❌ Real estate (you just own real estate)

❌ Stocks (you just own stocks)

❌ Bonds (you just own bonds)

These are all assets, indeed, and they each have benefits, but also counterparty risks and varying liabilities.

😬 A banknote (BUT, it is the liability of a central bank, hopefully they manage it well...)

✔️ A gold coin (AND it is no one else's liability)

✔️ A bitcoin (AND it is no one else's liability)

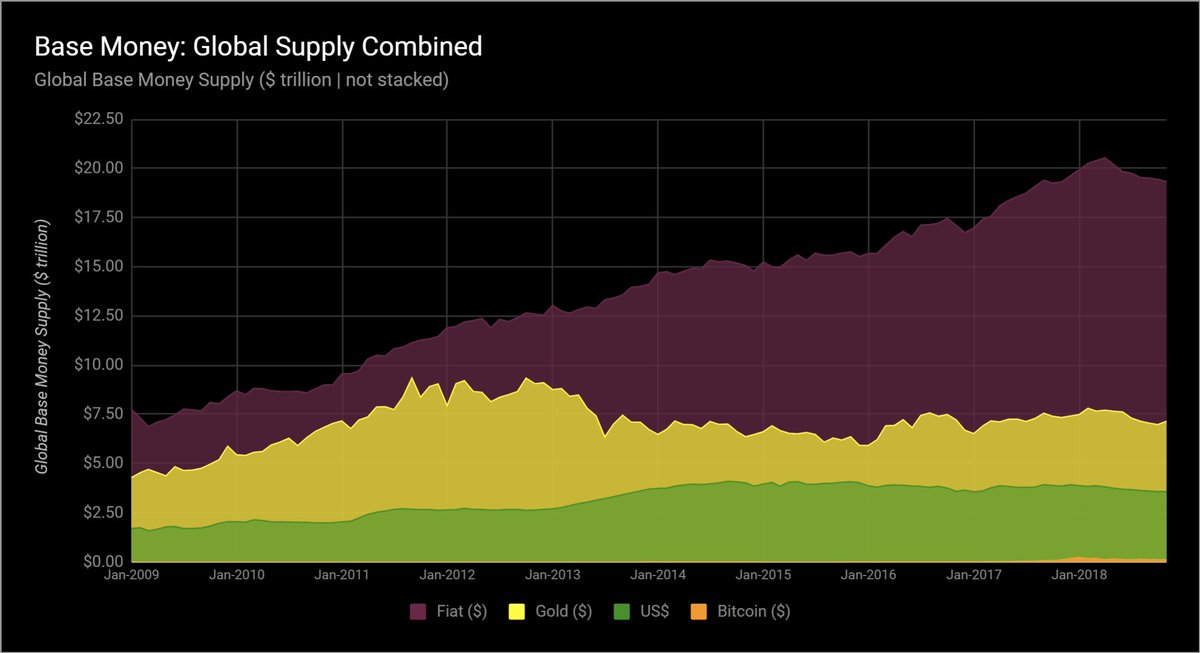

Where does Bitcoin rank globally? #12

USD? #5

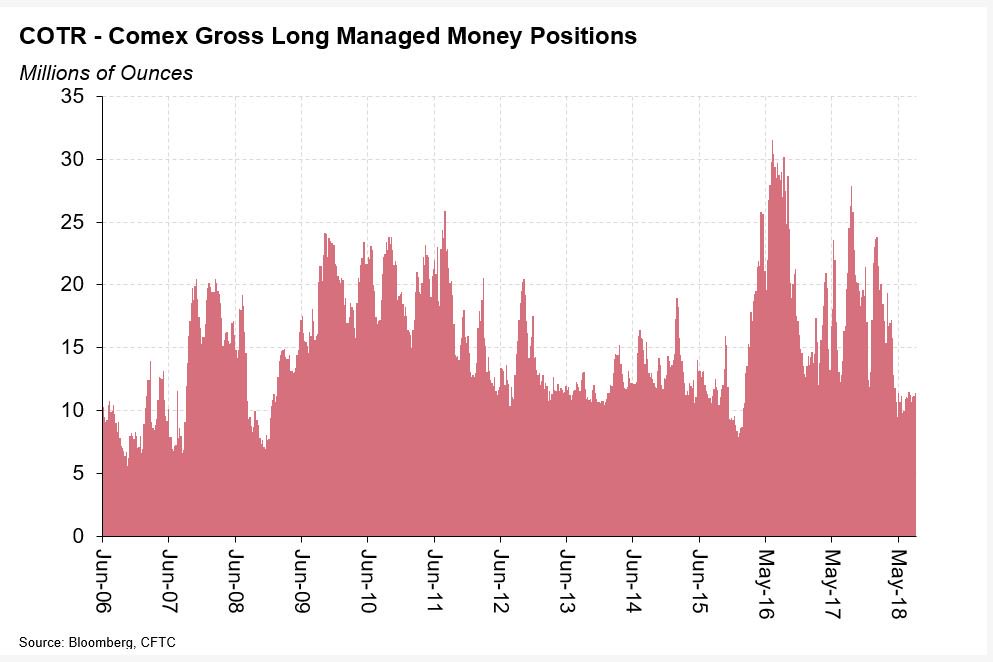

Gold? #1

Fiat base money is sourced from central bank balance sheets, wonderful gold history from Nick Laird, and bitcoin from @blockchain and @coinmarketcap.

/fin"