I've written a review of Andrew Browning's book for the Economic Historian.

The full review is here: economic-historian.com/2020/01/the-pa…

This thread contains some of my thoughts + images.

But by 1819, the economy was more connected through interregional and global networks.

This depression was noteworthy for afflicting all economic classes and regions

Accordingly, the U.S. Treasury borrowed $11.25 million from domestic and foreign investors by issuing bonds bearing six percent interest (p. 20).

The U.S. would have to pay the first installment in gold to France by December 1818.

As Browning writes, this was an immense challenge involving last-minute negotiating.

First, there was a *MASSIVE* volcano eruption in the Dutch East Indies, now Indonesia.

It created a thick atmospheric haze so disruptive to global weather systems that 1816 was remembered as “the year without a summer.”

New England farmers, repelled by unusually cold temperatures and attracted by the prospect of profiting from high prices, moved West in large numbers to buy cheap land.

There was an explosion in the number of banks between 1810 and 1820.

The First BUS failed to secure a new 20-year charter in 1811.

Federal legislation, in fact, helped encourage the boom. Browning doesn't emphasize this, but here is an example of govt institutions *shaping* markets (it's not a free market)

Bank notes are credit instruments that circulate from hand to hand as cash. Look at the account book of any bank and you'll often see the column "circulation." That's the number of notes the bank issues.

But their subordinates defied them!

The hope was to restore specie to the Bank's vaults.

Deflation ensued.

Perhaps a third of the country’s banks failed, a level of economic destruction that would only be matched by the Great Depression of the 1930s.

The second half deals with the symptoms and political consequences of the panic.

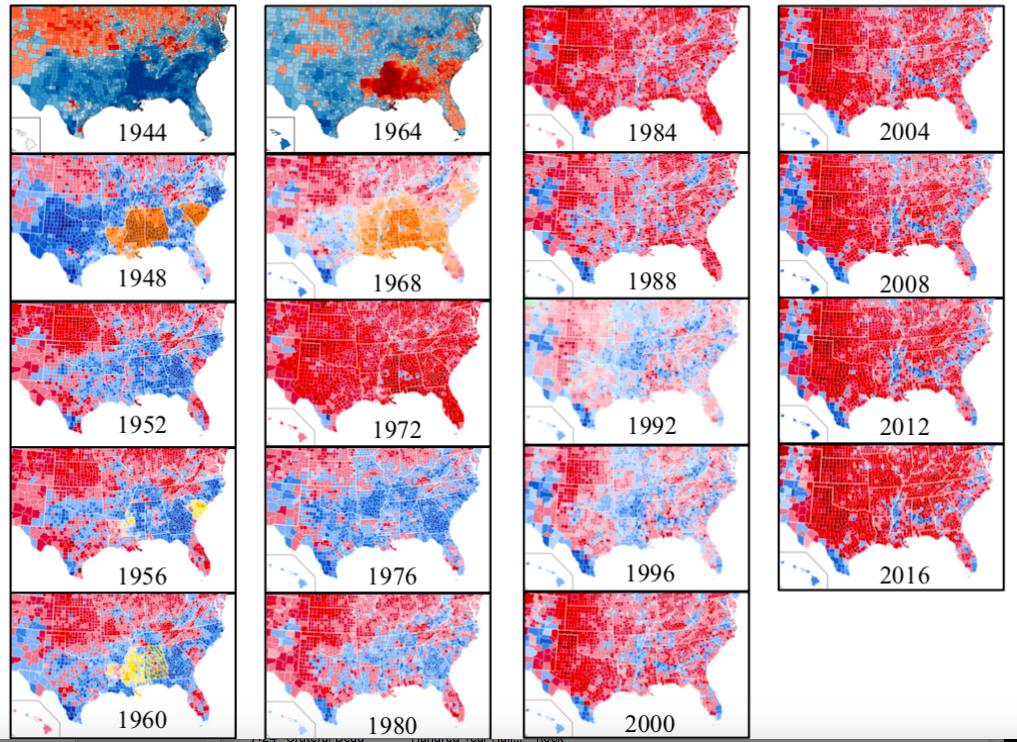

Did the panic really shape politics to the degree that the author contends?

Salient passages are culled from the public and private utterances of major political and financial figures

It is rare when a book offers both breadth and depth without getting excessively long. Both qualities are observable here, but the emphasis seems to be on the former.

Yet curiously absent from Browning’s lengthy bibliography are a host of relevant scholars with more recent publications.

Since Browning covers the boom in land, cotton, and slaves in the Old Southwest, the NHOC seems relevant.

@jlpasley was the book's series editor.

@CalScherm @Ed_Baptist @FarberHannah @joshrgreenberg @lomazoff @SMihm @Burrite @DrDanielPeart @gauthamrao @sethrockman @CC_Rosenthal @rothmanistan