I'd recommend reading full report, too! A couple things to highlight...

visualcapitalist.com/bank-late-cycl…

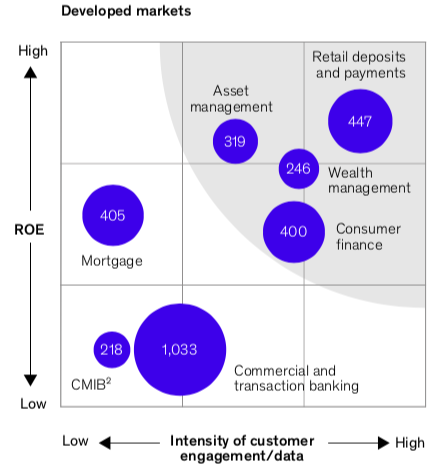

20% of banks capture nearly 100% of EVA!

ftpartners.docsend.com/view/v4z8trv

Fintechs still haven't been able to obtain banking charters to provide typical services and take customer deposits.

paymentsjournal.com/is-this-the-en…

latimes.com/business/story…

businessinsider.com/chime-outage-l…

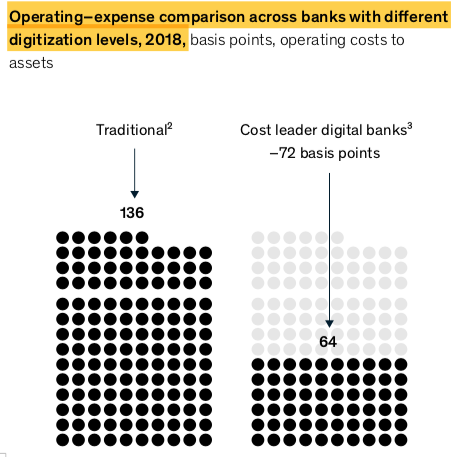

Running a heavily regulated bank has been tough and operating leverage is a differentiator.

Digital banks & neobanks continue to provide seamless UI/UX across profitable segments, but they also have their own problems.

In short, the banking wars continue!