@DavidGFool @JohnHuber72 @iancassel @IntrinsicInv @dmuthuk @Gautam__Baid @BluegrassCap @GavinSBaker @TMFInnovator @ROIChristie @TMFJMo @saxena_puru @investing_city

Thread ⬇️

-Anchoring (waiting for losers to come back to even so that you can sell).

-Status Quo (not checking on existing positions just because you don't want to disturb things as they are).

Stuff like this can wreck your Portfolio.

1)Are the companies performing as per your Business/Valuation thesis? In most cases, 2-3 years is more than enough to judge this.

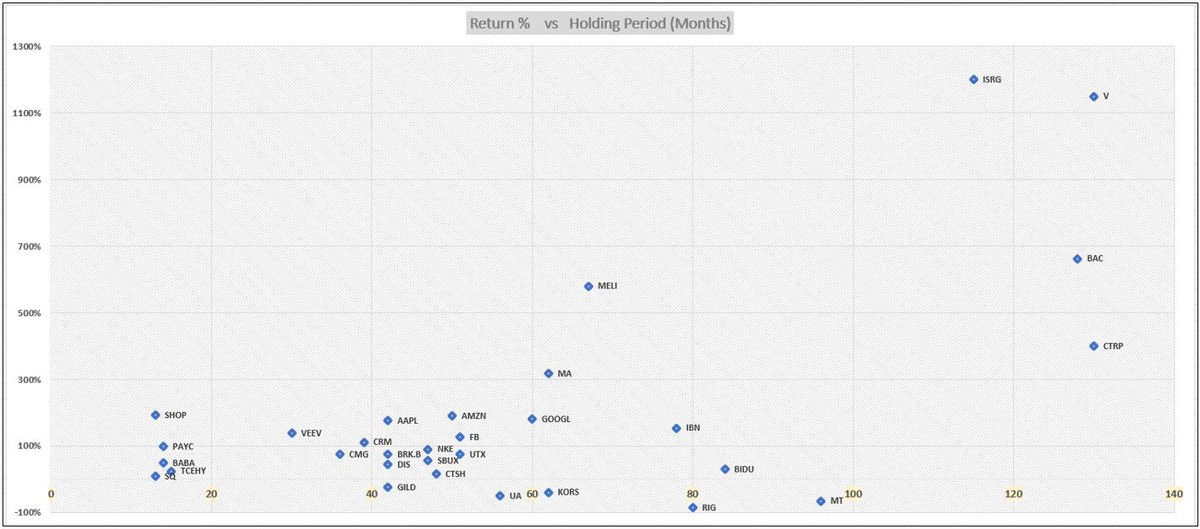

2)For the big winners, what are all the underlying reasons for the gains? More of Business or valuation improvement or both?

3)For the long-term losers, what are the fundamental and other reasons ? In flat to strong markets, you generally shouldn't have long-term losers if the company and it's future is good.

4)You also have to look at the path they took to be longterm losers (smaller losses getting bigger due to business deterioration, or decent gains then turning into losses due to few qtrly misses etc.)

Thank you for reading. 🙏

/END.