There is a lot not yet known or decided.

From @AnnaJerzewska

blogs.sussex.ac.uk/uktpo/2020/01/…

The method would provide limited traceability.

This burden is unlikely to be attractive to companies and could well inhibit trade.

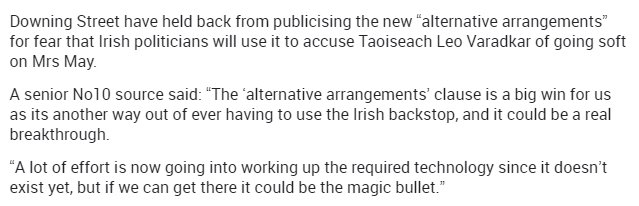

Are Johnson’s repeated claims (even yesterday) a signal that the U.K. has no intention of complying with the WA at all or a signal that he is a liar & eejit?