Big congrats to @nonfungibles on releasing their 2020 Annual Non-Fungible Tokens Report! @NathalieBcht, @latelier & I thoroughly enjoyed partnering with them on it: bit.ly/2ZkRiS8.

Some key takeaways from the report & my personal observations a/t #NFTs. A long-ish 🧵👇:

Some key takeaways from the report & my personal observations a/t #NFTs. A long-ish 🧵👇:

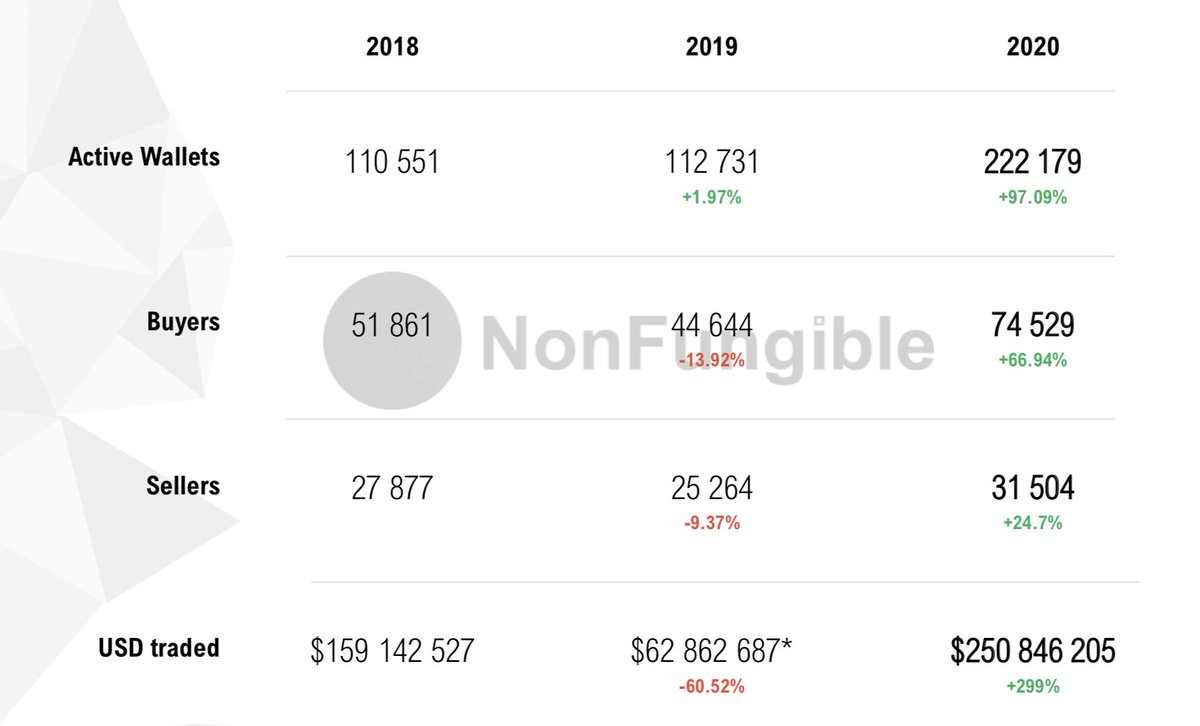

MARKET SIZE: The NFT market had a historic 2020 - tripled in value, reaching $250m (in terms of value of all #Ethereum transactions on chain, so actual market size is even bigger). This is rapid growth for a space that’s just a few years old.

Market is still volatile & prone to speculation but more sophisticated use cases are emerging based on utility, community, competitive elements. All are prerequisites for a more mature market. For all the hype around crypto, it is #NFTs that offer some of the more promising uses.

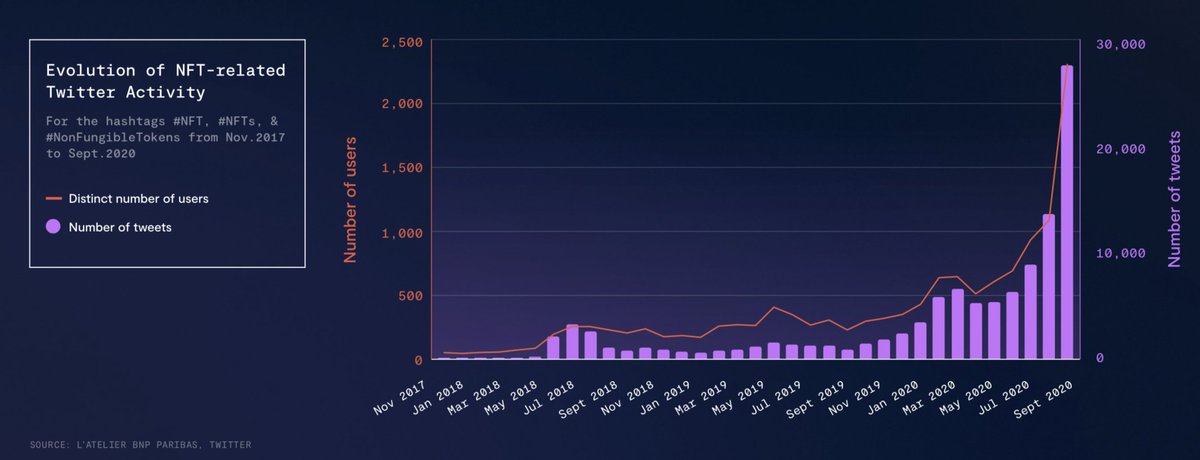

USERS: # of users transacting NFTs is up. So is interest in NFTs more broadly - using Twitter activity as a proxy, the uptick in interest is clear & rose 5x in Nov 2017- Sept 2020 (similar trajectory for #DeFi btw). BUT it's important to remember this is still a niche ecosystem.

PROFIT: Some NFT #Traders are commanding profits in the 100s of thousands. Again, this is still a niche activity. There are high barriers to entry (incl. technological) for non-crypto enthusiasts + asset prices are going up very fast. It's still hard to price and value NFTs.

FINANCIALISATION: The financialisation of NFTs is a natural & necessary next step. #NFT liquidity is GROWING but is still relatively LOW. We’re beginning to see the development of NFT-based #financial products. This will help with price discovery, valuations & market liquidity.

UTILITY: But it’s (potentially) about more than money. NFTs can provide social #utility - eg art, services like domain names or #geolocation data, etc. Virtual art was the strongest-performing NFT sector in 2020, up 2800% 📈. Again, still a niche activity driven by the initiated.

NFT ART: With the global art market at $65B+ & rising demand for alternative asset classes, digital art market can grow a lot more. Fractionalisation (similar to @OnRallyRd, @MasterworksIO) can open art market to new retail investors (but blockchains are a choice, not a must).

#ART & OTHER IP: Art is a natural use case for NFTs - unlike other digital assets (eg mp3), NFTs allow the enforcement of #property rights. NFT art has valuable features for creators, collectors & investors alike. This can be replicated for other IPs - music, video, AR, etc 👇:

- Programmability - NFT #art can be programmed to change dynamically

- Potential for higher #liquidity vs. physical art

- Productivity - can be designed to “work” for its creator/buyer long after sale, eg via recurring revenue streams 👇

- Potential for higher #liquidity vs. physical art

- Productivity - can be designed to “work” for its creator/buyer long after sale, eg via recurring revenue streams 👇

- #Transparency- the works of NFT artists with significant following can provide more transparency in pricing & valuations-eg artist popularity can be assessed via social following & purchase price and secondary market sales can be seen on exchanges, making them easier to measure

ART:☝️Crypto #art is still very market-driven. This makes it vulnerable to speculation (usually things are reversed- collectibles happen, then you put in a trading system). We are yet to see how the quality/interest in crypto art evolve if not mainly driven by #market incentives.

COLLECTIBLES: NFT #collectibles appeal to a new class of investors who have amassed virtual wealth. Obv. use cases are gaming, fantasy sports, fashion, etc. Potential of NFT collectibles depends on the capacity to create culturally relevant contexts beyond core NFT ecosystem.

Signs are there that NFTs could become mainstream #consumer goods with real uses beyond their value as speculative assets. In the short term, this would be cultural digital assets - art/music/fashion/sports/gaming - which already thrive off big communities/audiences outside NFTs.

BRANDS: #Brands & public are also creating & holding more NFTs. This is driving market & culture for novel branded digital collectibles. Luxury brands (@Nike, @LVMH etc) are creating virtual #fashion. Sports (@NBA, @PSG_English) & entertainment are creating collectibles & games.

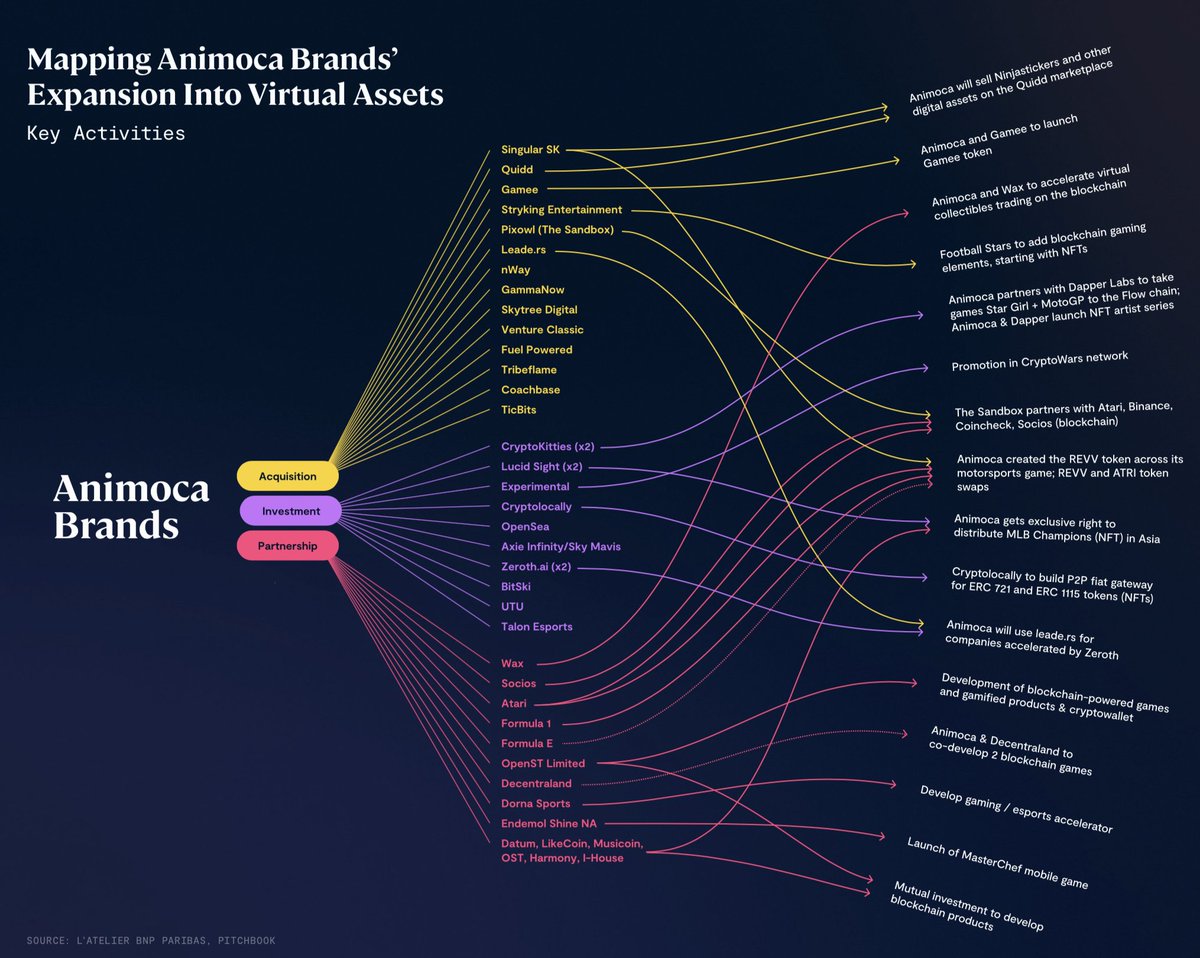

BRANDS/GAMING: #Gaming is an obvious use case that's driving much of the growth in the #virtualeconomy more broadly (centralised/decentralised). Had fun mapping out @animocabrands key investments, acquisitions, partnerships & products in blockchain &mobile gaming (up to Nov2020).

GAMING: Network effects are especially strong on social platforms like games. Despite very promising growth in this segment, #blockchain gaming still lacks culturally significant games that appeal to a critical mass of users, advertisers, content creators. This could soon change.

SPORTS: #Fantasy #sports have been growing in general & are primed for more growth due #Covid19; demographics; increased revenue potential from virtual fan experiences; & capacity to monetise fan-based digital assets. This is another obvious route to mainstream adoption.⚽️🏀⚾️

EMERGING ASSET CLASS: NFTs are slowly moving from being purely speculative to value creating. This signals that NFTs could become a leading emerging #asset class for the Virtual Economy, and a major driver of economic activity in virtual worlds.

IDENTITY: This will become more important as ppl spend more time virtually & create persistent digital identities that they want to preserve & transfer virtually. This space is ripe for novel solutions (eg @CrucibleNetwork). Who else is building digital #identity solutions?

INFRASTRUCTURE: NFTs are part of a bigger & growing ecosystem of novel infrastructure and services to build an interoperable decentralised #virtualeconomy in the mid/long term. It has many potential advantages vs status quo, but it is by no means inevitable or has a clear path.

Looking ahead 🔜, #NFTs have the potential to bridge the gap b/t the physical & virtual economies, creating an infinite market of goods in virtual & #MixedReality. NFTs could be the technology upon which (virtual) assets are created in the future: atelier.net/virtual-econom…

Last but not least, special thanks to NFT matchmaker @AndrewSteinwold, who introduced me and @NathalieBcht to @nonfungibles @Gauthier_Z & @dafky2000 back in the day. ✔️

• • •

Missing some Tweet in this thread? You can try to

force a refresh