Mortgage lenders struggling to roll over debt amid downgrades in their credit ratings.

Limited disbursals from committed Pre-sanctioned limits

livemint.com/industry/banki…

Even tougher to be a Regulator!

RBI can at most ensure systemic liquidity remains well provided.

How can the RBI enforce last mile liquidity which has dried up due to loss of risk appetite among lenders amidst defaults/rating downgrades?

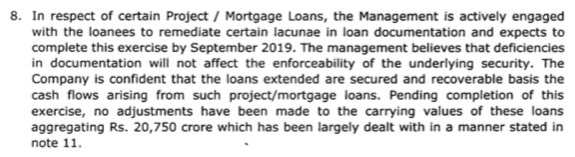

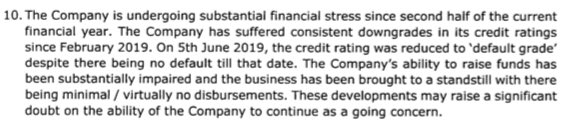

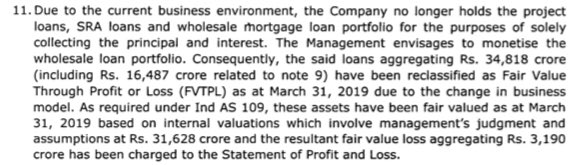

Disclosures by Dewan Housing, a AAA rated entity Jan-19, highlight the sources or risk aversion among banks/investors towards NBFCs and Real Estate financing at large.

The clean up of the ecosystem will continue, but the budget proposal of credit guarantee upto 10% first loss can help clear the credit thaw & isolate problem entities.

Unsold inventory across top eight cities recorded a decline of 9% in 1H 2019.

Mumbai was the only market to record an increase in inventory overhang of 14%.

thehindubusinessline.com/news/real-esta…

More than 80 slum redevelopment projects are stuck in the city as some or other the activist has instigated the public.

dnaindia.com/mumbai/report-…

Sought dismissal of all the petitions

timesofindia.indiatimes.com/city/delhi/law…

1. Financial distress of small developers;

2. Lack of execution capability;

3. Inventory Oversupply;

4. Excessive land banking;

5 Poor understanding of demand supply;

6. Unjustified price appreciation

economictimes.indiatimes.com/industry/servi…

Bets on expensive property go bad in downturn, scaring off buyers/choking credit.

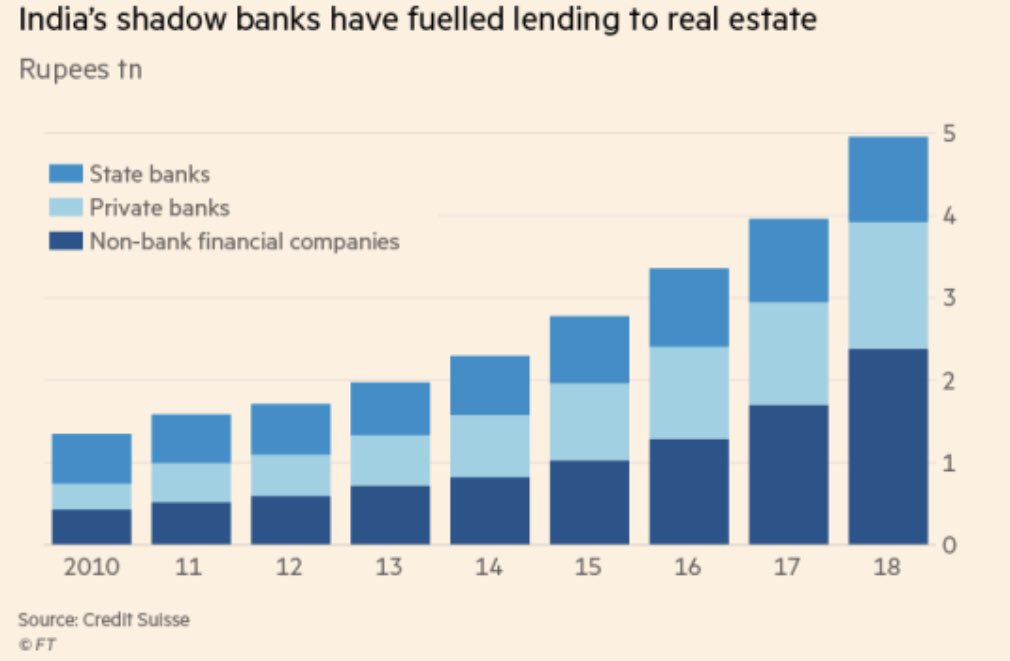

Real Estate Debt: Developers collectively owe about Rs2.5tn ($37bn) to the non-bank financial sector.

amp.ft.com/content/9f67b9…