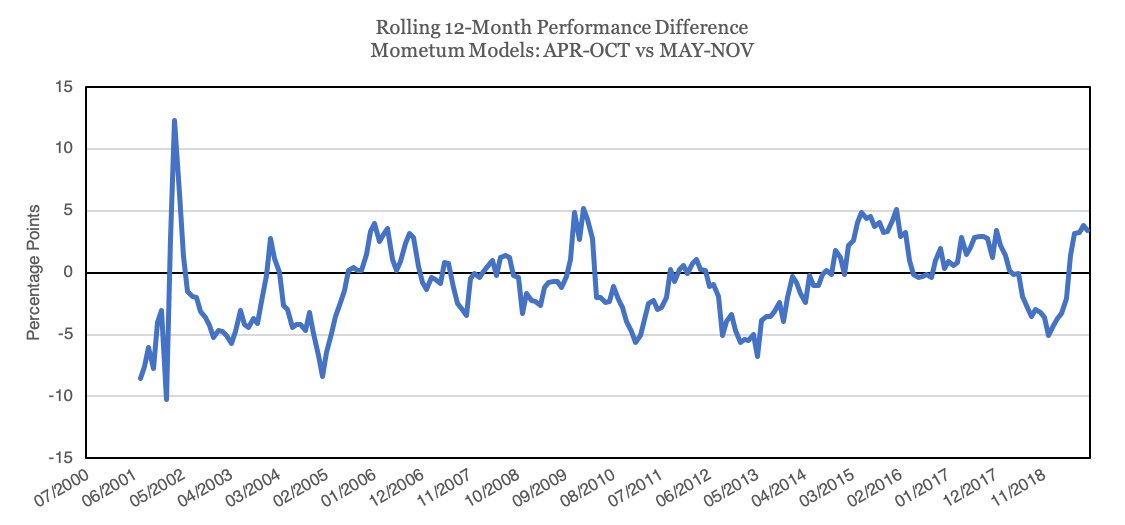

Q: What about seasonality?

A: Bootstrapped simulations suggest that there is no meaningful edge in selecting one rebalance date versus another.

But if there is, this data suggests the Sharpe is likely small.