First up, @CreditSuisse with their "Global

Investment Returns Yearbook 2019"

This is the yearly update to my favorite investing book, Triumph of the Optimists

amzn.to/2N9m7Ug

credit-suisse.com/about-us/en/re…

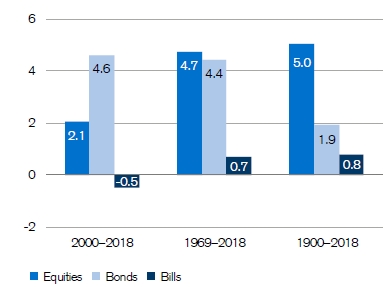

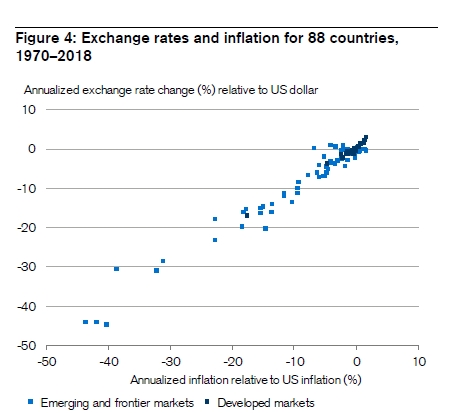

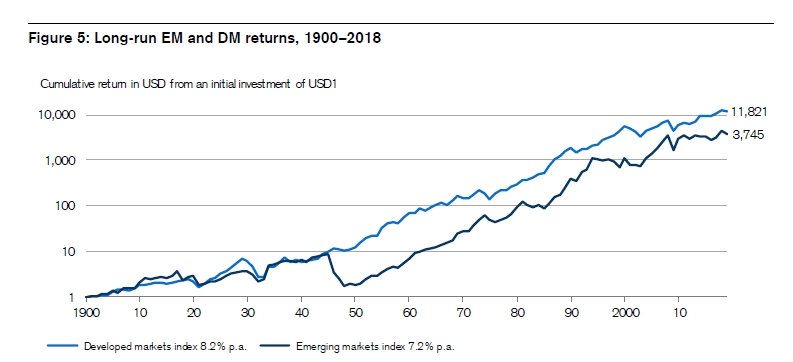

The report summarizes the long-run returns on stocks,

bonds, bills, inflation and currencies in 26 global markets over the last 119 years.

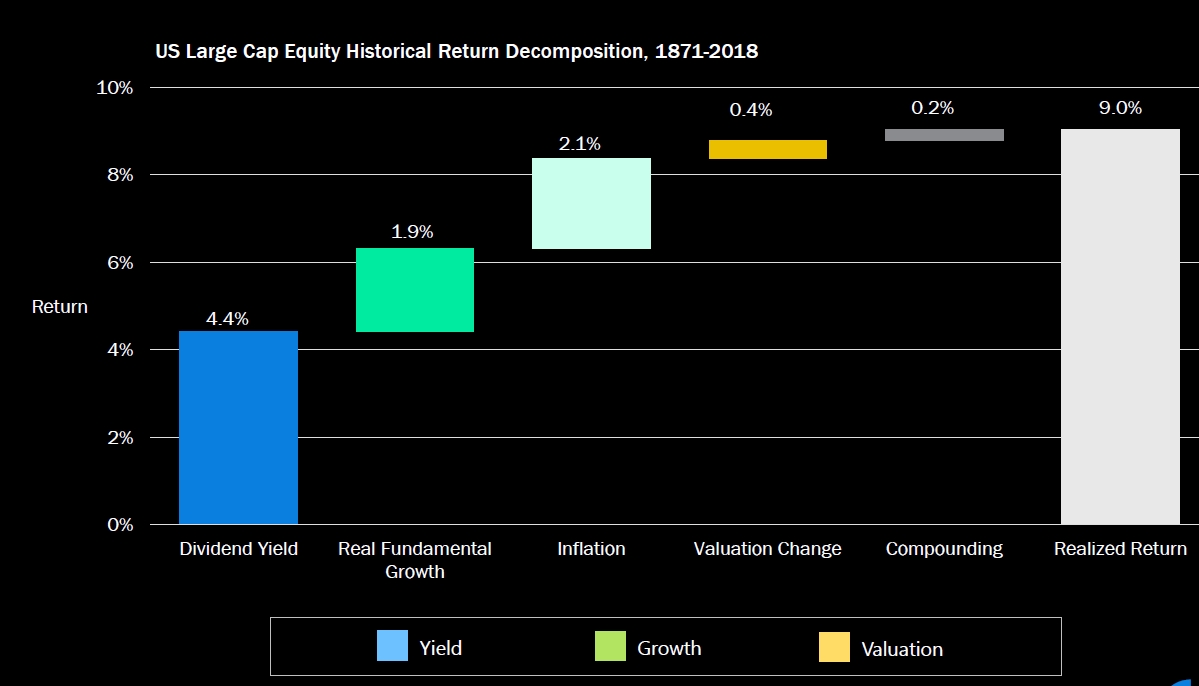

"Put in the context of the 119 years of history in the Yearbook and an equity risk premium over the period of just over 4%, it underlines how rewarding – and anomalous – the most recent past has been for equity investors."

consequence of what by historical standards

remains a world of low real interest rates...the long-run history of real interest rates in 23 countries since 1900, when real rates are low, future returns on equities and bonds tend to be lower."

-futures have a long history in financial markets and, by 1730, Osaka started trading rice futures.

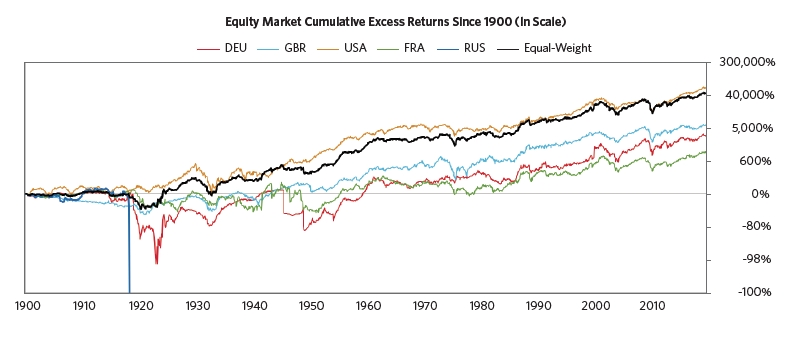

-From 1900-1939, Japan was the world’s second-best equity performer. But World War II was disastrous and Japanese stocks lost 96% of their real value.

- By the start of the 1990s, the Japanese equity market was the largest in the world, with a 41% weighting in the world index compared to 30% for the USA.

-

Perspectives reported that, in late 1991, the land

under the Emperor’s Palace in Tokyo was worth

about the same as all the land in California.

-

-Then the bubble burst. From 1990 to the start

of 2019, Japan was the worst-performing stock

market. At the start of 2019, its capital value is

still close to one-third of its value at the beginning

of the 1990s. Its weighting in the world

index fell from 41% to 9%.

The largest contributor was Japan, where

equities lost 98%...

markets were closed in 1949 following the

communist victory, and where investors effectively

lost everything. Other markets such as

Spain and South Africa also performed poorly

in the immediate aftermath of World War II.

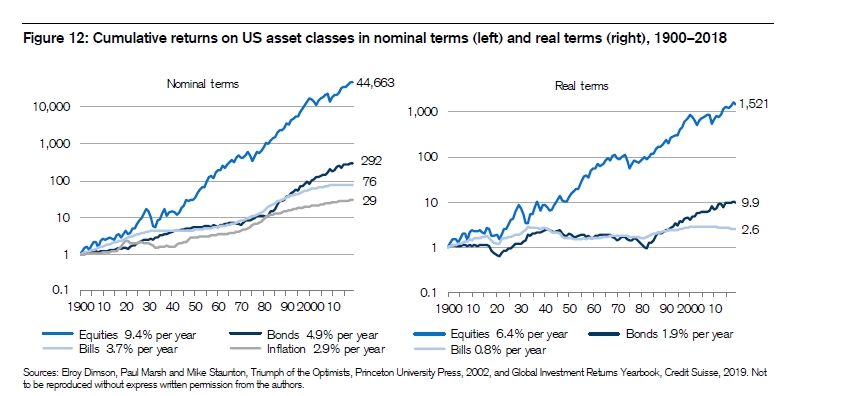

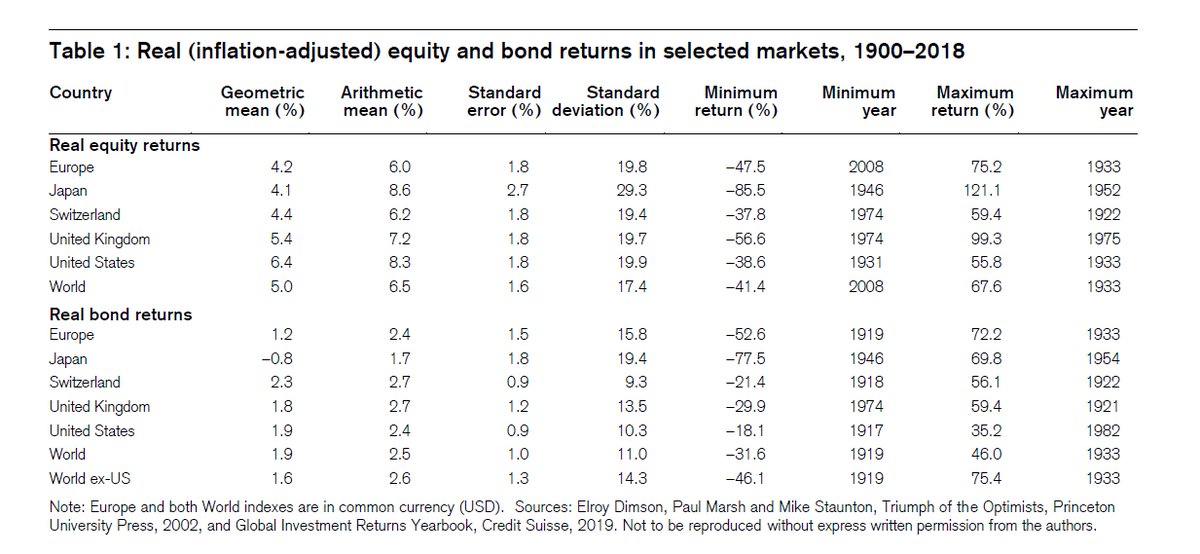

Historically, stocks, bonds, and bills have returned 5%, 2%, 1% after inflation.

Counties, assets, & sectors can and have essentially gone to zero. Extrapolating the experience of any one into the future is dangerous...diversifying your bets is a prudent idea.

vanguard.com/pdf/ISGGEB.pdf

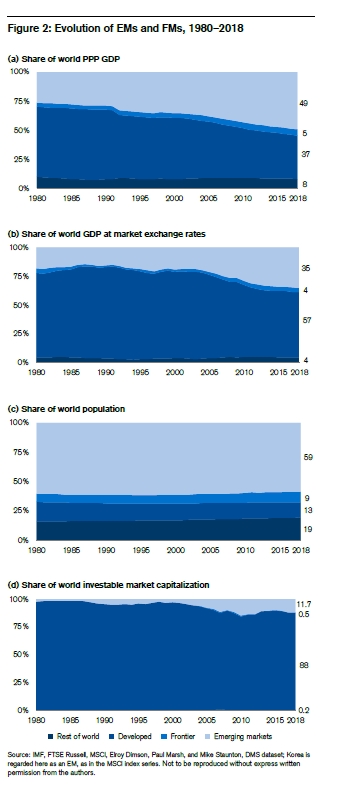

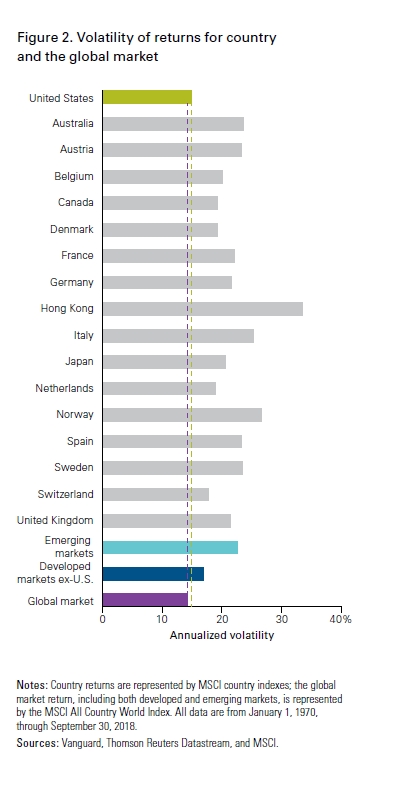

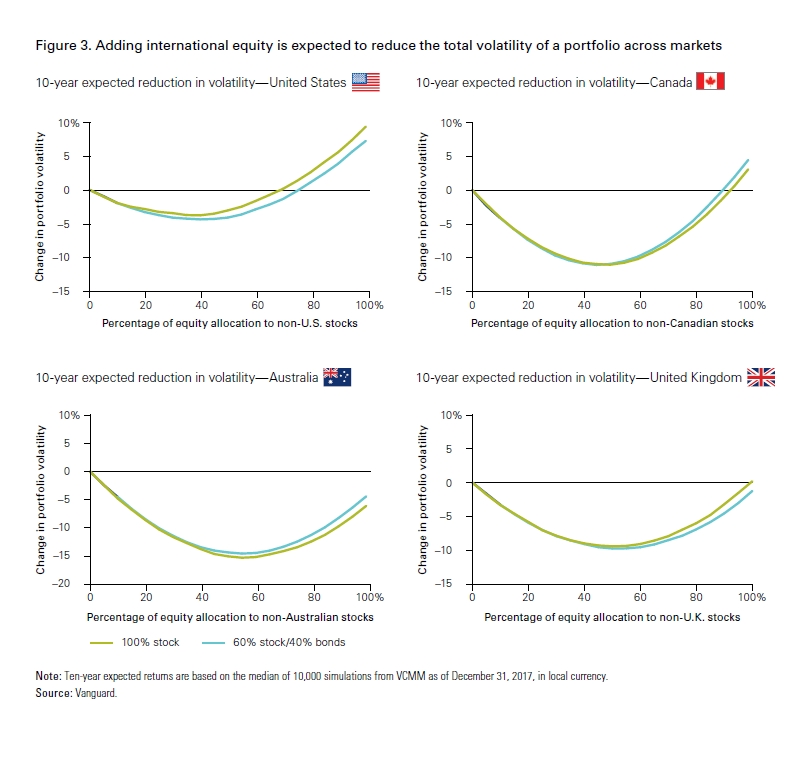

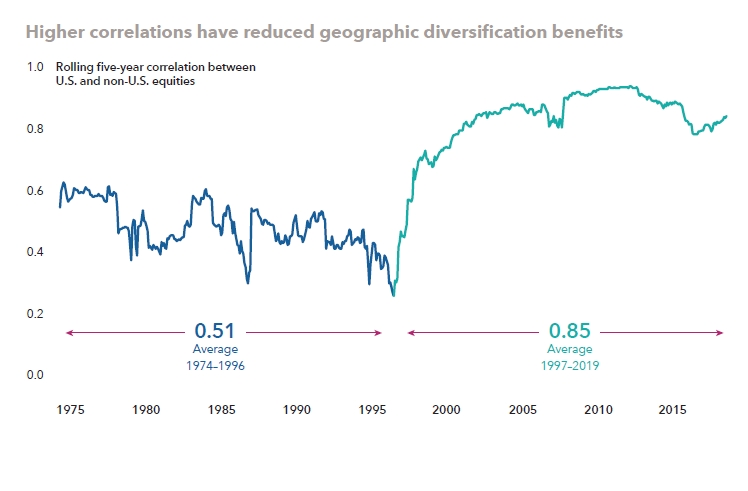

Again, diversify globally. Adding international stocks reduces volatility and averages outcomes.

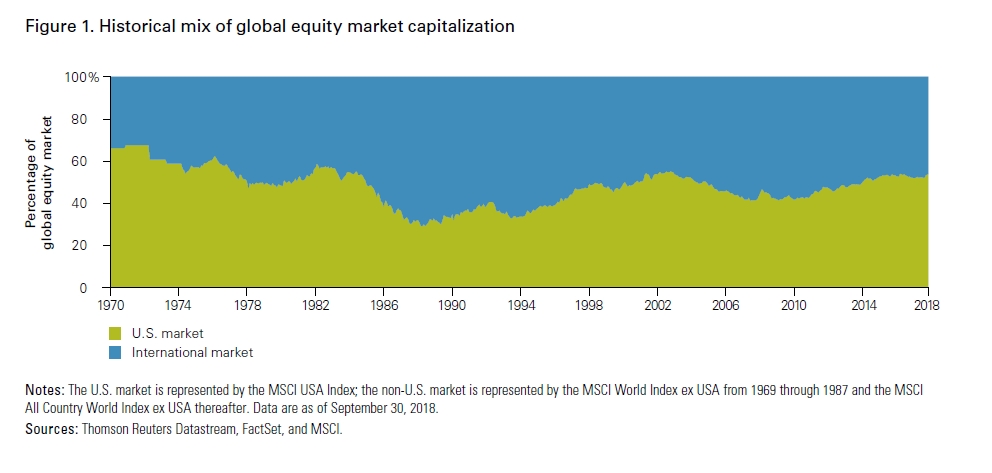

A starting point for US investors is the global weight of 50% in US and 50% international.

(Vanguard currently recs 40% international. Bogle before passing, zero!)

morningstar.com/lp/revenue-exp…

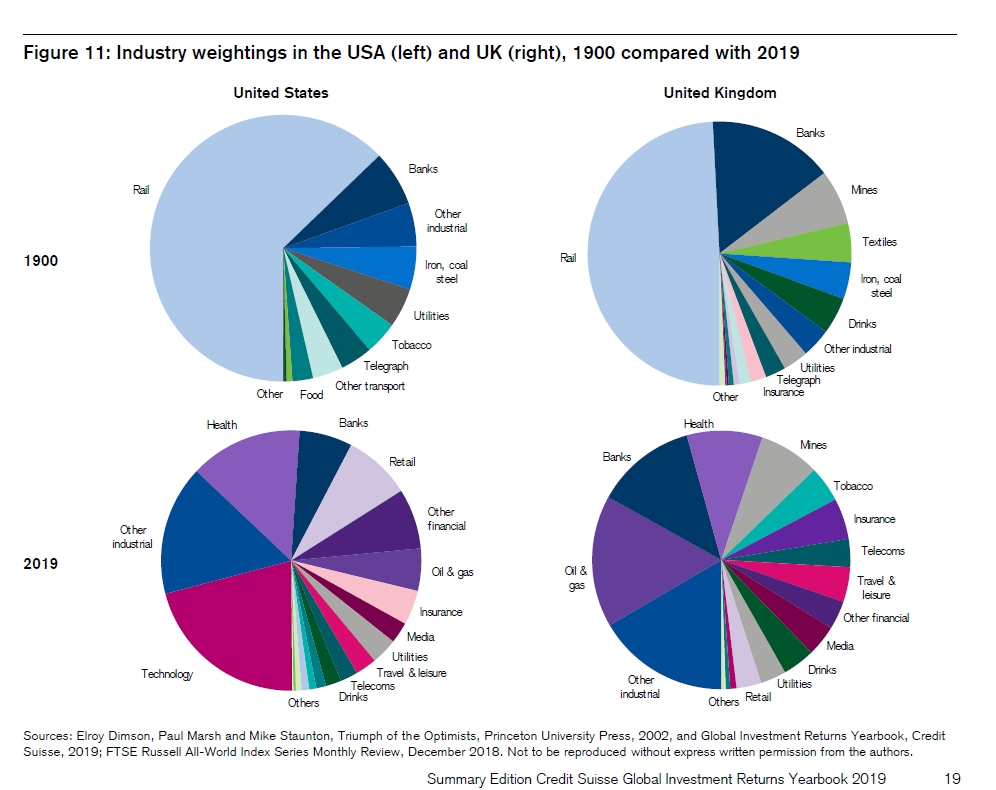

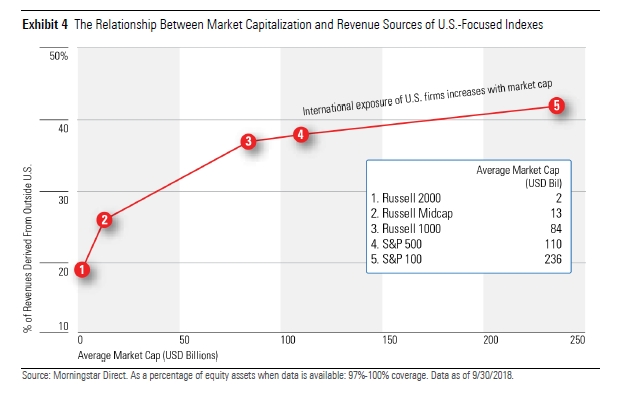

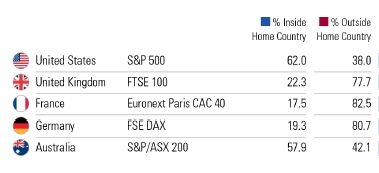

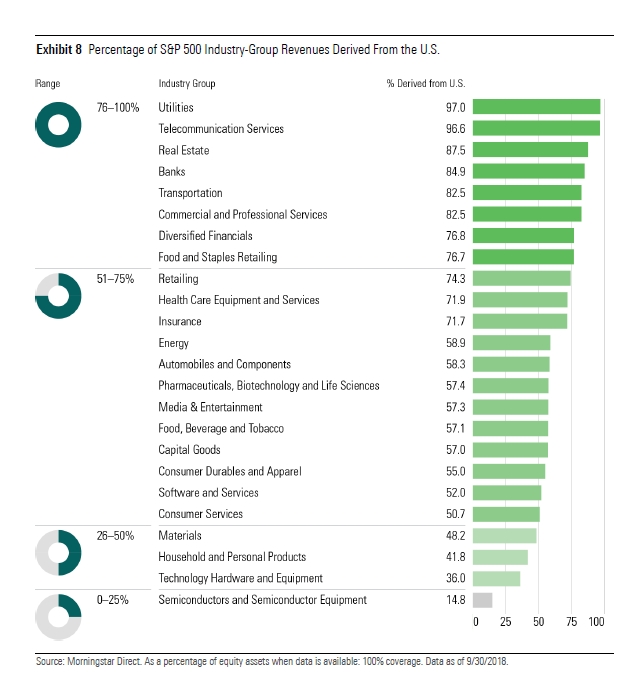

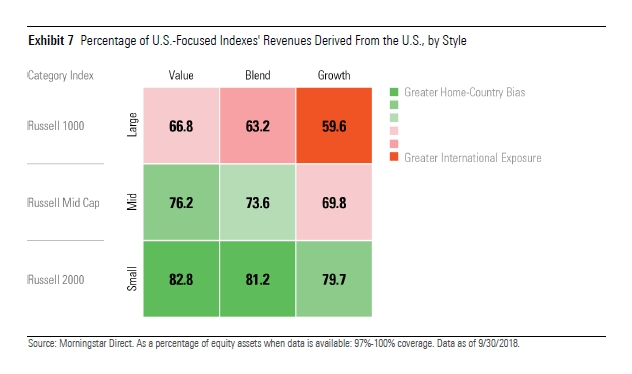

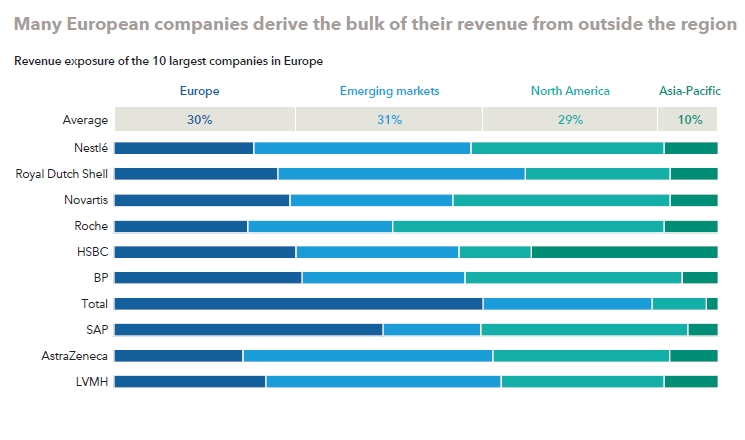

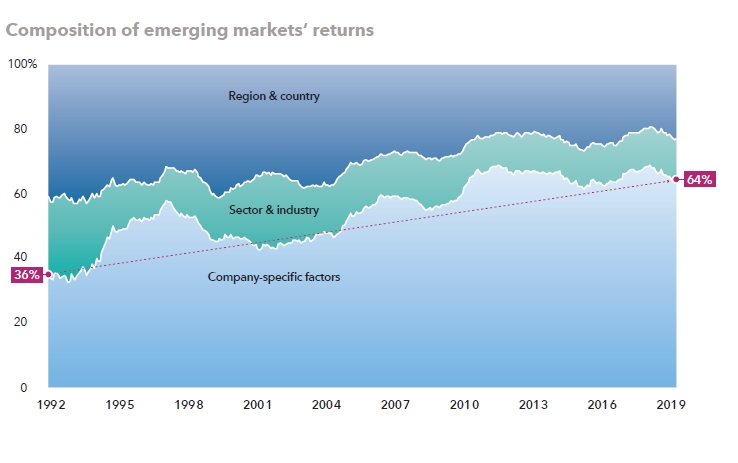

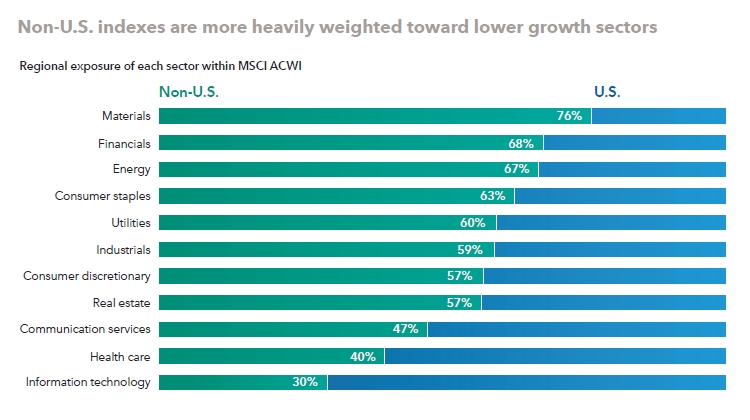

Borders and sectors are becoming increasingly meaningless. Anytime you move away from the global market portfolio to a segment like a region, country, or sector you are going to introduce bias & tilts to your portfolio (for better or worse).

(PS others will interpret this piece differently. )

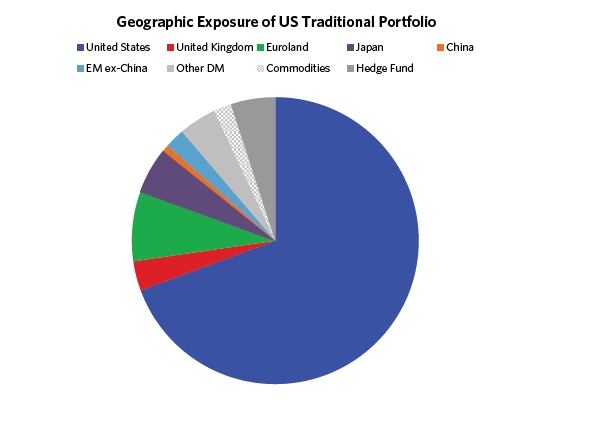

@capitalgroup with “Guide to International Investing: How to Go Global in an Uncertain World”

capitalgroup.com/advisor/ca/en/…

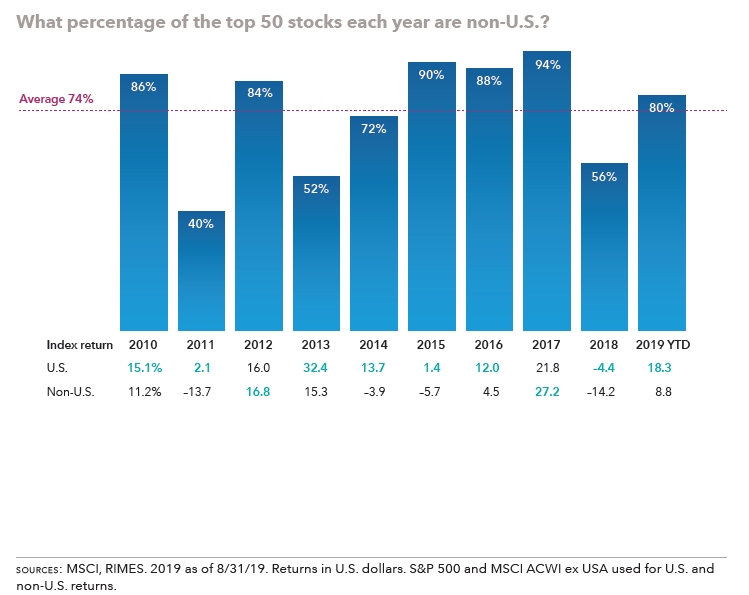

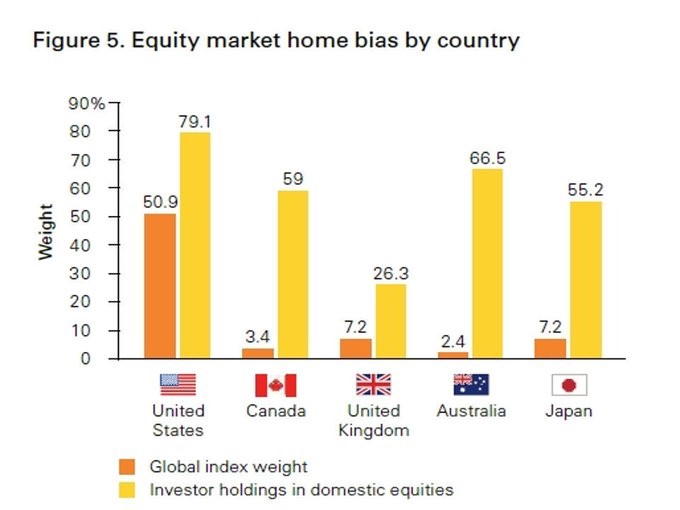

much international equity do you need?”the simple

answer may be,“More.”Whether it’s due to a home

bias or a lack of rebalancing during the long U.S.

bull market,many investors may find themselves

underexposed to non-U.S. equities."

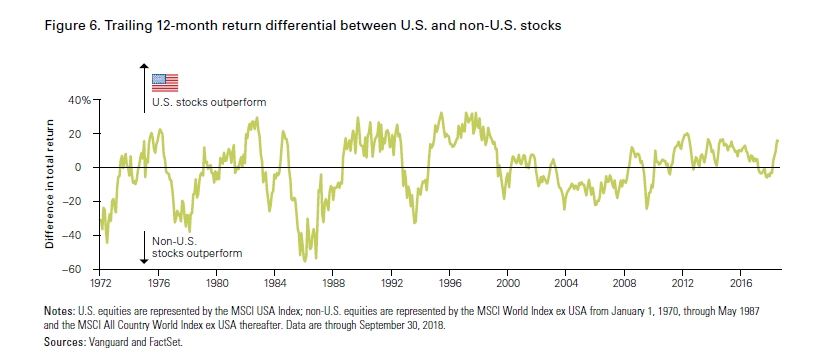

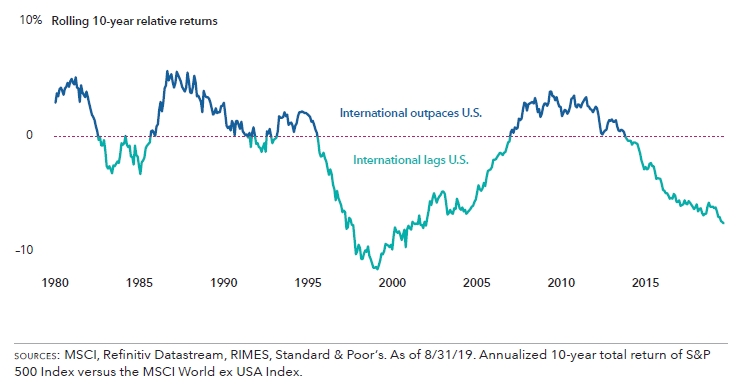

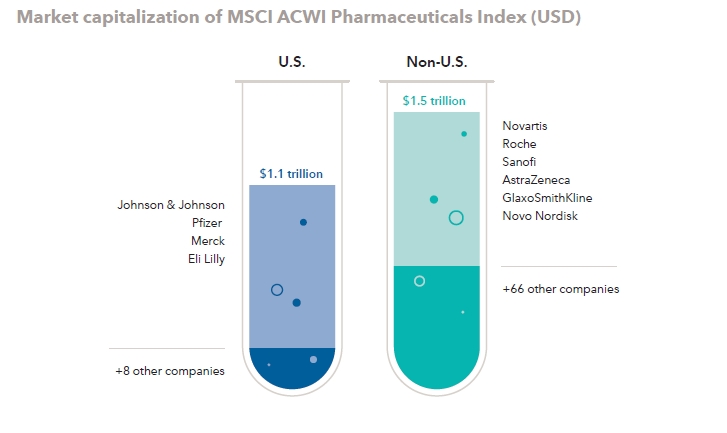

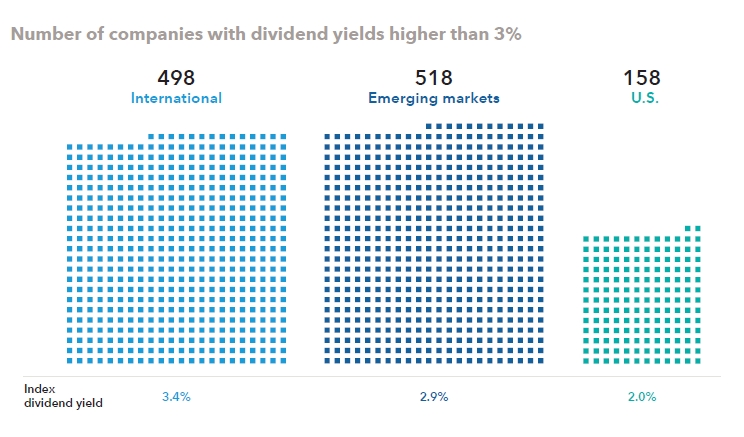

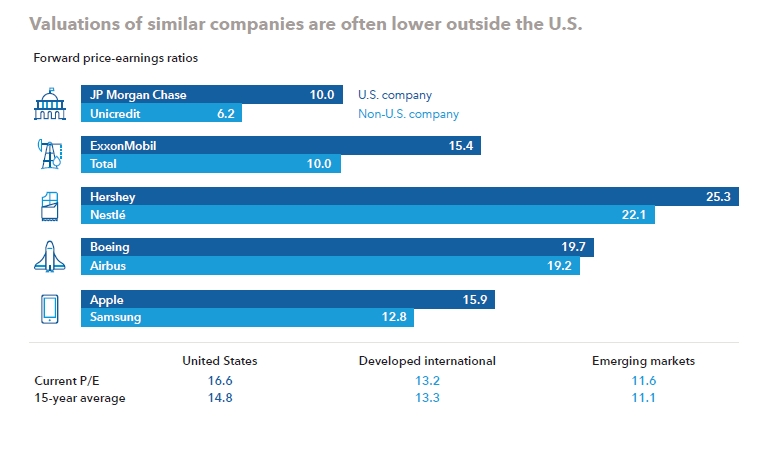

International has underperformed over the past decade, but that goes through cycles. Bargain hunters should consider focusing on companies all over the world due to breadth, higher income, and lower valuations.

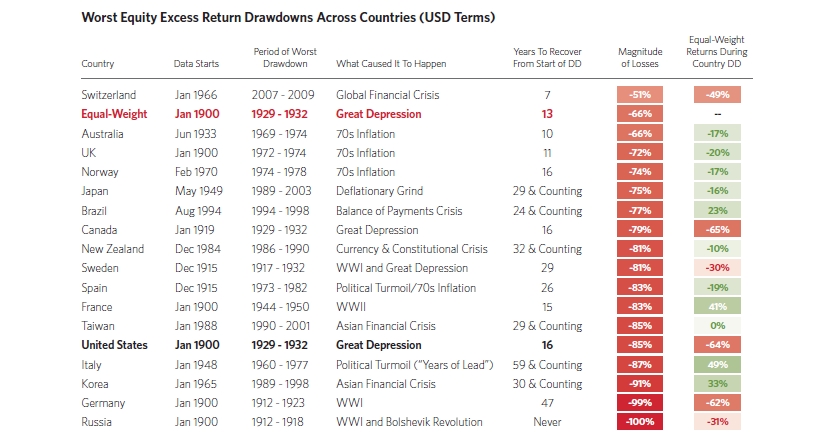

@Bridgewater with “Geographic Diversification Can Be a Lifesaver, Yet Most Portfolios Are Highly Geographically Concentrated”

bridgewater.com/research-libra…

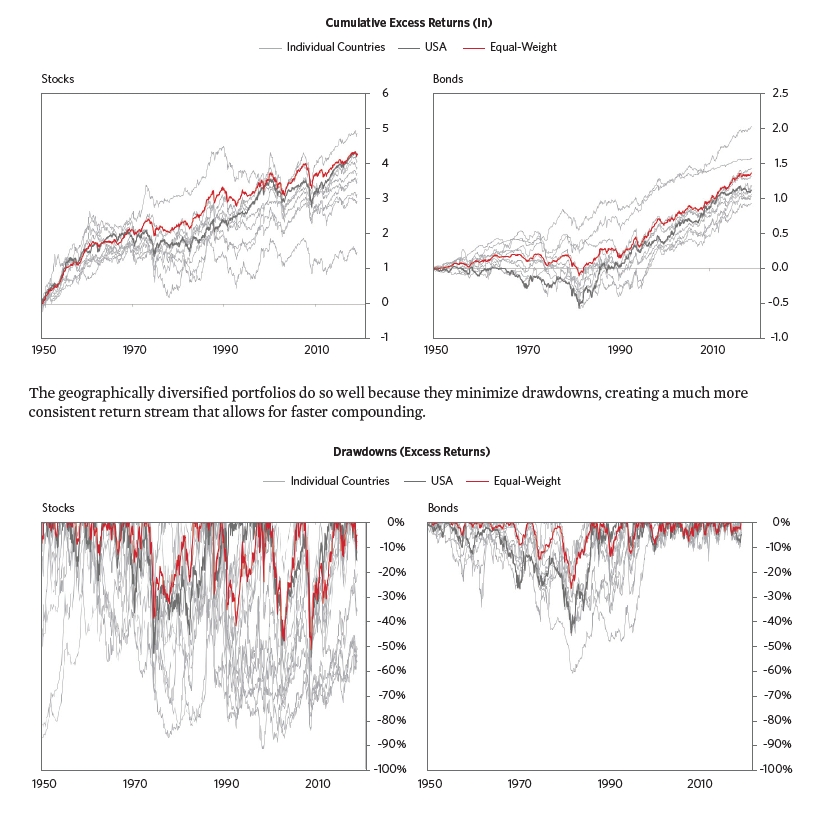

"The best way we know to earn consistent returns and preserve wealth is to build portfolios that are as resilient as possible to the range of ways the world could unfold."

downside for investors. Geographic diversification felt less urgent during the recent decade of great returns for most assets and portfolios."

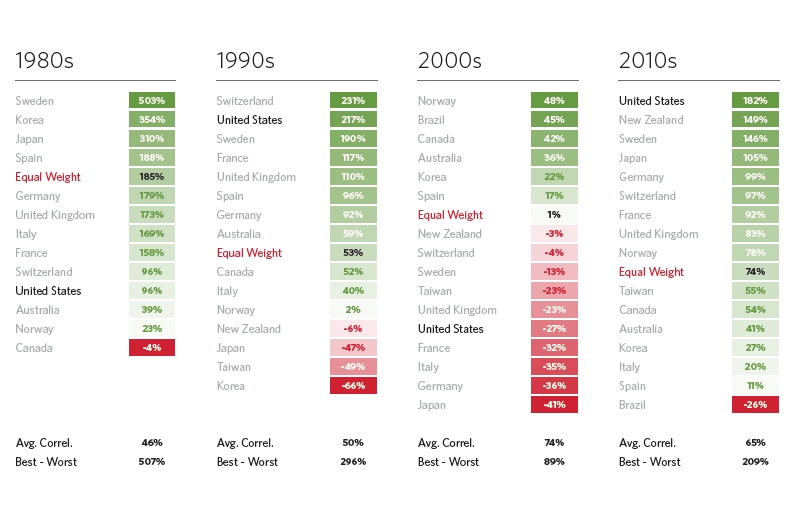

A simple diversified equal weight can achieve nice returns with low volatility and help avoid going bust.

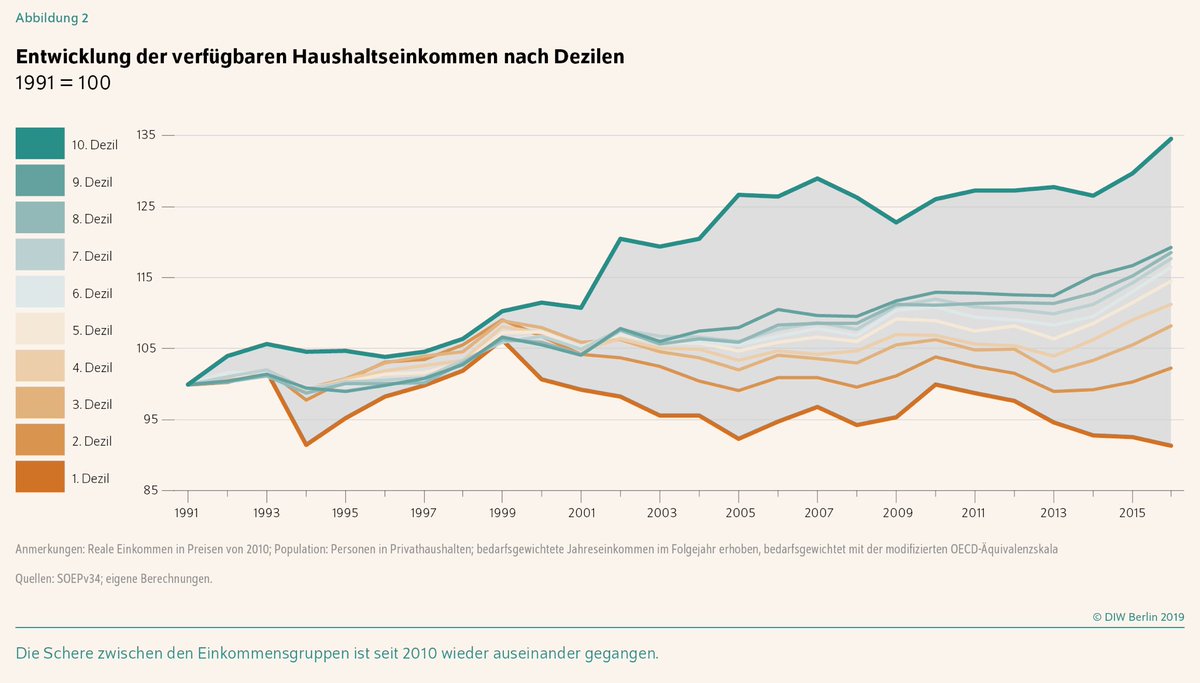

The US stock market has underperformed equal weighting in 8 of 12 decades.

(Let that sink in if you plan on extrapolating recent outperformance....)

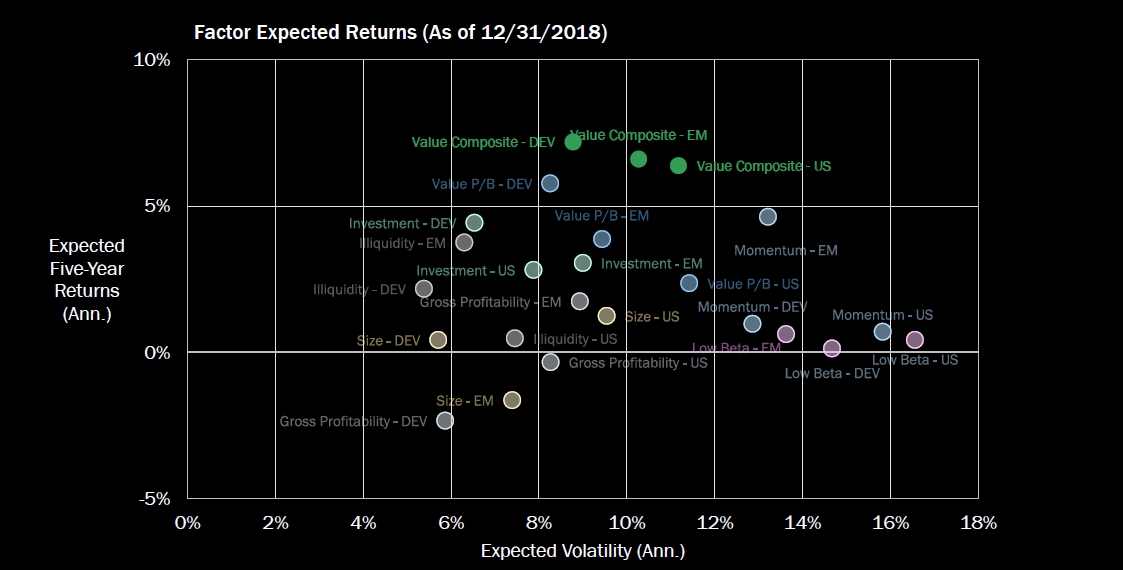

Last paper, Rob Arnott of @RA_Insights with “Are Valuations Now Irrelevant?”

researchaffiliates.com/documents/Rese…

(Note: This is from a PPT so some of the text will be headlines in CAPS)

interactive.researchaffiliates.com/asset-allocati…

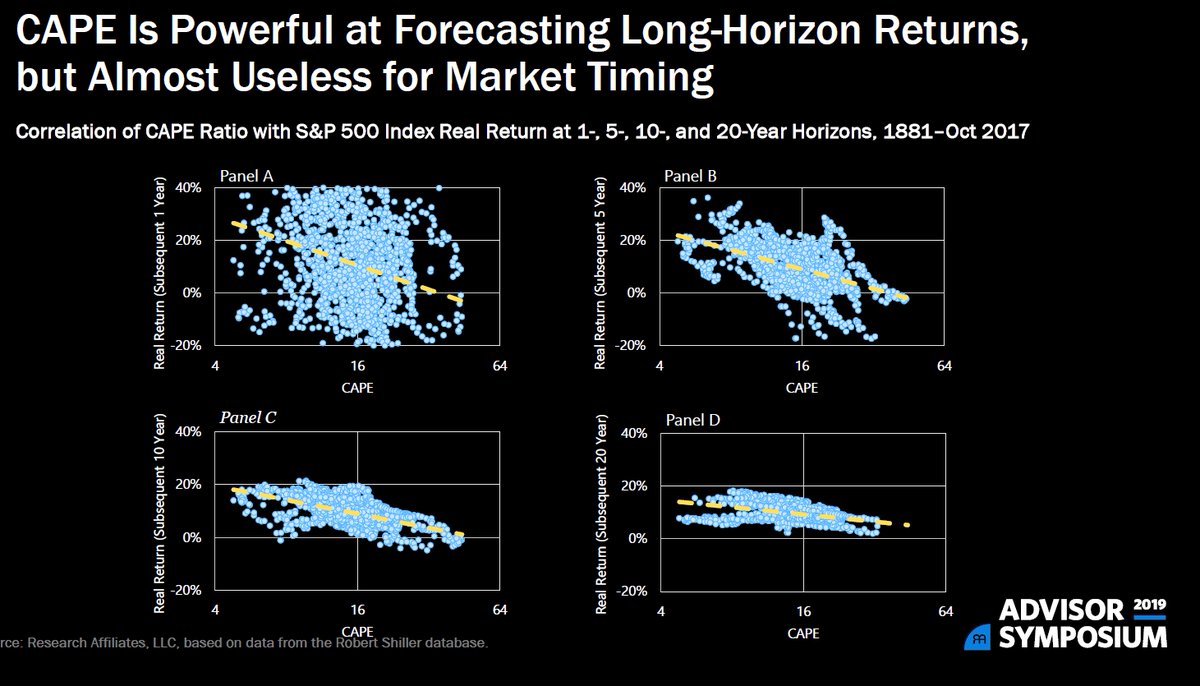

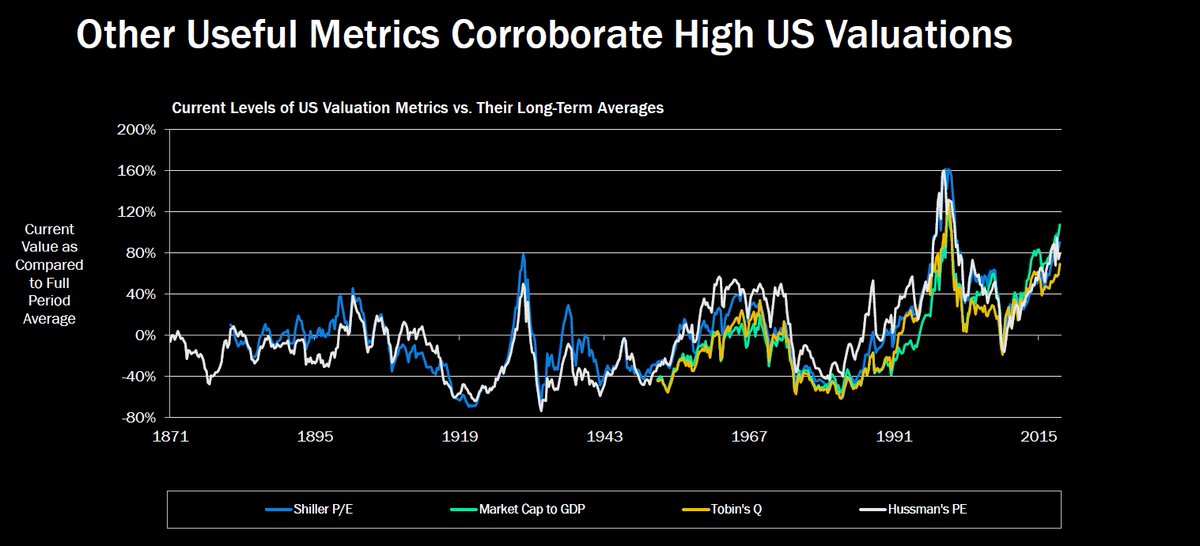

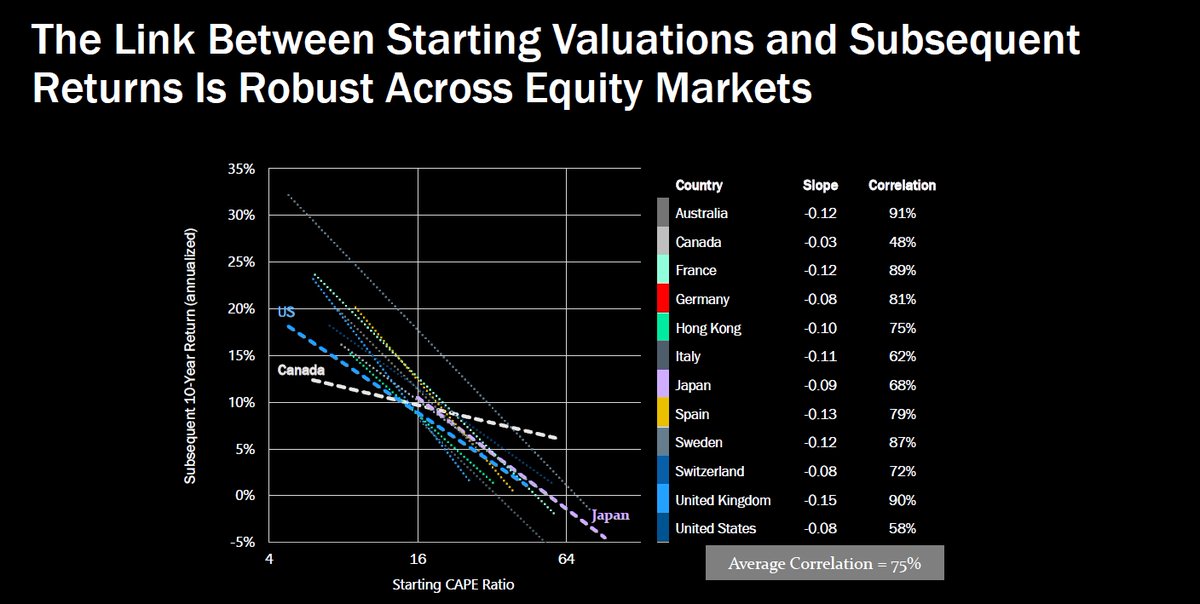

•Valuation levels are not useful for timing market tops and bottoms.

•Chasing returns can be very costly.High valuations can go higher, but not indefinitely.

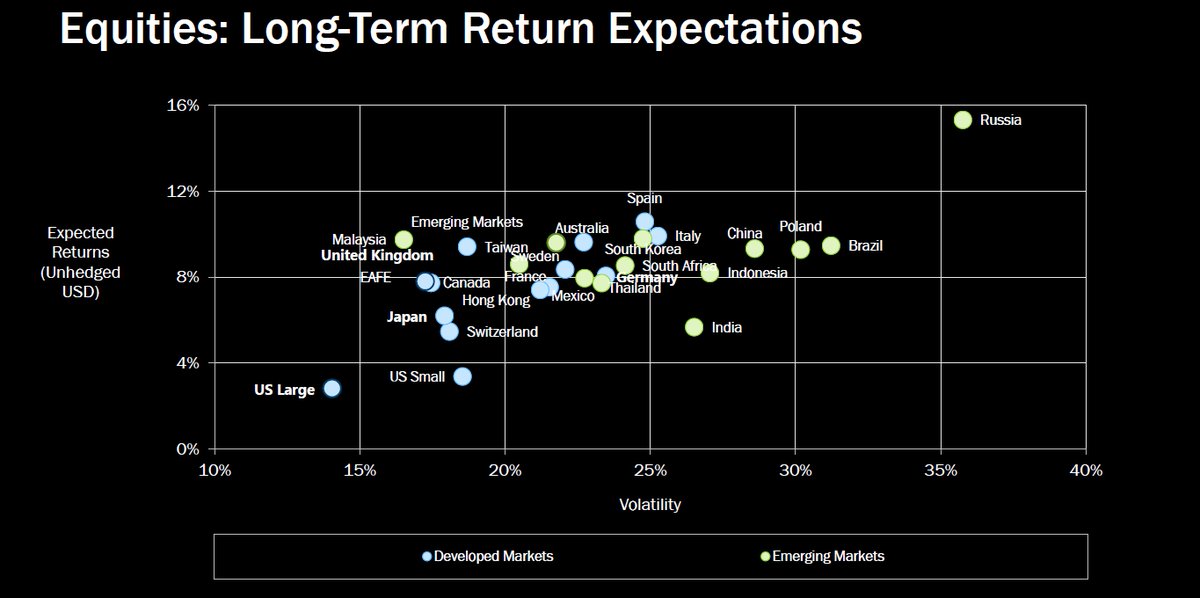

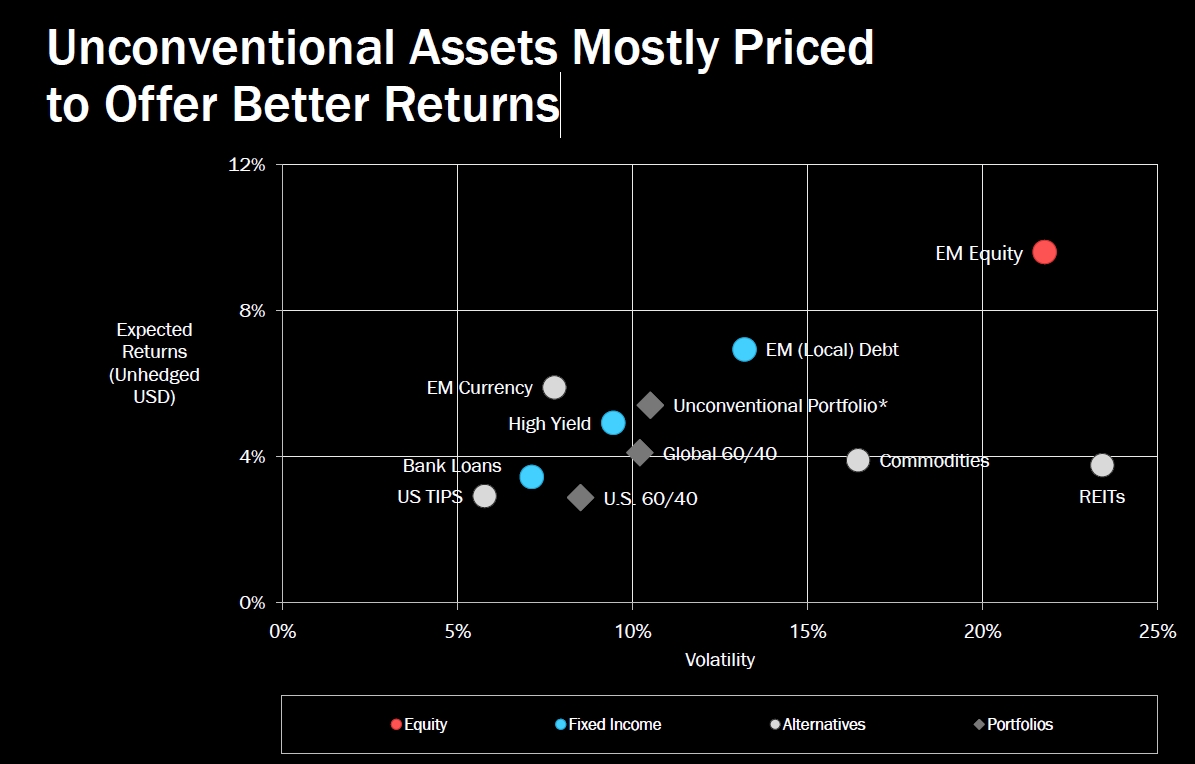

Across asset classes, higher return potential exists in international and diversifying markets

Within equities, the value factor offers the highest return potential today"

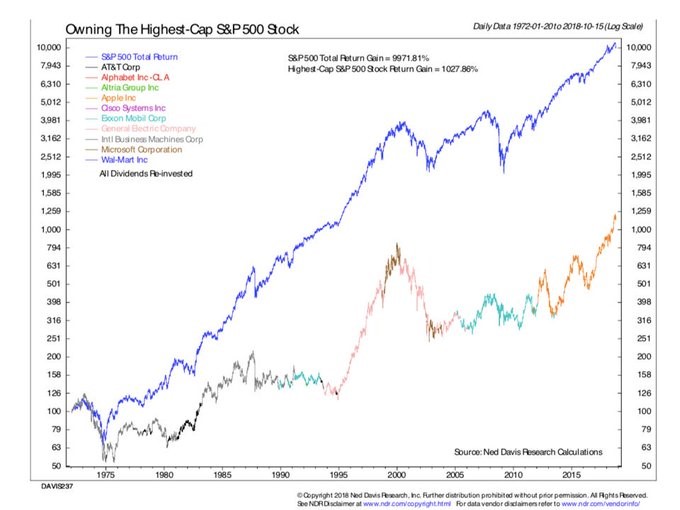

Meb: Didn't really touch on this but more in the PPT. Also, there's also a flaw with market cap weighting in that there is no tether to fundamentals.

mebfaber.com/2016/09/07/epi…

It's a laundry list of the top American companies like @walmart, @google..

Ok, so we've hit 100 tweets so lets summarize...despite all the evidence above most people will continue to massively concentrate in their own market. That "home country bias" is a really bad idea and easily avoidable...chart via @Vanguard_Group

Diversifying globally can save your butt

Investors should start with global market allocation (50% US / 50% Foreign) for full opportunity set and breadth

Consider adding value tilts

(This is uncomfortable for some)

Relax and sleep tight

cambriainvestments.com/investing-insi…

and you can listen to my monotone on the pod here:

mebfaber.com/podcast/

Have a great night!

1. theideafarm.com

2. @CAPE_invest

starcapital.de/en/research/st…

3. @RA_Insights

interactive.researchaffiliates.com/asset-allocati…

4. @Barclays

shiller.barclays.com/SM/21/en/indic…

5. @RobertJShiller

econ.yale.edu/~shiller/data.…

mba.tuck.dartmouth.edu/pages/faculty/…

7. @AswathDamodaran

pages.stern.nyu.edu/~adamodar/New_…

8. @GlobalFinData