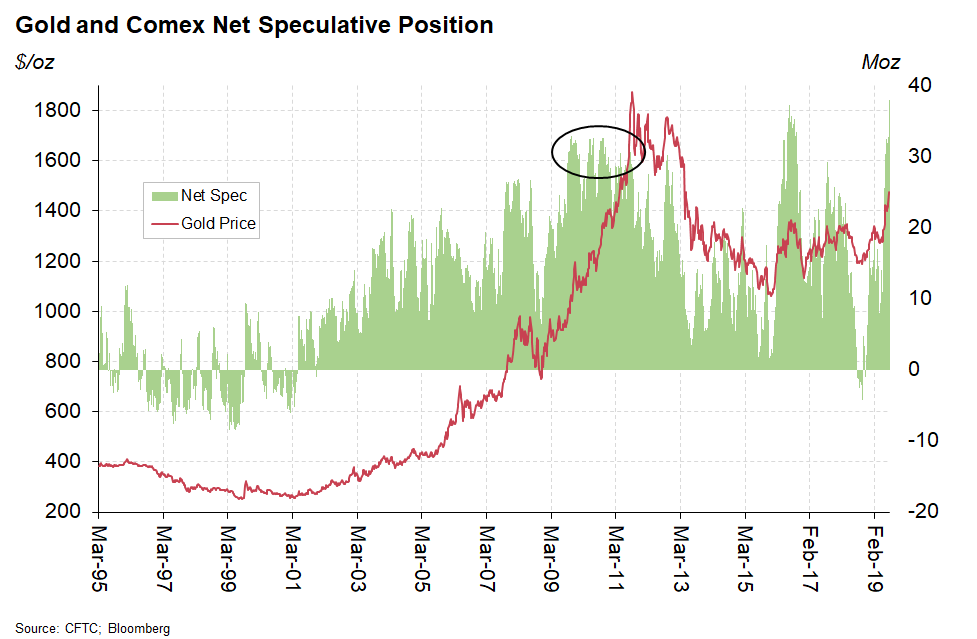

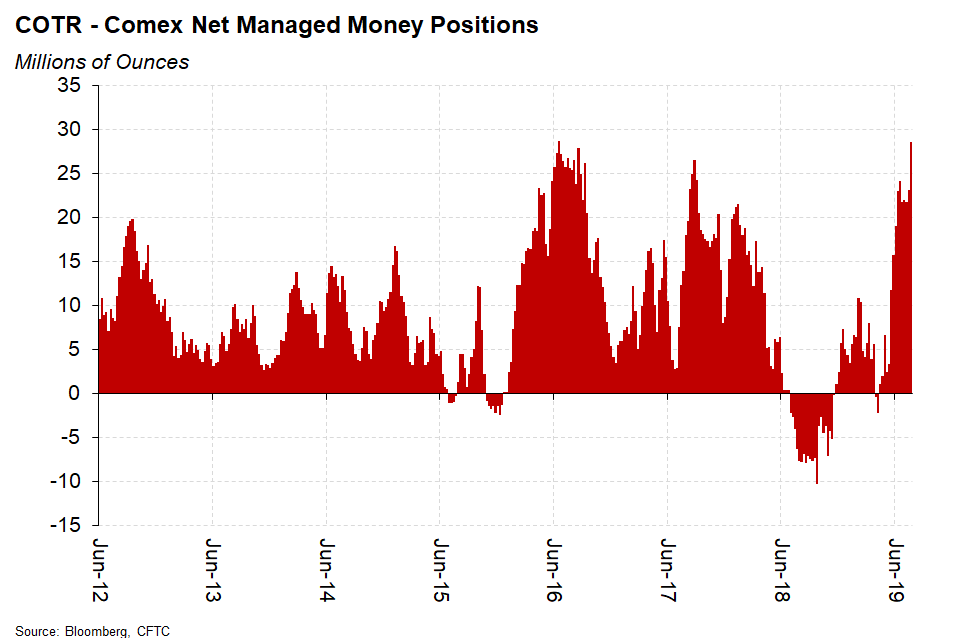

This saw a large jump in net long Managed Money positions in the week to last Tuesday, which were just shy of the all-time high seen in July 2016.

Elevated positioning warrants some caution here, even if economic and geopolitical factors are worrying.

gold.org/goldhub