1 A loan gets classified as NPA if interest or principal amount remain unpaid for 90 days or more

2 Bank has to suspend interest on the loan account, this interest though keeps accruing & is parked in a separate account called-Interest in Suspense

1/n

4 Gross NPA is the total amount of unpaid principal for 90 to 180 days

2/n

6 When a new loan is given bank needs to set aside a small amount from operating profit called provisions-this is called std provision

3/n

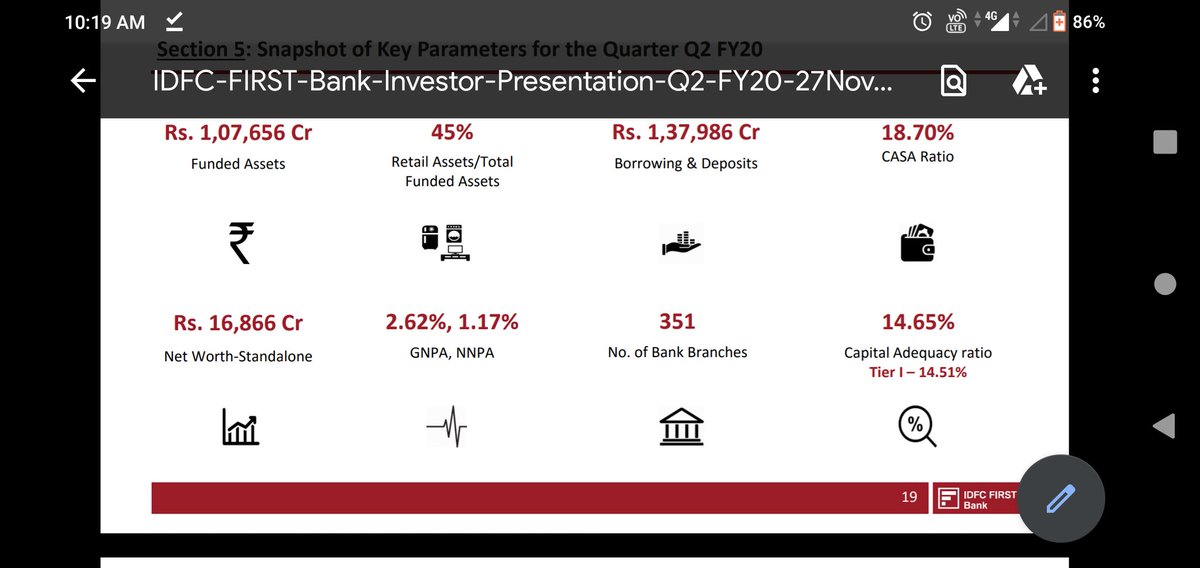

8 Gross & Net NPA divided by total loan assets gives you GNPA & Net NPA in %age terms

9 If a borrower makes a repayment on a NPA account & loan becomes current-

4/n

n/n