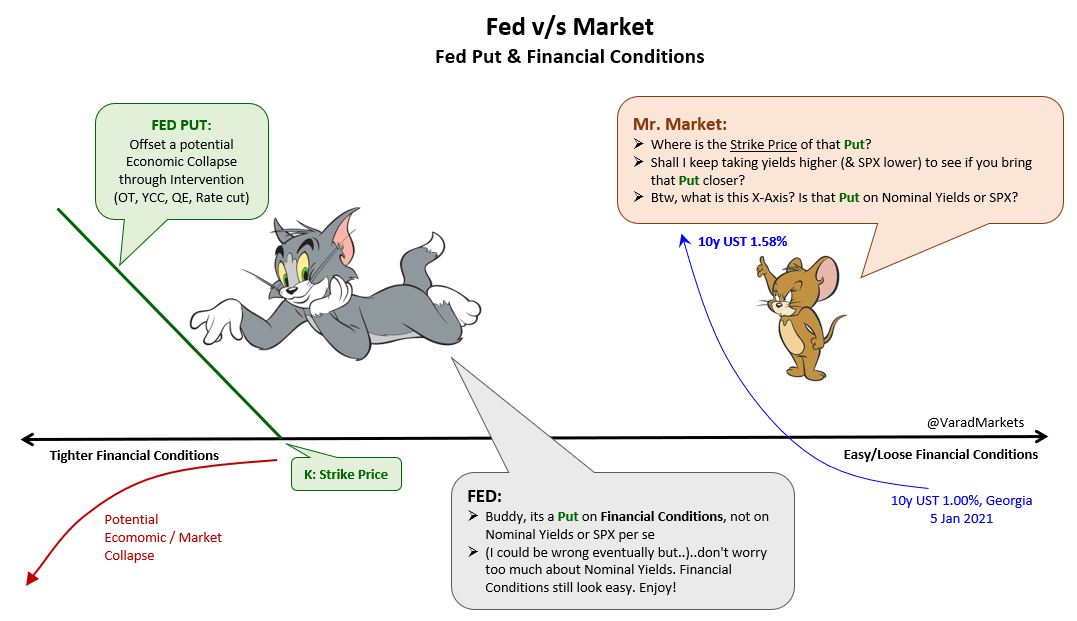

#Fed Put & Financial Conditions Index (#FCI):

#Powell: “…would be concerned by…persistent tightening in financial conditions…”

🚩Just-for-fun graphic: Fed Put - Market’s search for Put’s Strike Price = Fed’s intervention threshold

🚩#DiveIn: FCI & Macro

1/12

#Powell: “…would be concerned by…persistent tightening in financial conditions…”

🚩Just-for-fun graphic: Fed Put - Market’s search for Put’s Strike Price = Fed’s intervention threshold

🚩#DiveIn: FCI & Macro

1/12

So why learn about FCI?

#1 Fed tracks FCI

#2 FCI affects GDP/Output

Traditional Keynesian => s/t Interest Rates affect GDP

Goldman’s Hatzius/Stehn argue (2018 paper) Interest Rates first affect FCI (empirically mild relationship) & FCI then strongly affects GDP (Graphic)

2/12

#1 Fed tracks FCI

#2 FCI affects GDP/Output

Traditional Keynesian => s/t Interest Rates affect GDP

Goldman’s Hatzius/Stehn argue (2018 paper) Interest Rates first affect FCI (empirically mild relationship) & FCI then strongly affects GDP (Graphic)

2/12

Financial Conditions Index (FCI)?

▶️One # to capture state of conditions in financial/banking system

▶️weighted average of indicators of interest rates, exchange rate, credit spreads & equity valuations

▶️each indicator expressed relative to its avrg & scaled by its stdev

3/12

▶️One # to capture state of conditions in financial/banking system

▶️weighted average of indicators of interest rates, exchange rate, credit spreads & equity valuations

▶️each indicator expressed relative to its avrg & scaled by its stdev

3/12

FCI affects GDP components:

Y = C + I + G + NX

• Disposable Income & Wealth determine => Consumption C

• Corporate borrowing cost => Non-Residential Investment I

• Interest/Mortgage Rates => Residential I

• Real Effective FX => Net Trade NX

Chart: BBG FCI vs GDP

4/12

Y = C + I + G + NX

• Disposable Income & Wealth determine => Consumption C

• Corporate borrowing cost => Non-Residential Investment I

• Interest/Mortgage Rates => Residential I

• Real Effective FX => Net Trade NX

Chart: BBG FCI vs GDP

4/12

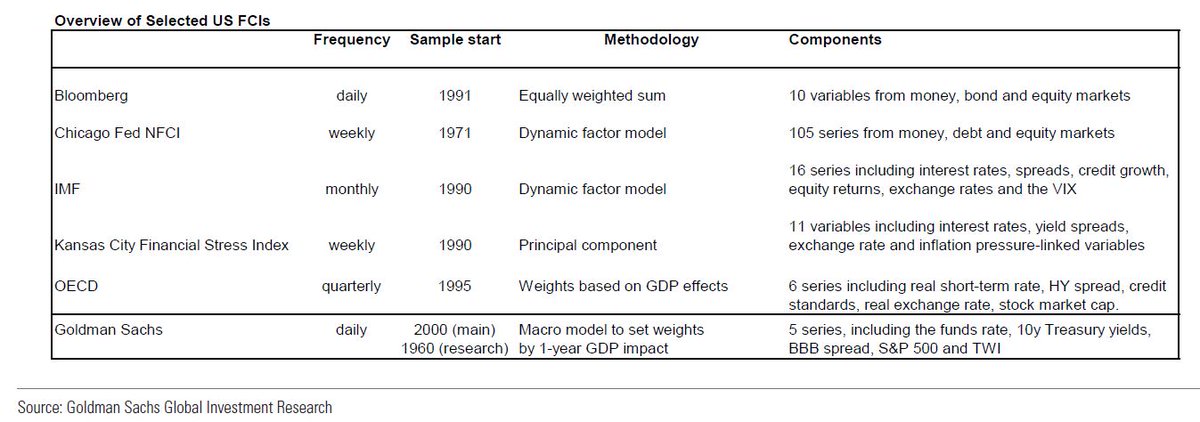

Overview of 3 off ~12 FCI out there:

🔴 Chicago Fed’s National FCI (NFCI):

- rigorous with 105 indicators

- measures conditions in markets & also banking system

- weights from PCA => relative importance in explaining index's historical fluctuations

@chigrl @HayekAndKeynes

5/12

🔴 Chicago Fed’s National FCI (NFCI):

- rigorous with 105 indicators

- measures conditions in markets & also banking system

- weights from PCA => relative importance in explaining index's historical fluctuations

@chigrl @HayekAndKeynes

5/12

NFCI Indicator Classification:

🚩#Risk indicators capture volatility & funding risk in financial sector

🚩#Credit measures household & nonfinancial business credit conditions

🚩#Leverage measures debt relative to equity

Chart: NFCI history

@bondstrategist @LONGCONVEXITY

6/12

🚩#Risk indicators capture volatility & funding risk in financial sector

🚩#Credit measures household & nonfinancial business credit conditions

🚩#Leverage measures debt relative to equity

Chart: NFCI history

@bondstrategist @LONGCONVEXITY

6/12

NFCI:

+ve => tighter-than-average financial conditions (FC)

-ve => looser-than-average FC

Zero => U.S. financial system operating at historical avrg levels of risk, credit & leverage

Table: NFIC Indicators from various segments

@sunchartist @DiMartinoBooth @TenYearNote

7/12

+ve => tighter-than-average financial conditions (FC)

-ve => looser-than-average FC

Zero => U.S. financial system operating at historical avrg levels of risk, credit & leverage

Table: NFIC Indicators from various segments

@sunchartist @DiMartinoBooth @TenYearNote

7/12

🔴Goldman FCI

- 5 Indicators across s/t, l/t interest rate, corporate spread, equity price & FX TWI

- 85% weight on 10yr UST yield & iBoxx Dom NF BBB 15y Sprd

- weights from effect of each Indicator's shock on real GDP over four quarters, ceteris paribus

8/12

- 5 Indicators across s/t, l/t interest rate, corporate spread, equity price & FX TWI

- 85% weight on 10yr UST yield & iBoxx Dom NF BBB 15y Sprd

- weights from effect of each Indicator's shock on real GDP over four quarters, ceteris paribus

8/12

🔴Bloomberg FCI

- Uses 10 Indicators from Money, Bond & Equity markets

Few Observations:

▶️GS FCI => more volatile (less # of variables, major weight on US Yield & Corp spread) but updated daily

▶️NFCI more stable but updated only weekly

9/12

- Uses 10 Indicators from Money, Bond & Equity markets

Few Observations:

▶️GS FCI => more volatile (less # of variables, major weight on US Yield & Corp spread) but updated daily

▶️NFCI more stable but updated only weekly

9/12

▶️NFCI has no weight on absolute level of any Equity Index

▶️But NFCI does account for:

- S&P VIX

- S&P Market Cap/GDP

- S&P F&O Open Interest

- S&P Financial/SPX Index Ratio relative to its MA

Chart: the three FCIs

10/12

▶️But NFCI does account for:

- S&P VIX

- S&P Market Cap/GDP

- S&P F&O Open Interest

- S&P Financial/SPX Index Ratio relative to its MA

Chart: the three FCIs

10/12

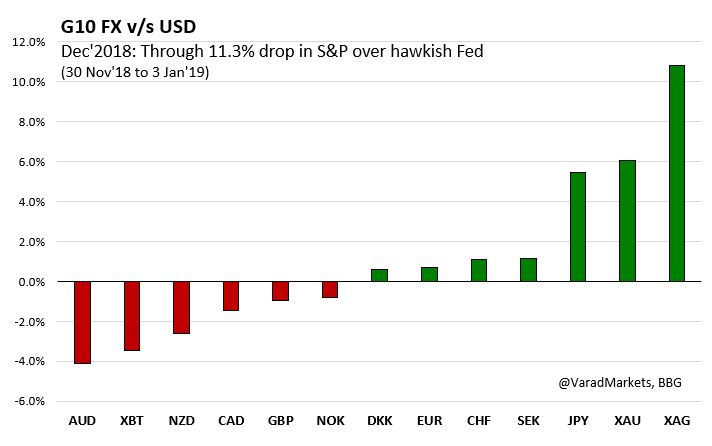

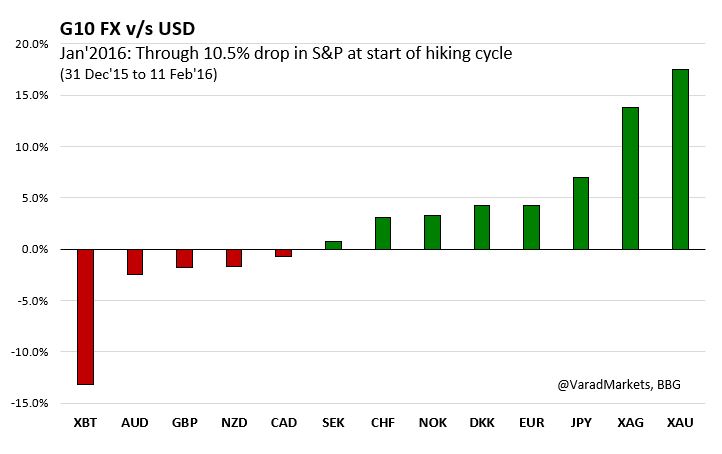

Side-note: Recent Yields vs Equities:

🚩10y UST back to pre-pandemic (Jan’20) lvl 1.60%; SPX still 13.5% above pre-pandemic peak (3386)

🚩~100 bp bond sell off (0.51%=>1.58%) since Aug’20; SPX +17.5% (from 3305) on reflation/growth

Chart: SPX vs UST

@saxena_puru

11/12

🚩10y UST back to pre-pandemic (Jan’20) lvl 1.60%; SPX still 13.5% above pre-pandemic peak (3386)

🚩~100 bp bond sell off (0.51%=>1.58%) since Aug’20; SPX +17.5% (from 3305) on reflation/growth

Chart: SPX vs UST

@saxena_puru

11/12

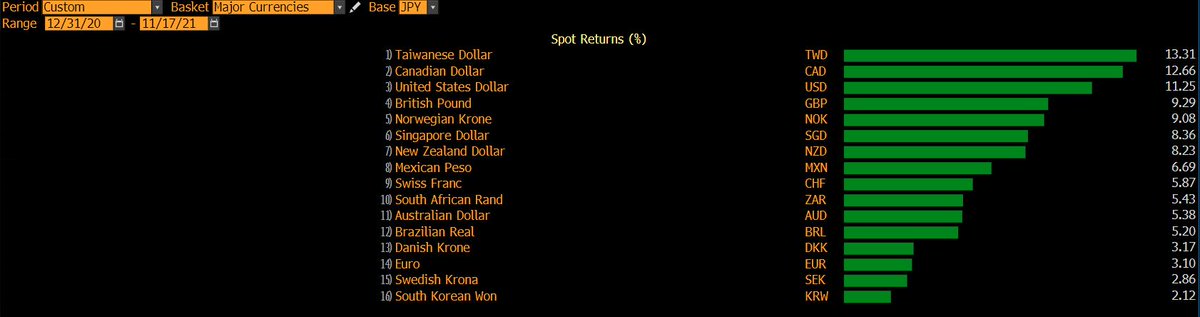

🚩Faster 60bp bond sell off since Georgia, 10y crossed 1%; SPX still 3% above pre-Georgia (3726)

One consequent view: need deeper equity correction (significantly tighter FCI) for Fed to become uneasy with higher rates

Btw, what's the Strike Price of Fed Put?

Thoughts?

One consequent view: need deeper equity correction (significantly tighter FCI) for Fed to become uneasy with higher rates

Btw, what's the Strike Price of Fed Put?

Thoughts?

• • •

Missing some Tweet in this thread? You can try to

force a refresh