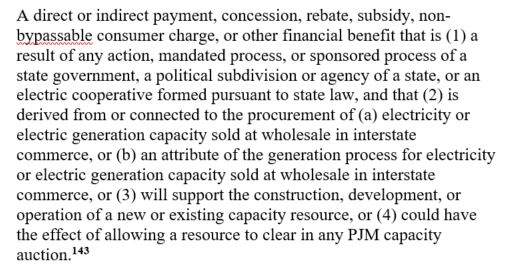

1) existing self-supply

2) existing demand-side

3) existing RPS

4) "Competitive" (new or existing that commit to forgo state subsidies)

5) Unit Specific (reviewed by market monitor)

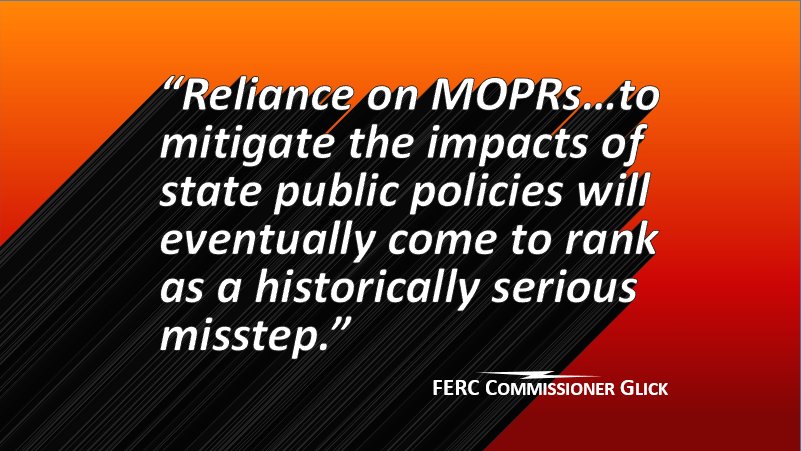

I agree with this in P 204:

"in a regional market dominated by states with retail competition, it is not clear why utilities in states that prefer the vertical integration model should be afforded a competitive advantage."

Worth reiterating that all MOPR-ized resources (renewables, self-supply, etc) can seek a unit-specific exemption.

From our May 2018 filing: eelp.law.harvard.edu/wp-content/upl…