let's call it Cantillon's graph. it is utterly damning and it should make you very, very mad.

h/t @TuurDemeester

🧵

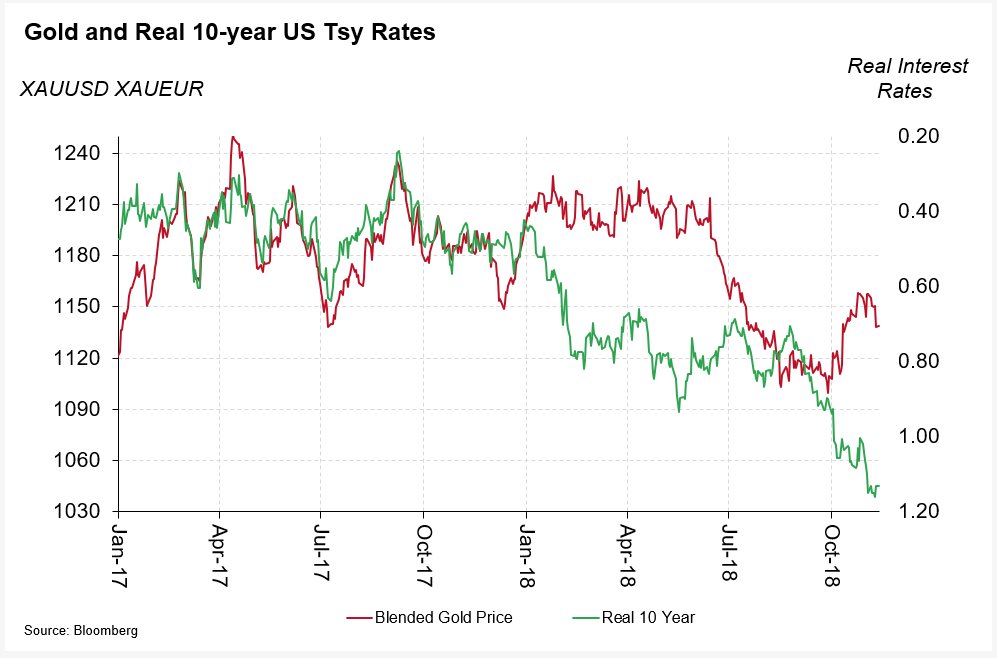

gold literally has value because it is good at maintaining value.

but there is the question of who benefits from the value that stock markets create.

if everybody benefited equally, there would be nothing to discuss. but they don't ...

obviously, by 'real value', I mean the stable measure of gold, and by 'fake value', I mean the inflationary measure of USD.

this is straightforward to grasp.

there are two obvious examples: executives "incentivised" by options, and bankers/traders/financiers/etc who are paid commission based on the value of the underlying.

stock market value is a stock to them, not a flow.

it is only a flow to those who are parasitic on its value as a stock.

that would be true to a small extent with a real measure of value, but is dramatically exacerbated with an inflationary one.

of course they pretend there is no difference.

parasitic wealth growth is cumulative in draws from the fake value chart, because they do not need to stay invested. the worst a crash can do is slow the rate of growth.

as can be seen, recent crashes have eviscerated real wealth.

this can only happen with a measure of value utterly lacking in integrity assurance:

medium.com/@allenfarringt…

it's about the mechanics and morality of value extraction from stock markets with access to fiat inflation and political cronyism.

quillette.com/2020/02/27/the…