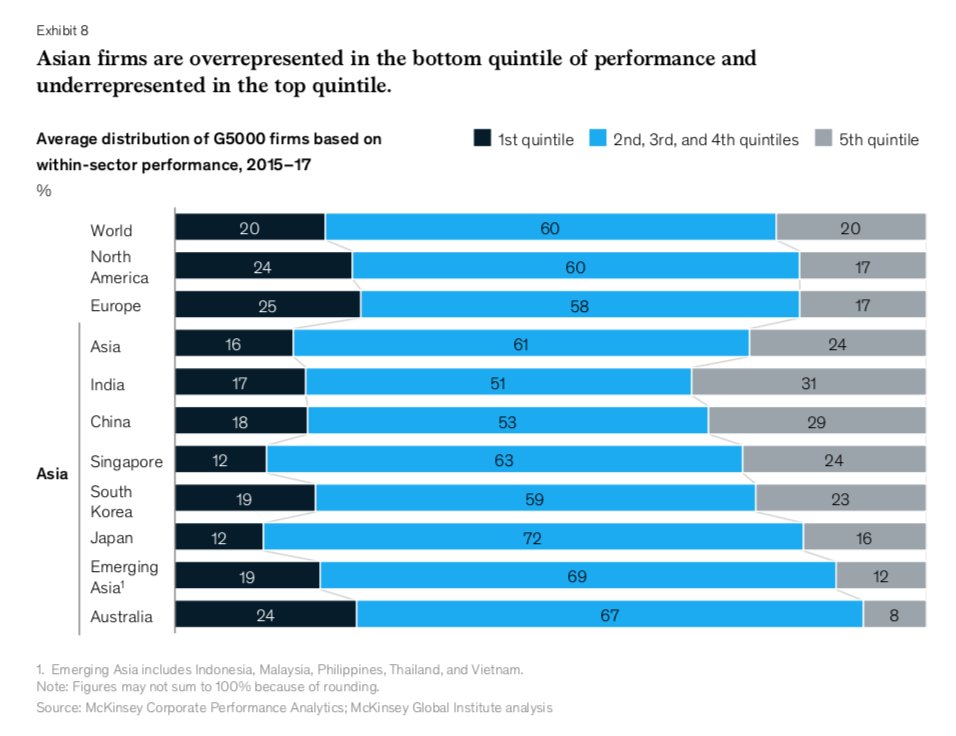

The @McKinsey_MGI 'The future of #Asia: Decoding the value & performance of corporate Asia' report provides some interesting #insights: mckinsey.com/featured-insig… A few takeaways...(1/5) Asia's corporates: Capturing the top line but struggling to convert to the bottom line..

2/5 #GlobalTrends - Corp profitability has declined around the world over the past decade w. #Asia account 4 appox. half of the decline. The world is more capital-intensive than it was a decade ago...#Macro

3/5 Asian corporations sub-optimally positioned...Different segments need to focus on different aspects to reach their full potential...#Asia #Macro

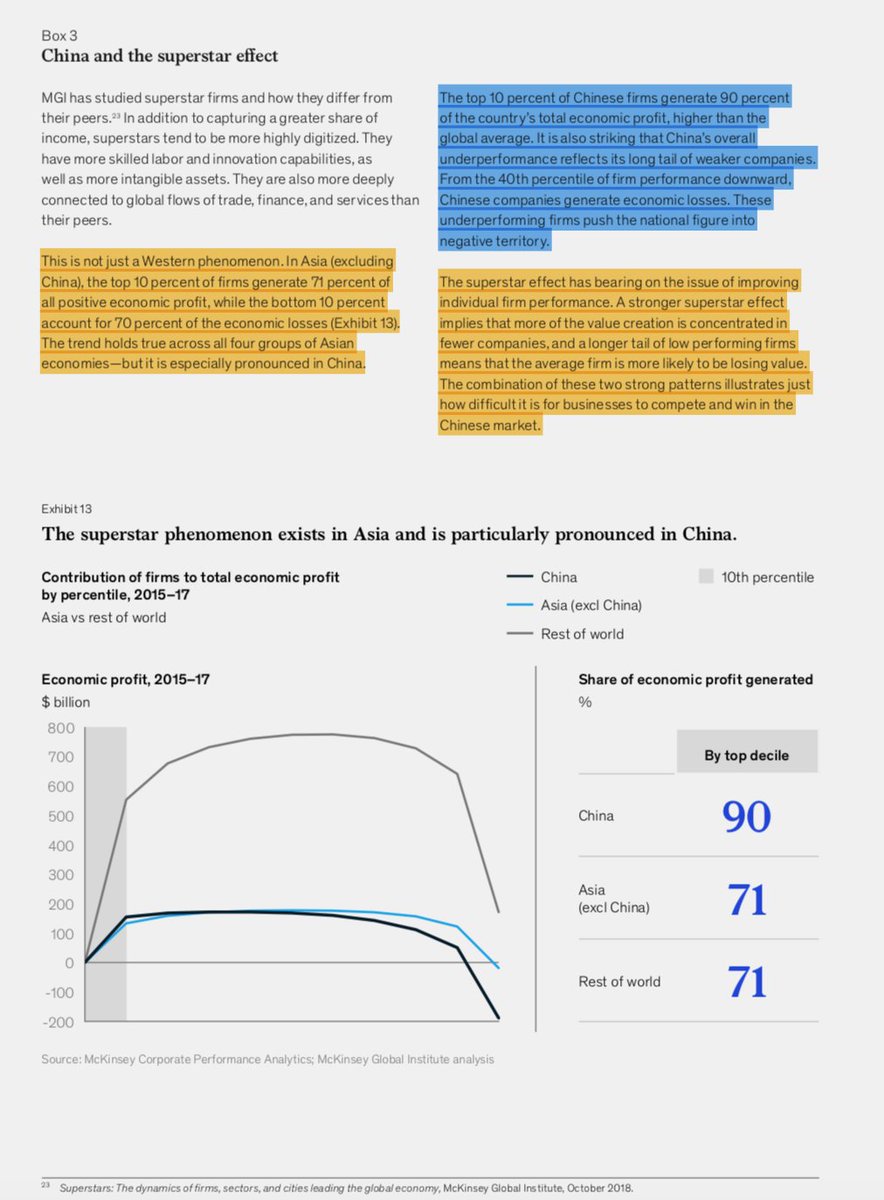

4/5 #China & the 'Superstar effect' - The top 10 of Chinese firms generates 90% of the country's total economic profit. It pays to focus your econ on key value creating sectors: IT & Pharma....#GlobalTrends #Asia

5/5 #Asia - Asian consumer-goods co's are very focused on home markets, Europe the opposite. Asia driver of commodity demand & their co's are increasingly dominant. Asia's #Urbanisation continues w. positive l. term trends 4 #RE sector...#GlobalTrends #Investing

• • •

Missing some Tweet in this thread? You can try to

force a refresh