1. Banks give out loans these are called risk assets

2. These loan assets decide how much capital a bank needs to have to reduce risk of insolvency

3. Every loan has a risk weight as per a formula devised by RBI

1/n

5. A secured loan like mortgage which has a collateral is assigned a lower risk weight

6. All loans put together by risk weightages are called risk weightage assets

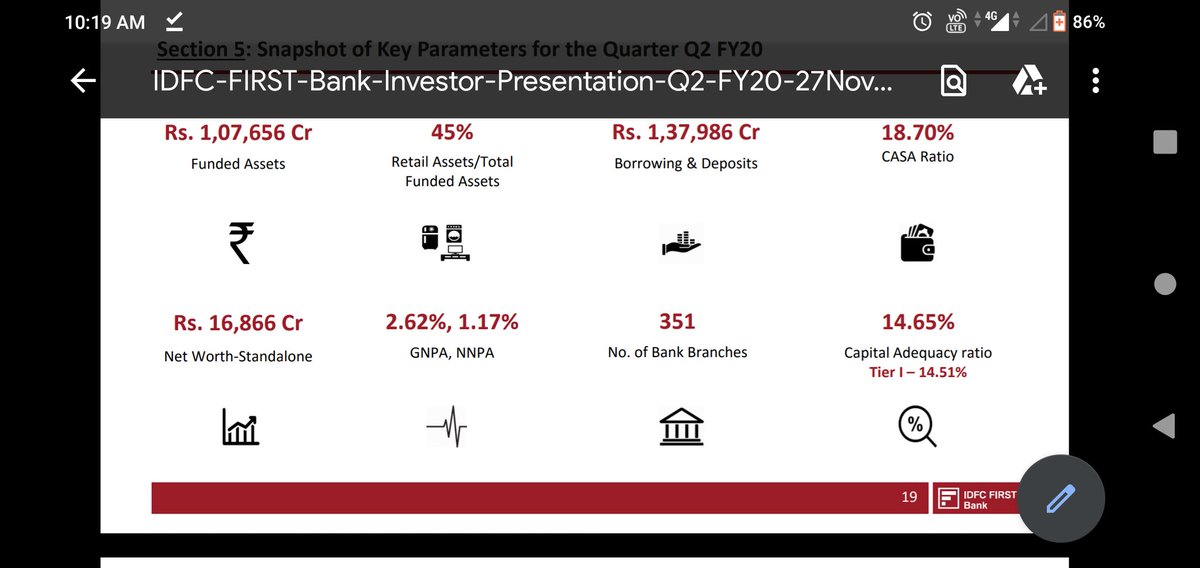

7. Capital Adequacy Ratio is measurement

2/n

8. A bank has two types of capital Tier 1 and Tier 2

9. Tier 1 is mainly equity capital which needs to be min 8% as per Basel 3 norms but as per RBI banks need to maintain 9% min

3/n

11. If a bank lends Rs 1000 then it should have min 9 as capital

12. The more the bank gives out loans the more capital it needs to raise

CAR = (tier 1 capital plus tier 2 capital) / Risk Weighted Assets