Here are the amazing guests I had on this season...

- Lessons learned from the 2008 crisis

- Lessons from manager evaluation

- Where does discretionary have an edge?

- 13F strategies

- What is relative value volatility investing?

- The "Star Wars" model of volatilty investing

- The volatility ETP landscape

- Communication in the realm of quant

- The up-hill battle quants face

- The impact of "smart beta"

- Strategies for effective communication

- Lessons from the 2008 crisis

- Why liquidity is the ultimate factor

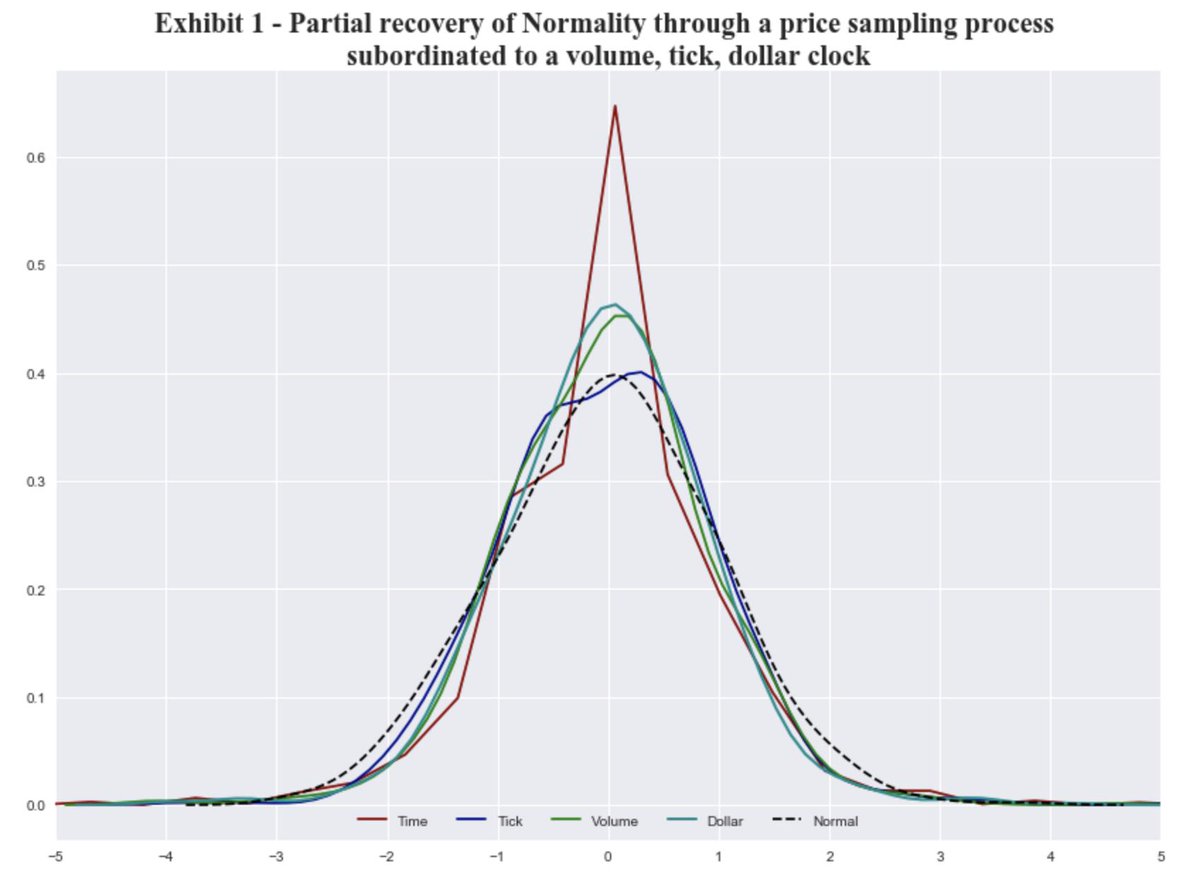

- How a picture is worth 1000 words with alternative risk premia

- The future of trend following

- Building on William O'Neill's CANSLIM model

- Why growth is not necessarily "expensive"

- The quant-like nature of high conviction, discretionary growth investing

- The practical difficulties of long/short investing

- Tail risk hedging without the bleed

- Why experience as a PM helps you be a better quant researcher

- Factors in theory versus practice

- What is the future of factor investing

- The three pillars of a robust research platform: data, tools, and people.

- The equation that drives all research proposals.

- The OSAM research partners prograrm.

Stay tuned ... the show will be out soon!

iTunes (itunes.apple.com/us/podcast/fli…)

Stitcher (stitcher.com/s?fid=201252&r…)

Google Play (play.google.com/music/m/I6w4ad…)

TuneIn (tunein.com/podcasts/Marke…)