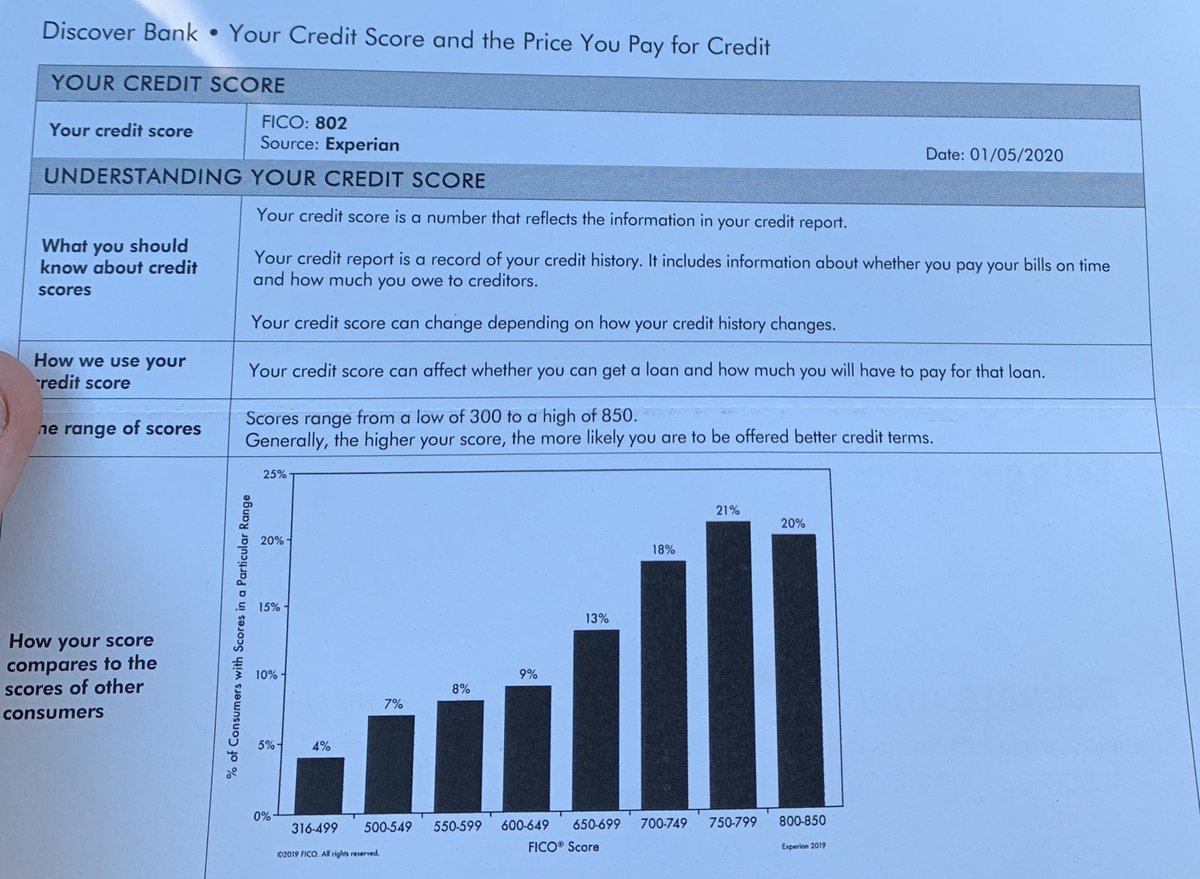

• Payment History: 35%

• Utilization Rate: 30%

• Age of Credit: 15%

• Mix/Different Types of Credit: 10%

• # Hard Inquiries: 10%

What are these? Continue below

Utilization Rate: Total $ amount you owe divided by your total credit limit. $1000 owed on a credit limit of $10,000 is a 10% utilization rate. Keep it under 30% at all times

Mix of Credit: # credit lines you have open and the different types. More is better

First, it's not the worst thing in the world. You can recover/start up relatively easy if you just stay disciplined

You need to apply for a secured credit card right away, like right now go do it

CC companies allow this because it's 0 risk to them, if you don't pay or run the credit up, you lose your deposit and they lose nothing

Making sure you pay consistently is the biggest thing here, never miss a payment and watch the score grow

For those with decent credit & those just trying to raise it above 740 (gold standard for banks), let's go over some tips and myths to be aware of

If you're in debt, paying these cards down is simply a numbers game

Credit card debt is considered consumer debt, this is what's known as "bad" debt

Costumer debt has high interest rates, this is anything financed with high rates

Focus on the amount of interest paid when thinking of what debt to pay down first

If you have $3000 financed at 26% and $12,000 financed at 18% for 6 years on each loan, you pay around $5,000 more in interest in the $12K loan

Use calculator.net/loan-calculato… for quick math on this

Quick myth: Keeping a balance on your card does not impact your score

Don't believe the lies, they want to make money

Whether you set it to pay it off in full every month (my recommendation) or just the minimum payments, set it up immediately

Missing a payment is the worst thing you can do to your credit

Don't mess this one up

Continue to pay off your credit card debt IN FULL every month

Don't pay unnecessary interest, only put things on the card that you need and can pay off each month

Both for piece of mind & your credit score, don't go over

These last 2 tips are the most important, refer to 2nd tweet

Use CreditKarma.com to track your score for free - not an ad just what I use personally

It's not rocket science people, just about knowing the system

Hope you enjoyed, more value to come