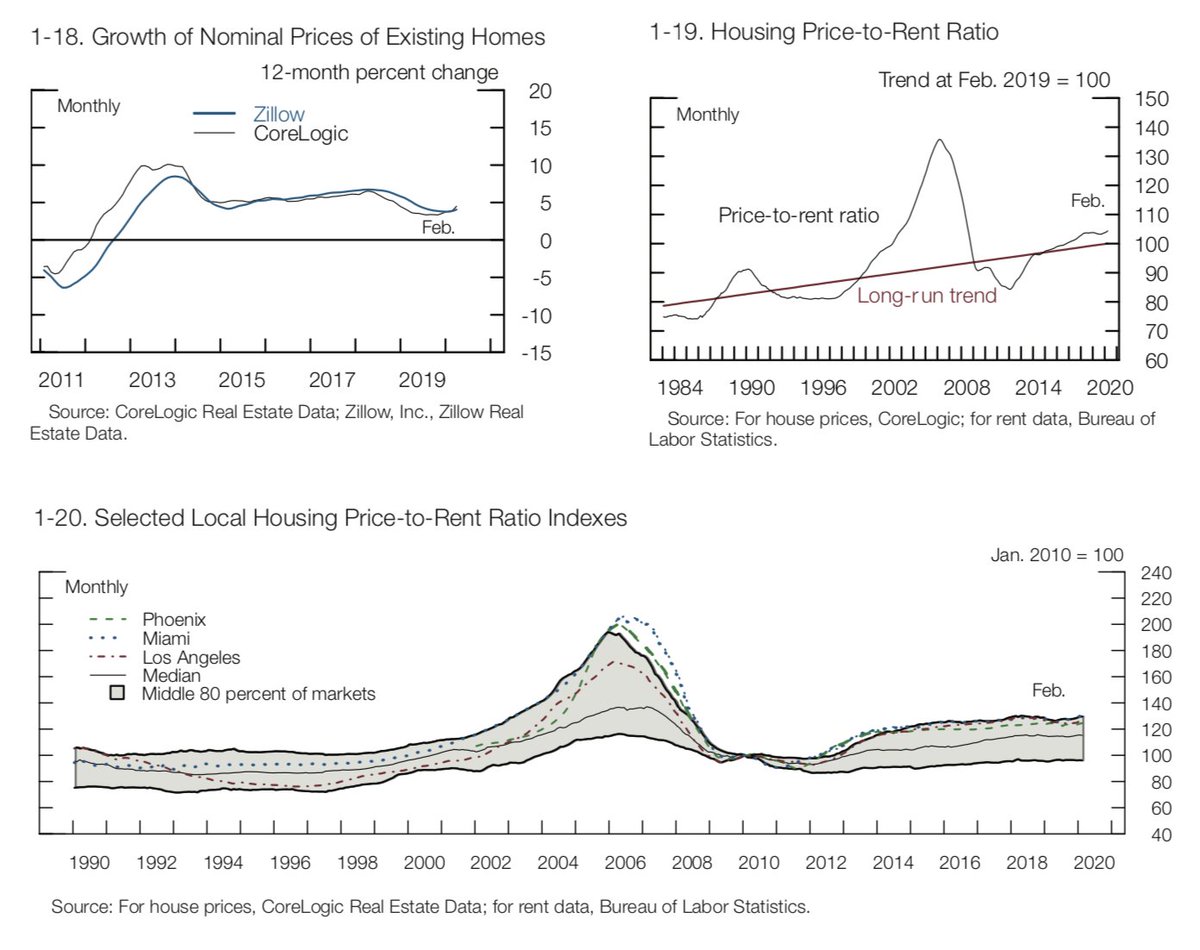

The Fed Board of Govs 'Financial Stability Report' from May holds some interesting perspectives: federalreserve.gov/publications/f… Some takeaways...(1/5)...The assets - where will these valuations be at in 2021? Which ones wld u want to hold? #Macro #US

2/5 The liabilities...Outstanding #US Non-financial corp & household #credit...#CorpCredit at record highs % to GDP..High yield/Lev. Lending looking challenged b4 Fed stepped in...#Macro #Risks

3/5 #US #CorpCredit & #LeveragedLoans quality deteriorated...Banks exposure to corporate borrowers via credit lines was at $3.6trln at the end of 2019, drawdowns increased as corporates hit turbulence in Q1...#Macro #Risks

4/5 #US #MutualFunds exposure to #CorpCredit at record levels coming into 2020 w. high yield accounting for the majority of the holdings...#CLOs was robust in 2019 after hitting record lvls in 2018, they started seeing downgrades and rising default rates in lower tranches in Q1..

5/5 #US "..life insurers have been increasing the share of risky and illiquid assets on their balance sheets"...including 15% on av. of the their issuances of #CLOs...In their survey respondents were most worried about #CorpCredit #Risks...#Macro

• • •

Missing some Tweet in this thread? You can try to

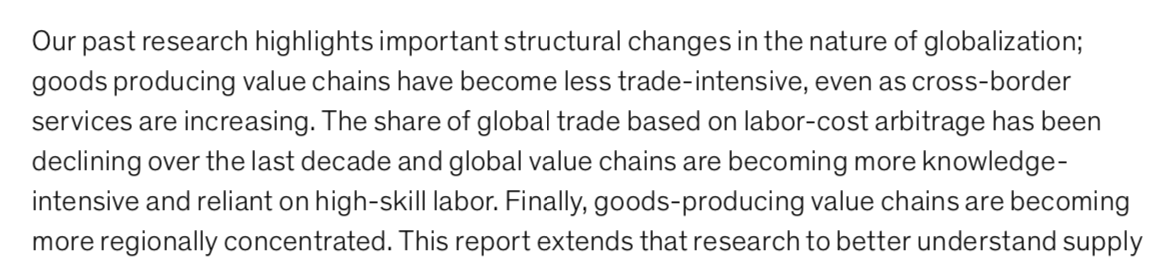

force a refresh