Gordon Brown, the head of the UK Treasury, in 1999 decided to sell off more than half of the UK's gold reserves. Over a couple of years he sold off around 400 tonnes leaving around 300 tonnes.

Gold doesn't pay dividends... okay, but swapping into EUR won't help!

The problem with fiat currencies however, as we all know, is that they are designed to inflate over time, and not in a fully controlled way.

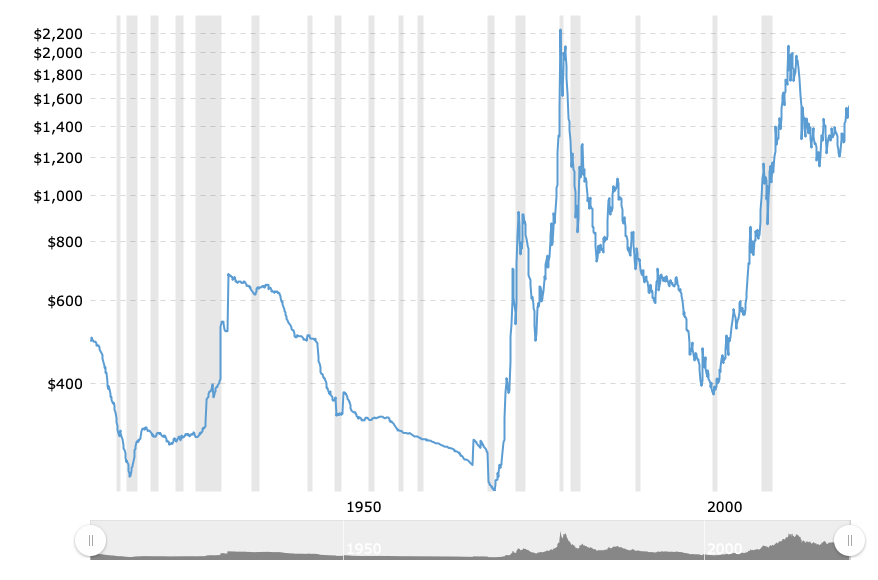

Gold is the archetypal reserve asset for well known reasons.

Would Mr. Brown have had the same worries if Bitcoin were the global safe haven?

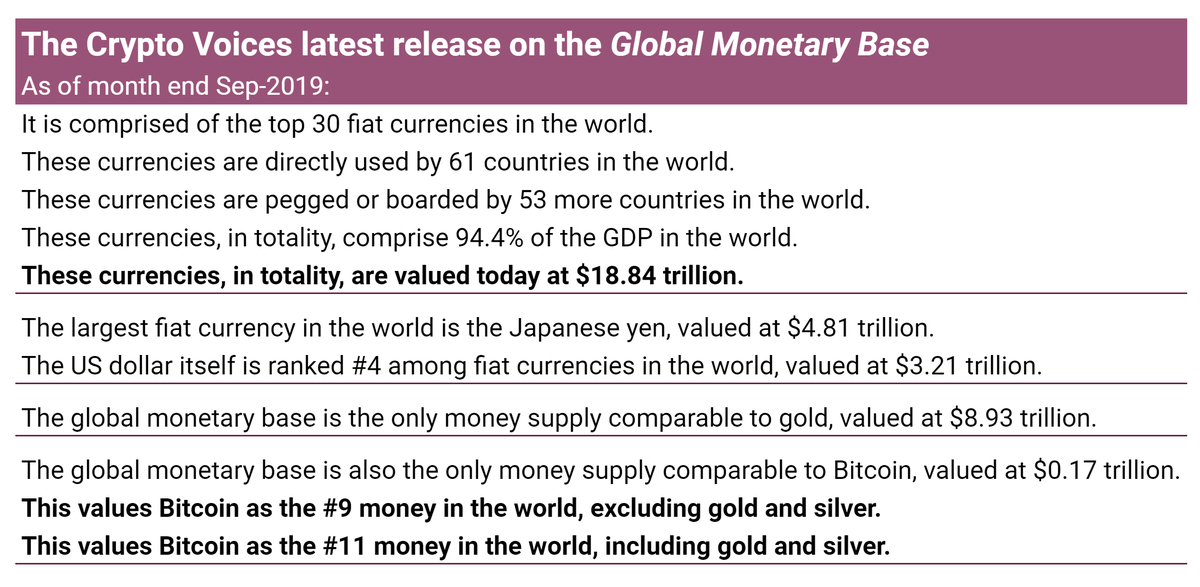

For hard, scarce, valuable, global assets like gold and bitcoin I don't think volatility is too important, but that aside, bitcoin is capable of being a modern currency in ways that gold isn't.

Thanks for reading!