appealie.com/high-versus-lo…

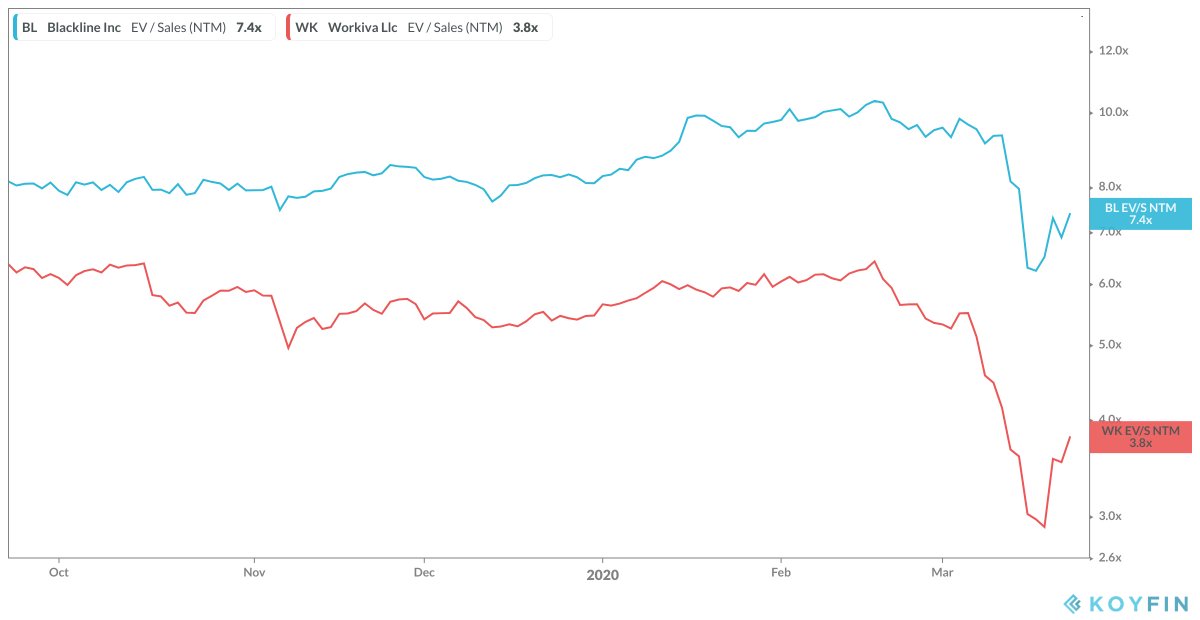

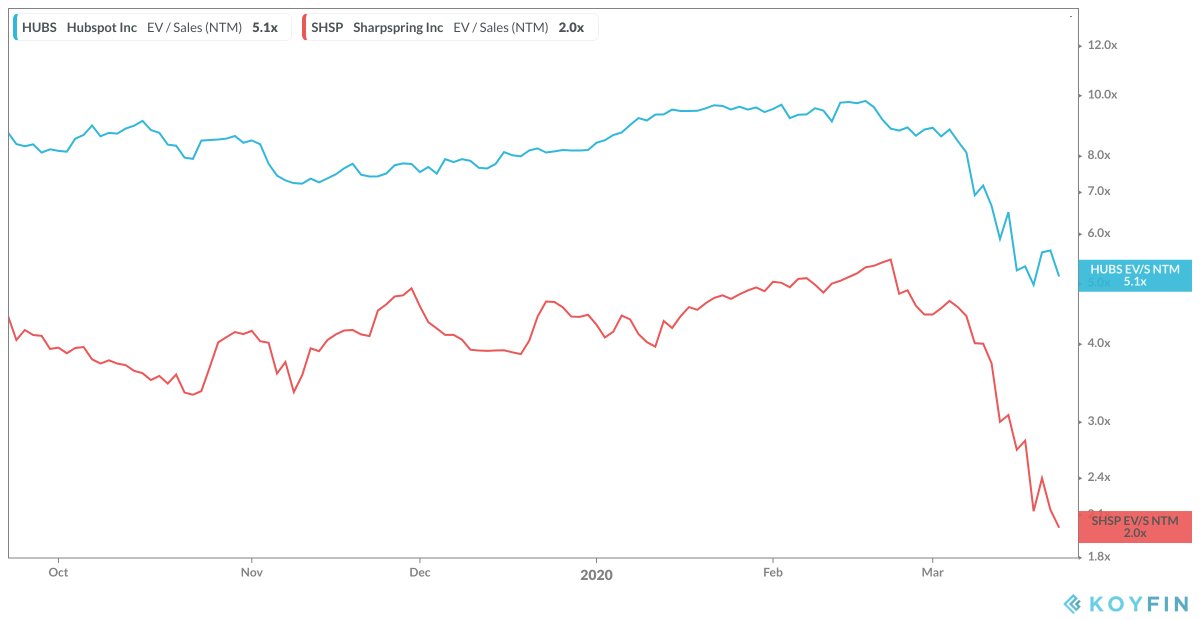

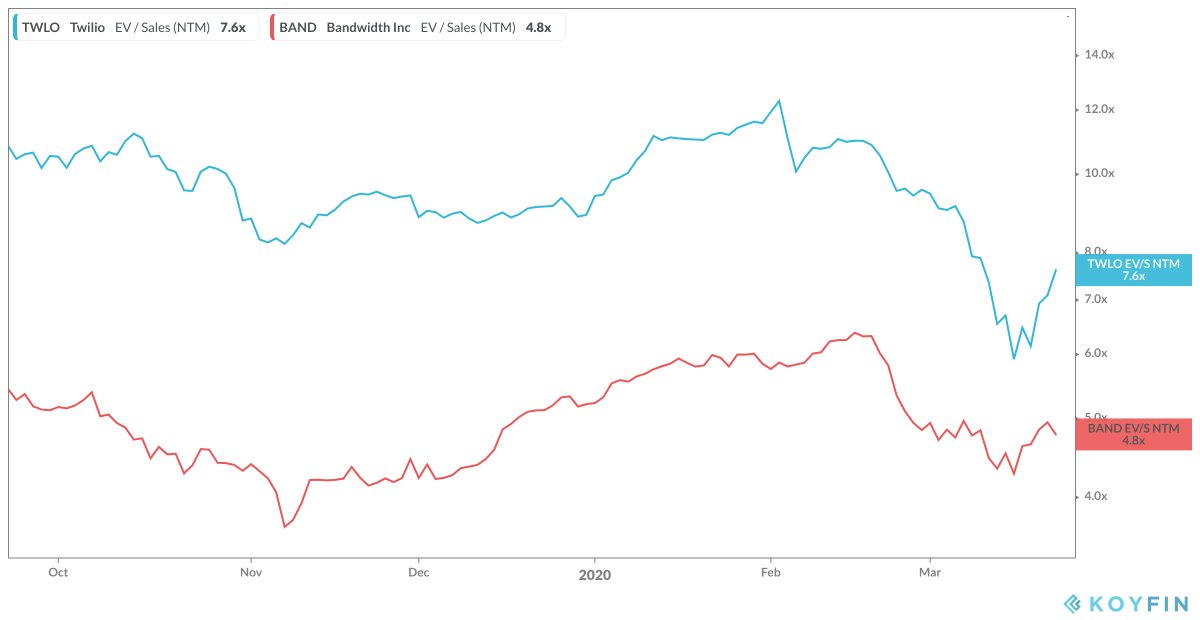

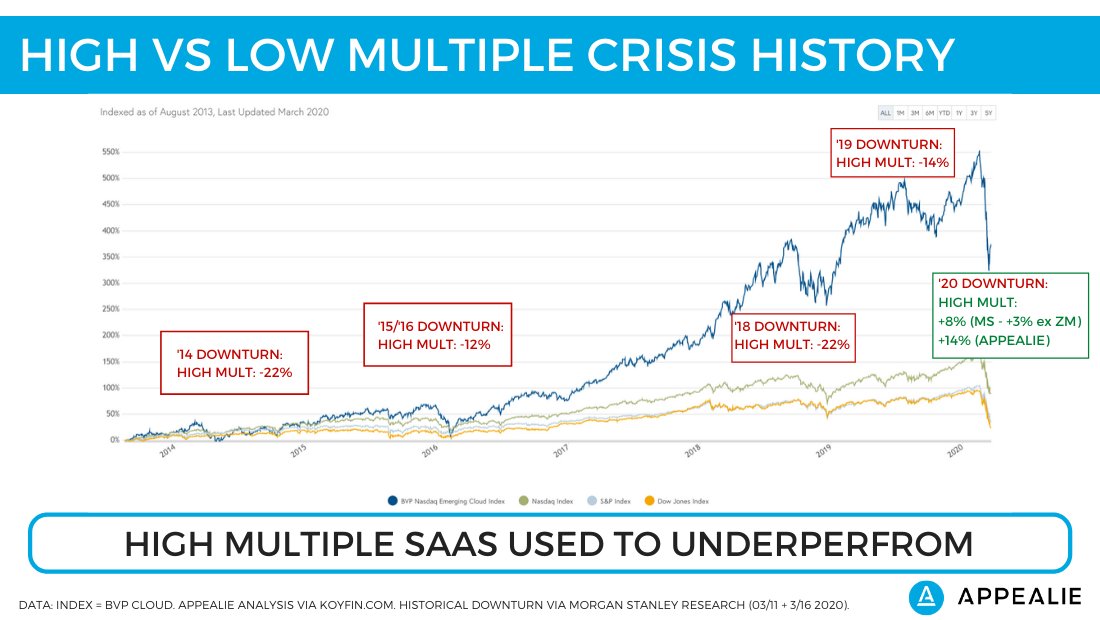

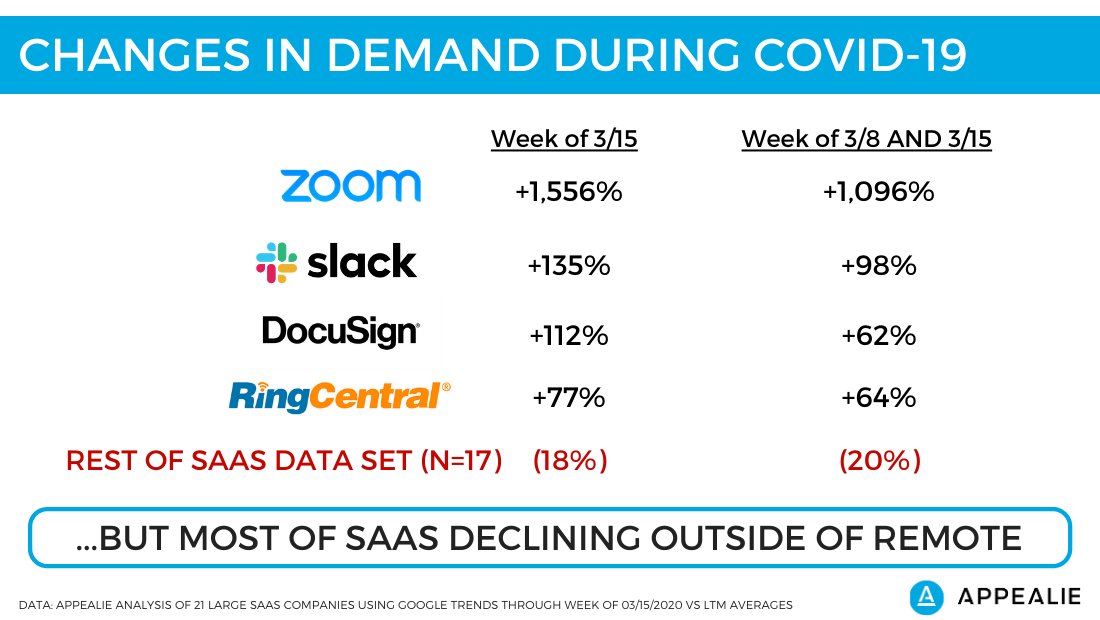

TL,DR: Higher multiples better in 2020...

...but lower multiples were better in last 4 drawdowns 2014-2019

- outperformed 4 of 6 cases

- with an average 1-month stock price outperformance of 4.5%.

On average:

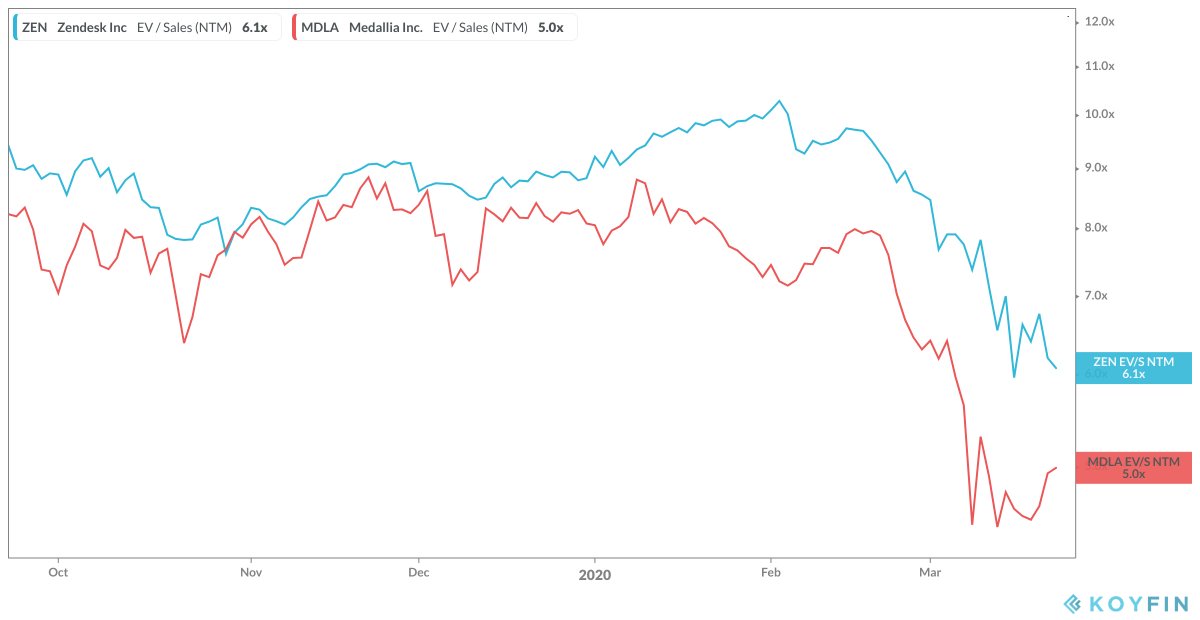

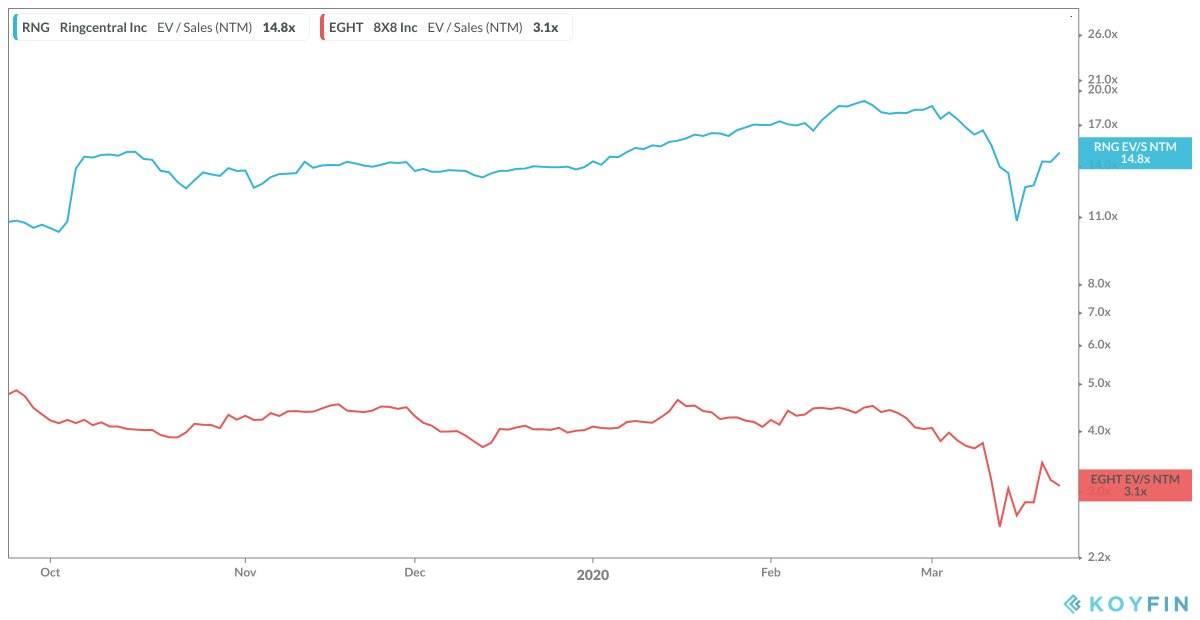

- the higher multiple names saw their multiples contract by 18% - 20%

- lower multiple comps saw their multiples compress by 33% - 35%

appealie.com/covid19-saas-i…

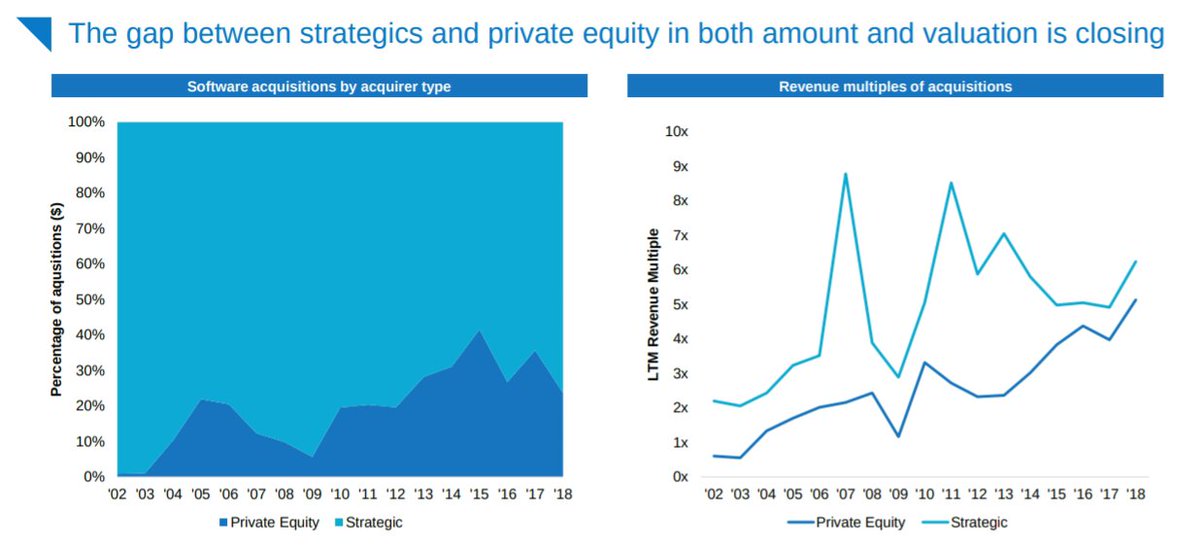

But worth including @BatteryVentures (@NeerajVC + @loganbartlett) on role of PE, a rising floor multiple(?), & diff risk-reward calculus(?).

The "Vista/Thoma Bravo put" *might* exist for 5x revenue names, not 14x revenue names.